“From $70 Million to $0: Trader James Wynn’s Risky Gamble Sparks Outrage!”

leverage trading risks, cryptocurrency profit strategies, market volatility impacts

—————–

Major Crypto Trading Losses: The Case of James Wynn

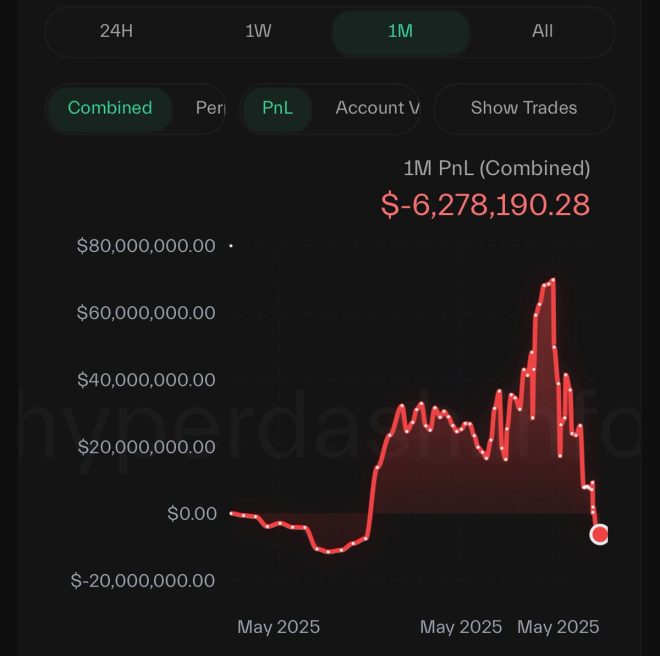

In the volatile world of cryptocurrency trading, fortunes can shift dramatically in a matter of days. A recent incident involving prominent leverage trader James Wynn serves as a cautionary tale for many in the crypto community. Just eight days prior to his reported losses, Wynn found himself in a position of immense wealth, boasting profits of approximately $70 million. However, as of May 27, 2025, reports indicate that he has fallen into the red, with his account balance dipping below zero.

The Rise and Fall of James Wynn

James Wynn’s story is not just another tale of a trader riding the highs of the crypto market; it encapsulates the risks associated with leverage trading. Leverage trading allows traders to control larger positions than their actual capital would normally permit, amplifying both potential gains and losses. Wynn’s impressive gains may have created a false sense of security, leading him to forego taking profits at a peak moment.

The decision to not cash out when at the top is a critical error made by many traders. Emotional decision-making, overconfidence, and the desire to maximize profits often cloud judgment, resulting in significant financial losses. In Wynn’s case, his failure to secure profits from a $70 million position ultimately left him exposed to the market’s unpredictable swings, leading to his current predicament.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Importance of Profit-Taking

Wynn’s experience underscores a fundamental principle in trading: the importance of profit-taking. Many traders, especially those in the crypto space, are often enticed by the prospect of further gains, only to be caught off guard when market conditions turn against them. Profit-taking is a risk management strategy that can help mitigate losses and secure gains before market volatility can erase them.

To avoid situations like Wynn’s, traders should establish clear profit-taking strategies and adhere to them. This could involve setting specific price targets or implementing trailing stop-loss orders to automatically secure profits as prices rise. By having a disciplined approach to trading, individuals can preserve their capital and navigate the often-turbulent waters of cryptocurrency markets more effectively.

The Role of Market Sentiment

Market sentiment is another critical factor that plays into the dynamics of cryptocurrency trading. The crypto market is notorious for its rapid shifts, often driven by speculation, news, and social media sentiment. Wynn’s abrupt shift from a profitable position to one in the red could be attributed to changing market sentiment, which can be swayed by a variety of external factors, including regulatory news, technological developments, and macroeconomic trends.

Traders should remain vigilant about market sentiment and continuously monitor the news and social media channels for signals that may affect their trading positions. Understanding the broader market context can help traders make informed decisions, reducing the likelihood of being caught off guard by sudden price movements.

Learning from Mistakes: A Cautionary Tale

For those in the trading community, James Wynn’s situation serves as a stark reminder of the risks inherent in leverage trading. While the potential for substantial profits exists, so too does the potential for devastating losses. As a leverage trader, Wynn’s experience highlights the need for a well-thought-out trading strategy, risk management practices, and the psychological discipline to execute them, even in the face of temptation.

Traders must educate themselves about the specific risks associated with leverage trading and develop a comprehensive understanding of their trading psychology. Emotional resilience is vital—traders must learn to detach their emotions from their trading decisions and stick to their predetermined strategies, regardless of market fluctuations.

Final Thoughts

The cryptocurrency market is an exciting yet perilous environment for traders. James Wynn’s recent financial disaster emphasizes the importance of taking profits and managing risk effectively. As the crypto landscape continues to evolve, traders must adapt and refine their strategies to navigate the complexities of this digital frontier.

In conclusion, whether you are a seasoned trader or just starting, learning from the experiences of others like James Wynn can provide valuable insights. Focus on sound trading practices, maintain a disciplined approach, and always stay informed about market conditions. By doing so, you can mitigate risks and enhance your chances of success in the ever-changing world of cryptocurrency trading.

