Trump’s Shocking Tariff Hike: Will 50% on Steel and Aluminum Ignite Trade war?

tariff impact on manufacturing, global steel price trends, aluminum market fluctuations

—————–

President trump‘s Tariff Increase on Steel and Aluminum: Implications and Reactions

On May 30, 2025, President Donald Trump announced a significant increase in tariffs on steel and aluminum, raising them from 25% to an unprecedented 50%. This decision, effective June 4th, has sparked widespread discussion about its economic implications, potential benefits, and drawbacks. Below, we delve into the details of this announcement and analyze its potential impact on various sectors and stakeholders.

Understanding the Tariff Increase

Tariffs are taxes imposed on imported goods, designed to make foreign products more expensive and encourage consumers to buy domestic products. President Trump’s decision to raise tariffs on steel and aluminum is part of a broader strategy to bolster American manufacturing and protect domestic industries from international competition. By increasing tariffs, the administration aims to support local steel and aluminum producers, which have been struggling due to cheaper imports.

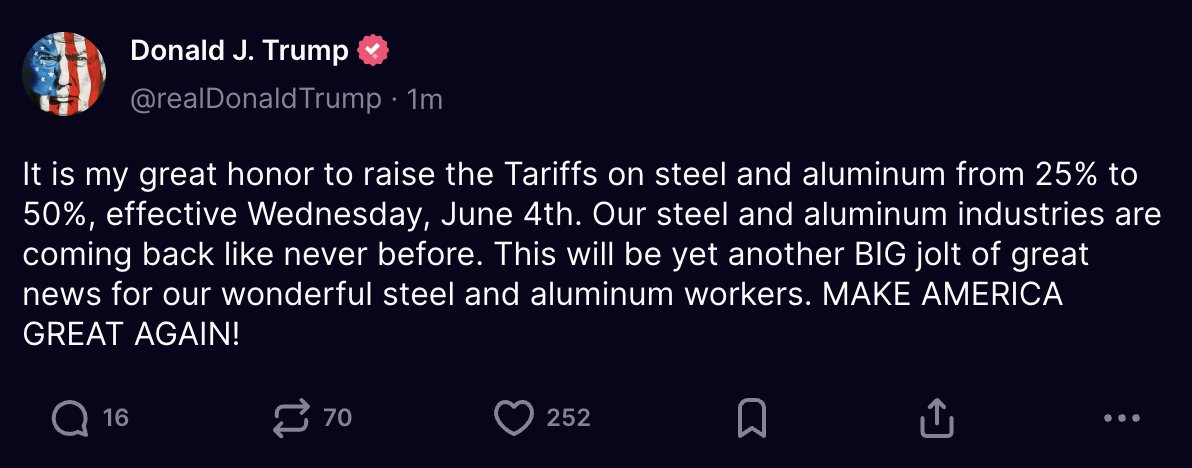

This announcement was made via a tweet from The Kobeissi Letter, a financial news outlet, which highlighted Trump’s statement that it was his "great honor" to enact this policy change. The move has sparked discussions across various sectors, from manufacturing to construction, and has raised questions about the potential fallout from such a drastic increase.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Implications

The immediate economic implications of raising tariffs on steel and aluminum are multifaceted:

- Domestic Manufacturing Support: The increased tariffs are expected to provide a boost to American steel and aluminum manufacturers by making their products more competitive against cheaper imports. This could lead to job creation in these sectors as domestic companies ramp up production to meet demand.

- Increased Costs for Consumers: On the flip side, the higher tariffs may lead to increased prices for products that rely on steel and aluminum. Industries such as automotive, construction, and consumer goods could see higher production costs, which may be passed on to consumers in the form of higher prices.

- Retaliation from Trade Partners: Historically, tariff increases have led to retaliatory measures from affected countries. Other nations may respond by imposing their tariffs on American goods, which could escalate into a trade war, affecting a wide range of industries and potentially slowing economic growth.

- Impact on Global Markets: The announcement is likely to affect global steel and aluminum markets, potentially leading to price fluctuations. Countries that export these metals may seek to adjust their strategies in response to the new tariffs, which could alter supply chains and trade balances.

Reactions from Industry Leaders

Reactions from industry leaders and experts have been mixed. Some have expressed support for the increased tariffs, arguing that they are necessary to protect American jobs and ensure fair competition. Leaders within the steel and aluminum industries are likely to welcome the announcement, as it may lead to increased orders and production levels.

Conversely, many economists and business leaders warn that such a drastic increase could harm the overall economy. They argue that while protecting domestic industries is important, a balanced approach that considers the interests of consumers and other sectors is crucial. The potential for increased prices and decreased international competitiveness could outweigh the benefits of protecting certain industries.

The Political Landscape

Trump’s announcement is also deeply rooted in the political landscape. The decision to raise tariffs aligns with his administration’s broader "America First" agenda, which prioritizes domestic economic interests. This approach has gained support among certain voter bases, particularly in regions heavily reliant on manufacturing.

However, as the political landscape evolves, the long-term sustainability of these policies remains uncertain. Opposition parties and some consumer advocacy groups may push back against such measures, advocating for free trade and cautioning against the risks of escalating trade tensions.

Conclusion

President Trump’s announcement to raise tariffs on steel and aluminum from 25% to 50% marks a significant shift in U.S. trade policy. While the move is intended to protect domestic industries and boost manufacturing, it also raises concerns about potential price increases for consumers, retaliation from trade partners, and the broader implications for the global economy.

