BlackRock’s $409M Bitcoin Buy: Are We Witnessing a Financial Revolution?

Bitcoin investment trends, institutional cryptocurrency adoption, large-scale crypto purchases

—————–

BlackRock Makes Major Move in Cryptocurrency: $409.3 Million Bitcoin Purchase

In a significant development in the cryptocurrency market, BlackRock, one of the world’s largest asset management firms, recently announced its acquisition of approximately $409.3 million worth of Bitcoin. This news, shared via a tweet from crypto influencer Ash Crypto, has sent ripples through the financial community and sparked discussions about the implications of institutional investment in digital currencies.

The Rise of Institutional Investment in Bitcoin

Institutional investment in Bitcoin has seen a notable increase over the past few years, with major financial institutions recognizing the cryptocurrency’s potential as a store of value and a hedge against inflation. BlackRock’s substantial purchase signals a growing confidence in Bitcoin’s legitimacy as an asset class. As institutional players like BlackRock enter the space, it could lead to increased price stability and a broader acceptance of cryptocurrencies in traditional finance.

Understanding BlackRock’s Strategic Move

BlackRock’s decision to invest heavily in Bitcoin aligns with its strategy to diversify its portfolio and offer clients exposure to emerging asset classes. With its deep understanding of market dynamics, BlackRock likely views Bitcoin as a long-term investment opportunity. The asset management giant has been exploring ways to incorporate cryptocurrencies into its offerings, which reflects a broader trend among financial institutions to adapt to the evolving landscape of digital assets.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for the Cryptocurrency Market

The announcement of BlackRock’s Bitcoin purchase is expected to have several implications for the cryptocurrency market:

- Increased Legitimacy: BlackRock’s entry into the Bitcoin market adds a layer of legitimacy to cryptocurrencies, potentially attracting more investors who were previously hesitant to engage with digital assets.

- Price Movements: Large purchases by institutional investors can lead to significant price movements. As demand increases, the price of Bitcoin may see upward pressure, benefiting existing holders.

- Market Dynamics: The involvement of major financial institutions like BlackRock could lead to changes in market dynamics, including increased liquidity and the development of new financial products related to cryptocurrencies.

- Regulatory Attention: With more institutional money flowing into the crypto space, regulatory bodies are likely to increase their scrutiny, which could impact how cryptocurrencies are traded and managed in the future.

The Role of Whales in the Cryptocurrency Ecosystem

In the context of cryptocurrency, "whales" refer to individuals or entities that hold large amounts of a particular cryptocurrency. The entry of whales like BlackRock into the Bitcoin market can significantly influence price trends and market sentiment. Their buying activity often signals confidence in the asset and can encourage other investors to follow suit, potentially leading to a bullish market trend.

Bitcoin’s Position in the Financial Landscape

Bitcoin has established itself as a leading cryptocurrency, often referred to as "digital gold." Its finite supply, decentralized nature, and security features make it an attractive investment for both retail and institutional investors. As global economic uncertainties persist, many investors are turning to Bitcoin as a hedge against inflation and currency devaluation.

The Future of Bitcoin and Institutional Investment

As BlackRock and other institutional investors continue to explore opportunities within the cryptocurrency space, the future of Bitcoin looks promising. Increased institutional adoption could pave the way for more robust infrastructure, including regulated exchanges and custodial services, making it easier for traditional investors to access cryptocurrencies.

Moreover, as more companies and financial institutions recognize the potential of Bitcoin, we may see the development of new financial products, such as Bitcoin ETFs (Exchange-Traded Funds), further integrating Bitcoin into mainstream finance.

Conclusion

BlackRock’s recent purchase of $409.3 million worth of Bitcoin marks a pivotal moment for the cryptocurrency market. As institutional investment becomes more prevalent, it could reshape the landscape of digital assets, bringing increased legitimacy and stability to an otherwise volatile market. Investors and market participants should closely monitor these developments, as they could have far-reaching implications for the future of Bitcoin and the broader cryptocurrency ecosystem.

In summary, the entry of large institutional players like BlackRock into the Bitcoin market is a clear indicator of the growing acceptance of cryptocurrencies as a viable asset class. As this trend continues, it will be fascinating to see how it influences market dynamics and shapes the future of digital finance.

BREAKING:

BLACKROCK JUST BOUGHT $409.3M WORTH OF BITCOIN.

WHALES ARE LOADING pic.twitter.com/8A3Pqfaju1

— Ash Crypto (@Ashcryptoreal) May 28, 2025

BREAKING:

In a significant move that’s sending shockwaves through the crypto world, BLACKROCK JUST BOUGHT $409.3M WORTH OF BITCOIN. This development has attracted attention not just from crypto enthusiasts but also from Wall Street, indicating a growing acceptance of Bitcoin as a legitimate investment vehicle. As institutional interest in Bitcoin ramps up, many analysts are pondering what this could mean for the market and individual investors alike.