In summary, the tale of James Wynn serves as a sobering reminder of the volatility of cryptocurrency markets and the risks associated with leverage trading. By understanding the importance of taking profits, managing risk, and staying aware of market sentiment, traders can better position themselves for success in this dynamic landscape.

BREAKING

Leverage trader ‘James Wynn’ is now in the red, below $0. He was up $70 million 8 days ago, but never took profit. pic.twitter.com/y8ANNPrLXw

— Crypto Beast (@cryptobeastreal) May 27, 2025

BREAKING

In the world of trading, especially in the volatile realm of cryptocurrencies, fortunes can change in the blink of an eye. A prime example of this is leverage trader James Wynn, who recently found himself in an astonishing predicament. Just eight days ago, he was riding high with a massive gain of $70 million. However, in a dramatic twist, he is now reported to be “in the red,” meaning his account balance has dropped below zero. This shocking story serves as a cautionary tale for traders everywhere, highlighting the importance of taking profits and managing risk.

Leverage Trading: A Double-Edged Sword

Leverage trading allows traders to borrow funds to increase their position size, which can amplify both gains and losses. Many traders are drawn to this strategy due to its potential for significant profits. But as James Wynn’s story illustrates, the risks can be equally substantial. When you trade on leverage, a small movement in the market can lead to massive swings in your account balance.

The allure of making a fortune can cloud judgment, leading traders to hold onto positions longer than they should. James Wynn’s case is a cautionary reminder: never let greed dictate your trading decisions. The market is unpredictable, and what goes up can just as easily come down.

Understanding the Risks of Holding

One of the most crucial lessons from James Wynn’s situation is the importance of taking profits. When traders see their investments rise, the excitement can lead them to hold out for even more significant gains. However, failing to lock in profits can be disastrous, especially in a market as volatile as cryptocurrency.

Many traders make the mistake of thinking they can time the market perfectly. The reality is that it’s nearly impossible to predict price movements accurately. Instead, it’s wiser to set profit-taking levels and stick to them. James Wynn had the chance to secure a monumental win but chose to hold on, ultimately leading to his current predicament.

Market Psychology: The Fear of Missing Out (FOMO)

One psychological factor that impacts traders is the fear of missing out (FOMO). This phenomenon often drives traders to hold onto assets longer than they should, hoping for even greater returns. When the market is moving rapidly, it can be incredibly tempting to stay in the game, especially after seeing substantial profits.

FOMO can lead to irrational decision-making, blinding traders to the reality of their situations. The emotional rollercoaster that comes with trading can cloud judgment, leading to poor choices. In James Wynn’s case, the thrill of being up $70 million may have contributed to his decision to stay in the trade, ultimately costing him everything.

Risk Management: A Trader’s Best Friend

To avoid ending up in a situation like James Wynn, implementing robust risk management strategies is crucial. This means not only setting profit-taking levels but also establishing stop-loss orders to protect against significant losses. A stop-loss order automatically sells your asset when it reaches a specified price, helping to limit your losses.

Traders should also diversify their portfolios to spread risk across different assets. Relying heavily on a single trade can lead to catastrophic losses. By managing risk effectively, traders can safeguard their capital and withstand the inevitable ups and downs of the market.

Learning from Mistakes: The Importance of Reflection

Every trader, whether novice or experienced, will encounter losses. What sets successful traders apart is their ability to learn from these experiences. Reflecting on what went wrong in a trade like James Wynn’s can provide invaluable insights for future decisions.

Instead of viewing losses as failures, consider them opportunities for growth. Analyze your trades, understand your emotional triggers, and adjust your strategies accordingly. By embracing a mindset of continuous learning, traders can improve their skills and increase their chances of success.

The Role of Social Media in Trading

In today’s digital age, social media plays a significant role in shaping trading behavior. Platforms like Twitter and Reddit have become popular forums for traders to share insights and strategies. While this can be beneficial, it also comes with risks.

Information spreads quickly on social media, often leading to hype and panic selling. Traders must be cautious about taking advice from unverified sources. In the case of James Wynn, the pressure of public scrutiny and the potential for FOMO could have influenced his decision-making.

The Bottom Line: Stay Vigilant and Informed

James Wynn’s story serves as a powerful reminder of the risks associated with trading, especially when leverage is involved. The allure of massive profits can lead to poor decision-making and ultimately significant losses. By prioritizing risk management, taking profits, and maintaining a reflective mindset, traders can navigate the unpredictable waters of the market more effectively.

As you embark on your trading journey, remember the importance of staying informed and vigilant. The cryptocurrency market is known for its volatility, and the landscape can change rapidly. Equip yourself with knowledge, develop a solid strategy, and don’t let emotions dictate your decisions.

In summary, whether you’re a seasoned trader or just starting, the lessons learned from James Wynn’s experience are invaluable. The world of leverage trading can be thrilling, but it’s essential to approach it with caution and a well-thought-out plan. Stay smart, stay safe, and may your trading endeavors be successful.

Source Links

For more information on leverage trading and its risks, check out Investopedia’s guide to leverage trading. You can also find insights into market psychology and FOMO at NerdWallet.