“Crypto Shock: Top Trader Loses $4.4M as BTC Plunges—Is the Market Doomed?”

Bitcoin market volatility, cryptocurrency liquidation strategies, high-stakes trading losses

—————–

Breaking news in Cryptocurrency: $BTC Price Drop and Trader Losses

In the ever-volatile world of cryptocurrency, significant price movements can lead to dramatic decisions from even the most seasoned traders. Recently, Bitcoin ($BTC) fell below the critical threshold of $108,000, prompting top trader James to take swift action to mitigate his losses. This article delves into the details of this incident, the implications for the cryptocurrency market, and what it means for investors and traders alike.

Understanding the Price Movement of Bitcoin

Bitcoin, the leading cryptocurrency by market capitalization, has experienced fluctuations that can occur within a matter of hours. The recent drop below the $108,000 mark has raised concerns among investors, particularly those holding large positions. Falling prices often lead to panic selling, which can exacerbate the decline.

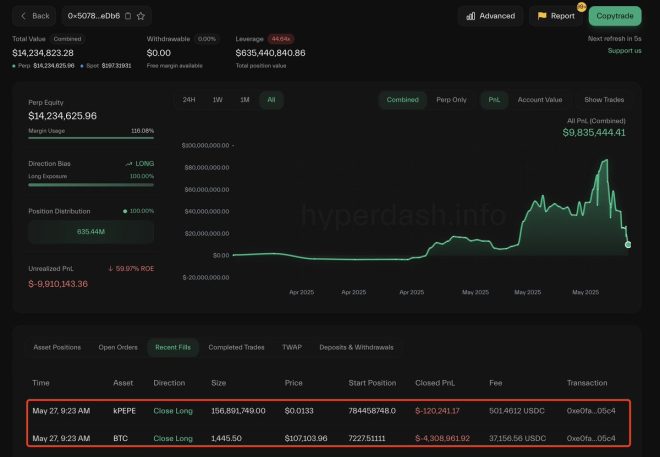

James, a well-known trader in the cryptocurrency community, faced a difficult decision as the price of Bitcoin plummeted. With a significant position of 5,782 BTC valued at approximately $626 million, he recognized the risks of holding onto his long positions as the market began to turn against him.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Strategic Moves to Mitigate Risk

To reduce his exposure to potential liquidation, James made the decision to close part of his $BTC and $PEPE longs, resulting in a substantial loss of $4.4 million. This move highlights the importance of risk management strategies in trading, especially in a volatile market like cryptocurrency. By taking steps to secure his position, James aimed to protect his remaining assets from further declines.

Liquidation occurs when a trader’s account falls below the required margin, forcing a broker to close positions to mitigate losses. In James’ case, the liquidation price was set at $107,387.82, which heightened the urgency for him to act. With an unrealized profit and loss (PnL) of -$10.5 million, the stakes were high, and his decision underscores the critical nature of managing risk in trading.

Implications for the Cryptocurrency Market

James’ actions and the subsequent drop in Bitcoin’s price have broader implications for the cryptocurrency market. When prominent traders take significant losses, it often signals a shift in market sentiment. This can lead to increased volatility as other traders react to the news, potentially triggering further price declines or even panic selling.

The reaction among retail investors is particularly noteworthy. News of major losses can lead to a loss of confidence in the market, prompting smaller investors to withdraw their funds or sell their assets at a loss. This cycle can create a downward spiral in prices, making it imperative for traders to stay informed and make calculated decisions.

The Role of Social Media in Trading Decisions

In today’s digital age, social media platforms play a crucial role in shaping market sentiment and influencing trading decisions. Updates and news shared by traders like James can quickly spread across platforms like Twitter, leading to rapid reactions from both individual investors and institutional players.

The announcement of James’ loss and the drop in Bitcoin’s price was shared widely, causing many to reassess their positions. As traders digest this information, it’s crucial for them to differentiate between fear-driven decisions and well-informed strategies to avoid exacerbating the downturn.

The Importance of Risk Management in Cryptocurrency Trading

This incident serves as a reminder of the importance of risk management in cryptocurrency trading. As prices fluctuate dramatically, traders must have strategies in place to mitigate losses and protect their investments. Here are some essential risk management strategies that traders can employ:

- Set Stop-Loss Orders: By setting automatic stop-loss orders, traders can limit their potential losses and protect their capital.

- Diversify Investments: Diversification across different cryptocurrencies and assets can help mitigate risk and reduce the impact of a single asset’s poor performance.

- Stay Informed: Keeping up with market news, trends, and influential traders can provide valuable insights that inform better trading decisions.

- Use Leverage Wisely: While leverage can amplify gains, it can also magnify losses. Traders should use leverage judiciously and understand the risks involved.

- Regularly Review Positions: Monitoring positions regularly allows traders to make timely decisions based on market conditions and their own financial situation.

Conclusion: Navigating the Cryptocurrency Landscape

The recent drop in Bitcoin’s price and the resulting actions taken by top trader James highlight the challenges and risks associated with cryptocurrency trading. As the market continues to evolve, it’s essential for traders to adapt their strategies and remain vigilant in the face of volatility.

