“GameStop & AMC Short Floats Surge: Are We Witnessing a Massive Squeeze?”

GameStop stock analysis, AMC investment strategies, short selling trends 2025

—————–

Understanding the Rising Short Floats of GameStop and AMC

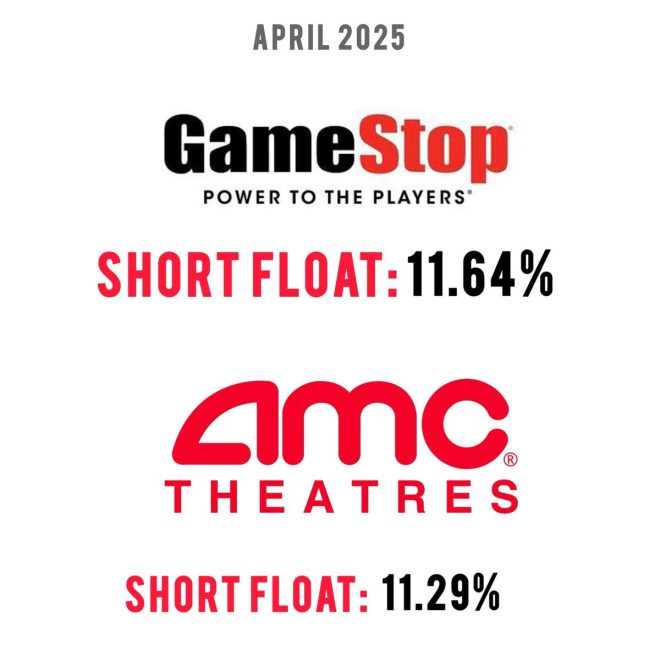

In the world of stock trading, few phenomena capture the attention of investors quite like the dynamics of short selling and short squeezes. Recently, significant developments concerning GameStop (GME) and AMC Entertainment (AMC) have emerged, highlighting an increase in short floats for both companies. As of the latest reports, GameStop’s short float stands at 12.12%, while AMC’s short float is at 14.91%. This surge in short float percentages could indicate a brewing short squeeze, with implications for investors and market dynamics alike.

What Is Short Float?

To fully grasp the significance of these figures, it’s essential to understand what short float means. The short float percentage represents the proportion of a company’s total shares that are currently sold short by investors who believe the stock price will decline. A high short float indicates that a considerable number of shares are being borrowed and sold, suggesting a bearish outlook among investors. However, a rising stock price combined with a high short float can lead to a phenomenon known as a short squeeze.

The Mechanics of a Short Squeeze

A short squeeze occurs when a heavily shorted stock experiences a rapid increase in price. This price surge forces short sellers to buy back shares to cover their positions, further driving the stock price higher. The combination of a high short float and increasing stock prices creates a perfect storm for short sellers, leading to heightened volatility and potential gains for those holding long positions in the stock.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

For GameStop and AMC, the recent increases in short float percentages suggest that many investors are betting against these companies, anticipating a decline in their stock values. However, if the stock prices continue to rise, short sellers may soon find themselves in a position where they need to buy back shares at higher prices, thus fueling further upward momentum.

Recent Trends in GameStop and AMC Stocks

Both GameStop and AMC have experienced significant volatility and media attention in recent years, particularly during the retail trading frenzy of early 2021. Retail investors, organized through online platforms like Reddit’s WallStreetBets, have frequently targeted these stocks, leading to dramatic price swings.

GameStop, once a struggling video game retailer, became a symbol of the power of retail investors against hedge funds that were shorting its stock. Similarly, AMC, a major player in the cinema industry, has seen its stock soar as a result of retail investor enthusiasm. The recent increases in short float percentages for both companies could signal a new chapter in this ongoing saga.

Factors Contributing to Increased Short Floats

Several factors contribute to the rising short floats of GameStop and AMC. One significant factor is the overall market sentiment regarding these companies. Despite facing challenges, such as changes in consumer behavior and the impact of the COVID-19 pandemic, both companies have garnered attention for their potential recovery and growth prospects.

Additionally, the ongoing discussions around the future of cinema and gaming, particularly in a post-pandemic world, have kept investors engaged. As retail investors continue to rally around these stocks, institutional investors may also increase their short positions, anticipating a decline in stock prices.

Implications for Investors

For investors, the current situation with GameStop and AMC presents both opportunities and risks. Those who are bullish on these stocks may see the rising short floats as a chance for a potential short squeeze, leading to significant gains. However, it is essential to approach this with caution, as the stock market is inherently unpredictable.

Investors should conduct thorough research and stay informed about market trends, company fundamentals, and broader economic indicators. Understanding the dynamics of short selling and the potential for short squeezes can help investors navigate these volatile waters.

Conclusion

The rising short floats of GameStop and AMC, with figures now at 12.12% and 14.91% respectively, underscore the continuing drama surrounding these stocks. The potential for a short squeeze looms large, as high short float percentages combined with rising stock prices could lead to significant volatility in the market.

As retail investors remain active and engaged, the dynamics of short selling continue to evolve. For those considering investments in GameStop or AMC, it is crucial to stay updated on market developments and be prepared for the inherent risks associated with trading heavily shorted stocks. Whether this situation leads to a short squeeze or a more prolonged bearish trend remains to be seen, but one thing is clear: the story of GameStop and AMC is far from over.

By keeping informed and strategically analyzing market movements, investors can position themselves to capitalize on the ongoing developments in the GameStop and AMC saga.

