“Ethereum and Solana ETFs Set to Bypass Regulations—Is This a Game-Changer?”

Ethereum staking opportunities, Solana investment strategies, cryptocurrency ETF approval news

—————–

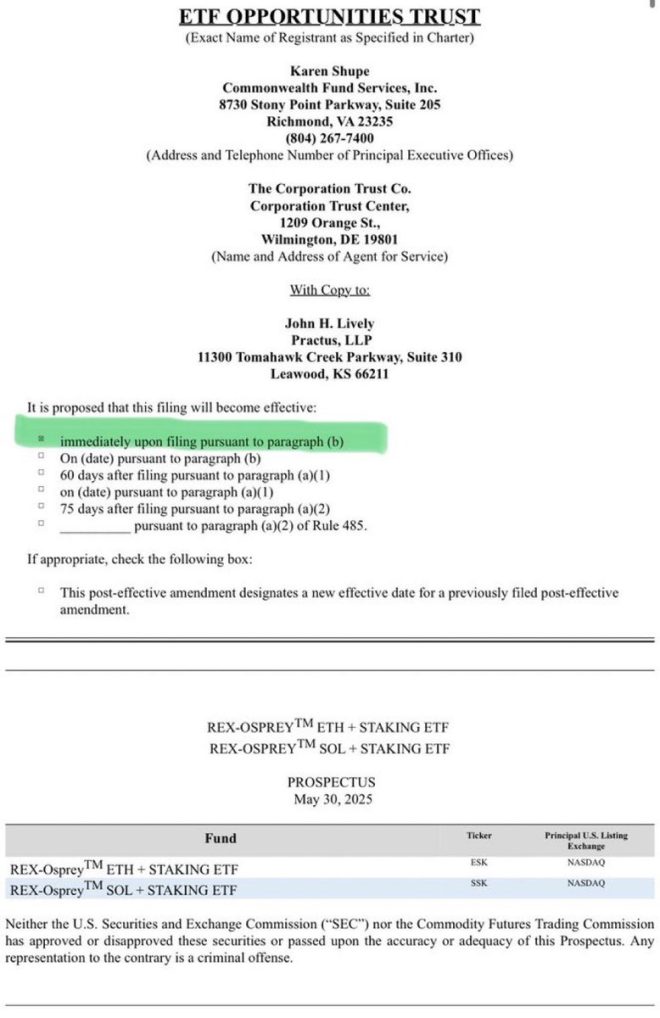

Breaking News: Approval of Ethereum and Solana Staking ETFs Imminent

In a significant development for the cryptocurrency market, analysts are predicting that Ethereum (ETH) and Solana (SOL) staking exchange-traded funds (ETFs) could receive regulatory approval as early as June 2025. This news has sparked excitement among investors and crypto enthusiasts alike, signaling a potential shift in how cryptocurrencies are integrated into mainstream finance.

Understanding Staking ETFs

Staking ETFs are investment funds that allow investors to gain exposure to cryptocurrencies while earning staking rewards. Staking is a process where investors hold and "stake" their cryptocurrencies in a wallet to support the operations of a blockchain network in exchange for rewards. This method not only provides a way to earn passive income but also helps secure the network.

The anticipated approval of ETH and SOL staking ETFs marks an important milestone in the growing acceptance of cryptocurrencies in traditional financial markets. ETFs are popular investment vehicles that offer a way to invest in a basket of assets, providing diversification and ease of trading on public exchanges.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

What Makes This Approval Significant?

The approval process for ETFs, especially those tied to cryptocurrencies, has been closely watched by market participants. Historically, the U.S. Securities and Exchange Commission (SEC) has been cautious in approving crypto-related financial products, primarily due to concerns about market manipulation, investor protection, and regulatory compliance.

However, according to a Bloomberg analyst, these specific ETFs may bypass the standard 19B-4 process, which is typically required for ETF approvals, and could receive a green light in a matter of weeks. This development suggests a more favorable regulatory environment for cryptocurrency investments and reflects the growing recognition of digital assets as a legitimate investment class.

The Implications for Ethereum (ETH) and Solana (SOL)

Ethereum, the second-largest cryptocurrency by market capitalization, is known for its smart contract functionality and vast ecosystem of decentralized applications (dApps). The ability to stake ETH through an ETF could attract a broader range of investors who are eager to participate in the Ethereum network without the complexities of managing their private keys or understanding the technical aspects of staking.

