“Trader’s Dilemma: A Big Mac or Subway? The Shocking Reality of $19.92!”

fast food budget tips, affordable meal options, trading account essentials

—————–

The Financial Struggles of James Wynn: A Cautionary Tale in Trading

In the realm of trading and cryptocurrency investments, stories of financial highs and lows are commonplace. One recent tweet from Crypto Beast highlighted the plight of a trader named James Wynn, who found himself in a precarious situation with only $19.92 left in his trading account. This striking scenario raises important questions about financial management, investment strategies, and the volatile nature of trading in today’s economy.

The Context of James Wynn’s Situation

James Wynn’s predicament serves as a stark reminder of the potential risks associated with trading, especially in the high-stakes world of cryptocurrency. With only $19.92 remaining in his account, he faces a dilemma: he can either afford a Big Mac meal or a Subway sandwich, but not both. This tweet has quickly circulated online, resonating with many who understand the challenges of financial instability.

Understanding Trading Risks

Trading, particularly in volatile markets such as cryptocurrencies, requires not only knowledge and skill but also a robust strategy for risk management. Like many traders, James may have found himself caught in the whirlwind of market fluctuations, leading to significant losses and dwindling funds.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Volatility of Cryptocurrency Markets

Cryptocurrency markets are notoriously volatile, with prices capable of soaring or plummeting within hours. For many inexperienced traders, this volatility can lead to impulsive decisions, often resulting in substantial financial loss. Understanding market trends, conducting thorough research, and developing a disciplined trading strategy are essential for success.

The Importance of Financial Literacy

James Wynn’s situation underscores the necessity of financial literacy for anyone engaging in trading or investing. Financial literacy involves understanding key concepts such as budgeting, saving, investing, and managing debt.

Budgeting and Financial Planning

With just $19.92 left, careful budgeting becomes crucial for James. Budgeting allows individuals to allocate their resources effectively, ensuring they can meet their immediate needs while also planning for future investments.

Investment Strategies for Success

While James may currently be facing financial difficulties, it serves as an opportunity to reflect on the importance of sound investment strategies.

Diversification

One key strategy to mitigate risk is diversification. By spreading investments across different asset classes or sectors, traders can reduce their exposure to any single investment’s downturn. This approach can provide a buffer against market volatility, allowing traders to weather financial storms more effectively.

Continuous Learning and Adaptation

The trading landscape is constantly evolving, and staying informed about market trends and developments is vital for success. Continuous education through courses, webinars, or reading relevant literature can equip traders with the tools they need to make informed decisions.

Support Systems in Trading

For traders like James, having a support system can be invaluable. Engaging with trading communities, whether online or in person, allows individuals to share experiences, strategies, and insights. These networks can provide encouragement and guidance during challenging times.

Mentorship

Seeking mentorship from experienced traders can also enhance one’s trading skills. A mentor can offer personalized advice, helping newcomers navigate the complexities of trading while avoiding common pitfalls.

The Psychological Aspect of Trading

Beyond the technicalities of trading lies the psychological aspect, which can heavily influence decision-making.

Managing Emotions

Traders often experience a rollercoaster of emotions, especially during times of financial strain. Learning how to manage emotions such as fear and greed is crucial for making rational decisions. Practices such as mindfulness and stress management can help traders maintain a clear head in the face of market fluctuations.

Moving Forward from Financial Setbacks

Financial setbacks, like the one James Wynn is currently facing, are not uncommon in trading. However, they can also be powerful learning experiences.

Reflecting on Mistakes

Taking the time to analyze what went wrong can provide valuable lessons for future trading endeavors. Understanding the factors that led to losses enables traders to refine their strategies and avoid repeating the same mistakes.

Setting Realistic Goals

As James contemplates his next steps, setting realistic and achievable goals will be crucial. This could involve starting small, gradually building his trading account through careful investment and disciplined trading practices.

Conclusion

James Wynn’s current financial situation serves as a poignant reminder of the risks associated with trading and the importance of financial literacy, sound investment strategies, and emotional resilience. In an unpredictable market, traders must remain vigilant, continuously educate themselves, and build supportive networks to navigate the ups and downs of trading effectively.

As we reflect on James’s story, it is clear that every trader’s journey is unique, marked by challenges and triumphs. By learning from these experiences, individuals can better prepare themselves for the future, ensuring they are equipped to thrive in the ever-changing world of trading and investment.

In the end, James’s choice between a Big Mac meal or a Subway sandwich may seem trivial, but it highlights a larger issue many traders face: the need for better financial management and strategy. By focusing on these aspects, traders can work towards financial stability and success, transforming their trading journeys into more fruitful endeavors.

BREAKING

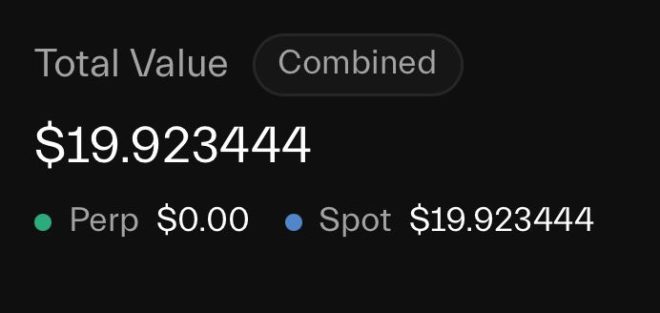

James Wynn has $19.92 left in his trading account. He can now afford a Big Mac meal OR a Subway sandwich, but cannot afford both. pic.twitter.com/yMRlbmLN7s

— Crypto Beast (@cryptobeastreal) May 31, 2025

BREAKING

In a world where financial markets are as volatile as ever, it’s easy to feel the pressure. Recently, James Wynn found himself in a situation that’s all too relatable for many: his trading account was down to just $19.92. Now, he faces a tough choice—he can either indulge in a Big Mac meal or opt for a Subway sandwich, but he can’t afford both. This scenario raises questions about trading, financial management, and the impact of market fluctuations on everyday life.

