Canary’s Bold Move: $CRO ETF Filing Shakes Up Crypto and Wall Street!

Canary S-1 filing, cryptocurrency ETF investment opportunities, Staked CRO performance analysis

—————–

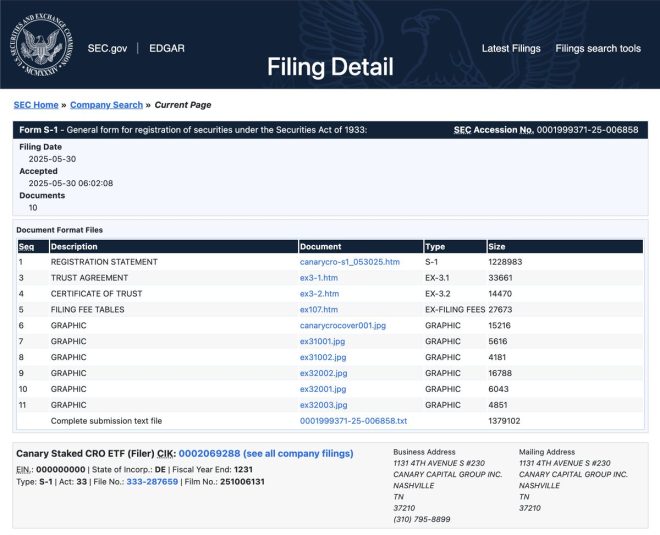

Canary Files S-1 with SEC for Staked $CRO ETF

In a significant move that could reshape the landscape of cryptocurrency investment, Canary has officially filed an S-1 registration statement with the U.S. Securities and Exchange Commission (SEC) for a Staked $CRO Exchange-Traded Fund (ETF). This development has stirred excitement within the cryptocurrency community, particularly among investors looking for regulated avenues to invest in digital assets.

Understanding the S-1 Filing

The S-1 registration statement is a crucial document that companies must submit to the SEC before going public. This filing provides detailed information about the company’s business model, financial condition, and the specific securities being offered. In this case, Canary’s S-1 filing suggests that they are seeking to launch a Staked $CRO ETF, which would allow investors to gain exposure to the native cryptocurrency of Crypto.com, $CRO, through a regulated investment vehicle.

What is a Staked ETF?

A Staked ETF is a type of exchange-traded fund that incorporates staking features. Staking is a process where cryptocurrency holders can lock up their assets to support the operations of a blockchain network, earning rewards in return. By investing in a Staked $CRO ETF, investors would not only gain exposure to the price movements of $CRO but also potentially earn staking rewards, providing them with an additional source of income.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications for Investors

The introduction of a Staked $CRO ETF has several implications for investors:

- Regulatory Compliance: One of the primary advantages is that it offers a regulated way for investors to access cryptocurrencies. Traditional investment vehicles like ETFs are governed by strict regulations, providing a sense of security for investors who may be hesitant to dive directly into the volatile cryptocurrency market.

- Accessibility: An ETF allows both seasoned and novice investors to gain exposure to $CRO without the complexities of managing private wallets or dealing with cryptocurrency exchanges. This ease of access could attract a broader audience, including institutional investors.

- Potential for Returns: Staking can provide additional returns, making the Staked $CRO ETF an attractive option for those looking to maximize their investment potential. With the growing popularity of staking in the crypto space, this ETF could be a game-changer for passive income seekers.

The Growing Interest in Crypto ETFs

The interest in cryptocurrency ETFs has been steadily increasing as more investors look to diversify their portfolios with digital assets. Several cryptocurrency ETFs have been launched in recent years, but the market is still relatively young. The approval of a Staked $CRO ETF could pave the way for more innovative financial products in the cryptocurrency space.

The Role of $CRO in the Crypto Ecosystem

$CRO is the native cryptocurrency of Crypto.com, a platform that offers a wide range of cryptocurrency services, including trading, staking, and payment solutions. The token has gained significant traction, with a growing user base and various partnerships that enhance its utility. As a result, $CRO has become a key player in the cryptocurrency market, and its inclusion in an ETF could further solidify its position.

Market Reactions and Future Prospects

Since the announcement of Canary’s S-1 filing, market reactions have been positive. Investors are keenly observing how the SEC will respond to this filing, as regulatory approval could lead to a surge in demand for $CRO. The cryptocurrency community is hopeful that this move signals a growing acceptance of cryptocurrencies within mainstream finance.

Potential Challenges Ahead

While the prospects for a Staked $CRO ETF are promising, there are several challenges that Canary may face in the approval process. The SEC has historically been cautious when it comes to cryptocurrency-related financial products, citing concerns over market manipulation and investor protection. Navigating these regulatory hurdles will be crucial for Canary as they seek to launch this innovative investment vehicle.

Conclusion

The filing of the S-1 with the SEC for a Staked $CRO ETF represents a significant milestone in the cryptocurrency space. By offering a regulated investment option that combines the benefits of staking with the accessibility of an ETF, Canary could potentially attract a wide range of investors. As regulatory attitudes toward cryptocurrencies continue to evolve, the successful launch of this ETF could pave the way for future innovations in the financial markets.