Similarly, Solana, recognized for its high throughput and low transaction costs, has been gaining traction among developers and investors alike. The approval of a staking ETF for SOL could enhance its appeal, particularly as investors seek opportunities in high-growth blockchain technologies.

Potential Market Impact

The approval of ETH and SOL staking ETFs could have several implications for the broader cryptocurrency market:

- Increased Institutional Adoption: The introduction of these ETFs may encourage institutional investors to enter the crypto space, as they provide a more familiar investment structure compared to direct cryptocurrency purchases.

- Market Liquidity: Staking ETFs could enhance liquidity in the crypto markets, as they would allow investors to buy and sell shares on traditional exchanges, making it easier to enter and exit positions.

- Price Appreciation: Historically, the approval of ETFs has often led to price surges for the underlying assets. If ETH and SOL staking ETFs gain approval, we may witness a bullish trend in their prices, driven by increased demand from both retail and institutional investors.

- Diversification of Investment Strategies: With the introduction of staking ETFs, investors will have more options for diversifying their portfolios. This could lead to a more balanced approach to investing in cryptocurrencies, reducing volatility associated with direct exposure.

Challenges Ahead

While the prospect of ETH and SOL staking ETFs is promising, challenges remain. Regulatory scrutiny is likely to continue, and the SEC may impose specific conditions or requirements that could impact the operation of these funds. Furthermore, the cryptocurrency market is known for its volatility, which can pose risks for investors.

Additionally, market participants need to be aware of the potential impact of external factors, such as macroeconomic conditions, regulatory changes, and technological advancements, which can influence the performance of cryptocurrencies and related financial products.

Conclusion

The anticipated approval of Ethereum and Solana staking ETFs marks a pivotal moment for the cryptocurrency landscape. As the market continues to evolve, the introduction of these investment vehicles could lead to increased adoption, improved liquidity, and heightened interest from institutional investors.

For those looking to invest in cryptocurrencies or explore new investment opportunities, ETH and SOL staking ETFs represent an exciting development. As always, potential investors should conduct thorough research and consider their risk tolerance before entering the crypto market.

In summary, the potential approval of Ethereum and Solana staking ETFs signifies a critical evolution in the financial landscape, paving the way for broader acceptance of cryptocurrencies as a viable investment option. As we move closer to June 2025, all eyes will be on regulatory developments and market reactions as this story unfolds.

BREAKING:$ETH AND $SOL STAKING ETFs COULD BE APPROVED IN JUNE

ACCORDING TO A BLOOMBERG ANALYST, THESE ETFs SKIP THE 19B-4 PROCESS AND MAY BE APPROVED IN WEEKS. pic.twitter.com/qC2ZQBmlQa

— Crypto Rover (@rovercrc) May 31, 2025

BREAKING: $ETH AND $SOL STAKING ETFs COULD BE APPROVED IN JUNE

Are you ready for some exhilarating news in the crypto world? According to a recent tweet from Crypto Rover, it looks like $ETH (Ethereum) and $SOL (Solana) staking ETFs could be hitting the approval stage as early as June! This is a big deal, especially when you consider how these ETFs are skipping the lengthy 19B-4 process. Yes, you heard that right—these ETFs may be approved in a matter of weeks. So, let’s break this down and explore what it means for investors and the crypto landscape.

Understanding Staking ETFs

First things first, what exactly are staking ETFs? In simple terms, ETFs, or Exchange-Traded Funds, are investment funds traded on stock exchanges, much like stocks. When we talk about staking ETFs, we’re specifically referring to funds that allow investors to stake cryptocurrencies like Ethereum and Solana without needing to do the heavy lifting themselves.

Staking is a process that allows holders of certain cryptocurrencies to earn rewards by participating in the network’s operations. For example, by staking Ethereum, users help validate transactions on the network and, in return, earn ETH. This process usually requires a fair bit of technical know-how and a good understanding of the underlying technology. However, with staking ETFs, you get to enjoy the benefits of staking while leaving the technicalities to the fund managers.

