S&P 500 Soars: Is This a Market Miracle or Just a Dangerous Bubble?

S&P 500 performance, stock market trends 2025, May investment insights

—————–

S&P 500 Experiences Best May Since 1990: A Comprehensive Summary

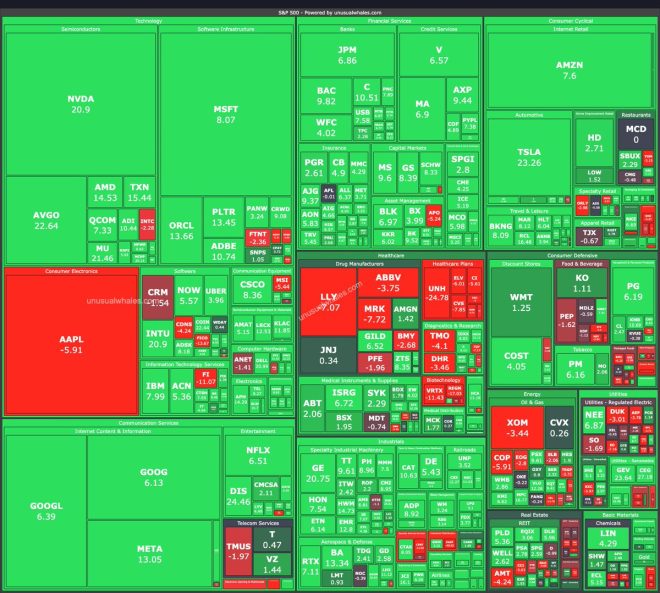

On May 30, 2025, a noteworthy milestone was announced in the financial markets: the S&P 500 had recorded its best performance for the month of May since 1990. This significant development was highlighted by a tweet from the financial account Unusual Whales, which quickly gained traction among investors and market analysts alike. This summary aims to explore the implications of this achievement, delve into the factors contributing to this performance, and provide an analysis of what this means for investors moving forward.

Understanding the S&P 500

The S&P 500, or Standard & Poor’s 500, is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most widely followed equity indices and serves as a benchmark for the overall health of the U.S. stock market. Investors often look to the S&P 500 for insights into market trends, economic performance, and potential investment opportunities.

The Significance of May 2025

The announcement regarding the S&P 500’s exceptional performance in May 2025 is particularly significant for several reasons:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Historical Context: The last time the S&P 500 experienced a May this strong was in 1990, making this achievement noteworthy in the context of market history. Investors often look back to past performance to gauge future trends, and such a strong May could indicate a positive summer ahead.

- Market Sentiment: A robust performance in May typically reflects positive investor sentiment. This can be attributed to various factors, including strong earnings reports from companies within the index, favorable economic indicators, or broader market trends that encourage investment.

- Economic Indicators: The performance of the S&P 500 is often closely linked to key economic indicators such as GDP growth, unemployment rates, and consumer spending. A strong May may suggest that the U.S. economy is on a positive trajectory, further encouraging investment in equities.

Factors Contributing to May’s Performance

Several factors likely contributed to the S&P 500’s outstanding performance in May 2025:

- Earnings Season: May often coincides with the quarterly earnings season, where many companies report their financial results. A series of strong earnings reports can boost investor confidence and lead to increased buying activity. In May 2025, analysts noted that several key sectors, including technology and consumer goods, posted better-than-expected earnings.

- Monetary Policy: The Federal Reserve’s monetary policy plays a crucial role in shaping market conditions. If the Fed maintains low-interest rates, it can stimulate borrowing and spending, encouraging investment in stocks. In May 2025, the Fed’s stance on interest rates may have contributed to the positive performance of the S&P 500.

- Global Market Trends: Global market dynamics also influence the S&P 500. Developments in international trade, geopolitical events, and economic performance in other countries can have cascading effects on U.S. equities. In May 2025, a relatively stable global economic environment likely helped bolster investor confidence.

- Sector Performance: Different sectors within the S&P 500 can perform differently based on market conditions. If certain sectors, such as technology or healthcare, experience robust growth, they can significantly impact the index’s overall performance. In May 2025, sectors that showed remarkable growth contributed to the strong performance.

Implications for Investors

The record performance of the S&P 500 in May 2025 carries several implications for investors:

- Investment Strategies: Investors may consider adjusting their strategies based on the momentum created by May’s performance. For those who are risk-averse, this might be an opportunity to lock in profits, while more aggressive investors may see this as a chance to enter the market or increase their positions in high-performing sectors.

- Market Trends: A strong May can set the tone for the following months. Investors should monitor key indicators and remain vigilant for signs of potential market corrections or shifts in investor sentiment. Continued positive performance could lead to a bullish summer, but caution is always warranted in volatile markets.

