Tesla Soars 69% Post-Walz’s Dip Celebration: Is the Governor a Market Guru?

Tesla stock performance, Minnesota governor Tim Walz, stock market trends 2025

—————–

Tesla Stock Surge and Tim Walz’s Role

In a recent Twitter update that has captured the attention of investors and Tesla enthusiasts alike, TaraBull shared an intriguing observation about the performance of Tesla’s stock. The tweet highlights that Tesla’s stock has surged nearly 69% since Minnesota Governor Tim Walz publicly celebrated a dip in the stock. This significant uptick raises questions about the implications of Walz’s statement and the overall sentiment surrounding Tesla as a leading electric vehicle manufacturer.

The Context of the Stock Market Dip

Stock market fluctuations are common, and dips often present opportunities for investors to capitalize on lower prices. Tim Walz’s celebration of the dip suggests a positive outlook on the company’s future and perhaps an encouragement for investors to buy during a perceived low point. Celebrating a dip can be a double-edged sword; while it may instill confidence in some investors, it can also draw skepticism from others who fear further declines.

Tesla’s Impressive Recovery

Tesla’s remarkable recovery since the dip is noteworthy. The company, founded by Elon Musk, has been a frontrunner in the electric vehicle industry and has garnered a loyal following of investors. The recent surge in Tesla stock is a reflection of renewed investor confidence and the company’s ongoing efforts to innovate and expand its market presence. Factors contributing to this surge may include strong quarterly earnings reports, the expansion of production capabilities, and increasing demand for electric vehicles as consumers become more environmentally conscious.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

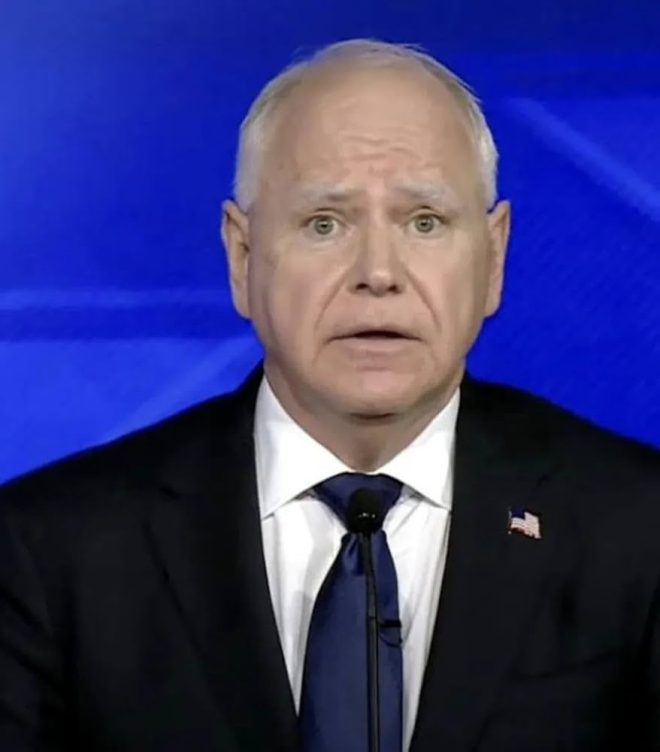

Tim Walz: A Figure of Interest

Tim Walz’s role as the Governor of Minnesota makes his comments particularly noteworthy. Politicians often influence public perception and investor sentiment, so his celebration of Tesla’s dip could be seen as a strategic move to bolster confidence in the electric vehicle market. Walz’s public endorsement may resonate with local investors and consumers, potentially driving up interest in Tesla and other electric vehicle companies.

Investor Reactions and Market Implications

The tweet by TaraBull not only highlights the stock movement but also invites a broader discussion about Tim Walz’s impact on investor sentiment. Investors are often influenced by public figures, and Walz’s positive remarks could have contributed to the stock’s upward trajectory. The conversation surrounding Walz’s comments may prompt more discussions about the future of electric vehicles, government policies, and how they intersect with market performance.

The Broader Electric Vehicle Market

Tesla operates within a rapidly evolving electric vehicle market. As awareness of climate change grows and governments push for greener alternatives, the demand for electric vehicles is expected to rise significantly. Tesla’s market position, driven by strong branding and innovative technology, places it at the forefront of this transformation. Other companies in the automotive sector are also making strides in electric vehicle development, which adds competition but also validates the growing market.

Conclusion: What Lies Ahead for Tesla?

The recent surge in Tesla’s stock, coinciding with Tim Walz’s comments, opens a dialogue about the interconnectedness of politics, public perception, and market performance. As Tesla continues to innovate and expand its offerings, investor sentiment will likely remain a crucial factor in its stock performance. Observers will be keen to see how Walz’s endorsement and the overall market dynamics evolve in the coming months.

In summary, Tim Walz’s public celebration of Tesla’s stock dip appears to have contributed to a significant rebound in the company’s stock price. With Tesla’s ongoing innovation, the broader electric vehicle market’s growth, and the influence of public figures on investor sentiment, the future looks promising for Tesla and its shareholders. As the electric vehicle market continues to expand, investors and consumers alike will be watching closely to see how Tesla navigates this dynamic landscape.

