Japan’s Top Insurers Hit by $60B Bond Losses: Is Financial Stability at Risk?

unrealized bond losses Japan, Nippon Life financial impact, Japanese life insurers Q1 2025

—————–

Record Unrealized Losses for Japan’s Life Insurers in 2025

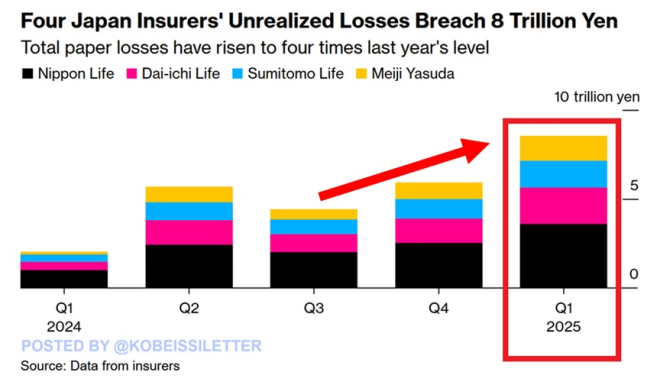

In a significant financial development reported on May 27, 2025, four of Japan’s largest life insurers have experienced an unprecedented rise in unrealized losses related to their domestic bond holdings. These losses have surged to a staggering $60 billion in the first quarter of 2025, marking a fourfold increase compared to the unrealized losses recorded in the same period in 2024. This phenomenon has raised concerns about the financial health of these institutions and the broader implications for the Japanese economy.

Understanding Unrealized Losses

Unrealized losses occur when the market value of an asset, such as government bonds, declines below its purchase price, but the asset has not yet been sold. For life insurers, these unrealized losses can significantly impact their financial statements, particularly in an environment characterized by rising interest rates or economic uncertainties. The recent spike in unrealized losses for Japan’s insurers highlights the challenges they face in managing their bond portfolios amidst changing market conditions.

The Impact on Major Life Insurers

Among the four life insurers reporting these record losses, Nippon Life stands out as the largest Japanese insurer and the sixth-largest life insurer globally. The surge in unrealized losses raises critical questions regarding the operational strategies of these companies. With a substantial portion of their investment portfolios tied up in bonds, life insurers are particularly vulnerable to fluctuations in interest rates, which can inversely affect bond prices.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Broader Economic Implications

The implications of these unrealized losses extend beyond the individual companies involved. The life insurance sector plays a crucial role in the Japanese economy, providing essential financial products and services to millions. A decline in the financial stability of these insurers could lead to reduced consumer confidence and potentially impact the overall economic landscape in Japan.

Moreover, the increase in unrealized losses could compel these insurers to reassess their investment strategies. They may need to pivot from traditional fixed-income securities to more diversified investment approaches to mitigate risks associated with fluctuating bond prices. This shift could have significant implications for the asset management industry as a whole.

Comparison with Previous Years

To better understand the gravity of the current situation, it’s essential to compare these figures with the previous year’s data. In Q1 2024, the unrealized losses of these insurers were considerably lower, signaling a more stable investment environment. The dramatic rise to $60 billion in Q1 2025 not only underscores the volatility of the bond market but also indicates that life insurers are increasingly exposed to risks that could jeopardize their financial health.

Factors Contributing to Increased Losses

Several factors have contributed to the unprecedented increase in unrealized losses for Japan’s life insurers. One primary factor is the rising interest rates in Japan and globally, which have led to a decline in the market value of bonds. As interest rates rise, newly issued bonds offer higher yields, making existing bonds with lower yields less attractive, resulting in a decline in their market value.

Additionally, global economic uncertainties, including geopolitical tensions and fluctuations in commodity prices, have further exacerbated the situation. Life insurers must navigate these challenging conditions while ensuring they remain financially resilient.

Future Outlook for Life Insurers

Looking ahead, Japan’s life insurers will need to adopt strategic measures to mitigate the impact of unrealized losses. This could involve diversifying their investment portfolios, exploring alternative asset classes, and enhancing risk management practices. Furthermore, insurers may need to improve their communication with stakeholders, providing transparency regarding their financial health and strategies moving forward.

Conclusion

The record unrealized losses of $60 billion reported by Japan’s largest life insurers in Q1 2025 reflect a significant challenge for the sector. As these companies navigate a complex financial landscape characterized by rising interest rates and economic uncertainties, the implications for the broader economy and consumers cannot be overlooked. The situation calls for strategic reassessment and proactive measures to ensure the long-term sustainability and resilience of Japan’s life insurance industry.

In summary, the financial landscape for Japan’s life insurers has dramatically shifted, highlighting the need for agility and innovation in investment strategies. As the sector confronts these challenges, stakeholders will be closely monitoring developments, making it crucial for the insurers to act decisively in the face of adversity.

BREAKING: Unrealized losses on domestic bond holdings for 4 of Japan’s largest life insurers rose to a record $60 billion in Q1 2025.

This is 4 TIMES more than unrealized losses seen in Q1 2024.