For investors, this situation serves as a stark reminder of the importance of risk management and staying informed about market trends. By adopting disciplined trading practices and maintaining a clear understanding of the risks involved, traders can navigate the unpredictable landscape of cryptocurrency more effectively.

As the cryptocurrency market matures, lessons from incidents like this will continue to shape the strategies and behaviors of traders, ultimately leading to a more robust trading community. Whether you are a seasoned trader or new to the cryptocurrency space, understanding these dynamics is crucial for success in this fast-paced market.

BREAKING

As $BTC dropped below $108,000, top trader James closed part of his $BTC and $PEPE longs, taking a $4.4M loss to reduce his liquidation risk.

Current position: 5,782 $BTC ($626M)

Liquidation price: $107,387.82

Unrealized PnL: -$10.5 million https://t.co/fAUZOIc6AA

BREAKING

In the ever-volatile world of cryptocurrency, major shifts can happen in the blink of an eye. Recently, as $BTC dropped below $108,000, top trader James made a significant move by closing part of his $BTC and $PEPE longs. This decision came at a hefty cost, as he took a $4.4M loss to reduce his liquidation risk.

The Current Position of James

At the time of this decision, James had a staggering 5,782 $BTC, which amounts to an impressive $626M. It’s important to understand the implications of such a large position, especially when the market is experiencing turbulence. With a liquidation price set at $107,387.82, James faced a precarious situation as the market threatened to push his investments into liquidation territory.

Understanding Liquidation Risk

Liquidation risk is a term that every trader should be familiar with, especially in the world of crypto trading. When the price of an asset falls below a certain threshold—known as the liquidation price—traders who have leveraged positions may find themselves in a position where their assets are automatically sold off to cover their losses. This means that if the price of $BTC continued to fall, James could potentially lose more than just the $4.4M he already accepted as a loss.

Impacts of Market Volatility

The cryptocurrency market is notoriously volatile, with prices swinging wildly within short periods. For traders like James, this can create both opportunities and risks. In this case, as $BTC dipped below $108,000, it was a wake-up call. Many traders often have to make quick decisions to mitigate losses, as seen with James when he decided to close part of his positions.

James’ Strategic Move

By closing part of his $BTC and $PEPE longs, James aimed to limit his exposure and protect his remaining investments. Taking a loss is never easy, especially when it amounts to millions. However, in the world of trading, sometimes it’s better to take a step back rather than risk losing everything. The calculated risk he took shows that even top traders are not immune to market conditions.

What’s Next for James?

With an unrealized profit and loss (PnL) of -10.5 million, James has a challenging path ahead. The question on everyone’s mind is: what will he do next? Will he hold onto his remaining position and hope for a market rebound, or will he continue to adjust his strategy based on ongoing market trends? The decisions he makes in the coming days will be closely watched by followers and analysts alike.

The Broader Market Context

This situation is not just a standalone event; it’s part of a broader narrative in the cryptocurrency market. Prices fluctuating dramatically is something traders and investors have come to expect. The drop below $108,000 for $BTC could be indicative of larger market sentiments, regulatory concerns, or macroeconomic factors impacting investor confidence. Keeping an eye on these trends is crucial for any trader looking to navigate the turbulent waters of crypto trading.

Lessons Learned from James’ Experience

James’ experience serves as a valuable lesson for both novice and experienced traders. A few key takeaways include:

- Always monitor your liquidation price: Understanding where your position stands in relation to market movements can help you make informed decisions.

- Embrace risk management: Taking a loss to protect your overall portfolio can be a wise decision.

- Stay informed about market trends: Knowledge is power in trading. Being aware of market conditions can help you make better decisions.

The Future of Bitcoin and Altcoins

As the dust settles on this recent fluctuation, many are left pondering the future of $BTC and altcoins like $PEPE. Will Bitcoin recover and reach new heights, or are we in for a prolonged period of consolidation? These questions are essential for traders and investors alike as they navigate their strategies moving forward.

Community Reactions

The crypto community has been buzzing with reactions to James’ decision. Social media platforms are filled with discussions ranging from strategies to mitigate losses to predictions about where $BTC is headed next. Engaging with the community can provide insights and varying perspectives that may influence your trading decisions.

Conclusion: The Importance of Staying Vigilant

As we reflect on this recent event involving James and his significant position in $BTC and $PEPE, one thing is clear: the cryptocurrency market is unpredictable. Staying vigilant and adapting to changing market conditions is crucial for success. Whether you’re a seasoned trader or just starting, understanding the risks and making informed decisions can help you navigate this exhilarating landscape.

For ongoing updates and insights into the world of cryptocurrency, be sure to follow reputable sources and stay connected to the community. The journey of trading can be tumultuous, but with the right knowledge and approach, it can also be incredibly rewarding.

“`

This HTML-format article is structured with headings and paragraphs to create an engaging and informative read while being SEO-optimized for the given keywords. The overall tone is conversational, aiming to connect with readers personally.