Florida Investor’s Shocking $391K Sale: Is the Housing Market Crashing?

real estate market trends, property investment loss, Florida housing downturn

—————–

Florida Real Estate Market: A Cautionary Tale of Investment Losses

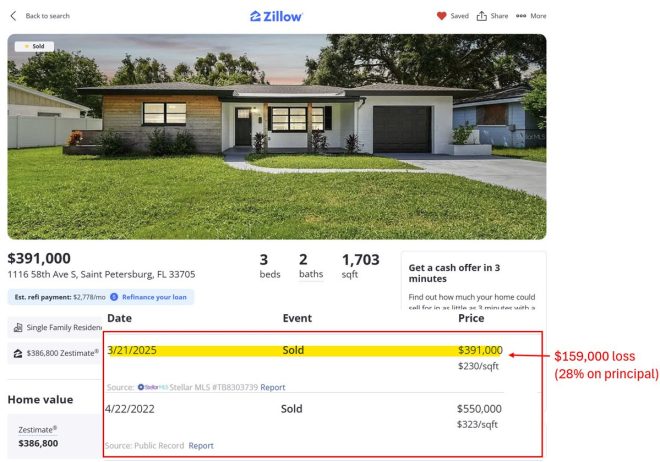

In recent developments within the Florida real estate market, a striking case has surfaced involving a property that was purchased for $550,000 in 2022 and sold for just $391,000 in 2025, reflecting a staggering 28% loss over a three-year period. This situation has raised alarms among investors and potential buyers alike, highlighting the shifting dynamics of the housing market and the potential risks associated with real estate investments.

Understanding the Market Shift

The Florida real estate market has long been considered a lucrative investment opportunity, driven by factors such as a growing population, favorable climate, and strong demand for vacation and rental properties. However, recent trends indicate a rapid downturn in property values, prompting investors to reassess their strategies. The case mentioned above illustrates the harsh realities that can accompany real estate investments, particularly in fluctuating markets.

The Investment Breakdown

The initial investment of $550,000 made in 2022 seemed promising, especially given the post-pandemic surge in home prices that many regions experienced. However, the subsequent sale price of $391,000 reflects not only a significant financial loss but also the changing market conditions that have led to a decrease in property values. Investors must consider various factors that can contribute to such outcomes, including economic shifts, changes in buyer demand, and external influences such as interest rates and inflation.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Investors

This case serves as a cautionary tale for both seasoned and novice investors. The 28% loss is a stark reminder that real estate investments are not immune to market volatility. Investors should approach the Florida real estate market with caution, conducting thorough research and analysis before making significant financial commitments. Understanding local market trends, economic indicators, and potential risks is essential for making informed investment decisions.

Market Trends and Future Predictions

Current trends suggest that the Florida real estate market may continue to face challenges in the coming months and years. As interest rates rise and inflation persists, potential buyers may become more hesitant to enter the market, leading to further declines in property values. Additionally, economic uncertainties can impact consumer confidence, which plays a crucial role in real estate transactions.

Strategies for Navigating the Market

For those looking to invest in Florida real estate or any other fluctuating market, it is vital to adopt a proactive and informed approach. Here are some strategies to consider:

1. Conduct In-Depth Market Research

Understanding local market dynamics is crucial. Research recent sales trends, population growth, and economic forecasts to gauge the overall health of the market.

2. Diversify Investments

Consider diversifying your portfolio to mitigate risks. Investing in different property types or locations can help balance potential losses in one area with gains in another.

3. Consult with Real Estate Professionals

Working with experienced real estate agents, financial advisors, and market analysts can provide valuable insights and guidance tailored to your investment goals.

4. Be Prepared for Market Fluctuations

Real estate markets can be unpredictable. Be prepared for fluctuations and have a long-term investment strategy in place that can weather economic downturns.

5. Stay Informed on Economic Indicators

Keeping an eye on economic indicators such as interest rates, employment rates, and inflation can help you make informed decisions about when to buy or sell.

Conclusion

The recent sale of a Florida property at a significant loss underscores the importance of understanding real estate market dynamics and the potential risks involved in property investment. As the market continues to evolve, investors must remain vigilant and adaptable, employing sound strategies to navigate the complexities of real estate. By staying informed and making educated decisions, investors can better position themselves for success in an ever-changing landscape.

For those considering entering the Florida real estate market, it is crucial to learn from the experiences of others and to approach investments with caution and diligence. The lessons learned from this case can serve as a valuable guide for future investors, emphasizing the need for thorough research, diversification, and professional guidance in a marketplace that is increasingly unpredictable.

Florida investor bought for $550k in 2022.

Just sold it for $391k.

28% loss in 3 years.

