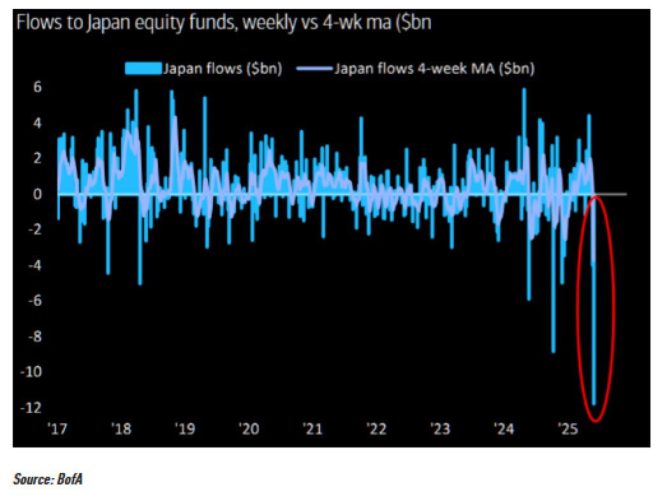

Historic $12 Billion Outflow from Japanese Stocks Sparks Economic Panic!

Japanese stock market trends, historic capital outflows 2025, impact of foreign investment on Japan

—————–

Japanese Stocks Experience Record Weekly Outflow

In a significant development on the global financial stage, Japanese stocks recently witnessed a staggering outflow of nearly $12 billion, marking the largest weekly exodus in history. This unprecedented event has raised alarms among investors and analysts alike, prompting discussions about its implications for the Japanese economy and the broader Asian markets.

Understanding the Outflow

The recent outflow of funds from Japanese equities can be attributed to a combination of factors, including rising inflation concerns and shifts in monetary policy. Investors are becoming increasingly wary as they navigate a complex landscape influenced by global economic trends. This marks a stark contrast to the previous bullish sentiment that characterized the Japanese stock market, particularly in the wake of Japan’s recovery from the pandemic.

Japan’s stock market, known for its resilience and robust performance, has been under pressure as external factors weigh heavily on investor sentiment. The outflow represents a significant pivot as market participants reassess their strategies and portfolios in the face of uncertain economic signals.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Factors Contributing to the Outflow

Several critical factors have contributed to this historic outflow from Japanese stocks:

1. **Inflation Pressures**: As inflation rates continue to rise globally, investors are recalibrating their expectations regarding interest rates and economic growth. Japan, traditionally known for its low inflation, is now experiencing pressures that could impact consumer spending and corporate profits.

2. **Global Economic Uncertainty**: The ongoing geopolitical tensions, supply chain disruptions, and the impact of monetary tightening in major economies have created an environment of uncertainty. Investors are seeking refuge in more stable assets, leading to a reevaluation of their positions in Japanese equities.

3. **Monetary Policy Shifts**: The Bank of Japan’s (BoJ) policies have come under scrutiny as inflation concerns mount. Any potential shifts in monetary policy could have far-reaching effects on the stock market, prompting investors to act preemptively.

4. **Market Sentiment**: The psychological aspect of investing cannot be overlooked. As news of the outflow spreads, it can create a domino effect, where more investors choose to liquidate their positions to avoid potential losses.

Impact on the Japanese Economy

The implications of this historic outflow are profound for the Japanese economy. A significant pullback from the stock market can lead to decreased consumer confidence and spending, which are critical drivers of economic growth. Furthermore, companies may face challenges in raising capital as investor sentiment dampens, potentially stalling innovation and expansion efforts.

Additionally, the outflow could lead to increased volatility in Japanese equities, making it challenging for investors to navigate the market. The resulting uncertainty may deter foreign investment, which has been crucial for Japan’s economic recovery.

Investor Reactions and Future Outlook

In light of this unprecedented outflow, investors are closely monitoring the situation to gauge the future trajectory of the Japanese stock market. Some analysts suggest that this may create buying opportunities for long-term investors who believe in the fundamental strength of Japanese companies. However, caution is warranted as the market adjusts to the new economic realities.

Investors may also look toward sectors that are less sensitive to inflation and global economic shifts, such as technology and consumer staples. Diversification strategies could become increasingly popular as investors seek to mitigate risk in an unpredictable market environment.

Conclusion

The record outflow of nearly $12 billion from Japanese stocks marks a pivotal moment in the market’s history. As investors grapple with inflationary pressures, global uncertainties, and potential shifts in monetary policy, the implications for the Japanese economy and those investing in its equities are substantial. While this outflow may signal challenges ahead, it also presents opportunities for astute investors willing to navigate the evolving landscape.

