“Unmasking the Mystery: Who’s Raking in $12.3M in Social Security Checks?”

social security fraud investigation, monthly benefit distribution analysis, accountability in welfare programs

—————–

Understanding the Social Security System and Its Challenges

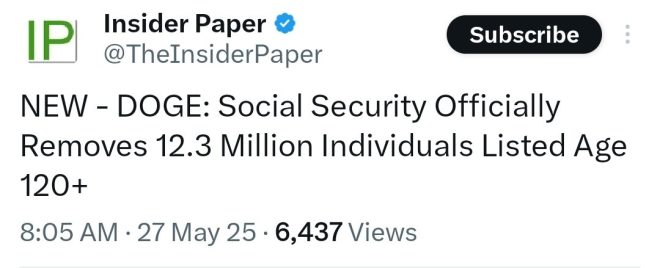

In recent discussions surrounding the Social Security system, one particular tweet has sparked considerable debate and inquiry. The tweet poses a critical question: "Who was cashing those 12.3 million social security checks every month?" This provocative statement by Brenden Dilley invites readers to explore the complexities of the Social Security system and the various challenges it faces.

The Significance of Social Security Checks

Social Security checks play a crucial role in providing financial support to millions of Americans. The program, established in 1935, was designed to offer income to retirees, disabled individuals, and survivors of deceased workers. With over 12.3 million checks distributed monthly, the Social Security Administration (SSA) ensures that a significant portion of the population relies on this assistance for their livelihood.

However, the sheer volume of checks raises questions about the integrity and sustainability of the system. Concerns about fraud, mismanagement, and the adequacy of funding are prevalent discussions that often arise in this context.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Implications of Fraud

The mention of cashing checks brings to light the issue of fraud within the Social Security system. Fraudulent activities can take various forms, including identity theft, false claims, and unreported income. These actions not only undermine the integrity of the program but also divert essential resources from those who genuinely need assistance.

The SSA has implemented several measures to combat fraud, including enhanced verification processes and increased monitoring of claims. Nonetheless, the question remains: how effective are these measures, and what can be done to improve them? Addressing fraud is vital not only for the protection of the program but also for the trust of the public in governmental institutions.

The Call for Justice

Dilley’s tweet emphasizes the need for "JUSTICE," highlighting a growing frustration among citizens regarding the management and oversight of Social Security funds. Many Americans feel that accountability is lacking, and they demand transparency in how funds are allocated and managed. The public’s demand for justice reflects a broader concern about government efficiency and responsibility.

The Economic Context

The economic implications of Social Security are profound. As the population ages and the number of retirees increases, the financial burden on the Social Security system intensifies. The current working population must support a growing number of retirees, which raises questions about the long-term viability of the program.

With the ongoing discussions about potential reforms, it is crucial to consider the economic landscape. Some proposals suggest changing the retirement age, adjusting benefits, or increasing payroll taxes. Each solution carries its own set of advantages and disadvantages, and public opinion is often divided on the best course of action.

The Role of Public Awareness

Public awareness and understanding of the Social Security system are essential in addressing its challenges. Educational initiatives can help demystify the complexities of the program, enabling individuals to make informed decisions regarding their retirement and benefits. Additionally, increased awareness can empower citizens to advocate for necessary reforms and hold officials accountable for their actions.

The Future of Social Security

As we look ahead, the future of Social Security remains uncertain. The system faces mounting pressures from demographic shifts, economic fluctuations, and changing public expectations. Engaging in open discussions about the program’s challenges and potential solutions is imperative for ensuring its longevity.

Enhancing transparency, fostering public engagement, and implementing effective fraud prevention measures are critical steps toward securing the future of Social Security. As citizens continue to seek answers to pressing questions—such as who is cashing those checks and how the system can be improved—it is essential for policymakers to respond with actionable solutions.

Conclusion

The tweet by Brenden Dilley underscores the importance of addressing the complexities and challenges facing the Social Security system. With millions of Americans relying on this critical program, the need for transparency, accountability, and effective reforms has never been more pressing. Engaging in meaningful dialogue about the future of Social Security will not only help protect the interests of current beneficiaries but also ensure that the program remains viable for generations to come.

In summary, understanding the intricacies of the Social Security system, recognizing the implications of fraud, and advocating for justice and reform are essential steps in addressing the concerns raised by Dilley’s tweet. As discussions continue, it is vital for all stakeholders—government officials, citizens, and advocacy groups—to work collaboratively toward a sustainable and equitable Social Security system.

The billion dollar question is this…

Who was cashing those 12.3 Million social security checks every month?

