“Taxpayers Rejoice: ITR Filing Deadline Extended! But at What Cost?”

ITR filing deadline extension, significant changes in tax forms, enhanced TDS credit processing

—————–

CBDT Extends ITR Filing Deadline: Important Update for Taxpayers

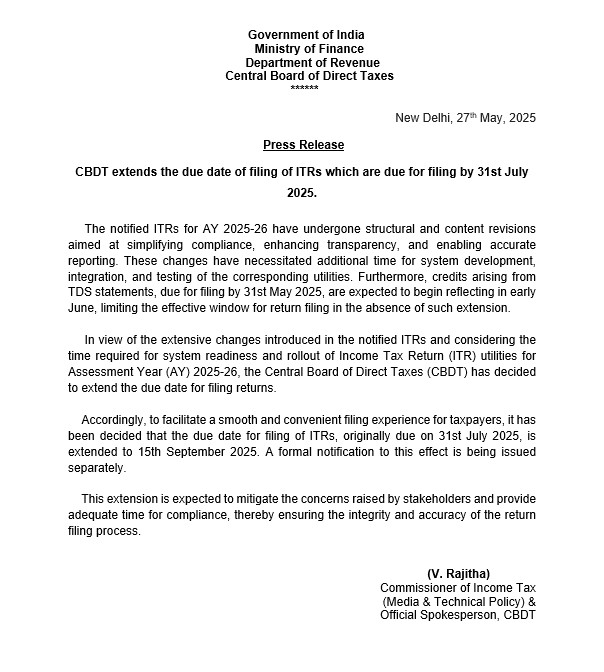

In a significant announcement, the Central Board of Direct Taxes (CBDT) has officially extended the deadline for the filing of Income Tax Returns (ITRs) for the financial year ending July 31, 2025. Taxpayers can now submit their ITRs until September 15, 2025. This extension comes as a relief for many individuals and businesses who may be grappling with the recent changes in ITR forms, system development requirements, and TDS (Tax Deducted at Source) credit adjustments.

Key Details of the Extension

The CBDT’s decision was made public through the official Twitter handle of Income Tax India. The announcement highlights the importance of providing taxpayers with adequate time to comply with new regulations and requirements. The extended deadline aims to facilitate a smoother filing process for all stakeholders involved, ensuring that taxpayers can fulfill their obligations without unnecessary stress or confusion.

Reasons for the Extension

The primary reasons behind the extension include significant revisions in the ITR forms and the need for improved system infrastructure to handle the complexities of tax reporting. The CBDT recognizes that these changes may require additional time for taxpayers to familiarize themselves with the new forms and processes.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Furthermore, the extension allows taxpayers to verify and reconcile their TDS credits more effectively. TDS is a vital component of the tax collection mechanism in India, and ensuring accurate TDS credit is crucial for preventing discrepancies and potential disputes with the tax authorities.

Implications for Taxpayers

For taxpayers, this extension provides several advantages:

- Reduced Stress: The additional time can alleviate the pressure of meeting the original filing deadline, allowing taxpayers to plan their submissions more effectively.

- Improved Accuracy: With the revised ITR forms, taxpayers will have more time to ensure that their returns are accurate, reducing the likelihood of errors that could lead to audits or penalties.

- Better TDS Reconciliation: Taxpayers can take advantage of the extended timeframe to verify their TDS credits, ensuring that they claim the correct amounts and avoid unnecessary tax liabilities.

Who Should Take Advantage of the Extension?

The extended deadline is relevant for a wide range of taxpayers, including:

- Individual Taxpayers: Salaried employees and individuals with other sources of income can benefit from this extension to file their returns accurately.

- Small Business Owners: Entrepreneurs and small business owners who may have more complex financial situations can use the extra time to organize their financial records and ensure compliance.

- Freelancers and Professionals: Individuals working in freelance capacities or professional services, who may have diverse income sources, can also take advantage of this extension.

How to Prepare for Filing

As the new deadline approaches, it is essential for taxpayers to prepare adequately. Here are some steps to consider:

- Review the Revised ITR Forms: Familiarize yourself with the changes in the ITR forms to understand what information is required and how to present it accurately.

- Gather Necessary Documents: Compile all relevant financial documents, including income statements, TDS certificates, bank statements, and any other documentation required for filing.

- Consult a Tax Professional: If you are unsure about any aspect of your tax return, consider consulting a tax professional for guidance. They can provide valuable insights and ensure that your return is filed correctly.

- Check TDS Credit: Review your TDS credits to ensure that they align with the amounts reported in your income statements. This step is crucial in preventing discrepancies.

- Plan Your Filing Strategy: Decide whether you will file your return independently or seek assistance from a tax consultant. Having a plan in place can help streamline the filing process.

Conclusion

The CBDT’s decision to extend the deadline for filing ITRs to September 15, 2025, is a welcome development for taxpayers across India. This extension not only provides additional time for compliance but also reflects the government’s commitment to facilitating a smoother tax filing experience amidst ongoing changes in the tax landscape. Taxpayers should take this opportunity to prepare diligently, ensuring that they meet their tax obligations accurately and efficiently.

