Ethereum’s $ETH Set to Surpass Nvidia’s $NVDA: A Game-Changer for Crypto?

Ethereum price prediction, Nvidia stock analysis, cryptocurrency market trends 2025

—————–

Ethereum (ETH) Set to Break Out Against NVIDIA (NVDA): An Analysis

In the dynamic world of cryptocurrency and stock markets, noteworthy trends often emerge that captivate investors and analysts alike. Recently, a tweet from prominent crypto analyst Crypto Rover suggested that Ethereum (ETH) is on the verge of breaking out against NVIDIA (NVDA). This analysis explores the implications of this potential breakout, providing insights into the performance of both ETH and NVDA, their market dynamics, and what this means for investors.

Understanding Ethereum (ETH)

Ethereum, often referred to as ETH, is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps). Launched in 2015, Ethereum introduced the concept of programmable blockchain, allowing for more complex transactions compared to Bitcoin. As the second-largest cryptocurrency by market capitalization, ETH has become a cornerstone of the DeFi (Decentralized Finance) ecosystem, fueling a multitude of innovative financial products and services.

The Current state of Ethereum

As of May 2025, Ethereum has been experiencing significant price movements, reflecting both its robust fundamentals and external market influences. The cryptocurrency has established itself as a key player in the blockchain space, with increasing adoption by institutional investors and major corporations. Recent developments, including upgrades aimed at improving scalability and reducing transaction costs, have further enhanced Ethereum’s appeal.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

NVIDIA (NVDA): A Tech Giant’s Performance

On the other hand, NVIDIA Corporation (NVDA) is a leading technology company known for its powerful graphics processing units (GPUs) and artificial intelligence (AI) solutions. With a focus on gaming, data centers, and automotive markets, NVIDIA has seen substantial growth and innovation in recent years. The company’s stock has been a favorite among investors, particularly as demand for AI technologies surges.

The Potential Breakout

The tweet from Crypto Rover suggests that ETH is on the cusp of a significant breakout against NVDA. This assertion could have several implications for both cryptocurrencies and stocks. A breakout typically refers to a situation where an asset’s price moves beyond a defined resistance level, signaling a potential upward trend. For ETH, this could mean a surge in price relative to NVDA, which would enhance its attractiveness as an investment.

Factors Influencing Ethereum’s Breakout Potential

- Market Sentiment: The overall sentiment in the cryptocurrency market plays a crucial role in influencing ETH’s price movements. Positive news, regulatory developments, and institutional interest can drive prices higher.

- Technological Advancements: Ethereum’s ongoing upgrades, such as the transition to Ethereum 2.0, aim to enhance scalability and reduce energy consumption. These improvements could attract more developers and investors, contributing to a price increase.

- DeFi Adoption: The growth of DeFi platforms built on Ethereum has resulted in increased demand for ETH. As more users engage with DeFi products, the value of ETH may rise.

- Comparative Performance with NVDA: Investors often look for opportunities to diversify their portfolios by comparing the performance of different assets. If ETH outperforms NVDA, it could lead to increased capital inflow into Ethereum.

The Broader Market Context

Understanding the broader market context is essential for evaluating the potential breakout of ETH against NVDA. The cryptocurrency market is inherently volatile, with prices influenced by a myriad of factors, including macroeconomic trends, regulatory changes, and technological advancements. Similarly, NVDA’s performance is tied to trends in the technology sector and investor sentiment regarding growth stocks.

What This Means for Investors

For investors, the possibility of ETH breaking out against NVDA presents both opportunities and risks. Here are several considerations for those looking to navigate this potential market shift:

Diversification

Investors may consider diversifying their portfolios by allocating funds to both ETH and NVDA. While historically, cryptocurrencies have been seen as high-risk assets, their growing acceptance and integration into mainstream finance could provide significant returns.

Risk Management

It is crucial for investors to implement risk management strategies when investing in volatile assets. Setting stop-loss orders and maintaining a balanced portfolio can help mitigate potential losses.

Research and Analysis

Staying informed about market trends, technological advancements, and regulatory developments is vital. Investors should conduct thorough research and analysis to make informed decisions about their investments in ETH, NVDA, or any other asset.

Conclusion

As suggested by Crypto Rover’s tweet, Ethereum is on the brink of a potential breakout against NVIDIA. This scenario presents an intriguing opportunity for investors to consider the dynamics between cryptocurrency and traditional stock markets. With Ethereum’s strong fundamentals, ongoing upgrades, and the growing appeal of DeFi, there is potential for significant price movements in the coming months. However, investors should remain vigilant, conducting thorough research and employing sound risk management strategies as they navigate this exciting but unpredictable landscape.

In summary, whether you’re a seasoned investor or new to the market, understanding the potential breakout of ETH against NVDA could be a pivotal moment in your investment strategy. Keep a close eye on market trends, technological advancements, and industry developments as you explore the opportunities within both the cryptocurrency and technology sectors.

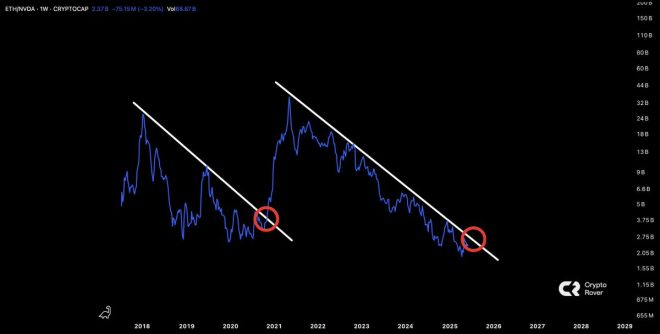

$ETH is on the verge of breaking out against $NVDA! pic.twitter.com/3HeRnakTfI

— Crypto Rover (@rovercrc) May 30, 2025

$ETH is on the verge of breaking out against $NVDA! pic.twitter.com/3HeRnakTfI

— Crypto Rover (@rovercrc) May 30, 2025

$ETH is on the verge of breaking out against $NVDA!