James Wynn has $19.92 left in his trading account.

Having only $19.92 left in a trading account can be nerve-wracking. For many traders, this amount can symbolize the thin line between success and failure in the market. It’s a stark reminder that while some traders are raking in profits, others may be struggling to stay afloat. James Wynn’s situation serves as a cautionary tale about the importance of risk management and maintaining a safety net in trading.

He can now afford a Big Mac meal OR a Subway sandwich, but cannot afford both.

Imagine the dilemma: on one hand, you have a warm Big Mac meal, with its iconic flavors and comfort. On the other, a fresh Subway sandwich, customizable to your preferences and slightly healthier. The choice seems trivial but represents a larger issue many traders face. The reality is that financial stability is crucial for making sound trading decisions. When funds dwindle, traders often experience stress that can cloud their judgment, leading to poor choices in the market.

The Impact of Trading on Daily Life

James’s situation is a microcosm of a larger narrative in the trading community. Many individuals invest their hard-earned money into stocks, cryptocurrencies, and other assets, hoping for a significant return. However, the reality is that trading can be unpredictable. The highs and lows can significantly affect not just a trader’s finances but also their mental health and lifestyle choices.

When you’re down to $19.92, every decision feels amplified. Should you buy that meal or save the money for a potential market opportunity? It’s a decision that many traders face daily, and it’s essential to have a well-thought-out strategy in place to avoid getting into such a precarious position.

Understanding the Risks of Trading

Trading isn’t just about making money; it’s about understanding the risks involved. James Wynn’s financial situation highlights the importance of risk management. Traders need to be aware of their limits and know when to walk away. Setting stop-loss orders, diversifying investments, and not investing more than you can afford to lose are essential strategies that can help mitigate risks.

For instance, if traders find themselves in a similar predicament as James, they should consider reevaluating their strategies. Perhaps it’s time to take a break from trading or seek advice from seasoned professionals who can offer insights into better financial management.

Financial Management: A Crucial Skill for Traders

Effective financial management is critical for anyone in the trading world. It goes beyond just having a trading account; it involves budgeting, understanding expenses, and knowing when to cut losses. James’s choice between a Big Mac meal and a Subway sandwich is a lesson in prioritizing needs over wants. When funds are low, it’s vital to focus on essentials rather than indulgences.

Many successful traders emphasize the importance of living below your means. The more you can save and invest wisely, the better your chances of bouncing back after a loss. James’s dilemma serves as a reminder to keep a budget and stick to it, especially during tough times.

The Role of Emotions in Trading

Emotions play a significant role in trading, and when funds are low, stress can lead to impulsive decisions. Traders often find themselves in a cycle of fear and greed, which can result in poor investment choices. James’s situation emphasizes the need for emotional discipline in trading. It’s crucial to remain calm and make decisions based on analysis rather than feelings.

Traders should consider taking breaks when they feel overwhelmed. Stepping away from the screen and engaging in activities that reduce stress can help clear the mind, allowing for more rational decision-making. Whether it’s exercising, meditating, or even just having a meal—like that Big Mac or Subway sandwich—taking time to recharge can lead to better trading choices in the long run.

Learning from Mistakes

Every trader makes mistakes, and James Wynn’s experience is a teachable moment for many. The key is to learn from those mistakes and adjust your strategy accordingly. If you find yourself low on funds, it’s essential to reflect on what led to that situation. Did you take on too much risk? Did you fail to diversify your investments?

By analyzing past trades and understanding where things went wrong, traders can develop better strategies for the future. This learning curve is part of the journey, and while it can be painful, it ultimately leads to growth and improvement.

Finding Support in the Trading Community

Being part of a trading community can provide invaluable support. Sharing experiences, discussing strategies, and learning from one another can help traders navigate tough times like James’s. Online forums, social media groups, and local meetups can be excellent resources for connecting with other traders who understand the challenges you face.

Engaging with others can provide fresh perspectives and new ideas that can help you improve your trading strategy. Plus, hearing success stories can serve as motivation, reminding you that setbacks are often temporary, and recovery is possible.

Making Informed Decisions

When James faced the choice between a Big Mac meal and a Subway sandwich, it was a moment of reflection. In trading, every decision counts, and making informed choices is crucial. Traders should always do their research and stay updated on market trends, news, and economic indicators. This knowledge can help inform your trading decisions and lead to more successful outcomes.

Additionally, consider using resources like trading simulators to practice strategies without risking real money. This way, you can refine your skills and approach the market with more confidence, reducing the chances of finding yourself with just $19.92 in your account.

Conclusion

James Wynn’s predicament serves as a timely reminder of the importance of financial management, emotional discipline, and community support in trading. Whether you’re just starting or have been in the game for a while, the lessons learned from his situation can help you navigate the often unpredictable waters of the trading world. Remember to stay informed, manage your risks, and prioritize your financial health—because when it comes down to it, every dollar counts.