The Implications for Ethereum ($ETH) and Solana ($SOL)

So, why is the approval of these staking ETFs such a game-changer for $ETH and $SOL? For starters, both Ethereum and Solana are two of the most prominent cryptocurrencies out there today. Ethereum is the backbone of decentralized finance (DeFi) and smart contracts, while Solana has gained traction for its high throughput and low transaction fees.

By allowing staking ETFs to flourish, we’re likely to see a surge in interest from institutional investors. This could potentially drive the prices of both cryptocurrencies higher, as more capital flows into the market. The approval of these ETFs could also bolster the legitimacy of staking as a viable investment strategy, inviting even more newcomers into the crypto space.

How ETFs Skip the 19B-4 Process

Now, you might be wondering, what is this 19B-4 process that these ETFs are skipping? Essentially, the 19B-4 process refers to a set of requirements and regulations that an ETF must go through before being approved. These regulations are designed to ensure that the ETF meets certain standards and protects investors.

The fact that these staking ETFs are reportedly bypassing this process is noteworthy. It suggests that regulatory bodies may be more open to innovative financial products tied to cryptocurrencies. If this trend continues, we might see a shift in how cryptocurrencies are regulated and accepted in traditional financial markets.

What Analysts Are Saying

According to the Bloomberg analyst who shared this information, the rapid approval timeline is a significant indicator of how regulatory bodies are adapting to the evolving crypto landscape. The analyst highlighted that the quick approval could be a response to the growing demand for staking options in the market. This adaptability is crucial, especially as more people look to enter the crypto space.

The buzz around these potential ETFs has ignited a conversation about the future of cryptocurrency investments. With major players in the financial markets showing interest, it’s clear that the institutional adoption of crypto assets is on the rise.

Why Investors Should Pay Attention

For those of you considering investing in cryptocurrency, the approval of these staking ETFs could represent a unique opportunity. Not only do they offer a more accessible way to earn rewards from staking, but they could also serve as a gateway for traditional investors who are hesitant to dive into the complexities of cryptocurrency.

If you’re already invested in $ETH or $SOL, the potential approval of these ETFs could mean significant price movements in the coming months. As always, it’s essential to do your due diligence and stay informed about market trends. Keep an eye on news outlets and analysts for updates, as the situation could evolve rapidly.

The Future of Crypto ETFs

Looking ahead, the potential approval of $ETH and $SOL staking ETFs could pave the way for more crypto-based ETFs. This development could lead to a broader acceptance of cryptocurrencies within the traditional finance ecosystem. Imagine a future where ETFs based on various cryptocurrencies become as commonplace as those based on stocks or bonds!

As the market matures, we might see a diversification of ETF offerings that cater to various aspects of the crypto world, including DeFi, NFTs, and blockchain technology. This diversification will likely attract a wider range of investors, making cryptocurrency a more integral part of investment portfolios.

Risks Involved

Of course, while the potential for profit is enticing, it’s important to remember that investing in cryptocurrencies carries risks. Prices can be incredibly volatile, and regulatory changes could impact the market in unforeseen ways. As such, it’s crucial to approach investments with caution and only invest what you can afford to lose.

Additionally, while ETFs can offer a more straightforward way to gain exposure to cryptocurrencies, they still come with their own set of risks. Fees associated with ETFs can eat into your profits, and the performance of the ETF may not always mirror the performance of the underlying asset. It’s essential to weigh these factors carefully before making any investment decisions.

How to Prepare for the Approval

If you’re excited about the potential approval of $ETH and $SOL staking ETFs, there are a few steps you can take to prepare. First, consider setting up a brokerage account that allows you to trade ETFs. This way, you’ll be ready to jump in as soon as the ETFs are launched.

Second, stay informed about the news and updates surrounding these ETFs. Following credible sources, like [Bloomberg](https://www.bloomberg.com), can help you keep track of any developments.

Lastly, consider your investment strategy. Are you looking for long-term growth, or are you more interested in short-term gains? Understanding your investment goals will guide your approach as you navigate this exciting new landscape.

In Conclusion

The news about the potential approval of $ETH and $SOL staking ETFs is undoubtedly thrilling for crypto enthusiasts and investors alike. With the prospect of expanding investment opportunities and increasing legitimacy for cryptocurrencies, this could be a turning point in the market. Keep an eye on the developments, and make sure you’re prepared to seize the opportunities that come your way!