As industries prepare for the changes set to take effect on June 4th, stakeholders across the board will need to strategize and adapt to the new economic landscape. The balance between protecting American jobs and maintaining competitive pricing will be a critical focal point as companies navigate the challenges and opportunities presented by this policy shift.

In summary, the increase in tariffs on steel and aluminum by President Trump is a move that has sparked a wide range of reactions and discussions. Its implications are complex, and as the situation develops, it will be essential to monitor how these changes impact various sectors and the overall economy.

BREAKING: President Trump says it is his “great honor” to raise tariffs on both steel and aluminum from 25% to 50% beginning on June 4th. pic.twitter.com/OT7WCpwmEa

— The Kobeissi Letter (@KobeissiLetter) May 30, 2025

BREAKING: President Trump says it is his “great honor” to raise tariffs on both steel and aluminum from 25% to 50% beginning on June 4th.

In a bold move that has sent ripples through the economic landscape, President Trump announced an increase in tariffs on steel and aluminum from 25% to a staggering 50%. This decision, effective June 4th, has sparked a flurry of reactions from various sectors, and it’s important to unpack what this really means for the economy, industries, and consumers alike.

Understanding the Tariff Increase

Tariffs are taxes imposed on imported goods, designed to make foreign products more expensive compared to domestic goods. By raising tariffs on steel and aluminum, President Trump aims to protect American manufacturers. The rationale here is straightforward: when foreign steel and aluminum become more costly, American-made products become more competitive. This could potentially lead to increased production within the U.S. and bolster jobs in these sectors.

However, there are complexities to consider. For instance, industries that rely heavily on steel and aluminum—such as automotive and construction—might face higher costs, which could be passed on to consumers. This increase in prices could also contribute to inflationary pressures, raising the cost of living for everyday Americans.

The Impact on American Manufacturing

The manufacturing sector has seen a renaissance in recent years, partly due to previous tariff implementations. Companies like Ford and General Motors have invested heavily in U.S. facilities, often citing tariffs as a reason for their commitment to American jobs. With the new 50% tariff, companies may feel more emboldened to continue expanding their operations domestically.

Nonetheless, there’s a balancing act here. If the cost of raw materials becomes too high, some companies may look to cut costs elsewhere, potentially leading to layoffs or reduced hiring. This is where the debate gets heated: is the long-term benefit of job protection worth the short-term pain of increased prices and potential job losses in other sectors?

Global Reactions and Trade Relationships

Internationally, reactions to the tariff hike have been mixed. Countries that export steel and aluminum to the U.S. are likely to retaliate. For example, Canada and Mexico, two of the largest suppliers of these metals to the U.S., have expressed concerns over this decision. The potential for trade wars looms large, as nations may impose their own tariffs in response, creating a tit-for-tat situation that could escalate tensions.

China, often a focal point in discussions about tariffs, has been particularly vocal about such measures. With the U.S. already engaged in a complex trade relationship with China, the increased tariffs could further complicate negotiations and lead to additional economic fallout. The question remains: how will these international dynamics shift in response to the U.S.’s new tariffs?

Consumer Impact

For the average consumer, the implications of these tariff increases are real and tangible. As manufacturers face higher costs due to increased tariffs, these costs will likely trickle down to consumers. Prices for goods that rely on steel and aluminum—think cars, appliances, and even infrastructure projects—could rise. Consumers may find themselves paying more at the checkout counter, which could lead to a decrease in spending and overall economic growth.

Moreover, the construction industry is poised to feel the effects of these tariffs acutely. With steel and aluminum being fundamental materials in construction, rising costs could delay projects, increase home prices, and lead to a slowdown in the housing market. This is a crucial area to monitor, as housing affordability is already a significant concern for many Americans.

Future of Tariffs and Economic Policy

This increase in tariffs raises broader questions about the future of U.S. economic policy. Will the Biden administration maintain these tariffs, or will they seek to renegotiate trade agreements with affected countries? How will this affect the global trade landscape, particularly as countries look to recover from the economic impacts of the pandemic?

Additionally, economists are divided on the potential long-term effects of such tariffs. Some argue that while they protect certain industries, they can harm the economy as a whole by increasing prices and limiting competition. Others believe that they are a necessary step to ensure the longevity of domestic manufacturing.

What’s Next for Businesses and Consumers?

As businesses and consumers brace for these changes, staying informed is key. Companies will need to evaluate their supply chains and pricing strategies to adapt to the new tariff landscape. For consumers, it’s wise to remain vigilant about price changes in the market and consider how these tariffs might impact purchasing decisions.

In the coming weeks and months, we can expect ongoing discussions and debates surrounding these tariffs. From industry leaders to policymakers, everyone will be weighing the pros and cons of this decision. Keeping an eye on how these tariffs evolve will be crucial for understanding their long-term impact on the U.S. economy.

Conclusion: A New Era of Tariffs?

The decision to raise tariffs on steel and aluminum is a pivotal moment in U.S. trade policy. As President Trump stated, it’s a “great honor” to protect American jobs through these measures. However, the implications are vast and complex, affecting everything from manufacturing jobs to consumer prices. As we move forward, it’s essential to engage in conversations about these changes and their potential impacts on our economy.