BREAKING: Tesla stock is up almost 69% since Tim Walz celebrated the dip

What do you think of Tim? pic.twitter.com/9DUPfTIdhs

— TaraBull (@TaraBull808) May 30, 2025

BREAKING: Tesla Stock is Up Almost 69% Since Tim Walz Celebrated the Dip

When news breaks about stocks, especially for a company like Tesla, it grabs attention. Recently, a tweet from TaraBull stated, “BREAKING: Tesla stock is up almost 69% since Tim Walz celebrated the dip.” This tweet sparked various discussions and debates online, making everyone curious about what Tim Walz’s celebration actually means in the broader context of the stock market and Tesla’s performance.

So, let’s dive in and unpack this situation. What does it mean for Tesla? How does Tim Walz fit into this narrative? And what should investors take away from this spike in Tesla’s stock price?

Understanding the Context of Tesla’s Stock Movement

Tesla has always been a volatile stock. Market fluctuations, global events, and even social media remarks can cause significant shifts in its value. The comment about Tesla’s stock rising nearly 69% since Tim Walz celebrated the dip is an example of how outside factors can influence stock performance. In the world of investments, particularly with a company like Tesla, every little event can have a ripple effect.

Celebrating the dip could mean that Walz, the Governor of Minnesota, publicly acknowledged a low point in Tesla’s stock price, which may have prompted investor confidence. When a notable figure shows faith in a company at a low point, it can encourage others to buy in, driving the price back up. It’s a classic case of psychology in investing—confidence breeds confidence.

What Do We Know About Tim Walz?

Tim Walz is not just a politician; he’s a figure who represents a significant portion of American sentiment on economic matters. His public statements can sway opinions and influence investment decisions. When he celebrated the dip in Tesla’s stock, it was likely a nod to the company’s resilience and potential for recovery. Some investors may have taken this as a signal to buy, contributing to the stock’s surge.

While Walz’s influence might not be solely responsible for the stock’s increase, his acknowledgment can’t be dismissed. It highlights how interconnected the world of politics and investing can be, especially when influential leaders show support for major companies like Tesla.

The Importance of Investor Sentiment

Investor sentiment plays a vital role in stock prices. Positive news can lead to a surge in buying, while negative news can trigger panic selling. Tesla, known for its passionate fanbase and investor community, is particularly susceptible to these shifts in sentiment. When someone like Tim Walz praises the company, it can create a wave of enthusiasm. This is essential for understanding the nearly 69% rise since his celebration.

The excitement around Tesla doesn’t just stem from its electric vehicles; it’s about the brand itself, the mission of sustainability, and the innovative technology behind its products. When influential figures show support, it solidifies the company’s positioning in the market, leading to increased stock prices.

What Should Investors Consider?

If you’re an investor looking at Tesla, this recent surge might have you excited. But it’s essential to take a step back and think critically. Stock prices can be driven by hype, and while a nearly 69% rise sounds incredible, it’s crucial to evaluate the fundamentals of the company. Are sales increasing? Is Tesla meeting its production goals? Are there any upcoming innovations or challenges on the horizon?

Investors should always look beyond the headlines. While Walz’s celebration may have contributed to the rise, understanding the broader market dynamics and Tesla’s position within it is key. Keeping an eye on these factors can help you make informed decisions.

What Do You Think of Tim?

So, what do you think of Tim Walz? His role in this scenario is fascinating. Some might see him as a hero for supporting innovation and sustainable energy; others might view him skeptically, questioning if politicians should be involved in market sentiments. Regardless of your stance, it’s clear that his actions have made waves in the investment community.

In the end, everyone has an opinion. Social media platforms are buzzing with discussions about Walz’s influence. Some see it as a positive endorsement for Tesla, while others worry about the risks of following trends driven by public figures.

Your thoughts on Tim can reflect how you perceive the interplay between politics and investing. Do you believe that endorsements from politicians like Tim Walz can lead to more informed investments, or do you think it creates unnecessary hype? Engaging in discussions can provide insights and differing perspectives, which are invaluable in the world of investing.

The Future of Tesla’s Stock

Looking ahead, the future of Tesla’s stock is a topic of much speculation. Will it continue to rise, or is a correction on the horizon? Analysts often have mixed opinions, and keeping up with news, trends, and market analysis is crucial for any investor.

In addition to public sentiment and endorsements from figures like Tim Walz, broader economic factors will play a vital role. Changes in government policies, global supply chain issues, and competition in the electric vehicle market all contribute to Tesla’s stock trajectory.

As an investor, staying informed and adaptable is essential. The market can shift rapidly, and understanding how external influences like Walz’s comments affect stock prices can give you an edge.

Wrapping Up the Tesla Discussion

The surge in Tesla’s stock price, attributed to Tim Walz’s celebration of the dip, serves as a reminder of how interconnected our world is. Politics, economics, and public sentiment all intertwine, creating a complex tapestry that can significantly impact investments.

Whether you’re a seasoned investor or just starting out, keeping an eye on these dynamics can help you navigate the ever-changing landscape of the stock market. And as for Tim Walz, his impact on Tesla’s stock is a testament to the power of public figures in the financial realm.

So, keep asking yourself: What do you think of Tim? How do you view the relationship between politics and investing? These reflections can shape your approach to investing and understanding the market at large.

Engage in conversations, do your research, and always stay curious. The world of investing is as much about knowledge as it is about numbers.