“Bitcoin ETFs Surge with $5.25B Inflows—Is Gold Losing Its Safe Haven Status?”

Bitcoin investment trends, Gold ETF performance analysis, Cryptocurrency market growth 2025

—————–

Bitcoin ETFs Surge Ahead of Gold ETFs: A May 2025 Overview

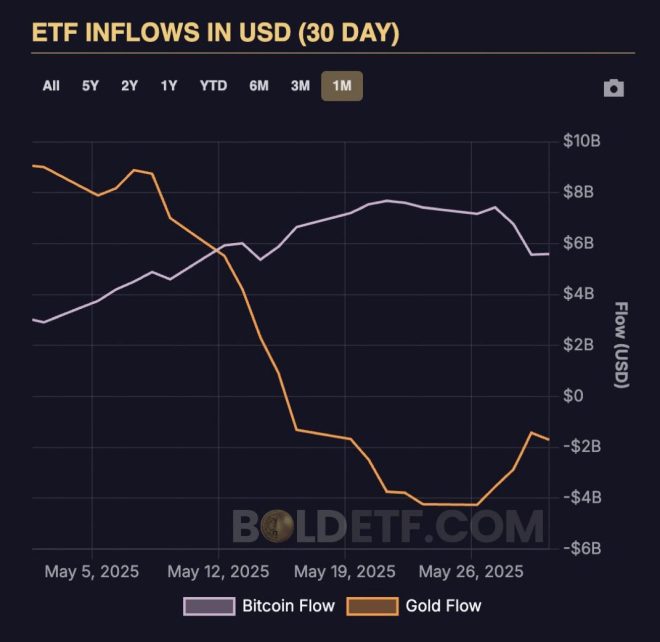

In the ever-evolving world of cryptocurrency, May 2025 marked a significant milestone for Bitcoin Exchange-Traded Funds (ETFs). According to a recent tweet from Whale Insider, Bitcoin ETFs experienced a staggering net inflow of $5.25 billion. In contrast, Gold ETFs faced a challenging month, suffering outflows amounting to $1.58 billion. This remarkable shift in investment patterns highlights a growing confidence in Bitcoin as a viable asset class, signaling a shift in investor sentiment away from traditional commodities like gold.

Understanding Bitcoin ETFs

Bitcoin ETFs are investment funds that track the price of Bitcoin and allow investors to gain exposure to the cryptocurrency without needing to buy and store the digital currency directly. These funds have gained popularity as they offer a simplified way for traditional investors to access Bitcoin and benefit from its price movements. The ability to trade Bitcoin ETFs on stock exchanges adds a layer of convenience and regulatory oversight, attracting a broader audience of investors.

The Rise of Bitcoin in 2025

The $5.25 billion net inflow into Bitcoin ETFs in May underscores a trend that has been gaining momentum over the past few years. Factors contributing to this surge include increased institutional interest, the maturation of the cryptocurrency market, and a growing acceptance of Bitcoin as a hedge against inflation and economic uncertainty. Institutional players, including hedge funds and asset managers, are increasingly allocating portions of their portfolios to Bitcoin, further legitimizing its status as a mainstream asset.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Gold ETFs Struggle Amidst Market Changes

Conversely, Gold ETFs faced a challenging month, witnessing outflows totaling $1.58 billion. This trend could be attributed to several factors, including rising interest rates and changing investor preferences. As central banks around the world continue to adjust monetary policies, traditional safe-haven assets like gold may lose their luster. Investors are increasingly looking for assets that offer higher returns, and Bitcoin has emerged as an attractive alternative.

Market Implications of the Shift

The significant inflows into Bitcoin ETFs and the outflows from Gold ETFs reflect a broader trend in the investment community. Investors are becoming more willing to embrace the volatility and potential high returns associated with cryptocurrencies, particularly Bitcoin. This shift may lead to increased adoption of Bitcoin as a store of value and a legitimate alternative to traditional assets.

The Future of Bitcoin and Gold ETFs

As we move forward, the dynamics between Bitcoin and Gold ETFs will likely continue to evolve. The growing acceptance of Bitcoin by institutional investors and its increasing integration into traditional finance could further solidify its position in the investment landscape. Meanwhile, Gold ETFs may need to adapt to changing market conditions and investor preferences to remain relevant.

Conclusion

The significant net inflows into Bitcoin ETFs in May 2025, juxtaposed with the outflows from Gold ETFs, highlight a pivotal moment in the investment landscape. As Bitcoin continues to gain traction as a mainstream asset, traditional commodities like gold may face increasing competition. Investors should stay informed about these trends and consider how they may impact their investment strategies moving forward.

This shift in market dynamics not only reflects changing investor sentiment but also underscores the growing importance of cryptocurrencies in the broader financial ecosystem. As Bitcoin continues to establish itself as a legitimate asset class, it will be fascinating to see how this impacts the future of investing and the role of traditional assets like gold in portfolios.

