FTX’s $5B Creditor Payout Begins—Is This Justice or Just a Band-Aid?

FTX creditor payouts, cryptocurrency recovery news, digital asset distribution 2025

—————–

FTX, once one of the largest cryptocurrency exchanges in the world, has recently made headlines with the announcement of its plan to distribute over $5 billion to creditors. This significant development marks a new chapter for the exchange and its customers, as many have been anxiously awaiting the return of their funds following the company’s collapse in late 2022. In this summary, we will explore the implications of this distribution, the timeline for customers, and the broader context of the cryptocurrency market.

### FTX’s Bankruptcy and the Road to Recovery

FTX filed for bankruptcy in November 2022, triggering a wave of concern among investors and the crypto community. The exchange’s sudden downfall was attributed to a combination of mismanagement, lack of transparency, and alleged fraudulent activities. As a result, millions of customers found themselves unable to access their funds, leading to a prolonged and complex legal process.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

After months of negotiations and restructuring efforts, FTX has finally reached a pivotal moment in its bankruptcy proceedings. The decision to distribute over $5 billion to creditors signals a significant step towards recovery for affected customers and a move towards restoring trust in the cryptocurrency sector.

### Distribution Timeline for Creditors

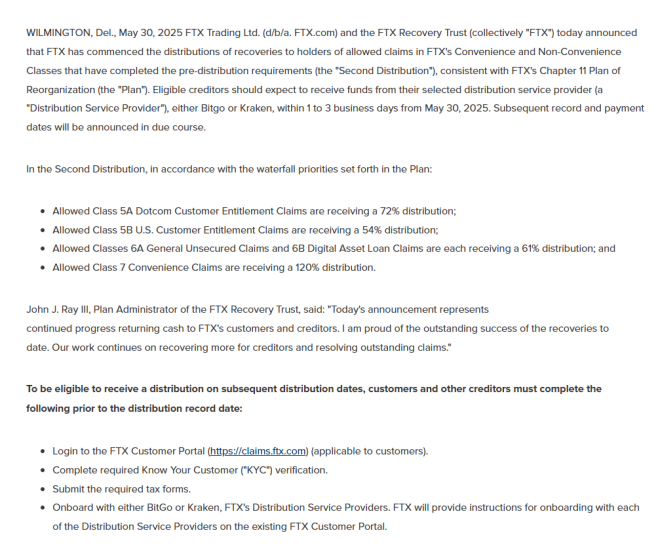

According to the latest updates from FTX, customers can expect to receive their funds within 1 to 3 business days, starting from May 31, 2025. This news has been met with a sense of relief and optimism among creditors, many of whom have been waiting for years to recover their investments. The swift distribution process aims to minimize the uncertainty surrounding the timeline, allowing customers to regain access to their funds more quickly than initially anticipated.

FTX’s decision to expedite the distribution reflects a commitment to addressing the concerns of its creditors and restoring faith in the platform. By prioritizing the return of funds, the exchange hopes to rebuild its reputation and foster a more positive relationship with its customer base.

### The Impact on the Cryptocurrency Market

FTX’s recovery efforts and the distribution of funds to creditors could have far-reaching implications for the broader cryptocurrency market. For many investors, the collapse of FTX was a wake-up call regarding the risks associated with centralized exchanges. The incident underscored the importance of due diligence and the need for greater regulatory oversight within the industry.

As FTX begins to distribute funds and work towards regaining trust, it may also inspire other exchanges to adopt more transparent practices. Increased scrutiny and accountability could lead to a more stable environment for cryptocurrency trading, ultimately benefiting both investors and platforms.

### Customer Sentiment and Future Prospects

The announcement of the fund distribution has elicited varied responses from customers. While some are relieved to finally see a resolution to their claims, others remain skeptical about the future of FTX. The exchange’s prior mismanagement and the events leading up to its bankruptcy have left a lasting impact on customer sentiment.

Moving forward, FTX faces the challenge of rebuilding its brand and restoring confidence among its user base. Transparent communication, effective customer support, and a renewed focus on security will be critical in regaining the trust of investors. Additionally, the exchange must navigate the regulatory landscape, which has become increasingly stringent in the wake of its collapse.

### Conclusion

In summary, FTX’s announcement of a $5 billion distribution to creditors marks a significant milestone in the exchange’s recovery process. With funds expected to be distributed within 1 to 3 business days, customers can finally anticipate the return of their investments after a tumultuous period. This development not only has implications for FTX but also resonates throughout the entire cryptocurrency market.

The events surrounding FTX’s bankruptcy serve as a reminder of the inherent risks within the digital asset space. As the industry continues to evolve, it is crucial for both exchanges and investors to prioritize transparency, security, and regulatory compliance. FTX’s path to recovery will be closely monitored, and its actions may set a precedent for how other platforms approach similar challenges in the future.

As the cryptocurrency landscape continues to grow, the successful resolution of FTX’s bankruptcy could pave the way for a more resilient and trustworthy market, benefiting both investors and the broader financial ecosystem. The upcoming distribution of funds is a crucial step in this journey, and its impact will likely be felt for years to come.