For further updates and information, taxpayers are encouraged to follow official channels such as the Income Tax India Twitter handle and the CBDT website. Staying informed will help ensure that you are aware of any further changes or announcements regarding tax filing and compliance.

Kind Attention Taxpayers!

CBDT has decided to extend the due date of filing of ITRs, which are due for filing by 31st July 2025, to 15th September 2025

This extension will provide more time due to significant revisions in ITR forms, system development needs, and TDS credit… pic.twitter.com/MggvjvEiOP

— Income Tax India (@IncomeTaxIndia) May 27, 2025

Kind Attention Taxpayers!

Hey there, taxpayers! If you’re feeling the weight of tax season creeping up on you, you’re not alone. The Central Board of Direct Taxes (CBDT) has some news that might just lighten your load. They’ve decided to extend the due date for filing Income Tax Returns (ITRs) that are typically due by July 31, 2025. Now, you have until September 15, 2025, to get your filings in order. This extension isn’t just a random act of kindness; it comes as a response to significant revisions in the ITR forms, system development requirements, and TDS credit issues.

Why the Extension Matters

So, why should you care about this extension? For starters, filing your ITR can often feel like a daunting task. With the added time, you can breathe a little easier knowing you have a few extra weeks to gather your documents, clarify any doubts, and ensure everything is in tip-top shape before hitting that submit button. This change is especially crucial this year because of the revisions in the ITR forms.

Understanding ITR Revisions

The revisions in the ITR forms can be significant. Each year, the CBDT updates these forms to reflect changes in tax laws, compliance requirements, and digital filing processes. The latest updates may require you to revisit how you report your income, deductions, and credits, particularly concerning TDS (Tax Deducted at Source). Ensuring that you are using the correct forms not only helps in accurate filing but also mitigates any chances of penalties or discrepancies later on.

System Development Needs

Another reason for this extension revolves around system development needs. As we move towards a more digitized tax filing process, the backend systems that support online ITR submissions need to be robust and user-friendly. The government is working diligently to ensure these systems are up to the task. They want to avoid any technical glitches that could lead to delays or frustrations for taxpayers like you and me.

The Importance of TDS Credit

Let’s not forget about TDS credits. Understanding how TDS works is crucial for every taxpayer. It’s essentially a way for the government to collect tax at the source of income, but reconciling these TDS credits can sometimes be a headache. With the additional time provided by this extension, you’ll have a better chance to ensure that your TDS credits are accurately reflected in your tax return. This can ultimately affect your overall tax computation and any potential refunds.

Preparing for Your ITR Filing

With the new deadline in mind, it’s a great time to start preparing your documents. Here are a few things you should consider gathering:

- Form 16: This is crucial if you’re a salaried individual. It’s your proof of income and TDS deductions.

- Bank Statements: Whether you’re self-employed or salaried, having your bank statements handy will help track your income and any deductions.

- Investment Proofs: Make sure you have all the necessary documents for investments that qualify for deductions under sections like 80C, 80D, etc.

- Previous Year’s ITR: Having last year’s return can help you compare and ensure consistency in your filings.

How to Stay Updated

Keeping yourself informed about any changes to tax laws and filing procedures is essential. Follow reliable sources like the official Income Tax Department website or trusted financial news outlets. Social media platforms can also provide timely updates, so following the official accounts can be a smart move.

Consulting with Tax Professionals

If you’re feeling overwhelmed, it might be worth consulting a tax professional. They can help you navigate the complexities of tax laws and ensure you maximize your deductions and credits. With the extended deadline, now is the perfect time to seek their expertise without the usual rush.

Filing Your ITR Online

When it comes to filing your ITR, going digital can save you a lot of headaches. The online filing process is designed to be user-friendly, and you can often find step-by-step guides to help you through it. Plus, e-filing can reduce your chances of making errors compared to traditional paper filing.

Benefits of Timely Filing

Even with the extended deadline, it’s still beneficial to file as soon as you can. Timely filing not only ensures that you avoid late fees but also allows for faster processing of your return, which means quicker refunds. Plus, if the government owes you money, why wait longer to get it?

What Happens if You Miss the Deadline?

While the new deadline is a relief, it’s essential to remember what happens if you miss it. Failing to file your ITR on time can lead to penalties, and you might lose out on potential refunds. Plus, if you owe taxes, the longer you wait to file, the more interest and penalties can accumulate. So, even with the extension, it’s best to aim for early filing!

Embrace the Extension

In summary, the CBDT’s decision to extend the ITR filing deadline to September 15, 2025, is a welcome relief for many taxpayers. It provides you with ample time to make necessary adjustments to your filings, gather essential documents, and consult with professionals if needed. The revisions in ITR forms, coupled with system improvements and TDS credit reconciliation, underscore the importance of this extension.

So, take a deep breath, and start preparing! You’ve got this. With a little organization and the right resources, you can navigate this tax season smoothly. Remember, knowledge is power, and staying informed will only benefit you in the long run. Happy filing!