“Massive $100M Bitcoin Whale Liquidation Sparks Outrage in Crypto Community!”

Bitcoin liquidation news, cryptocurrency market impact, whale trading strategies

—————–

Breaking News: Major Bitcoin Whale Liquidation

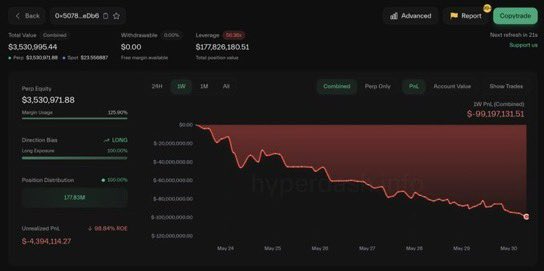

In a significant development within the cryptocurrency market, a Bitcoin whale has been liquidated for an astonishing $100 million. This event has sent shockwaves throughout the crypto community, highlighting the volatility and risks associated with trading large amounts of Bitcoin.

Who is the Bitcoin Whale?

The term "whale" in cryptocurrency refers to individuals or entities that hold large quantities of a particular cryptocurrency. In this instance, the whale in question is reported to have a position that was 40 times leveraged, meaning they were using borrowed funds to amplify their potential profits. While leverage can lead to substantial gains, it also increases the risks significantly, and in this case, it resulted in a massive liquidation.

The Impact of Liquidation on the Market

When a whale is liquidated, it can lead to considerable price movements in the market. Liquidation occurs when an investor’s position is forcibly closed by a broker due to the inability to meet margin requirements. This can lead to a cascade effect, where the liquidation of large positions causes a rapid decline in price, triggering further liquidations among other traders.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The recent liquidation of this Bitcoin whale is a stark reminder of the high-stakes nature of cryptocurrency trading. The market is known for its volatility, and such events can create panic among investors. As a result, Bitcoin’s price may experience fluctuations as traders react to the news.

Understanding Leverage in Cryptocurrency Trading

Leverage is a common practice in trading that allows investors to control larger positions with a smaller amount of capital. While it can amplify profits, it also increases the potential for losses. In the case of the 40X leveraged position, the whale was taking a significant risk. If the market moved against their position, the losses could be substantial, which is precisely what happened.

For many traders, understanding the risks associated with leverage is crucial. While the potential for high returns can be enticing, it’s essential to approach leveraged trading with caution. Responsible risk management strategies, such as setting stop-loss orders and diversifying investments, can help mitigate potential losses.

The Broader Implications for the Cryptocurrency Market

The liquidation of a major Bitcoin whale can have broader implications for the cryptocurrency market. It serves as a reminder of the inherent risks involved in trading and investing in cryptocurrencies. As more institutional investors enter the space, understanding how such events affect market dynamics becomes increasingly important.

Moreover, the incident underscores the need for greater regulatory oversight in the cryptocurrency space. As the market continues to mature, regulators are scrutinizing trading practices to ensure investor protection. The liquidation of large positions raises questions about the adequacy of current trading regulations and the potential need for reforms.

What Does This Mean for Investors?

For individual investors, the liquidation of a Bitcoin whale should serve as a cautionary tale. It highlights the importance of conducting thorough research and understanding market dynamics before making investment decisions. While the potential for significant gains exists, so too does the risk of significant losses.

Investors should consider their risk tolerance and investment strategy carefully. Diversification, setting appropriate stop-loss levels, and staying informed about market trends can help navigate the volatile cryptocurrency landscape.

Conclusion

The recent liquidation of a 40X Bitcoin whale for $100 million is a pivotal moment in the cryptocurrency market. It serves as a reminder of the risks associated with leveraged trading and the potential for significant price movements in response to large liquidations. As the cryptocurrency market continues to evolve, both retail and institutional investors must remain vigilant and informed to navigate this dynamic and often unpredictable environment.

For more updates on cryptocurrency trends and market analysis, stay tuned to trusted financial news sources and platforms. Understanding the intricacies of cryptocurrency trading is key to making informed investment decisions in this rapidly changing landscape.

BREAKING:

40X BITCOIN WHALE HAS JUST BEEN LIQUIDATED FOR $100 MILLION DOLLARS pic.twitter.com/TMqVa9F81Z

— Crypto Rover (@rovercrc) May 30, 2025

BREAKING:

In the fast-paced world of cryptocurrency, news travels fast, and it can often feel like you’re on a rollercoaster ride. Just recently, a stunning announcement sent shockwaves through the crypto community. A significant player, often referred to as a “whale,” has been liquidated for a staggering $100 million! This liquidation involved a jaw-dropping 40X leverage on Bitcoin, raising numerous questions and discussions among investors and enthusiasts alike.

40X BITCOIN WHALE HAS JUST BEEN LIQUIDATED FOR $100 MILLION DOLLARS

This incident isn’t just another blip on the radar; it’s a massive event that underscores the volatility and risks associated with trading in the cryptocurrency market. For those who might not be familiar with the term, a “whale” in crypto parlance refers to an individual or entity that holds a substantial amount of cryptocurrency. Their movements can significantly affect market prices, and a liquidation of this magnitude is bound to stir the pot.

The Implications of a 40X Liquidation

When you leverage your trades, you’re essentially borrowing funds to increase your exposure to the asset. In this case, the whale was utilizing a 40X leverage on Bitcoin. This means that for every dollar they had, they could control $40 worth of Bitcoin. While this can amplify profits, it also magnifies losses. If the market turns against you, as it did in this scenario, the consequences can be devastating.

Liquidations happen when the value of the collateral falls below a certain threshold, leading exchange platforms to close positions to prevent further losses. The fact that this whale was liquidated for $100 million signals a significant downturn in Bitcoin’s value at that time, causing panic and uncertainty among traders.

Understanding Market Reactions

After such a massive liquidation, the market often reacts with a mix of fear and speculation. Traders and investors start to worry about the overall stability of Bitcoin and the broader cryptocurrency market. This can result in a downward spiral, where more traders decide to sell their positions to avoid potential losses, further driving down prices. It’s a classic case of market psychology at play.

What Does This Mean for Bitcoin Investors?

For Bitcoin investors, this situation serves as a stark reminder of the risks involved in trading cryptocurrencies. The allure of high returns can be tempting, but as this incident illustrates, the potential for significant losses is just as real. It’s crucial for investors to have a solid risk management strategy in place, especially when considering leverage.

For those looking to invest in Bitcoin or other cryptocurrencies, it’s vital to stay informed and educated about market dynamics. Understanding how leverage works, along with the potential consequences of high-risk trading strategies, can make a significant difference in your investment journey.

Is There a Silver Lining?

While the liquidation of a 40X Bitcoin whale for $100 million is undoubtedly a concerning event, it’s essential to view it within the broader context of the cryptocurrency market. Volatility can also create opportunities. Experienced traders often look for entry points following significant price drops, hoping to capitalize on potential rebounds. This is where having a well-thought-out strategy and the ability to stay calm under pressure comes into play.

Keeping an Eye on the Future

As we move forward, the cryptocurrency landscape continues to evolve. Events like this liquidation can serve as valuable learning experiences for both new and seasoned traders. Keeping abreast of market trends, understanding the implications of major liquidations, and maintaining a disciplined approach to trading can help navigate the tumultuous waters of cryptocurrency investing.

Conclusion

The recent liquidation of a 40X Bitcoin whale for $100 million has undoubtedly made waves in the crypto community. It highlights the risks associated with high-leverage trading and serves as a reminder of the importance of risk management. As the market continues to fluctuate, staying informed and adaptable will be key for anyone looking to invest in this exciting yet unpredictable space.