Japan’s Historic $12 Billion Stock Exodus: What’s Behind the Panic?

Japanese stock market trends, historical investment outflows, economic impact on Japan 2025

—————–

Japan’s Stock Market Faces Historic Outflow: An In-Depth Analysis

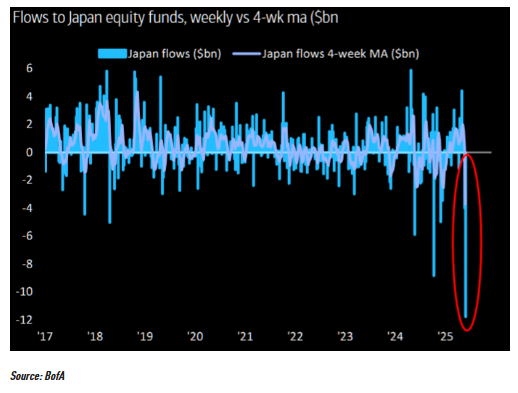

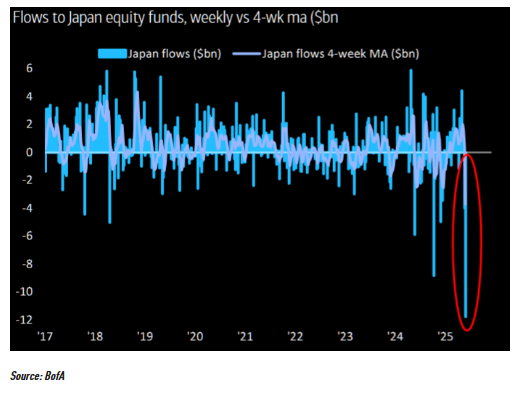

In a significant turn of events, Japanese stocks have experienced a staggering outflow of nearly $12 billion in a single week, marking the largest recorded exodus in the nation’s financial history. This alarming development was reported by Barchart on May 31, 2025, and it raises critical questions about the current state of Japan’s economy, investor sentiment, and the potential implications for the future.

Understanding the Outflow

The reported outflow represents a dramatic shift in investor behavior, particularly in a country that has long been known for its stable economy and robust stock market. This unprecedented withdrawal signals a loss of confidence among both domestic and international investors, prompting a closer examination of the underlying causes.

Several factors may have contributed to this historic outflow. Economic concerns, including inflation, interest rates, and geopolitical tensions, have created an uncertain environment for investors. Additionally, the ongoing effects of the global pandemic and supply chain disruptions have further complicated Japan’s economic landscape.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Factors Impacting Japan’s Stock Market

Japan’s economy has been grappling with various challenges that could account for this unusual outflow. Inflationary pressures have been on the rise, leading to increased costs for consumers and businesses alike. As prices continue to escalate, the purchasing power of the yen has weakened, causing concern among investors about future profitability and growth.

Moreover, interest rates have been a focal point for market participants. The Bank of Japan has maintained a policy of ultra-low interest rates for years to stimulate economic growth. However, as other central banks signal potential rate hikes, investors may be reevaluating their positions in Japan’s equities. A shift in monetary policy could significantly impact stock valuations and investor confidence.

Furthermore, geopolitical tensions in the Asia-Pacific region have also contributed to investor anxiety. Heightened tensions with neighboring countries, as well as global trade disputes, have made the investment climate more precarious. Investors often seek stability in uncertain times, and the growing complexity of Japan’s geopolitical landscape may have prompted some to pull their funds from the market.

The Role of Foreign Investors

Foreign investors play a crucial role in Japan’s stock market, and their sentiment can significantly influence market dynamics. The nearly $12 billion outflow indicates that international investors are reevaluating their exposure to Japanese equities. This could be driven by a combination of factors, including the aforementioned economic concerns and a search for better opportunities elsewhere.

As markets around the world recover from the pandemic, investors may be shifting their focus to regions perceived as having stronger growth potential. The U.S. stock market, for instance, has been performing robustly, attracting capital from global investors. This shift in focus could be exacerbating the outflow from Japan, as investors seek to capitalize on more favorable market conditions.

Implications for the Future

The record outflow from Japanese stocks raises important questions about the future trajectory of the nation’s financial markets. If the trend continues, it could lead to increased volatility and downward pressure on stock prices. A prolonged period of outflows could also undermine investor confidence, making it more challenging for Japanese companies to raise capital in the future.

However, it’s essential to recognize that market conditions can change rapidly. While the current outflow is concerning, it does not necessarily signal a long-term downturn for Japan’s economy. Factors such as government policy responses, corporate earnings, and global economic conditions will play pivotal roles in determining the market’s recovery.

Potential Government Responses

In light of this unprecedented outflow, the Japanese government and the Bank of Japan may need to consider proactive measures to restore investor confidence. Potential strategies could include:

- Monetary Policy Adjustments: The Bank of Japan could explore adjustments to its monetary policy, including interest rate changes or quantitative easing measures, to stimulate economic growth and attract investors.

- Fiscal Stimulus: The government may implement fiscal stimulus measures to bolster the economy, such as increased infrastructure spending or tax incentives for businesses.

- Regulatory Reforms: Streamlining regulations and improving the business environment could make Japan a more attractive destination for foreign investment.

- Public Communication: Clear and transparent communication from policymakers can help reassure investors and mitigate concerns about the economy’s stability.