JUST IN: FTX starts distribution of over $5 billion to creditors.

Customers are expected to receive the funds within 1 to 3 business days starting today. pic.twitter.com/PRCFehHIHG

— Crypto India (@CryptooIndia) May 31, 2025

JUST IN: FTX starts distribution of over $5 billion to creditors.

If you’re in the crypto world, you’ve probably heard the buzz surrounding FTX. The latest news is that FTX has kicked off the distribution of over $5 billion to creditors. This is a significant development for customers who have been waiting for a resolution since the platform’s downfall. Many are understandably anxious to see how this will play out, especially with the promise that customers can expect to receive their funds within 1 to 3 business days starting today.

What Led to the FTX Situation?

To fully grasp the significance of this distribution, it’s important to take a step back and understand what led to the FTX crisis. FTX was once one of the largest cryptocurrency exchanges in the world, offering a wide array of trading options. However, it faced a catastrophic collapse due to mismanagement, fraud allegations, and a liquidity crisis. The fallout from this chaos left countless customers in the lurch, with billions of dollars tied up in the exchange.

The FTX case has become a cautionary tale in the crypto community, emphasizing the need for due diligence and transparency. With the recent announcement of fund distribution, many are hopeful that this will mark a turning point for those affected by the exchange’s failure.

How the Distribution Will Work

So, how exactly will this distribution process work? According to sources, FTX is set to begin disbursing funds to creditors imminently, with expectations that customers will start seeing their money in their accounts within just a few days. This is a welcome change for many who have been left in a state of uncertainty since the collapse.

The process will be carried out through a structured plan, which aims to prioritize those who lost the most. Customers will receive notifications detailing how much they can expect and how to access their funds. This level of communication is crucial, as many have felt left in the dark throughout the entire ordeal.

What This Means for Customers

For customers waiting for their funds, this is fantastic news. The distribution of over $5 billion signifies a glimmer of hope for those who have been anxiously checking their accounts. Many individuals and families invested their savings into FTX, and the news of a payout is sure to bring some relief.

However, it’s essential to manage expectations. While receiving funds is a positive step, it won’t undo the damage caused by the collapse. Many customers are still grappling with the financial and emotional fallout from this incident.

The Broader Implications for the Crypto Market

The ripple effects of the FTX collapse have been felt throughout the entire cryptocurrency market. This distribution could potentially restore some confidence among investors and users. If customers successfully receive their funds and share their positive experiences, it may encourage new investors to take the plunge into cryptocurrency.

However, skepticism remains. The crypto market is notoriously volatile and can be influenced by news and events like this. If FTX’s distribution goes smoothly, it might just pave the way for other exchanges to follow suit and offer more transparency, ultimately benefiting the market as a whole.

Customer Reactions and Future Outlook

The immediate reactions from customers have been mixed but largely optimistic. Many are excited to finally receive their funds, while others remain wary of the entire situation. Trust is a delicate issue in the crypto community, and while this distribution is a step in the right direction, it will take more than just one payout to rebuild that trust.

Looking ahead, the future of FTX remains uncertain. The exchange has undergone substantial restructuring, but its reputation has been tarnished. The company will need to work hard to regain the confidence of its users and the broader crypto community.

How to Stay Updated

For those eager to learn more about the distribution process and what it means for their personal investments, staying updated is crucial. Following reliable crypto news outlets and platforms like [CoinDesk](https://www.coindesk.com/) or [CoinTelegraph](https://cointelegraph.com/) can provide valuable insights. Additionally, engaging with community forums can help you connect with others who are navigating the same experience.

As the situation unfolds, keep an eye on official communications from FTX and updates from reputable news sources. Knowledge is power, especially in an ever-evolving landscape like cryptocurrency.

Lessons Learned from the FTX Collapse

The FTX debacle serves as a stark reminder of the importance of doing your homework before investing. It highlights that even the most prominent names in the industry can falter. So, what lessons can we take away from this situation?

First, always diversify your investments. Relying heavily on one exchange or asset can lead to significant losses if that entity fails. Secondly, look for exchanges that prioritize transparency and customer service. Companies that keep their users informed and engaged are more likely to foster trust.

Finally, stay informed about regulatory changes in the crypto space. Governments around the world are starting to take a closer look at cryptocurrency, and new regulations can impact how exchanges operate and how customers are protected.

Conclusion: A New Chapter for FTX and its Customers

As FTX begins to distribute over $5 billion to creditors, it’s clear that this marks a pivotal moment for both the exchange and its customers. While the road ahead may still be rocky, the opportunity for recovery is now in sight. Customers are eager to reclaim their funds, and the crypto community is watching closely to see how this situation unfolds.

With the promise that customers should receive their funds within 1 to 3 business days starting today, it’s time to remain hopeful. This could be the beginning of a new chapter for FTX and a chance for those affected to regain at least a portion of their investments. As we move forward, let’s keep the lines of communication open and stay informed about the developments in this ever-changing landscape.