Investors should keep a close eye on the developments surrounding this filing, as it may have far-reaching implications for the future of cryptocurrency investments. The growing interest in Staked ETFs reflects a broader trend toward integrating digital assets into traditional financial frameworks, and the $CRO ETF could be a leading example of this transformation.

As we move forward, the cryptocurrency community is optimistic about the potential approval of Canary’s Staked $CRO ETF, viewing it as a significant step toward legitimizing digital assets in the eyes of regulators and investors alike.

BREAKING: Canary files S-1 with SEC for a Staked $CRO ETF. pic.twitter.com/IOljDG4S6C

— Cointelegraph (@Cointelegraph) May 30, 2025

BREAKING: Canary files S-1 with SEC for a Staked $CRO ETF

Big news is hitting the financial world today! Canary has officially filed an S-1 registration statement with the SEC for a Staked $CRO ETF. This development could be a game-changer for both investors and the cryptocurrency market. If you’re wondering what this means, you’re in the right place. Let’s break it down.

What is an S-1 Registration Statement?

An S-1 registration statement is a document that companies must file with the U.S. Securities and Exchange Commission (SEC) before they can go public. This document provides vital information about the company, including its financials, management, and the risks associated with the investment. For the Staked $CRO ETF, this filing indicates that Canary is looking to offer an exchange-traded fund (ETF) that focuses on the cryptocurrency associated with Crypto.com, known as CRO.

Understanding ETFs and Their Benefits

ETFs, or exchange-traded funds, are investment funds that are traded on stock exchanges, much like stocks. They usually hold a collection of assets, including stocks, bonds, or commodities, and they can be a fantastic way for investors to diversify their portfolios. One of the biggest advantages of ETFs is their liquidity; you can buy and sell them throughout the trading day, making them more flexible than mutual funds.

The Staked $CRO ETF aims to allow investors to gain exposure to the cryptocurrency market without needing to buy and manage individual cryptocurrencies. Instead, they can invest in a fund that holds a basket of these assets, which is managed by financial professionals.

Why $CRO is Gaining Attention

CRO, the native cryptocurrency of Crypto.com, has been making waves in the crypto space lately. With its various use cases, including staking, payments, and trading, it’s no wonder that investors are paying attention. The ability to stake CRO for rewards adds another layer of appeal. Staking allows users to earn passive income by locking up their coins, making it a lucrative investment strategy.

Canary’s filing for a Staked $CRO ETF could further enhance the visibility of CRO in the investment community, attracting both seasoned investors and newcomers looking to dip their toes into the crypto market.

The Impact of This Filing

The filing of the S-1 with the SEC is a significant step for Canary and the broader cryptocurrency market. It signals that traditional financial institutions are increasingly recognizing the potential of cryptocurrencies and blockchain technology. This move could pave the way for more ETFs focused on digital assets, creating a more mainstream acceptance of crypto investments.

Moreover, having an ETF centered around a specific cryptocurrency like CRO could lead to increased demand and liquidity for the token itself. As more investors enter the market through the ETF, we could see a positive impact on CRO’s price and its overall market cap.

What to Expect Next

Now that the S-1 has been filed, there are several steps ahead before the Staked $CRO ETF can hit the market. The SEC will review the filing, which can take some time. During this period, investors will be watching closely for any updates or changes. It’s also an opportunity for Canary to engage with potential investors and build excitement around the ETF.

As the financial landscape continues to evolve, it’s crucial to stay informed about developments like this one. The introduction of new investment vehicles can create opportunities, but they also come with risks. So, if you’re considering investing in the Staked $CRO ETF once it’s available, make sure you do your research and understand both the benefits and risks involved.

Investor Sentiment and Market Reactions

The announcement has already generated buzz on social media and various financial news platforms. Many investors are optimistic about the potential of the Staked $CRO ETF, seeing it as a bridge between traditional finance and the burgeoning world of cryptocurrency. The excitement is palpable, and discussions around the ETF are lighting up Twitter.

The overall sentiment in the market could also be influenced by how the SEC responds to the filing. If the SEC grants approval, it could lead to a wave of similar filings, further legitimizing the crypto space and attracting institutional investment.

How to Stay Updated

For those interested in following the developments surrounding the Staked $CRO ETF, it’s essential to keep an eye on reputable financial news sources. Websites like [Cointelegraph](https://cointelegraph.com/) and [Bloomberg](https://www.bloomberg.com/) often provide timely updates on such filings and the implications for investors. Additionally, tracking discussions on platforms like Twitter can give you insights into how the market is reacting to the news.

Final Thoughts

The filing of the S-1 for a Staked $CRO ETF by Canary is a pivotal moment in the world of cryptocurrency. It showcases the growing interest in digital assets and the increasing acceptance of crypto in mainstream finance. As investors, we have a unique opportunity to engage with these developments, understanding their potential impacts on our investment strategies.

As always, approach any investment with caution. The world of cryptocurrencies can be volatile, and while ETFs may offer some level of stability, it’s crucial to stay informed and make decisions based on solid research. The Staked $CRO ETF could be an exciting addition to the investment landscape, but like all investments, it comes with its own set of risks and rewards.

Stay tuned for more updates as we continue to track the progress of this significant filing and what it could mean for the future of cryptocurrency investing!