When it comes to the world of cryptocurrency and technology stocks, few things excite investors more than the potential for a breakout. Recently, the buzz surrounding Ethereum ($ETH) suggests that it might be on the brink of a significant surge against NVIDIA ($NVDA). So, what does this mean for investors and the market as a whole? Let’s dive deeper into this intriguing scenario.

Understanding $ETH and $NVDA

First off, let’s get a grip on what we’re talking about. Ethereum, often referred to as $ETH, is a decentralized platform that enables smart contracts and decentralized applications (dApps) to be built and run without any downtime, fraud, control, or interference from a third party. It’s the second-largest cryptocurrency by market capitalization, just behind Bitcoin.

On the other hand, NVIDIA, symbolized as $NVDA, is a leading technology company known for its graphics processing units (GPUs) and has made significant strides in artificial intelligence and machine learning. As the demand for AI technologies skyrockets, NVIDIA’s stock has seen remarkable growth, making it a favorite among tech investors.

But why are we talking about these two seemingly different entities in the same breath?

The Current Market Sentiment

As of now, the market sentiment appears to be shifting. Many investors are keenly watching the movements of $ETH in relation to $NVDA. Given the recent tweet by Crypto Rover, which highlights that “$ETH is on the verge of breaking out against $NVDA,” it seems there’s a growing belief that Ethereum might be poised to gain traction.

In the cryptocurrency market, breakouts are often indicators of a significant shift in price action. For instance, if Ethereum can manage a breakout against NVIDIA, it could signal a new wave of investment interest in the crypto space. This is particularly interesting considering how traditional tech companies, like NVIDIA, have started to embrace blockchain technologies.

Why Is This Breakout Important?

You might be wondering, why should I care if $ETH breaks out against $NVDA? Well, this potential breakout could have several implications:

1. **Market Confidence**: If $ETH performs well against a strong stock like $NVDA, it could boost confidence in the cryptocurrency market. More investors may begin to see crypto as a viable investment option, leading to increased capital inflow.

2. **Diversification Opportunities**: For those who traditionally invest in stocks, the possibility of $ETH outpacing $NVDA offers an opportunity to diversify their portfolios. It might encourage tech investors to explore cryptocurrencies as part of their investment strategy.

3. **Increased Adoption**: If Ethereum’s value surges, it can lead to greater adoption of blockchain technology and its applications. This could pave the way for more innovative projects and collaborations between tech companies and the crypto space.

Analyzing the Technical Indicators

Technical analysis is crucial when assessing potential breakouts. Traders often look at various indicators to determine entry and exit points. In the case of Ethereum and NVIDIA, some key indicators could include:

– **Resistance Levels**: If $ETH can break through established resistance levels against $NVDA, it would signal a strong upward trend.

– **Volume Trends**: Increasing trading volumes often accompany breakouts. If you see a spike in Ethereum’s trading volume, it could indicate that more investors are entering the market.

– **Relative Strength Index (RSI)**: This momentum oscillator can help traders assess whether an asset is overbought or oversold. An RSI approaching the higher end might suggest that a pullback could occur, but if it maintains strength, it could confirm bullish momentum.

The interplay between these indicators could provide valuable insights into whether this breakout is indeed on the horizon.

The Role of News and Events

Market dynamics are significantly influenced by news and events. For example, if Ethereum announces significant upgrades or partnerships, it could fuel excitement and drive prices higher. Similarly, developments in NVIDIA’s AI initiatives could impact its stock price, creating further volatility in the comparison between the two.

Keeping an eye on news sources like [CoinDesk](https://www.coindesk.com/) or [TechCrunch](https://techcrunch.com/) can help investors stay updated on the latest happenings that could influence these assets.

Investor Sentiment and Social Media Influence

Social media platforms have become a powerful tool for shaping investor sentiment. Tweets from influential figures, like Crypto Rover, can spark conversations and drive momentum in the market. The tweet highlighting that “$ETH is on the verge of breaking out against $NVDA” serves as a prime example of how social media can influence perceptions and trading behaviors.

Platforms like Twitter and Reddit have communities that closely follow cryptocurrency trends. Engaging with these communities can provide insights into market sentiment and help investors make informed decisions.

Long-Term Perspectives on $ETH and $NVDA

While short-term trading opportunities can be thrilling, it’s essential to consider the long-term perspectives of both $ETH and $NVDA.

Ethereum continues to evolve with upgrades aimed at improving scalability and sustainability. As the network grows, its utility and value could increase, making it an attractive long-term investment.

NVIDIA, on the other hand, is deeply entrenched in the tech sector and is capitalizing on the AI boom. Its growth trajectory appears robust, but the volatility in tech stocks can be a double-edged sword.

Ultimately, the decision to invest in either asset should be based on a comprehensive analysis of their long-term potential and alignment with your investment goals.

Wrapping Up the Discussion

The potential breakout of $ETH against $NVDA is certainly an exciting topic for investors across the board. Whether you lean towards cryptocurrency, tech stocks, or a mix of both, keeping an eye on this development could pay off.

As always, do your research, stay updated with market trends, and consider diversifying your portfolio to navigate the ever-changing landscape of investments. With the right approach, you can position yourself to take advantage of the opportunities that lie ahead in both the crypto and tech sectors.