Crypto Chaos: $644M Liquidated as Markets Plunge—Is the Bubble Finally Bursting?

crypto market crash, cryptocurrency liquidation trends, trading strategies for volatile markets

—————–

Overview of Recent Crypto Market Movements

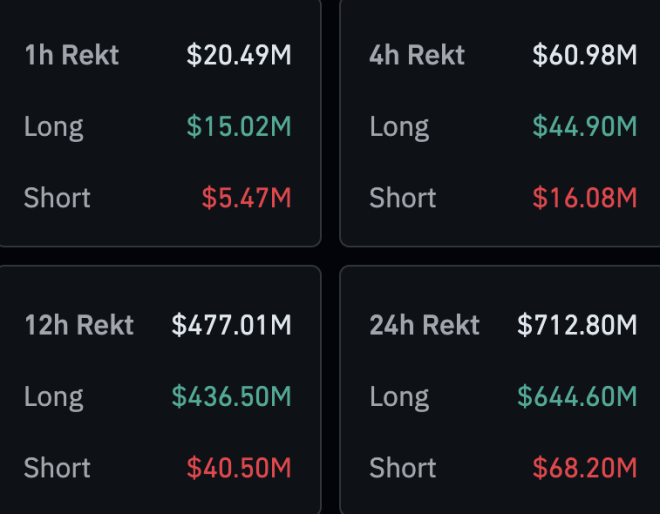

In a significant development within the cryptocurrency landscape, over $644 million in long positions were liquidated as the crypto markets experienced a sharp downturn within just 24 hours. This sudden decline has sent shockwaves through the crypto community, highlighting the volatility and unpredictability that can characterize this financial sector.

Understanding Liquidations in Crypto Trading

Liquidation occurs when a trader’s position is forcibly closed by an exchange due to insufficient margin to maintain the trade. In the context of long positions, this means that traders betting on price increases are facing losses that exceed their initial investments. As prices fall, margin calls trigger liquidations, leading to a cascading effect that can exacerbate market downturns.

The Impact of Liquidations

The liquidation of such a substantial amount—over $644 million—indicates a high level of leverage used by traders. Leverage allows traders to control larger positions with a smaller amount of capital, but it also increases the risk of significant losses. When prices drop, those in long positions are particularly vulnerable, leading to a rapid sell-off as positions are liquidated.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions and Trends

The recent sell-off has led to a broader decline across various cryptocurrencies, prompting discussions about market stability and potential recovery. Traders and analysts are closely monitoring the situation to assess whether this downturn is a temporary blip or indicative of a more prolonged bear market phase.

Factors Contributing to the Market Downturn

Several factors could contribute to the recent downturn in the cryptocurrency markets:

1. Regulatory Concerns

Regulatory scrutiny has been a persistent issue in the crypto space. Increased regulations can lead to uncertainty among investors, causing them to pull back from the market. Any news regarding potential crackdowns or new regulatory measures can trigger rapid sell-offs.

2. Market Sentiment

Investor sentiment plays a crucial role in the cryptocurrency markets. Negative news, such as security breaches or significant exchanges experiencing issues, can lead to panic selling. The general market sentiment can shift quickly based on news and events, impacting trading behavior.

3. Macro-Economic Factors

Broader economic conditions can also influence cryptocurrency prices. Economic indicators such as inflation rates, interest rates, and changes in the stock market can affect investor confidence in cryptocurrencies. For instance, if traditional markets are volatile, investors may opt to liquidate their crypto holdings to cover losses elsewhere.

4. Technical Analysis

Traders often rely on technical analysis to predict price movements. If certain key levels are breached, it can trigger automated sell orders, leading to further liquidations and a downward spiral in prices.

The Future of Cryptocurrency Markets

Looking ahead, the future of cryptocurrency markets remains uncertain. While volatility is inherent to the crypto space, periods of downturn often lead to subsequent recoveries. Long-term investors may see opportunities to enter the market at lower prices, while short-term traders may need to exercise caution.

Potential Recovery Strategies

- Diversification: Investors may consider diversifying their portfolios to mitigate risks associated with market volatility. Holding a mix of assets can help balance potential losses.

- Education and Awareness: Understanding market trends and the factors influencing price movements can help investors make more informed decisions. Staying updated with news and analysis can help traders navigate turbulent times.

- Risk Management: Employing effective risk management strategies, such as setting stop-loss orders and limiting leverage, can help protect against severe losses during market downturns.

The Role of Institutional Investors

Institutional investors have increasingly entered the cryptocurrency market, bringing with them larger volumes of capital and a different trading dynamic. Their participation can lead to increased stability, but it can also introduce new risks, especially as these entities react to market movements.

Conclusion

The recent liquidation of over $644 million in long positions highlights the inherent risks and volatility present in cryptocurrency markets. As traders and investors grapple with this downturn, it is essential to understand the factors at play and consider strategies for navigating the ever-changing landscape. By staying informed and practicing prudent risk management, participants in the crypto market can better position themselves for potential recovery and long-term success.