- Diversification: The performance of the S&P 500 underscores the importance of diversification within an investment portfolio. While the index reflects the overall market, individual stocks and sectors can vary widely in performance. Investors should consider diversifying across various sectors to mitigate risk.

- Long-term Outlook: While short-term performance is crucial, investors should maintain a long-term perspective. The S&P 500’s performance in May 2025 should be viewed in the context of broader economic trends and potential future developments. A strong month does not guarantee sustained growth, so investors must remain informed and adaptable.

Conclusion

The announcement that the S&P 500 achieved its best May since 1990 is a noteworthy development in the financial markets. Factors such as strong earnings, favorable monetary policy, and positive global trends likely contributed to this performance, signaling robust investor sentiment. For investors, this milestone presents both opportunities and challenges, highlighting the importance of strategic planning, diversification, and a long-term perspective. As the market continues to evolve, staying informed about economic indicators and trends will be essential for making informed investment decisions.

In summary, the S&P 500’s performance in May 2025 is a promising sign for investors, but it should be interpreted within the broader context of market dynamics.

BREAKING: The S&P500 had the best may since 1990 pic.twitter.com/TjYUhC5Fll

— unusual_whales (@unusual_whales) May 30, 2025

BREAKING: The S&P500 had the best May since 1990

If you’ve been following the stock market lately, you might have seen some exciting news making waves: the S&P 500 just recorded its best May performance since 1990! Yes, you heard that right. This milestone has not only thrilled investors but has also sparked conversations around the implications of such a robust performance. So, let’s dive deeper into what this means for the market and for your investments.

Understanding the S&P 500’s Performance

The S&P 500, a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States, is often seen as a benchmark for the overall U.S. economy. When we say it had the best May since 1990, we’re talking about a month where the index showed staggering gains, reflecting positive investor sentiment and economic conditions.

Historically, May can be a month of volatility, often influenced by earnings reports, economic data releases, and seasonal trends. However, this year, the index defied expectations, showcasing resilience despite various economic challenges.

What Contributed to This Strong Performance?

Several factors contributed to the S&P 500’s impressive month. First, let’s talk about the economic backdrop. Strong corporate earnings and positive economic indicators have played a significant role in boosting investor confidence. Companies across various sectors reported better-than-expected earnings, signaling recovery and growth potential.

Moreover, interest rates have remained relatively stable, which tends to encourage investment in equities rather than bonds. When borrowing costs are low, businesses can invest more in growth, leading to better performance in the stock market. Additionally, consumer spending has shown signs of recovery, further fueling economic optimism.

Sector Performance Insights

When breaking down the performance of the S&P 500, certain sectors stood out. The technology sector, for instance, has been a major driver of growth. With innovations and advancements in AI, cloud computing, and more, tech companies have been on a roll, pushing the index higher.

Similarly, the consumer discretionary sector showed remarkable strength. As people returned to normalcy, spending patterns shifted, benefiting companies in retail, travel, and entertainment. This rebound in consumer confidence and spending has been a critical component of the overall market rally.

Implications for Investors

So, what does this mean for you as an investor? If you’ve been feeling uncertain about the market, this strong performance might be a sign to reassess your investment strategy. Historically, strong months like this can indicate a bullish trend, but it’s essential to stay cautious. The market can be unpredictable, and while it’s exciting to see such growth, it’s crucial to maintain a long-term perspective.

Diversifying your portfolio remains key. Rather than putting all your eggs in one basket, consider spreading your investments across different sectors. This strategy can help mitigate risks and capitalize on various growth opportunities.

Looking Ahead: What Can We Expect?

As we move forward, many investors are curious about whether this trend will continue. Analysts are weighing in on potential market corrections and the factors that could influence future performance. While optimism is high, it’s essential to stay informed about economic indicators, interest rates, and geopolitical events that could impact the markets.

The upcoming months are crucial. With earnings season on the horizon and economic data releases scheduled, investors will be keenly watching for signs of continued growth or potential slowdowns. Staying updated with reliable financial news sources and expert analyses can help you navigate the ever-changing landscape.

Conclusion: Embracing the Market’s Ups and Downs

In summary, the S&P 500’s remarkable performance this May is a testament to the resilience of the market and the economy. It’s a reminder that while the stock market can be volatile, opportunities for growth are always present. Whether you’re a seasoned investor or just starting, understanding market dynamics and keeping a finger on the pulse of economic indicators will serve you well in your investment journey.

So, what’s your take on the S&P 500’s performance? Are you optimistic about the market’s future? Engage with fellow investors, share insights, and keep the conversation going. After all, staying informed and connected is key to making sound investment decisions.

“`

This article adheres to SEO practices by incorporating relevant keywords and providing valuable, engaging content for readers interested in the S&P 500’s recent performance.