El Salvador’s Controversial Bitcoin Bet: IMF Loan Approved Amidst Turmoil!

El Salvador Bitcoin strategy, IMF loan impact on cryptocurrency, daily Bitcoin purchases in 2025

—————–

El Salvador Secures IMF Loan Payment Approval and Continues Bitcoin Investment Strategy

In a significant development for El Salvador, the country has successfully secured approval for an International Monetary Fund (IMF) loan payment. This milestone is particularly noteworthy as it comes in conjunction with the nation’s ongoing commitment to investing in Bitcoin—a cryptocurrency that has been at the forefront of El Salvador’s economic strategy since it became the first country in the world to adopt Bitcoin as legal tender in September 2021.

Background on El Salvador’s Bitcoin Adoption

El Salvador made headlines when President Nayib Bukele announced the decision to embrace Bitcoin as legal tender, positioning the nation as a pioneer in the cryptocurrency space. The move was intended to boost financial inclusion, attract foreign investment, and reduce remittance costs for the many Salvadorans living abroad. By allowing Bitcoin to be used alongside the U.S. dollar, the government aimed to modernize its economy and encourage cryptocurrency adoption among its citizens.

The Significance of the IMF Loan Payment Approval

The recent approval of the IMF loan payment is a crucial development for El Salvador, particularly given the economic challenges the country has faced in recent years. The IMF has been closely monitoring El Salvador’s fiscal policies and economic health, and this approval signifies a level of confidence in the country’s ability to manage its debts and financial commitments.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The funds from the IMF are expected to provide much-needed liquidity to the Salvadoran economy, allowing the government to invest in critical infrastructure and social programs. This financial support is especially important as the nation continues to navigate the complexities of integrating Bitcoin into its economy while addressing concerns regarding volatility and regulation.

Ongoing Bitcoin Purchases: A Daily Commitment

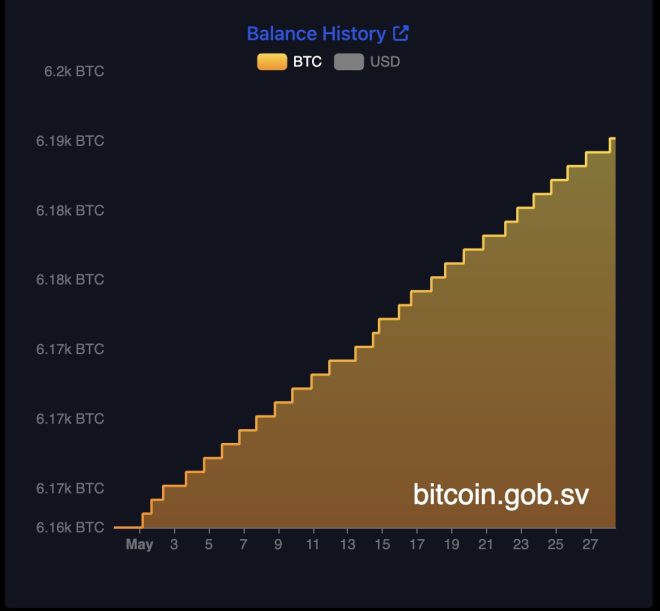

Despite the challenges associated with Bitcoin’s price fluctuations, President Bukele has reiterated his administration’s commitment to purchasing Bitcoin every single day. This strategy reflects a long-term vision for the country’s economic future, with the aim of building a Bitcoin reserve that could potentially stabilize the national economy.

The daily acquisition of Bitcoin underscores the government’s belief in the cryptocurrency’s potential to serve as a store of value and a hedge against inflation. Moreover, Bukele’s stance on Bitcoin aligns with a broader movement among some countries and investors who view cryptocurrencies as a viable alternative to traditional fiat currencies.

Economic Implications of Bitcoin Investment

El Salvador’s investment in Bitcoin comes with both risks and opportunities. On one hand, the volatility of Bitcoin can pose significant financial risks, potentially leading to large losses if the cryptocurrency’s value declines sharply. On the other hand, if Bitcoin experiences substantial gains, it could bolster the country’s finances and provide a new revenue stream through capital gains.

Moreover, the government’s focus on Bitcoin has sparked interest from international investors and tech entrepreneurs, who are drawn to the country’s innovative approach to financial technology. El Salvador’s unique position as a Bitcoin-friendly nation may attract cryptocurrency-related businesses, creating jobs and stimulating economic growth.