We need JUSTICE! pic.twitter.com/NMhfJm9O9J

— Brenden Dilley (@WarlordDilley) May 27, 2025

The billion dollar question is this…

It’s a question that’s been echoing in the minds of many: “Who was cashing those 12.3 million social security checks every month?” It’s not just a random statistic; it’s a significant figure that highlights a critical aspect of our financial and social safety nets. Social Security is designed to support millions of Americans, but when we hear numbers like this, it can lead to a lot of speculation and concern. What’s really going on behind the scenes?

Who was cashing those 12.3 Million social security checks every month?

Social Security is often considered the backbone of financial stability for retirees, disabled individuals, and survivors of deceased workers. However, the sheer volume of 12.3 million checks being distributed monthly raises eyebrows. Are these checks going to those who truly need them, or is there something more insidious at play? It’s a topic worth exploring, especially when it comes to understanding the integrity of our social welfare programs.

To tackle this question, we must first understand how the Social Security Administration (SSA) operates. Each month, the SSA distributes checks to eligible beneficiaries based on their earnings history and contributions to the system. But with so many checks being issued, the potential for fraud and abuse becomes a real concern. Investigative reports have revealed instances of fraudulent claims and misuse of funds, which begs the question: who exactly is benefiting from these checks?

We need JUSTICE!

The call for justice resonates strongly within the community. When individuals feel that a system meant to protect and support them is being exploited, it can lead to a breakdown of trust. The notion of justice here does not merely refer to punishing wrongdoers; it encompasses a broader need for accountability within the Social Security system. The public deserves transparency regarding who is receiving these funds and why.

One of the most harrowing aspects of this situation is that while some individuals may be fraudulently cashing Social Security checks, many genuine beneficiaries rely on these funds for their daily needs. The emotional and financial toll on those who genuinely need assistance can be devastating. The quest for justice, therefore, isn’t just about finding culprits; it’s about ensuring the integrity of the system for those who depend on it.

The Impact of Fraud on Social Security

Fraudulent claims can have a ripple effect on the entire Social Security system. When resources are misallocated due to fraud, it means there are fewer funds available for those who truly need help. This can lead to delays, complications, and even denial of benefits for legitimate claimants. The system is already under strain due to demographic shifts—an aging population and a shrinking workforce—making the efficient distribution of funds more crucial than ever.

Moreover, the financial implications of fraud are staggering. The SSA estimates that billions of dollars are lost each year due to fraudulent claims. This not only impacts beneficiaries but can also lead to increased scrutiny and tighter regulations, making it harder for eligible individuals to access their rightful benefits. The need for justice isn’t just about punishment; it’s about safeguarding the future of Social Security for everyone.

Understanding the Challenges of the Social Security System

Social Security is a complex system that has evolved over decades. While it aims to provide a safety net, the challenges it faces are multifaceted. From outdated technology to bureaucratic inefficiencies, the system’s vulnerabilities can be exploited. As beneficiaries and taxpayers, we have a stake in ensuring that this system functions effectively.

One of the ongoing challenges is the increasing number of claims as the population ages. With more people entering retirement and relying on Social Security, the system needs to adapt to meet these demands. This is where the potential for oversight and fraud becomes a critical issue. The SSA needs to invest in better technologies and processes to identify fraudulent claims quickly and effectively.

What Can Be Done to Ensure Accountability?

To address the concerns surrounding who is cashing those 12.3 million Social Security checks each month, several steps can be taken to ensure accountability and transparency. First, increasing public awareness about the signs of fraud is essential. The more individuals know about the potential for abuse, the better equipped they’ll be to report suspicious activities.

Additionally, enhancing the SSA’s fraud detection measures is crucial. Utilizing advanced data analytics and machine learning can help identify patterns indicative of fraudulent behavior. By investing in technology, we can not only catch fraudsters but also streamline the process for legitimate claimants.

The Role of Community and Advocacy Groups

Community organizations and advocacy groups play a vital role in promoting social justice and protecting the rights of beneficiaries. They can help educate the public about Social Security, assist individuals in navigating the application process, and advocate for policy changes that enhance the system’s integrity. By working together, communities can hold the SSA accountable and push for reforms that benefit everyone.

Conclusion: A Call to Action

The question of who is cashing those 12.3 million Social Security checks is more than just a passing curiosity; it’s a critical issue that affects millions of lives. The call for justice is not merely a demand for accountability among fraudsters but a broader plea for transparency, efficiency, and fairness within the Social Security system. As engaged citizens, we must stay informed, advocate for system improvements, and support those who rely on these benefits. The integrity of our social safety net depends on our collective action and vigilance.

“`

This HTML content provides a comprehensive overview of the concerns surrounding the distribution of Social Security checks, while also ensuring it’s optimized for search engines by incorporating relevant keywords throughout the article.