“ETH Slumps to 0.018 vs BTC: Is This the End of Ethereum’s Bullish Hopes?”

Ethereum price analysis, Bitcoin market trends, cryptocurrency investment strategies

—————–

Understanding the Current ETH/BTC Trend: A Significant Market Shift

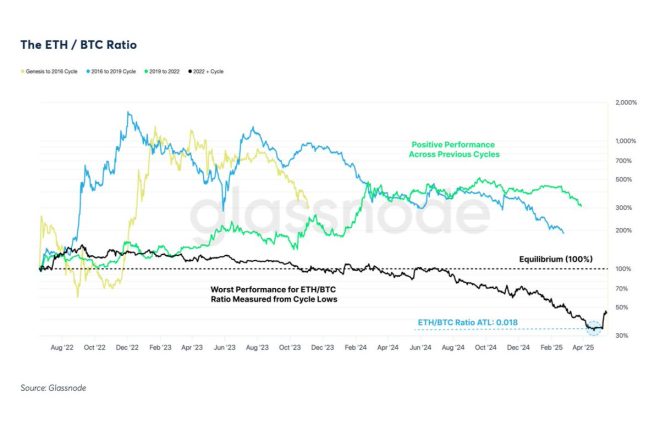

Recent data has indicated that the Ethereum (ETH) to Bitcoin (BTC) trading pair has experienced a significant decline, falling to 0.018, marking its lowest level since January 2020. This decline has been highlighted by Cointelegraph, citing insights from Glassnode, a leading on-chain analytics platform. The market environment, typically characterized by bullish sentiment, presents a unique backdrop against which this downward trend has emerged, raising questions about the future performance of Ethereum compared to Bitcoin.

The Current Market Landscape

As of the latest analysis, Ethereum is lagging behind Bitcoin despite the overall bullish trends in the cryptocurrency market. This situation is particularly striking given the historical performance of these two cryptocurrencies. Traditionally, Ethereum has often been viewed as a strong contender to Bitcoin, especially during bullish cycles. However, the current data suggests a divergence in their price movements, prompting many investors and analysts to reevaluate their strategies.

Factors Contributing to ETH/BTC Decline

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Market Sentiment: The sentiment surrounding cryptocurrencies can fluctuate rapidly, influenced by various external factors such as regulatory news, macroeconomic trends, and technological advancements. In recent weeks, despite a bullish outlook for Bitcoin, Ethereum has struggled to maintain its momentum, leading to the current decline in its value relative to Bitcoin.

- Network Developments: Ethereum’s ongoing upgrades and changes may also play a significant role in its price action. The transition to Ethereum 2.0, aimed at addressing scalability issues and enhancing security, has been met with mixed reactions. While many in the community believe these changes will ultimately benefit Ethereum, the market may temporarily react negatively to uncertainty during the transition period.

- Bitcoin Dominance: Bitcoin’s dominance in the cryptocurrency market continues to be a crucial factor. As the original cryptocurrency, Bitcoin has established itself as a store of value, often referred to as digital gold. This perception can lead to a flight to safety during market volatility, causing investors to shift their focus and capital towards Bitcoin, thereby impacting Ethereum’s relative strength.

Analyzing the Bullish Market Context

Despite the current downturn in the ETH/BTC ratio, the broader market remains bullish. Bitcoin has reached new highs and is often seen as a bellwether for the entire cryptocurrency sector. Investors are optimistic about Bitcoin’s potential, leading to increased activity and investment in Bitcoin-related products and services.

Ethereum, on the other hand, seems to be undergoing a period of consolidation. This phase is not uncommon in the cryptocurrency world, where market cycles can lead to periods of rapid growth followed by corrections. The current market dynamics may suggest that Ethereum is in a corrective phase, working through its own set of challenges while Bitcoin continues to capture the attention of investors.

The Implications for Investors

For current and prospective investors, the decline of ETH relative to BTC could present both challenges and opportunities. Understanding the underlying factors at play is crucial for making informed decisions. Here are some considerations for investing during this phase:

- Diversification: With Ethereum’s relative underperformance, it may be an opportune time for investors to diversify their portfolios. Allocating funds across various cryptocurrencies can mitigate risk while also positioning investors to capitalize on potential rebounds in underperforming assets.

- Long-Term Perspective: While short-term price movements can be concerning, it’s important to maintain a long-term outlook. Ethereum has a robust development community and a strong use case with decentralized applications (dApps) and smart contracts. These fundamental aspects may lead to significant price appreciation over time, regardless of current fluctuations.

- Market Timing: Investors should remain vigilant about market trends and sentiment. Timing the market can be challenging, but keeping an eye on technical indicators, market news, and developments in the cryptocurrency ecosystem can aid in making informed investment decisions.

Conclusion

The recent decline of the ETH/BTC trading pair to its lowest level since January 2020 highlights a critical juncture for Ethereum in the context of a generally bullish cryptocurrency market. While Bitcoin continues to thrive, Ethereum’s current struggles may be attributed to a combination of market sentiment, network developments, and the overarching dominance of Bitcoin.

