White house Shocks Nation: Steel Tariffs Skyrocket to 50% Next Week!

steel trade policy, import duties increase, metal industry impact

—————–

White House Announces Steel Tariff Increase to 50%

In a significant policy shift, the White House has declared an increase in tariffs on steel from 25% to a staggering 50%, effective next week. This announcement has sent ripples through the financial markets and the global steel industry, raising concerns about trade relations and potential inflationary pressures on consumers.

Understanding Tariffs and Their Implications

Tariffs are taxes imposed on imported goods, designed to protect domestic industries by making foreign products more expensive. The current increase in tariffs on steel is part of a broader strategy aimed at bolstering the U.S. steel manufacturing sector. By increasing the cost of imported steel, the government aims to encourage consumers and businesses to purchase domestically-produced steel, thereby supporting local jobs and reducing reliance on foreign imports.

The Context of the Tariff Increase

The decision to raise tariffs comes during a time of heightened economic uncertainty and ongoing discussions about trade policies. The original 25% tariff was implemented to combat unfair trade practices and to protect American steel manufacturers from foreign competition. However, the recent increase to 50% indicates a more aggressive stance by the administration towards international trade and a commitment to supporting U.S. industries at all costs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Impact of the Steel Tariff Hike

The immediate economic implications of this tariff increase are manifold. Steel is a critical component in various industries, including construction, automotive, and manufacturing. A 50% tariff increase will likely lead to higher prices for steel, which can subsequently affect the pricing of products that rely on steel as a primary material. This could result in increased costs for construction projects, automotive manufacturing, and other sectors, potentially leading to higher prices for consumers.

Furthermore, businesses that rely heavily on steel imports may face increased operational costs, which could lead to reduced profit margins or a reevaluation of their supply chains. Some companies may even consider relocating their operations overseas to avoid the tariff implications, which could result in job losses in the U.S.

Long-term Effects on U.S. Steel Industry

In the long run, the increased tariffs could have a transformative effect on the U.S. steel industry. By protecting domestic steel manufacturers, the government is creating an environment conducive to growth and innovation. This could lead to increased investments in steel production technology and infrastructure, positioning the U.S. steel industry for future competitiveness on a global scale.

However, it is crucial to balance this protectionist approach with the potential downsides, such as retaliatory tariffs from other countries. International trade relationships may become strained as other nations respond to the U.S.’s aggressive tariff policies. This could lead to a trade war, which might further disrupt the global supply chain and impact various industries beyond steel.

Reactions from Industry Leaders and Economists

The announcement has elicited mixed reactions from industry leaders and economists. While some domestic steel manufacturers have praised the decision, arguing that it will protect jobs and promote local production, others have expressed concerns about the negative consequences for consumers and the broader economy. Economists warn that the increased tariffs could lead to inflation, as manufacturers may pass on the higher costs to consumers.

Moreover, experts caution that such a drastic increase in tariffs may not necessarily translate into long-term benefits for the steel industry. The global market is interconnected, and the U.S. faces competition from countries like China, India, and Brazil, which could undermine efforts to protect domestic producers.

The Broader Implications for International Trade

The steel tariff increase also raises questions about the future of international trade relations. As countries navigate the complexities of trade agreements and tariffs, the potential for retaliatory measures looms large. Other nations may impose their own tariffs on U.S. goods in response, leading to a cycle of escalating trade tensions.

The global economy relies heavily on cooperation and trade between nations, and unilateral tariff increases can disrupt established relationships. The long-term effects of such policies can lead to decreased trade volumes, economic isolation, and challenges in aligning international standards.

Conclusion

The White House’s decision to raise steel tariffs from 25% to 50% marks a significant development in U.S. trade policy. While the intention is to protect and bolster the domestic steel industry, the potential consequences for both the economy and international trade relationships are complex and multifaceted. As the situation unfolds, stakeholders across various sectors will need to assess the implications of these changes and adapt to the evolving economic landscape.

As the administration navigates this challenging terrain, it remains to be seen how these tariff increases will shape the future of the U.S. steel industry and its role within the broader global market. The coming weeks and months will be crucial in determining the effectiveness of this strategy and its impact on both domestic and international economic dynamics.

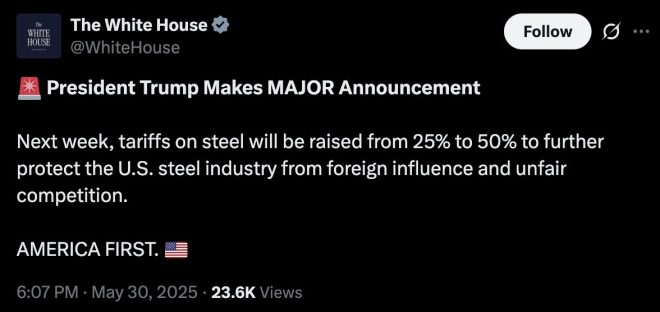

BREAKING: The White House says tariffs on steel will rise from 25% to 50% beginning next week. pic.twitter.com/WRYNsnrPYI

— The Kobeissi Letter (@KobeissiLetter) May 30, 2025

BREAKING: The White House says tariffs on steel will rise from 25% to 50% beginning next week.