Nippon Life, the largest Japanese insurer and the world’s sixth-largest life… pic.twitter.com/cqUsVNfLhE

— The Kobeissi Letter (@KobeissiLetter) May 27, 2025

BREAKING: Unrealized Losses on Domestic Bond Holdings for 4 of Japan’s Largest Life Insurers Rose to a Record $60 Billion in Q1 2025

Have you been following the financial news lately? If so, you might have caught wind of a significant development concerning Japan’s largest life insurers. Recently, it was reported that unrealized losses on domestic bond holdings for four of these financial giants surged to a staggering $60 billion in Q1 2025. This figure is not just a minor bump; it represents a whopping four times the unrealized losses recorded in the same quarter of 2024.

But what does all this mean? Let’s unpack this a bit.

This is 4 TIMES More Than Unrealized Losses Seen in Q1 2024

The sharp increase in unrealized losses has raised eyebrows across the financial landscape. To put it into perspective, the unrealized losses from Q1 2024 were already concerning, but this year’s numbers blow them out of the water. The implications are vast and multifaceted, affecting not just the insurers themselves but also the broader economic ecosystem in Japan.

Why the sharp increase, you might wonder? A combination of factors has contributed to this dramatic rise. Increasing interest rates have played a significant role, impacting the value of bonds held by these insurers. As rates go up, the price of existing bonds typically falls, leading to unrealized losses. This cycle can create a ripple effect, raising questions about the stability of these life insurers and the potential ramifications for policyholders.

Nippon Life, the Largest Japanese Insurer and the World’s Sixth-Largest Life Insurer

When it comes to the landscape of life insurance in Japan, Nippon Life stands out as a key player. As the largest Japanese insurer and the sixth-largest life insurer globally, Nippon Life’s financial health is crucial not just for its policyholders, but for the entire industry. With such significant unrealized losses on the books, what does this mean for Nippon Life and its competitors?

Investors and policyholders alike may start to feel uneasy. The sheer scale of these losses could lead to tighter regulations and an increased focus on risk management within the industry. For Nippon Life, maintaining investor confidence and ensuring the protection of policyholders’ interests will be paramount in the months and years to come.

The Broader Implications for Japan’s Financial Landscape

The record $60 billion in unrealized losses isn’t just a number; it has far-reaching implications for the Japanese economy. With life insurers holding a significant portion of Japan’s domestic bonds, their financial stability is intertwined with the government’s fiscal health. As these insurers grapple with losses, it can create a more challenging environment for funding various initiatives, from infrastructure projects to social programs.

It’s not just about the numbers, either. Public sentiment can shift dramatically when people feel that their financial security is at risk. If policyholders begin to worry about the solvency of their insurers, it could lead to increased withdrawals or a decline in new policy sales. This potential chain reaction can create a feedback loop that further complicates the landscape.

Analyzing the Factors Behind the Losses

So, what exactly is driving these unrealized losses? While rising interest rates are a significant factor, let’s dive deeper into the mechanics. Many of these insurers hold long-term bonds, which are typically stable investments. However, when rates rise, the market value of these bonds can plummet, leading to unrealized losses on their balance sheets.

Moreover, the economic climate has been unpredictable, influenced by global factors such as inflation and geopolitical tensions. All of this creates a perfect storm for insurers, who must balance their portfolios to mitigate risk while ensuring they can meet policyholder obligations.

The situation is precarious, and many analysts are keeping a close eye on how these insurers will adjust their strategies moving forward. Will they shift their investment focus? Will they need to raise premiums to cover potential losses? The answers to these questions will be critical in shaping the future of the industry.

What Can Policyholders Expect Moving Forward?

For current policyholders, the immediate question is: what does this mean for me? While a $60 billion loss sounds alarming, it’s crucial to remember that these losses are unrealized. Insurers won’t necessarily face immediate financial distress unless they are forced to liquidate these bonds in a volatile market.

However, it’s wise for policyholders to stay informed. Keeping an eye on your insurer’s financial health and understanding their investment strategies can empower you as a consumer. If you’re feeling uneasy about your current policy, consider reaching out to your insurer for clarity and possibly even reevaluating your coverage options.

The Outlook for Japan’s Life Insurance Industry

Looking ahead, the future of Japan’s life insurance industry is uncertain but not without hope. While the current landscape presents challenges, it also offers opportunities for innovation and growth. Insurers may begin to diversify their portfolios, investing in alternative assets or even expanding their operations into international markets.

As the industry adapts, we may see a focus on technology to improve risk assessment and portfolio management. Additionally, the current situation may prompt a shift in regulatory frameworks, leading to more robust measures that protect both insurers and policyholders.

In essence, while the record unrealized losses are concerning, they also serve as a catalyst for change. The insurance landscape will inevitably transform, and those who can adapt will emerge stronger.

For those interested in the financial markets, this situation is a reminder of the intricate balance between risk and reward. The life insurance sector in Japan is facing a pivotal moment, and how it responds will shape the future of the industry.

Final Thoughts on the Current Situation

The recent announcement about unrealized losses of $60 billion for Japan’s largest life insurers is certainly a significant development. It underscores the challenges these institutions face in a rapidly changing economic environment. While the situation may seem dire, it also opens up conversations about financial responsibility, innovation, and the necessity for robust risk management.

As we continue to monitor this unfolding story, staying informed and proactive will be essential for both policyholders and investors. Whether you’re a policyholder with Nippon Life or one of its competitors, understanding the implications of these losses can help you make informed decisions about your financial future.

Keep an eye on the financial news, and don’t hesitate to reach out to your insurance provider to ensure that you’re making the best choices for your situation. After all, financial literacy is your best tool in navigating uncertain waters.