JUST IN: Bitcoin ETFs see $5.25 billion net inflows in May, surpassing Gold ETFs, which faced $1.58 billion in outflows. pic.twitter.com/sb4iKiWp1u

— Whale Insider (@WhaleInsider) June 1, 2025

JUST IN: Bitcoin ETFs See $5.25 Billion Net Inflows in May

Bitcoin is making headlines again, and this time it’s for a remarkable reason. In May, Bitcoin Exchange-Traded Funds (ETFs) saw a staggering **$5.25 billion net inflows**, according to the latest reports. This surge in investment is not just a small blip; it’s significant enough to surpass traditional safe-haven assets like gold, which experienced **$1.58 billion in outflows** during the same period. This trend raises some fascinating questions about the evolving landscape of investment and what it means for the future of both Bitcoin and gold.

What Are Bitcoin ETFs?

Before diving deeper, let’s clarify what Bitcoin ETFs are. Essentially, a Bitcoin ETF allows investors to gain exposure to Bitcoin without having to buy the cryptocurrency directly. Instead, these funds track the price of Bitcoin, offering a way for traditional investors to participate in the crypto market through their regular brokerage accounts. For many, this has been a game-changer, making Bitcoin more accessible and appealing.

Why the Surge in Bitcoin ETF Inflows?

The surge in Bitcoin ETF inflows can be attributed to several factors. For one, institutional interest in Bitcoin has skyrocketed. Major financial institutions are beginning to recognize Bitcoin as a legitimate asset class, and their involvement is driving a significant amount of capital into ETF products. The entry of institutional players not only adds credibility to Bitcoin but also brings in substantial investment capital.

Moreover, the macroeconomic environment has played a role. With central banks around the world adopting loose monetary policies, many investors are seeking alternatives to traditional assets. Bitcoin, often dubbed “digital gold,” presents itself as a hedge against inflation and currency devaluation, which may explain why more people are flocking towards Bitcoin ETFs.

Bitcoin vs. Gold: The Battle of Safe Havens

It’s fascinating to see Bitcoin ETFs outpace gold ETFs in inflows. Gold has long been considered a safe haven during times of economic uncertainty. Investors usually turn to gold when they want to preserve wealth. However, the recent trend suggests a shift in perception. Many see Bitcoin as a new form of digital gold, combining the benefits of being a decentralized, scarce asset with the potential for high returns.

As traditional markets face uncertainty, Bitcoin’s appeal is growing. Unlike gold, Bitcoin is easily transferable, divisible, and can be accessed 24/7 on various trading platforms. This convenience is resonating with a new generation of investors who are more tech-savvy and comfortable with digital assets.

The Implications of These Inflows

So, what does it mean for the market when Bitcoin ETFs see such substantial inflows? First, it indicates a growing acceptance of Bitcoin in mainstream finance. As more investors put their money into Bitcoin through ETFs, it could lead to increased demand and potentially higher prices for the cryptocurrency itself.

Additionally, these inflows reflect a shift in investment strategies. Traditional investors are diversifying their portfolios, incorporating cryptocurrencies as a vital component. This transition could pave the way for further financial products tied to Bitcoin and other cryptocurrencies, enhancing the overall market liquidity and stability.

What About Gold ETFs?

While gold ETFs experienced outflows, it doesn’t mean that gold is losing its status as a safe haven. Many investors still view gold as a reliable asset, especially during economic downturns. However, the competition with Bitcoin is undeniable. As more investors look for higher returns and exposure to innovative financial products, gold may need to adapt.

We could see the introduction of new gold-related financial products that merge traditional gold investing with the efficiencies of blockchain technology, allowing for improved accessibility and perhaps even fractional ownership of gold assets.

The Future of Bitcoin ETFs

Looking ahead, the future of Bitcoin ETFs appears bright. With ongoing interest from both retail and institutional investors, we can expect to see continued growth in this sector. Regulatory clarity is also evolving, with governments around the world working on frameworks to govern cryptocurrency investments.

As these regulations become more defined, they could lead to even more institutional adoption. Greater institutional participation would likely drive more retail interest, creating a positive feedback loop that could further boost Bitcoin prices and ETF inflows.

Investing in Bitcoin ETFs: What You Need to Know

If you’re considering jumping into the Bitcoin ETF market, it’s essential to do your research. Not all Bitcoin ETFs are created equal. It’s crucial to understand the underlying assets, fees, and performance history of any ETF before investing. Look for funds that offer transparency and have a solid track record.

Moreover, keep an eye on market trends and news. The cryptocurrency landscape is volatile, and prices can swing dramatically in short periods. Staying informed will help you make better investment decisions.

Conclusion: The Shifting Landscape of Investment

The recent inflows into Bitcoin ETFs signal a significant shift in the investment landscape. With Bitcoin surpassing gold in ETF inflows, it’s clear that many investors are viewing cryptocurrencies as a viable and attractive alternative to traditional assets. The ongoing competition between Bitcoin and gold will likely continue to evolve, shaping the future of investing.

As we move forward, it’s crucial for investors to remain adaptable and open-minded. The world of finance is changing rapidly, and those who embrace these changes may find themselves at the forefront of a new investment era.

For those interested in diving deeper into this topic, [Whale Insider](https://twitter.com/WhaleInsider/status/1929205656432586853?ref_src=twsrc%5Etfw) provides valuable insights and updates on market trends, making it a great resource for anyone looking to stay informed about Bitcoin ETFs and the broader cryptocurrency market.