JUST IN GameStop & AMC Short Floats Are Both Increasing

GameStop Short Float is now: 12.12%

AMC Short Float is now: 14.91%

High short float + rising stock price = short sellers buy back shares, driving price higher in a short squeeze $GME $AMC https://t.co/JsBqCUzw3T

JUST IN GameStop & AMC Short Floats Are Both Increasing

In the ever-evolving world of stock trading, there’s some exciting news for investors and traders alike. Recently, the short floats for GameStop and AMC have seen an uptick, sparking conversations and speculation across financial platforms. The latest figures reveal that the GameStop short float now stands at 12.12%, while the AMC short float has reached 14.91%. But what does this mean for investors and the potential for a short squeeze? Let’s break it down.

GameStop Short Float is now: 12.12%

GameStop, the iconic video game retailer that became a household name during the meme stock craze of 2021, is once again in the spotlight. The current GameStop short float at 12.12% indicates that a significant percentage of the stock is being shorted. For those who might not be familiar, short selling is when investors bet against a stock, hoping that its price will decline. A higher short float can create a tense situation for short sellers, especially if the stock price begins to rise.

The rise in GameStop’s short float suggests that more investors are betting against the company’s stock, perhaps believing that the stock price is inflated or unsustainable. However, this can backfire dramatically if the price starts to climb, leading to what is known as a “short squeeze.” In such a scenario, short sellers are forced to buy back shares to cover their positions, which further drives up the stock price.

AMC Short Float is now: 14.91%

Similarly, AMC Entertainment has been making headlines with a short float of 14.91%. This percentage reflects the amount of AMC stock that is currently sold short. Just like with GameStop, a high short float for AMC signals that many investors are betting against the stock. Some may argue that this is a risky move, especially considering AMC’s resilient fanbase and its unique position in the entertainment industry.

With blockbuster films returning to theaters and the resurgence of in-person entertainment experiences, AMC could surprise the market. Investors betting against AMC may soon find themselves in a precarious position if the stock begins to rally. The combined short float for both GameStop and AMC creates a perfect storm for potential short squeezes, making them hot topics in the stock market.

High short float + rising stock price = short sellers buy back shares, driving price higher in a short squeeze $GME $AMC

The formula for a short squeeze is simple yet powerful: a high short float combined with a rising stock price leads short sellers to buy back shares. This phenomenon can create a rapid increase in stock prices, leading to wild trading sessions and heightened volatility. For traders and investors, understanding how this dynamic works is crucial for making informed decisions.

In recent weeks, GameStop and AMC have both experienced fluctuations in their stock prices. As the short floats continue to rise, many investors are keeping a close eye on potential bullish trends. If either stock sees a significant uptick in price, short sellers may scramble to cover their positions, leading to a cascading effect that could propel prices even higher.

While some investors may view this as an opportunity to profit, others may see it as a risk-laden gamble. The stock market can be unpredictable, and short squeezes can happen suddenly and without warning. Therefore, it’s essential for investors to conduct thorough research and stay updated on market conditions, especially for stocks as volatile as GameStop and AMC.

The Role of Social Media and Retail Investors

Another factor contributing to the rising short floats of GameStop and AMC is the influence of social media and retail investors. Platforms like Reddit, Twitter, and TikTok have become breeding grounds for stock market discussions, with communities rallying behind these meme stocks. The power of collective action among retail investors has shown that they can significantly impact stock prices, as seen in early 2021.

As retail investors share information, strategies, and opinions, the potential for short squeezes increases. The excitement surrounding GameStop and AMC has been fueled by the passionate communities that support them, making it crucial for investors to stay engaged and informed. Following trends on social media can provide valuable insights into market sentiment and trading behavior.

Strategies for Investors During a Short Squeeze

If you’re considering investing in GameStop or AMC amidst rising short floats, it’s essential to have a strategy in place. Here are a few tips to navigate this potentially volatile landscape:

- Do Your Research: Always stay informed about the latest news and trends related to GameStop and AMC. Understanding the fundamentals, as well as the technical aspects of trading, can help you make better decisions.

- Set Clear Goals: Determine what you want to achieve with your investment. Are you looking for short-term gains from a potential squeeze, or are you interested in holding for the long term? Having clear objectives can guide your trading strategy.

- Manage Your Risks: Investing in highly volatile stocks like GameStop and AMC can be risky. Consider setting stop-loss orders to protect your investment and avoid significant losses.

- Stay Connected: Engaging with online communities and following financial news platforms can provide valuable insights and updates on market trends.

Potential Outcomes and Future Trends

As the short floats for GameStop and AMC continue to increase, the potential for a short squeeze remains high. Investors must remain vigilant and adaptable in this rapidly changing environment. While the excitement and volatility can lead to substantial profits, they can also result in significant losses. Keeping a close eye on market trends and investor sentiment will be crucial in the coming weeks and months.

In summary, the current situation with GameStop and AMC presents both opportunities and risks for investors. The rising short floats are a clear signal that volatility is on the horizon. By understanding the dynamics of short selling, staying informed, and employing sound investment strategies, traders can navigate this exciting yet unpredictable landscape.

For those who are intrigued by the world of stocks and trading, the developments surrounding GameStop and AMC are just the tip of the iceberg. As the market continues to evolve, it will be fascinating to see how these stocks perform and what new opportunities arise.

“`

This article is designed to engage readers while providing valuable information about the current state of GameStop and AMC stocks. It incorporates a conversational style, utilizes relevant keywords, and provides insights into the implications of rising short floats.