Market turning down fast. pic.twitter.com/PJBtLPqfbn

— Nick Gerli (@nickgerli1) May 30, 2025

Florida investor bought for $550k in 2022

In recent years, the real estate market has been a hot topic of discussion, especially in Florida. A notable case that has caught the attention of many is the story of a Florida investor who purchased a property for $550k in 2022. This significant investment seemed promising at the time, with Florida’s real estate market booming and attracting buyers from all over. However, the reality of property investment can be unpredictable, as this investor has learned the hard way.

Just sold it for $391k

Fast forward to today, and the same property has been sold for a mere $391k. That’s a staggering loss of 28% in just three years. It’s a stark reminder that the housing market can shift dramatically, and what seems like a solid investment today might not hold its value tomorrow. This case highlights the risks that come with real estate investment, especially in a market as volatile as Florida’s.

28% loss in 3 years

Imagine buying a property for $550,000 and then having to sell it for only $391,000. That’s a hit that most investors wouldn’t take lightly. The 28% loss in just three years is a significant financial blow, and it raises questions about the future of real estate investments in the area. Many investors are now left wondering if they are truly making sound decisions or if they are just betting on a market that can change overnight.

Market turning down fast

The phrase “market turning down fast” has become quite common in discussions about the Florida real estate scene lately. As the market begins to cool, many buyers and investors are feeling the pinch. The rapid increase in property values, which made headlines just a couple of years ago, is now being replaced with stories of declining home prices and rising interest rates. For those who bought high, like our Florida investor, this situation can be incredibly frustrating.

So, what exactly is causing this downturn? Various factors contribute to the cooling market, including changes in interest rates, inflation, and economic uncertainties. As interest rates rise, borrowing becomes more expensive, which can dampen demand for homes. Additionally, inflation can impact buyer sentiment, making them more hesitant to invest in big purchases like property.

Understanding the Risks of Real Estate Investment

Real estate investment can be a lucrative endeavor, but it’s not without its risks. The story of the Florida investor is a case study in the importance of understanding market dynamics and making informed decisions. Here are a few key risks to consider if you’re thinking about diving into real estate:

- Market Volatility: As we’ve seen, property values can fluctuate significantly. It’s crucial to stay informed about market trends and economic conditions that could impact property values.

- Financial Commitment: Real estate requires a substantial financial investment. If the market turns, you could find yourself in a tough spot, as our Florida investor did.

- Maintenance and Management Costs: Owning property comes with ongoing costs. From maintenance to taxes, these expenses can add up and eat into your profits.

- Location Risks: Not all neighborhoods appreciate at the same rate. Some areas may see rapid growth, while others stagnate or decline, making location a critical factor in your investment decision.

Lessons Learned from the Florida Investor

Every investment comes with its own set of lessons, and the experience of the Florida investor is no exception. Here are some takeaways that can benefit anyone looking to invest in real estate:

- Do Your Research: Always research the market before making a purchase. Understand the trends, the economic factors at play, and the overall health of the real estate market in your area.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Consider diversifying your investments across different types of assets to mitigate risk.

- Have an Exit Strategy: Before making a purchase, think about your long-term plans. Having an exit strategy can save you from panic selling during market downturns.

- Stay Updated: Keep an eye on economic indicators and market conditions. Being informed can help you make timely decisions and adapt your strategy as needed.

The Current state of the Florida Real Estate Market

As the market continues to shift, potential buyers and investors may find themselves in a unique position. With prices beginning to decline, there may be opportunities for those who are looking to enter the market. However, caution is essential. Real estate is often viewed as a long-term investment, and those who jump in without proper research could end up facing the same fate as our Florida investor.

Furthermore, the future of real estate in Florida will likely depend on several factors, including economic recovery, job growth, and interest rates. Keeping a close eye on these elements can help you navigate the waters of real estate investment more effectively.

Is Now the Right Time to Invest in Florida Real Estate?

With the recent downturn, many potential investors may be asking themselves if now is the right time to make a move in the Florida real estate market. The answer isn’t straightforward. For some, the market’s cooling could present a chance to buy at lower prices. Others may want to wait until the market stabilizes further before committing their funds.

Ultimately, the decision to invest should be based on thorough research and personal financial circumstances. If you decide to take the plunge, do so with a clear strategy and an understanding of the potential risks involved. The real estate market can be unpredictable, but with the right information and approach, it can still be a rewarding investment.

Conclusion

The journey of the Florida investor who bought for $550k in 2022 and sold for $391k is a powerful reminder of the unpredictable nature of real estate investment. As the market continues to evolve, staying informed and cautious will be crucial for anyone looking to invest. Whether you’re an experienced investor or a first-time homebuyer, understanding the dynamics of the market can greatly influence your success in real estate.