The Role of Bitcoin in Financial Inclusion

One of the primary objectives of adopting Bitcoin as legal tender is to enhance financial inclusion among the Salvadoran population. Many citizens lack access to traditional banking services, and Bitcoin provides an alternative means of conducting transactions and saving money. By leveraging mobile technology and cryptocurrency wallets, individuals can participate in the global economy without the need for a bank account.

The government’s promotion of Bitcoin has also led to educational initiatives aimed at informing citizens about cryptocurrency and its potential benefits. As more Salvadorans become familiar with Bitcoin, the hope is that they will be empowered to take control of their finances and access new economic opportunities.

Challenges Ahead

While the approval of the IMF loan payment and the ongoing Bitcoin investment strategy are positive developments for El Salvador, the country still faces several challenges. Economic instability, high levels of poverty, and concerns about corruption and governance remain significant hurdles. Additionally, the volatility of Bitcoin poses a constant risk, as dramatic price swings can impact government revenues and public sentiment.

Furthermore, international scrutiny regarding the government’s Bitcoin policies and their implications for financial stability continues to be a topic of debate. Critics argue that the reliance on a volatile cryptocurrency could jeopardize the country’s economic future, while supporters maintain that it represents an innovative approach to modernizing the economy.

Conclusion

El Salvador’s approval of the IMF loan payment and its unwavering commitment to Bitcoin investment highlight the country’s ambitious economic strategy. As it navigates the complexities of integrating cryptocurrency into its financial system, the nation is poised to become a significant player in the global cryptocurrency landscape.

With the potential for increased financial inclusion, economic growth, and innovative investment opportunities, El Salvador’s approach to Bitcoin could serve as a model for other nations considering similar paths. However, the challenges inherent in this strategy will require careful management and a commitment to transparency and governance to ensure a sustainable and prosperous economic future.

As El Salvador continues to make headlines with its bold moves in the cryptocurrency space, the world will be watching closely to see how this pioneering nation balances its innovative ambitions with the realities of economic governance and stability.

JUST IN: El Salvador gets IMF loan payment approved.

Still buying Bitcoin.

Every. Single. Day.— Bitcoin Archive (@BTC_Archive) May 28, 2025

JUST IN: El Salvador gets IMF loan payment approved

El Salvador is making headlines again! Just recently, the country received approval for an International Monetary Fund (IMF) loan payment. This news has sent ripples through the financial world, particularly among cryptocurrency enthusiasts. But what does this approval mean for the tiny Central American nation, and why is it still buying Bitcoin every single day? Let’s dive in and explore.

El Salvador, under the leadership of President Nayib Bukele, has been at the forefront of a bold experiment: adopting Bitcoin as legal tender. This move, while controversial, has placed the country in the global spotlight. With the IMF loan payment now approved, it seems El Salvador is steadfast in its commitment to cryptocurrency, particularly Bitcoin. The news comes as no surprise to those who have been following El Salvador’s financial strategies, as the government has been vocal about its belief in Bitcoin’s long-term potential.

Still buying Bitcoin

What’s more fascinating is that El Salvador isn’t just sitting back and waiting for things to unfold. The country is actively purchasing Bitcoin. Yes, you read that right—every single day! This strategy might sound risky to some, but for El Salvador, it’s part of a broader vision to stabilize its economy and increase financial inclusion among its citizens.

The decision to keep buying Bitcoin stems from the belief that the cryptocurrency will appreciate in value over time, providing the country with a safety net against economic fluctuations. Bukele and his administration are betting on Bitcoin’s potential to generate wealth and attract foreign investment. It’s a bold move, but one that aligns with their commitment to modernize the nation’s economy.

Moreover, the daily Bitcoin purchases serve as a statement of confidence in the cryptocurrency market, especially during a time when many investors are skittish due to market volatility. By continuously buying Bitcoin, El Salvador positions itself as a leader in the crypto space, encouraging other nations to consider similar paths.

Every. Single. Day.

The phrase “Every. Single. Day.” speaks volumes about El Salvador’s dedication to this initiative. It’s not just a one-time purchase or a temporary phase; it’s a consistent strategy that reflects a long-term vision. This commitment to daily Bitcoin purchases has garnered international attention, with many watching closely to see how it pans out.

The government of El Salvador has been transparent about its Bitcoin acquisitions. They have been posting updates on social media, showcasing the growing Bitcoin reserves and inviting citizens to participate in the Bitcoin ecosystem. This level of engagement is crucial in building confidence among Salvadorans, many of whom are still understanding and adapting to the new digital currency landscape.