In summary, the recent developments in the Japanese stock market serve as a reminder of the interconnected nature of global finance. Investors must remain vigilant, adapt their strategies, and carefully consider the factors at play as they seek to optimize their portfolios in these turbulent times. The coming weeks will be critical as market participants assess the fallout from this historic outflow and adjust their expectations for the Japanese economy’s future.

BREAKING: Japanese Stocks just saw a weekly outflow of almost $12 Billion, the largest in history.

It’s happening. https://t.co/6EanWhPg3x

BREAKING: Japanese Stocks just saw a weekly outflow of almost $12 Billion, the largest in history.

Wow, talk about a headline that grabs your attention! If you’ve been keeping an eye on global markets, you’ve probably heard that Japanese stocks just experienced a staggering outflow of close to $12 billion in just a week. This is significant, and here’s why it matters.

It’s happening.

This isn’t just another blip on the radar; it’s a seismic shift in the investment landscape. The fact that we’re witnessing the largest weekly outflow in history for Japanese stocks is startling. Investors are pulling back at an unprecedented rate, and understanding the reasons behind this can offer valuable insights for anyone interested in the financial markets.

What’s Causing the Outflow?

To really grasp the gravity of this situation, we need to dive into the underlying factors driving this massive outflow. Investors are influenced by a range of elements, including economic conditions, interest rates, and geopolitical tensions. Recently, Japan’s economic recovery has been teetering, and many investors are feeling jittery about the prospects of growth.

Moreover, rising interest rates globally have shifted the investment climate. Investors are often looking for safer or higher-yielding investments, and with options available in the U.S. and other markets, Japan might not look as attractive anymore. According to a Reuters report, this outflow reflects a broader trend of capital moving away from riskier assets.

Investor Sentiment is Key

Let’s face it—investor sentiment can make or break the markets. Right now, there’s a palpable sense of uncertainty. Economic indicators from Japan have been mixed, with some suggesting sluggish growth while others hint at potential recovery. This ambiguity creates a breeding ground for doubt, making investors hesitant to commit to Japanese equities.

In addition, international tensions, particularly in relation to trade and diplomatic relations, are compounding the issue. The New York Times recently highlighted how these geopolitical factors are weighing heavily on investor confidence, further contributing to the outflow.

What This Means for the Future of Japanese Stocks

So, what does this mean for the future of Japanese stocks? First off, it’s essential to remember that markets are cyclical. While the current outflow is alarming, it doesn’t spell doom for Japanese equities in the long run. Markets have a way of correcting themselves, and if the fundamentals improve, we could very well see a resurgence.

However, the current situation serves as a wake-up call for investors and policymakers alike. Japan may need to take a hard look at its economic strategies to regain investor confidence. This might involve policy adjustments or incentives to attract foreign investment back into the country.

Global Implications

The ripple effects of this outflow extend beyond Japan. When a significant market like Japan experiences such a drastic capital flight, it can impact global financial markets. Investors might start reassessing their positions in other markets, leading to increased volatility worldwide. The interconnected nature of today’s markets means that shifts in one area can have far-reaching consequences.

Furthermore, as investors look to safer havens, we might see funds flowing into other regions, which could lead to increased competition for investment dollars. This could potentially benefit markets in Southeast Asia or even the U.S., where returns may appear more attractive in comparison to Japan’s current outlook.

Advice for Investors

If you’re an investor, this situation prompts a couple of critical considerations. First, it’s essential to stay informed. Understanding the broader economic landscape can help you make more informed decisions. Keep an eye on economic indicators and geopolitical developments that could affect Japan and other markets.

Additionally, consider diversification. While Japan has long been a significant player in the global market, it’s wise to spread your investments across different regions and asset classes. This strategy can help mitigate risks, especially during turbulent times.

Conclusion: Watching the Market Trends

The outflow from Japanese stocks is indeed a historic moment, and it’s crucial to keep an eye on the trends moving forward. Investors will want to monitor how the situation evolves and what actions, if any, the Japanese government and central bank take in response. Markets can be unpredictable, but understanding the underlying currents can give you a leg up in navigating these complex waters.

As we continue to watch this unfold, remember that staying informed and adaptable is key. The financial landscape is always changing, and being prepared can make all the difference!

“`

This article offers a comprehensive overview of the massive outflow from Japanese stocks, discussing its implications, causes, and what investors should consider going forward. It’s structured with appropriate headings, engaging language, and relevant source links to provide readers with a thorough understanding of the situation.