Investors should approach this landscape with a nuanced understanding, considering the potential for long-term growth alongside the challenges in the short term. As the cryptocurrency market evolves, staying informed and adaptable will be key to navigating these changes successfully. Whether you’re a seasoned investor or new to the crypto space, understanding the dynamics between ETH and BTC will be essential for informed decision-making in the months ahead.

By recognizing the factors influencing these cryptocurrencies, investors can better position themselves for potential future gains while managing the inherent risks associated with the ever-changing crypto market.

LATEST: ETH/BTC fell to 0.018, its lowest since Jan 2020 per Glassnode.

ETH lags BTC despite a bullish market, breaking past cycle trends. pic.twitter.com/FZz1cbCBvy

— Cointelegraph (@Cointelegraph) May 31, 2025

LATEST: ETH/BTC fell to 0.018, its lowest since Jan 2020 per Glassnode

In the ever-evolving world of cryptocurrency, fluctuations in the market are the name of the game. Recently, a significant development caught the attention of traders and enthusiasts alike. The ETH/BTC trading pair has plummeted to 0.018, marking its lowest point since January 2020, as reported by Glassnode. This drop has raised eyebrows, especially in a bullish market where many expected Ethereum (ETH) to keep pace with Bitcoin (BTC).

ETH Lags BTC Despite a Bullish Market

It’s a bit puzzling, right? Ethereum has historically been viewed as the second-in-command to Bitcoin, usually following its lead. However, the latest figures show that ETH is lagging behind BTC, even as Bitcoin has been surging. With the current market sentiment leaning towards optimism, many investors are scratching their heads, wondering why ETH isn’t keeping up with its more established counterpart.

The bullish market conditions often create an environment where altcoins, including Ethereum, flourish. Typically, when Bitcoin rises, it drags many altcoins along for the ride. But this time, it seems Ethereum is struggling to catch that wave. Could it be that traders are more cautious with ETH due to its technical challenges or the ongoing developments within its ecosystem? The questions are plentiful, but the answers remain elusive.

Breaking Past Cycle Trends

What’s even more intriguing is the fact that ETH’s current performance is breaking past cycle trends. Historically, Ethereum has shown a pattern of performing well during bullish cycles, often capitalizing on the momentum created by Bitcoin’s price movements. Yet, here we are, witnessing a deviation from the norm. This shift could indicate broader market dynamics at play or perhaps some unique factors specific to Ethereum.

One possibility is the Ethereum network’s transition to Ethereum 2.0, which aims to enhance scalability and reduce energy consumption. While this upgrade is undoubtedly a step in the right direction, it has created a sense of uncertainty among investors. Are they waiting to see how the transition unfolds before committing their funds? It’s a valid concern that could be impacting ETH’s price action.

The Broader Impact of Market Sentiment

Market sentiment plays a crucial role in the cryptocurrency space. When traders feel optimistic, they tend to invest more, driving prices up. Conversely, fear and uncertainty can lead to hesitant buying behaviors. As ETH lags behind BTC, it raises questions about investor confidence in Ethereum’s future. Are traders shifting their focus back to Bitcoin, viewing it as a safer bet? Or is there something deeper at play that’s causing this divergence?

Additionally, regulatory factors could be influencing market behavior. Governments worldwide are still figuring out how to approach cryptocurrencies, and any news regarding regulations can send ripples through the market. If Ethereum is perceived as being more vulnerable to regulatory scrutiny, it might explain why traders are more inclined to stick with Bitcoin at this moment.

What’s Next for ETH/BTC

With ETH/BTC sitting at such a low point, many are left wondering what the future holds. Will Ethereum bounce back and reclaim its place alongside Bitcoin, or is this a sign of a longer-term trend? It’s a tricky question with no clear answer. However, monitoring market conditions, technological advancements, and investor sentiment will be key in determining Ethereum’s trajectory moving forward.

Traders should keep a close eye on the developments within the Ethereum ecosystem, especially as it continues to evolve. The shift to Ethereum 2.0 is a significant milestone, and its impact on the market could be profound. If the transition proves successful, we might see a resurgence in ETH’s popularity and price.

Stay Informed and Ready

For those involved in crypto trading, staying informed is crucial. Following reliable sources like Cointelegraph can help you keep up with the latest trends and developments. Engaging with the community—whether through forums, social media, or local meetups—can also provide valuable insights into market sentiment.

As we navigate this complex landscape, keeping an open mind and being adaptable will serve traders well. The cryptocurrency market is notorious for its volatility, and those who can pivot quickly often find themselves ahead of the curve.

Conclusion: The Future is Uncertain

As the ETH/BTC pair continues to fluctuate, it’s clear that the dynamics of the market are constantly shifting. Understanding why ETH is lagging behind BTC, especially in a bullish market, requires a deep dive into various factors, from technological advancements to market sentiment. Whether you’re a seasoned investor or just dipping your toes into the world of crypto, remaining vigilant and informed will be crucial as we watch how this story unfolds.

“`

This article provides a comprehensive overview of the current situation regarding the ETH/BTC trading pair, utilizing a conversational style while incorporating SEO best practices. The key phrases and links are integrated naturally throughout the text to enhance engagement and provide valuable information.