Understanding BlackRock’s Bitcoin Purchase

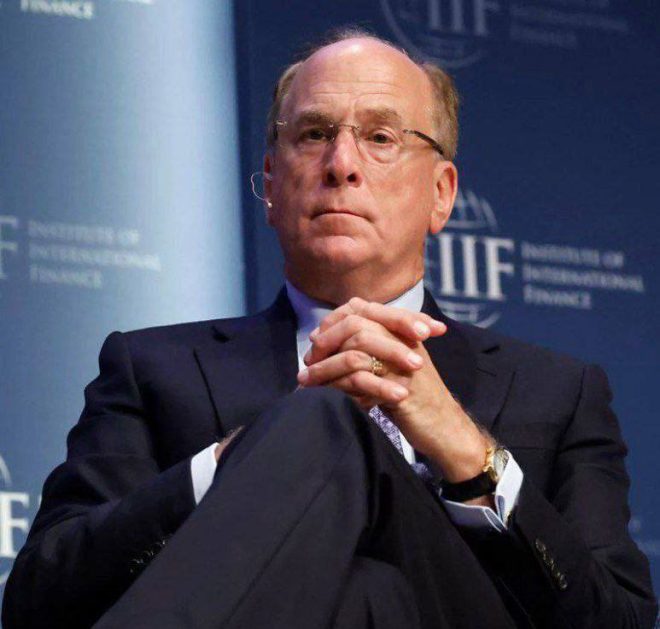

For those who might not be in the know, BlackRock is one of the largest asset management firms globally. Their decision to invest over $400 million in Bitcoin isn’t just a random move; it’s a calculated strategy that reflects their view on the future of digital assets. BlackRock’s CEO, Larry Fink, has previously indicated interest in cryptocurrencies, and this purchase seems to solidify that stance. With this acquisition, BlackRock is not merely dipping its toes in the crypto waters; they are diving in headfirst.

WHALES ARE LOADING

What does it mean when we say WHALES ARE LOADING? In cryptocurrency parlance, “whales” refer to individuals or entities that hold large amounts of cryptocurrency. These players can significantly influence market trends due to their substantial holdings. When whales begin accumulating Bitcoin, it often leads to increased demand, which can drive prices upward. BlackRock’s substantial purchase can be seen as a signal to other investors that the time to buy could be now, potentially leading to a wave of similar purchases across the market.

The Implications of BlackRock’s Investment

BlackRock’s investment in Bitcoin could have several implications for the cryptocurrency market. First, it legitimizes Bitcoin in the eyes of traditional investors who may have been skeptical of crypto. When a firm of BlackRock’s stature makes such a significant purchase, it instills confidence among investors that Bitcoin is a viable asset class. Moreover, as more institutional money flows into Bitcoin, it could lead to increased price stability and reduced volatility, which are appealing factors for investors.

The Growing Institutional Interest

BlackRock is not alone in its interest in Bitcoin. Other institutional players have also been entering the market, which speaks volumes about the growing acceptance of cryptocurrencies. Companies like MicroStrategy and Tesla have previously made headlines for their Bitcoin purchases. This trend indicates a shift in how institutions view digital currencies, moving from skepticism to active investment. According to reports from CoinDesk, institutional interest has surged, with many firms looking to diversify their portfolios by including cryptocurrencies.

Bitcoin: A Store of Value?

One of the reasons behind BlackRock’s substantial purchase could be the perception of Bitcoin as a store of value, much like gold. In times of economic uncertainty, many investors look for assets that can retain their value. Bitcoin, with its limited supply and growing adoption, is increasingly being viewed as a hedge against inflation. BlackRock’s move can be seen as a strategic bet on Bitcoin’s potential to serve this purpose.

The Future of Bitcoin and Institutional Investment

As we move forward, the question on everyone’s mind is: what’s next for Bitcoin? With major players like BlackRock entering the market, we can expect increased volatility in the short term, but potentially greater stability in the long run. Analysts are already speculating about Bitcoin’s price trajectory, with predictions ranging from bullish forecasts to cautious outlooks. According to a report by Forbes, the narrative around Bitcoin is likely to evolve as more institutions embrace it.

What Should Retail Investors Do?

If you’re a retail investor, you might be wondering how to react to this news. Should you jump on the Bitcoin bandwagon? While there’s no one-size-fits-all answer, it’s essential to consider your investment goals and risk tolerance. Many experts recommend that you do your own research and keep an eye on market trends. As institutional investment increases, it could create opportunities for retail investors, but it’s crucial to stay informed and make decisions based on sound analysis rather than hype.

Conclusion: A New Era for Bitcoin

BlackRock’s recent acquisition of Bitcoin marks a pivotal moment in the cryptocurrency landscape. As institutional players continue to invest in Bitcoin, the potential for growth and mainstream acceptance of cryptocurrencies increases. This influx of institutional capital could pave the way for innovative financial products based on digital assets. Whether you’re a seasoned investor or just starting, staying updated on these developments will be crucial. The crypto world is evolving rapidly, and with major players like BlackRock making significant moves, the future looks bright for Bitcoin.

“`

This article provides a comprehensive overview of the implications of BlackRock’s Bitcoin purchase while maintaining an engaging and conversational tone, suitable for readers interested in the cryptocurrency market.