It’s essential to recognize that this daily commitment to Bitcoin isn’t just about the currency itself. It also represents a shift in the financial mindset of a nation that has historically faced economic challenges. By embracing Bitcoin, El Salvador is striving to break away from traditional financial barriers and empower its citizens to take control of their financial futures.

The Bigger Picture

The decision to adopt Bitcoin and the recent loan payment approval from the IMF are part of a more extensive strategy to reshape El Salvador’s economy. The country’s economy has faced numerous hurdles, including high levels of debt, limited access to financial services, and reliance on remittances from abroad. By turning to Bitcoin, El Salvador aims to alleviate these issues and foster economic growth.

Additionally, the country’s picturesque landscapes and warm climate offer a unique advantage in attracting cryptocurrency enthusiasts and investors. Imagine a world where crypto conferences and events are held on the beautiful beaches of El Salvador. This vision could potentially bring in tourism revenue and create jobs, further solidifying the country’s economic foundation.

However, it’s important to note that the journey towards fully integrating Bitcoin into the economy is not without its challenges. Critics have raised concerns about the volatility of cryptocurrency and its implications for the average citizen. Many Salvadorans remain skeptical about the benefits of Bitcoin, especially those who are not familiar with digital currencies.

Challenges Ahead

While El Salvador’s bold moves have put it on the global map, the road ahead is not entirely smooth. The country faces several challenges, including the need for robust infrastructure to support Bitcoin transactions and ensuring that citizens have the education and resources necessary to navigate this new financial landscape.

Moreover, the reliance on Bitcoin introduces inherent risks due to its price volatility. A significant drop in Bitcoin’s value could have adverse effects on the economy, especially if the country accumulates substantial holdings. Balancing these risks while promoting the benefits of Bitcoin remains a critical task for the Salvadoran government.

The IMF’s approval of the loan payment provides some much-needed financial breathing room for El Salvador, but it also comes with conditions. The country must demonstrate fiscal responsibility and implement structural reforms to ensure long-term stability. How the government manages these expectations while maintaining its commitment to Bitcoin will be closely monitored by both supporters and critics.

Future Implications

The implications of El Salvador’s decisions extend beyond its borders. The country serves as a case study for other nations contemplating the adoption of cryptocurrency as legal tender. If El Salvador’s experiment proves successful, it could pave the way for a broader acceptance of Bitcoin and other cryptocurrencies worldwide.

As the global financial landscape continues to evolve, El Salvador’s actions could inspire other nations to reconsider their own monetary policies. The ongoing dialogue about the future of money is becoming increasingly relevant, particularly as technology continues to disrupt traditional financial systems.

In essence, El Salvador is not just buying Bitcoin; it’s making a statement about the future of finance. The nation is stepping into uncharted territory, and while there are risks, the potential rewards could be transformative.

A Community Approach

For El Salvador to truly succeed in this endeavor, community involvement is essential. The government has been making strides to educate its citizens about Bitcoin and encourage participation in the digital economy. Local businesses are starting to accept Bitcoin payments, and educational initiatives are being rolled out to ensure that Salvadorans understand how to use and invest in cryptocurrency.

Engaging the community fosters a sense of ownership and buy-in, which is crucial for the long-term success of this initiative. As more people become familiar with Bitcoin and its benefits, the likelihood of widespread adoption increases.

In this journey, collaboration between the government, private sector, and citizens will be vital. By working together, El Salvador can navigate the complexities of integrating Bitcoin into the economy, ensuring that everyone benefits from this revolutionary shift in financial thinking.

Conclusion

El Salvador’s approval for the IMF loan payment is more than just a financial milestone; it symbolizes the country’s unwavering commitment to embracing the future of finance through Bitcoin. By purchasing Bitcoin every single day, El Salvador is making a bold statement about its potential for economic growth and transformation.

The journey ahead may be filled with challenges, but with community engagement, education, and strategic planning, El Salvador could very well set a precedent for the world to follow. As the nation continues to navigate this new frontier, many will be watching closely, eager to see how this bold experiment unfolds.

In a world where financial landscapes are constantly shifting, El Salvador’s story serves as a reminder that innovation and resilience can lead to new possibilities for growth and empowerment. With each Bitcoin purchased, the country is not just investing in cryptocurrency; it’s investing in a brighter future for its people.