Conclusion

The recent outflow of nearly $12 billion from Japanese stocks represents a critical moment for the nation’s financial markets. As investors react to a complex interplay of economic factors, geopolitical tensions, and changing market dynamics, the future of Japan’s stock market remains uncertain. Policymakers must navigate these challenges carefully to restore confidence and ensure sustainable economic growth.

As we look ahead, it will be essential for investors, analysts, and policymakers to monitor developments in Japan’s economy and stock market closely. By understanding the underlying causes of this historic outflow, stakeholders can better position themselves to respond to the evolving landscape and capitalize on potential opportunities in the future.

BREAKING : Japan

Japanese Stocks just saw a weekly outflow of almost $12 Billion, the largest in history pic.twitter.com/Rv2av1qG3G

— Barchart (@Barchart) May 31, 2025

BREAKING : Japan

Japan’s financial markets are making headlines, and not necessarily for good reasons. Recently, reports surfaced that Japanese stocks just saw a weekly outflow of almost $12 billion, marking the largest outflow in history. This news has sent shockwaves through the investment community, raising questions about the future of the Japanese economy and its stock market. But what does this truly mean for investors and the broader market? Let’s dive deeper.

Understanding the Outflow of Funds

When we talk about a “weekly outflow,” we’re referring to the amount of money that investors are pulling out of the stock market. This figure is significant because it reflects investor sentiment. In this case, a whopping $12 billion has been withdrawn from Japanese stocks, which is unprecedented. To put it simply, this is a clear signal that investors are feeling nervous about the economic outlook or are seeking safer investment opportunities elsewhere.

Why Are Investors Pulling Out?

Investor behavior can often be driven by a variety of factors, and the recent outflow from Japanese stocks can be attributed to several key elements. First, global economic conditions play a crucial role. The ongoing fluctuations in the global economy, along with geopolitical tensions, have made many investors cautious. Additionally, inflation rates and interest rate hikes in other parts of the world, especially the United States, have caused ripple effects that reach Japan.

Another point to consider is Japan’s own economic indicators. Despite efforts by the Bank of Japan to stimulate the economy, growth has been sluggish. If investors feel that the economic policies are not yielding the desired results, they may opt to move their investments to more promising markets. It’s a classic case of “better safe than sorry.”

The Impact on the Japanese Stock Market

The immediate effect of such a massive outflow is a decline in stock prices. As more investors sell off their shares, it creates downward pressure on stock prices, leading to a potential market correction. This can lead to a vicious cycle as declining stock prices may prompt more investors to exit, fearing further losses.

Moreover, this trend can discourage foreign investment in Japan. Foreign investors often look for stable markets, and a large outflow of funds can signal instability. This could deter future investments, which are crucial for economic growth. If foreign investors lose confidence, it could have long-term ramifications for Japan’s economy.

What Historical Context Tells Us

To fully grasp the significance of this event, let’s look at some historical context. Japan has seen similar outflows in the past, but nothing quite like this. The financial crisis of 2008 saw significant withdrawals as investors rushed to safety, but the scale of the recent outflow dwarfs those numbers. This situation is unprecedented, making it a critical moment for analysts and economists alike.

For instance, during the 2011 earthquake and tsunami, Japan experienced a temporary outflow of funds as investors reassessed risk. However, that was a natural disaster, and the market eventually rebounded. In the current scenario, the reasons are more complex, involving a blend of economic, political, and global factors.

How Should Investors Respond?

So, what should investors do in light of this news? It’s essential to evaluate your investments carefully. If you’re heavily invested in Japanese stocks, it may be time to reassess your portfolio. Diversification is key. Spreading your investments across different sectors and geographic regions can help mitigate risks associated with a single market.

Moreover, staying informed is crucial. Keep an eye on economic indicators, company earnings reports, and global events that could impact the Japanese economy. If you’re uncertain, consulting with a financial advisor can provide personalized insights based on your financial goals and risk tolerance.

Looking Ahead: The Future of Japanese Stocks

Despite the current outflow, it’s worth noting that markets are cyclical. What goes down can come back up, and investor sentiment can shift dramatically in a short period. While the outflow of almost $12 billion is alarming, it doesn’t necessarily spell doom for Japanese stocks in the long term.

Japan has strong fundamentals, including a robust manufacturing sector and a highly skilled workforce. Additionally, the government is likely to intervene if necessary to stabilize markets. Investors may find opportunities in the volatility, especially if they’re willing to adopt a long-term perspective.

The Role of Media and Information

The role of media in shaping public perception cannot be overstated. News outlets reporting on the outflow of funds can exacerbate fears and prompt more investors to sell. This is why it’s crucial to consume news critically and look at the broader picture rather than reacting impulsively to headlines.

For example, while the outflow is significant, it’s important to consider the broader economic context and the potential for recovery. Understanding the nuances of the market can prevent hasty decisions driven by fear.

Conclusion: A Call for Caution and Strategy

The recent outflow of almost $12 billion from Japanese stocks, the largest in history, serves as a critical reminder of the volatility inherent in financial markets. While the immediate outlook may appear grim, it’s essential for investors to remain calm, informed, and strategic. By assessing their portfolios, diversifying their investments, and keeping an eye on economic indicators, investors can navigate these turbulent waters more effectively.

Japan’s economy has faced challenges before and has often managed to rebound. While the current situation is concerning, it’s also an opportunity for savvy investors to rethink their strategies and potentially capitalize on market fluctuations. After all, in the world of investing, timing and the ability to stay informed can make all the difference.