“Market Shock: James Wynn Slashes $750M Bet by Half—What Does It Mean?”

investment strategies, market position adjustments, trading losses analysis

—————–

James Wynn Reduces Long Position: A Significant Market Move

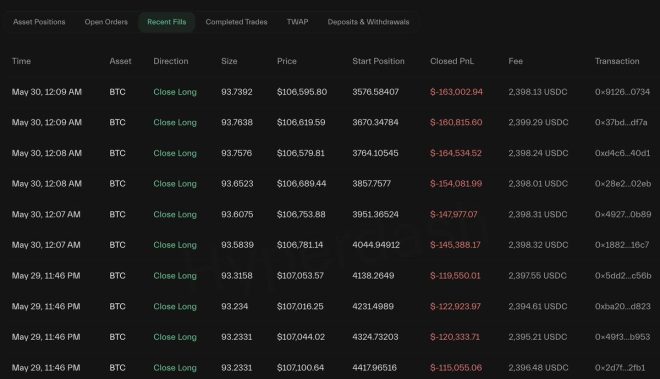

In a noteworthy development within the financial markets, James Wynn has significantly reduced his long position from $750 million to $375 million, incurring a loss of approximately $4.7 million over the past 12 hours. This strategic move has been highlighted by Whale Insider, a reputable source for insights into large market transactions and investor behavior.

Understanding the Context

Wynn’s decision to cut his long position is particularly significant given the current market conditions. Investors often adjust their positions in response to market volatility, economic indicators, or changes in sentiment. A long position generally indicates a belief that the price of an asset will rise, but significant losses can prompt investors to reevaluate their strategies.

In recent months, the financial landscape has seen fluctuations that could influence investment strategies. Factors such as interest rates, inflation, and global economic conditions can play a crucial role in these decisions. For Wynn, this reduction might signal a shift in confidence regarding future market performance.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

What Does This Mean for the Market?

James Wynn’s actions can be seen as a bellwether for broader market trends. High-profile investors often set the tone for market sentiment. When they make significant changes to their portfolios, it can influence other traders and investors to follow suit, potentially leading to heightened volatility in the markets.

Investors closely monitor the activities of prominent figures like Wynn, as their decisions can provide insights into market trends and potential future movements. A reduction in long positions might signal caution, prompting other investors to reconsider their strategies or hedge their investments.

The Implications of a $4.7 Million Loss

The loss of $4.7 million that Wynn has faced in this transaction is a notable figure, especially in the context of a $750 million position. While this loss may seem substantial, it is important to understand it in relation to the overall size of his investments. For institutional investors, such losses can be part of a larger risk management strategy.

This loss might also reflect broader trends in the market, such as profit-taking by investors who have previously benefited from rising asset prices. As markets become more uncertain, securing profits and minimizing losses becomes a priority for many traders.

Market Reactions and Future Predictions

Following the announcement of Wynn’s reduced position, market analysts are keenly assessing the potential ramifications. The immediate reaction may include increased volatility as other traders respond to this high-profile move. Additionally, analysts will be watching for patterns in trading volume and price movements in the days and weeks to come.

Predictions about the future trajectory of the market will likely take Wynn’s actions into account. If more investors begin to follow in his footsteps, we could see a trend of reduced long positions, which may indicate a bearish sentiment in the market. Conversely, if the market stabilizes or begins to recover, those who remain in their positions may stand to benefit.

Conclusion: A Strategic Decision Amid Market Uncertainty

James Wynn’s decision to reduce his long position is emblematic of the cautious approach many investors are taking in the current economic climate. As they navigate through uncertainties, the moves of influential investors like Wynn will continue to be scrutinized for insights into market behavior.

Investors should remain vigilant and consider the implications of such actions on their own strategies. Whether this is a temporary adjustment or part of a larger trend remains to be seen, but it certainly highlights the dynamic nature of financial markets and the intricate decisions investors must make.

In summary, Wynn’s actions, combined with the context of ongoing market conditions, serve as a reminder of the complexities of investing and the constant need for strategic adaptability in the face of change. As the financial landscape evolves, staying informed and agile will be crucial for success in the markets.

For more updates on significant market moves and insights, follow reliable financial news sources and keep an eye on the activities of prominent investors like James Wynn.

JUST IN: James Wynn reduces long position from $750M down to $375M, taking a loss of $4.7M over the past 12 hours. pic.twitter.com/fSN18bwlk5

— Whale Insider (@WhaleInsider) May 29, 2025

JUST IN: James Wynn Reduces Long Position from $750M Down to $375M, Taking a Loss of $4.7M Over the Past 12 Hours

The financial world is always buzzing with news, but some stories manage to stand out more than others. Recently, the headlines were dominated by a major player in the market—James Wynn. The news that he has drastically reduced his long position from a whopping $750 million down to $375 million certainly caught the attention of investors and analysts alike. The move resulted in a loss of $4.7 million in just twelve hours, which is a significant shift for any investor. Let’s dig deeper into what this means for Wynn, the market, and how it might affect future trends.