In a move that’s bound to send shockwaves through multiple sectors, the White House has announced a significant increase in tariffs on steel. Starting next week, these tariffs will jump from 25% to a staggering 50%. This decision has a lot of people talking and raises quite a few questions about its implications for the economy, industry, and consumers alike.

Understanding the Tariff Increase

So, what does this increase really mean? In simple terms, tariffs are taxes imposed on imported goods. By ramping up the steel tariffs, the government aims to protect domestic producers from foreign competition. However, this strategy can have mixed results. While it may boost local steel manufacturers, it could also lead to higher prices for consumers and businesses that rely on steel for their products.

Steel is a fundamental material in various industries, including construction, automotive, and manufacturing. With the tariff hike, companies that import steel will face higher costs, which are often passed down to consumers. This could mean more expensive cars, homes, and everyday products that utilize steel. The ripple effect of such a decision can be extensive.

The Rationale Behind the Tariff Increase

Why is the White House making this bold move? Proponents of the tariff increase argue that it aims to level the playing field for American steel manufacturers. They believe that foreign steel, often subsidized by governments abroad, has been sold at artificially low prices, undercutting local producers. By raising tariffs, the government hopes to protect jobs in the American steel industry and encourage domestic production.

However, it’s essential to consider the arguments against such tariffs as well. Critics argue that these measures could lead to retaliation from other countries, potentially sparking a trade war. Moreover, the increased costs of steel might lead to higher prices for consumers, which can slow down economic growth.

Impact on Businesses and Consumers

Businesses that rely on steel will undoubtedly feel the pinch of these raised tariffs. Construction companies, for example, may face increased costs for materials, which could delay projects or result in higher prices for new homes and commercial buildings. Similarly, the automotive industry, which uses steel in everything from frames to engines, might see a rise in vehicle prices.

For consumers, this could mean paying more for everyday items. Whether it’s buying a new car, renovating a kitchen, or even purchasing appliances, the increased costs associated with steel tariffs could add up quickly. It’s a complex situation that has many stakeholders watching closely.

Potential Economic Consequences

The economic repercussions of a dramatic tariff increase like this can be far-reaching. On the one hand, protecting local industries can lead to job preservation in the short term. But on the other hand, it can also lead to inflation, as businesses pass on their increased costs to consumers. Experts worry that if inflation rises too quickly, it could stifle economic growth and investment.

Additionally, if other countries retaliate with their own tariffs, American exporters could find it harder to sell their products abroad. This could hurt industries outside of steel, leading to a broader economic impact. It’s a delicate balance that policymakers must navigate carefully.

Reactions from Industry Leaders

Industry leaders are speaking out about the tariff increase, and their reactions are as diverse as the sectors they represent. Some steel manufacturers are applauding the decision, viewing it as a necessary step to protect American jobs and production.

Conversely, leaders in industries that rely heavily on steel are voicing concerns. For example, the National Association of Home Builders has expressed fears that the tariff hike will lead to increased housing costs, making it even harder for potential homeowners to enter the market.

Public Opinion on Tariffs

Public sentiment regarding tariffs can be quite mixed. Some Americans support the idea of protecting domestic industries and jobs, while others worry about the potential for higher prices and economic instability. Surveys and polls show a divide in opinion, often reflecting regional differences in industry reliance.

In urban areas where manufacturing jobs may not be as prevalent, people might lean towards a more global trade perspective. In contrast, communities that depend on steel production may strongly back the tariff increase, viewing it as essential for their survival.

Future Outlook for Steel Tariffs

Looking ahead, the future of steel tariffs remains uncertain. While the current administration is committed to this increase, many factors could influence the landscape. Economic indicators, international relations, and domestic pressures will all play a role in shaping the future of tariffs on steel.

Moreover, as the global economy continues to evolve, the government may need to reassess its approach to tariffs. The balance between protecting domestic industries and fostering a competitive economy is a tightrope walk that requires careful consideration and ongoing dialogue.

Conclusion

The announcement from the White House regarding the increase in steel tariffs from 25% to 50% certainly raises eyebrows across various sectors. While the intent may be to bolster American manufacturing, the potential consequences for consumers and industries reliant on steel are significant. As this situation unfolds, individuals and businesses alike will be watching closely to see how it impacts the economic landscape.

In the end, tariffs are a complex and often polarizing topic. Understanding the implications for both domestic industries and consumers is crucial as we navigate this latest development. Whether you’re in the steel business or simply someone who buys products made with steel, the upcoming changes will likely touch your life in some way.