In summary, the cryptocurrency market remains a dynamic and often unpredictable space. The recent downturn serves as a reminder of the potential risks involved, and it underscores the importance of informed trading strategies and market awareness. As the situation evolves, both seasoned investors and newcomers will need to adapt to the shifting landscape and remain vigilant in their trading endeavors.

JUST IN: Over $644M in long positions liquidated as crypto markets tumble across the board in the past 24 hours. pic.twitter.com/AILp6KrKYJ

— Cointelegraph (@Cointelegraph) May 30, 2025

JUST IN: Over $644M in long positions liquidated as crypto markets tumble across the board in the past 24 hours.

In the fast-paced world of cryptocurrency, volatility is the name of the game. Just recently, a staggering $644 million in long positions were liquidated as the crypto markets took a nosedive. This sudden drop sent shockwaves through the crypto community, showing just how quickly fortunes can change in this digital financial space. Let’s delve deeper into what this means for investors and the broader cryptocurrency market.

The Current state of Crypto Markets

The cryptocurrency market has been on a rollercoaster ride, with prices fluctuating wildly in response to various factors, including regulatory news, market sentiment, and macroeconomic trends. The recent liquidation of long positions indicates a significant shift in investor confidence, leading many to question the stability of their investments. When you see figures like $644 million wiped out in such a short time, it raises alarms about market health and investor behavior.

Understanding Long Positions in Cryptocurrency

Before we jump into the implications of this liquidation, it’s essential to understand what long positions are. In simple terms, when traders open long positions, they are betting that the price of a cryptocurrency will rise. If it does, they can sell at a profit. However, if the price drops, as it did recently, those positions can be liquidated, meaning the trading platform closes them automatically to prevent further losses. This mechanism can lead to a cascade of sell-offs, further driving down prices.

Why Did This Happen?

Several factors can contribute to a sudden market downturn. Recently, a combination of negative news, such as regulatory crackdowns and macroeconomic uncertainties, has spooked investors. Additionally, many traders were likely over-leveraged, meaning they borrowed money to amplify their positions. When prices fell, margin calls forced these traders to liquidate their positions, creating a domino effect that further depressed prices.

The Impact on Investors

For many investors, the liquidation of long positions can feel like a punch to the gut. Those who were heavily invested in long positions may find themselves facing significant losses. It’s a harsh reminder of the risks involved in trading cryptocurrencies, where the potential for high rewards comes with equally high risks. This downturn could lead to a more cautious approach among investors, as they reassess their strategies and risk tolerance.

Market Sentiment and Future Predictions

Market sentiment plays a crucial role in the cryptocurrency landscape. After such a significant liquidation event, fear and uncertainty can spread quickly among investors. Social media platforms and forums are buzzing with speculation about the future of the market. Some analysts believe this could be a temporary setback, while others fear it may signal more prolonged bearish trends ahead. Keeping an eye on market indicators and news will be vital for anyone involved in trading or investing in cryptocurrencies.

What Can Investors Do Now?

So, what should investors do in light of this recent turbulence? First and foremost, it’s essential to stay informed. Following reputable sources like Cointelegraph can provide valuable insights into market movements and news. Additionally, diversifying investments can help mitigate risk. Instead of putting all your eggs in one basket, consider spreading your investments across various assets to cushion against market volatility.

The Role of Risk Management

Effective risk management strategies are more crucial than ever in the current climate. This might mean setting stop-loss orders to limit potential losses or adjusting your leverage when trading. Remember, the goal is to protect your capital while still allowing for growth. Understanding your risk tolerance and setting clear investment goals can help you navigate these turbulent waters more effectively.

Learning from the Experience

Every market downturn provides an opportunity for reflection and learning. Analyze what led to the liquidation of these positions and how it aligns with your trading strategy. Were you too aggressive? Did you ignore warning signs? Use this experience to refine your approach moving forward. Knowledge and adaptability are key to thriving in the unpredictable world of cryptocurrency.

Looking Ahead: The Future of Cryptocurrency

Despite the recent turmoil, the long-term outlook for cryptocurrency remains positive for many enthusiasts and analysts. Innovations in blockchain technology, increased adoption by mainstream businesses, and the potential for regulatory clarity could all contribute to a more stable market in the future. Keeping an eye on these developments can provide hope and direction for investors looking to ride out the highs and lows of the crypto space.

Conclusion: Staying Informed and Ready

In conclusion, the liquidation of over $644 million in long positions serves as a stark reminder of the volatility inherent in cryptocurrency trading. As the markets continue to evolve, it’s crucial for investors to stay informed, manage their risks, and learn from past experiences. By doing so, they can position themselves to navigate the challenges ahead and take advantage of the opportunities that may arise in the future. Remember, in the world of cryptocurrency, knowledge is power, and adaptability is key.

“`

This article is structured with clear headings, engages the reader in a conversational tone, and provides valuable insights into the recent crypto market events. Each section is informative, ensuring a comprehensive understanding of the topic while optimizing for SEO.