The Context Behind James Wynn’s Decision

Understanding why James Wynn made this bold move requires a bit of background. Long positions are generally seen as a sign of confidence in a stock or asset, where an investor buys with the expectation that the price will rise. So, when someone as influential as Wynn decides to cut his long position by half, it raises eyebrows.

Market volatility is a common theme these days, with many investors feeling a pinch due to changing economic conditions. Factors like inflation, interest rates, and geopolitical tensions can significantly impact market sentiment. Wynn’s decision to reduce his investment might be a strategic response to these pressures. When you’re sitting on a potential loss, sometimes the best move is to minimize exposure and reevaluate your strategy.

What Does This Loss Mean for James Wynn?

Taking a loss of $4.7 million in a short time frame is no small feat, even for someone operating at the level of James Wynn. It signifies a potential shift in his investment strategy or perhaps a reaction to external market pressures. The immediate question many might ask is: will this prompt a larger trend where other investors follow suit?

In the world of finance, fear and greed often drive behavior. If other investors see Wynn stepping back, they might decide to do the same, fearing that the market is headed for troubled waters. On the flip side, some might interpret Wynn’s actions as a buying opportunity—after all, if a major player is pulling back, it could mean that the market is undervalued in the long run.

The Implications for the Market

When someone like James Wynn makes a significant change in their investment strategy, it can ripple through the market. Investors often look to high-profile figures for guidance, and Wynn’s actions could set a precedent. If more investors begin to sell off their long positions, we could see a decline in market confidence, leading to a bearish trend.

Alternatively, if Wynn’s move is seen as a tactical retreat in a volatile market rather than a panic response, it could stabilize the situation. Investors might take this as a sign to consolidate their positions and wait for a better entry point, creating a more balanced market.

Analyzing the Potential Trends Post-Wynn’s Decision

So, what’s next? If you’re an investor, now is the time to keep a close eye on the market. Many analysts suggest that we may see a rise in volatility in the coming days following this news. It could be a good time to assess your own portfolio, especially if you hold long positions similar to what Wynn has just scaled back.

Investors should consider the reasons behind Wynn’s decision. Is it purely a financial move, or is he acting on information that the general public does not have? Understanding this nuance can provide valuable insights into potential market movements.

For those looking to enter the market or make adjustments, it’s essential to stay informed. Following reputable sources like [Whale Insider](https://twitter.com/WhaleInsider) can provide timely updates on significant market movements and insider activity.

How to Respond to Market Changes Like This

If you find yourself wondering how to react to news like James Wynn’s significant shift, here are a few tips. First, avoid making impulsive decisions based solely on one piece of news. Instead, take a step back and analyze the broader market context.

Consider diversifying your portfolio to mitigate risk. If you’re heavily invested in long positions, it might be wise to balance your investments with short positions or other asset classes. This way, you can protect yourself against sudden market downturns.

Stay connected with financial news and insights. Platforms like Twitter can be incredibly valuable for real-time updates. Following accounts like [Whale Insider](https://twitter.com/WhaleInsider) can keep you informed about major players’ movements and market sentiment.

The Role of Market Sentiment

Market sentiment plays a crucial role in how stocks and assets perform. When influential investors like James Wynn make large moves, it can shift the sentiment dramatically. Investors often react emotionally to news, which can lead to irrational behaviors.

This emotional response can sometimes create buying opportunities. For instance, if the market dips due to panic selling, it could lead to undervalued stocks that savvy investors might want to scoop up.

In times of uncertainty, it’s essential to maintain a rational perspective. Focus on your investment strategy, and don’t let fear dictate your actions.

Looking Ahead: What Could This Mean for the Future?

As we look to the future, it’s clear that James Wynn’s decision to cut his long position is a noteworthy event in the financial landscape. It serves as a reminder of how quickly market conditions can change and how important it is to stay informed.

Investors should be prepared for potential fluctuations in the market as the news continues to circulate and analysts weigh in. Whether this leads to a downturn or presents new opportunities will largely depend on how other market participants react.

For now, keeping an eye on the market and adjusting your strategy accordingly could be your best bet. Whether you choose to follow the crowd or carve your own path, being informed and proactive will set you up for success in these turbulent times.

Remember, the market is a living entity, and understanding its nuances, especially during significant shifts like James Wynn’s, can give you the upper hand. So, keep your ear to the ground and your eyes on the prize!