Japanese Public Company Remixpoint to Buy 200 More Bitcoin for ¥1 Billion: A Major Move in the Cryptocurrency Market

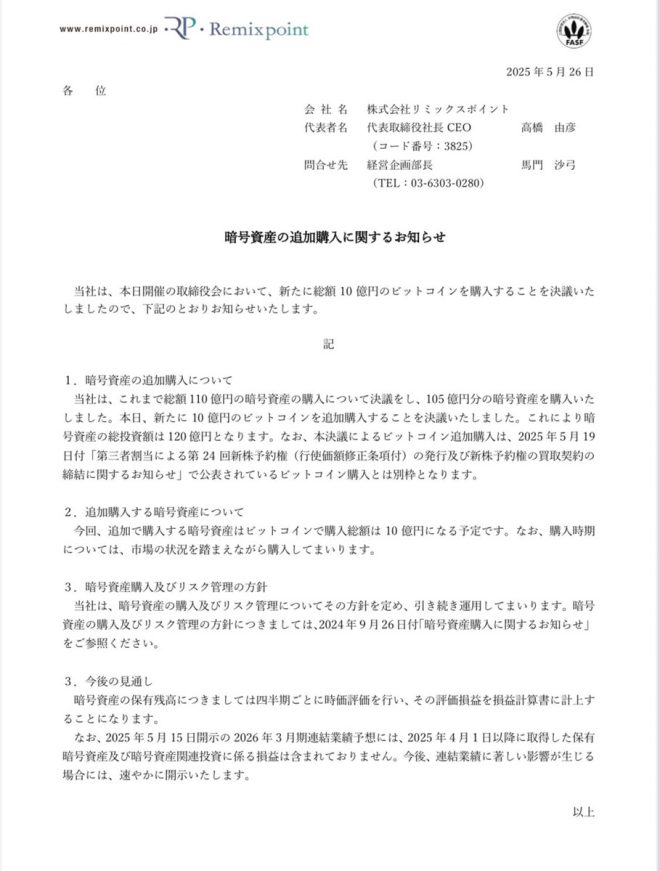

In a groundbreaking announcement that has sent ripples through the cryptocurrency world, Remixpoint, a public company based in Japan, is set to acquire an additional 200 Bitcoin (BTC) for a staggering ¥1 billion (approximately $9 million). This significant investment underscores Remixpoint’s aggressive strategy to expand its Bitcoin holdings, with a goal of accumulating a total of 1,000 BTC. As the market continues to evolve, Remixpoint’s latest move highlights the growing acceptance and integration of cryptocurrencies in mainstream business practices.

The Significance of Remixpoint’s Investment

Remixpoint’s decision to invest heavily in Bitcoin is a clear indication of the increasing institutional interest in cryptocurrency. This acquisition not only reflects the company’s confidence in Bitcoin as a long-term asset but also positions Remixpoint as a key player in the digital currency space. By purchasing 200 BTC, the company is taking advantage of the current market dynamics, where Bitcoin continues to be a leading cryptocurrency in terms of market capitalization and adoption.

Analyzing the Current Bitcoin Market

Bitcoin has been experiencing significant fluctuations in price, making it both a risky and potentially rewarding investment. The cryptocurrency has gained immense popularity due to its decentralized nature and the potential for high returns. As the leading cryptocurrency, Bitcoin serves as a benchmark for the entire digital asset market. With institutions like Remixpoint stepping in to increase their holdings, it signals a broader trend of acceptance among traditional financial entities.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Remixpoint’s Goal: 1,000 BTC

With this latest purchase, Remixpoint is racing towards its ambitious target of owning 1,000 BTC. Achieving this milestone would not only solidify the company’s position in the cryptocurrency market but also enhance its credibility as an innovative player in financial technology. The acquisition aligns with Remixpoint’s broader strategy to leverage blockchain technology and cryptocurrency for its business operations, potentially leading to new revenue streams and enhanced shareholder value.

Understanding the Broader Implications

The decision by Remixpoint to invest heavily in Bitcoin comes at a time when many companies are exploring the benefits of integrating cryptocurrency into their business models. As digital currencies become more mainstream, companies that adopt and invest in cryptocurrencies may find themselves at a competitive advantage. This trend reflects a shift in how businesses view digital assets, transitioning from skepticism to proactive engagement.

The Future of Cryptocurrency Investments

Investments in cryptocurrency, particularly Bitcoin, are likely to continue growing as more companies recognize the potential benefits. Bitcoin is often referred to as "digital gold," and many investors view it as a hedge against inflation and economic uncertainty. As the global economy faces challenges, the appeal of Bitcoin as a store of value becomes increasingly relevant.

Conclusion: A New Era for Cryptocurrency

Remixpoint’s commitment to acquiring more Bitcoin represents a significant step forward in the integration of cryptocurrency into the mainstream financial landscape. As the company races to secure its position with 1,000 BTC, it exemplifies the evolving narrative around digital currencies and their adoption by established businesses. This development not only highlights the potential for profitability in cryptocurrency investments but also sets a precedent for other companies considering a similar path.

In summary, the strategic investment by Remixpoint in Bitcoin is a noteworthy event that signals a larger trend of institutional adoption of cryptocurrencies. As the landscape continues to shift, the implications of such investments will resonate throughout the financial sector, paving the way for a new era of digital asset integration.

Key Takeaways:

- Remixpoint is set to acquire 200 more Bitcoin for ¥1 billion.

- The company aims to reach a total of 1,000 BTC, emphasizing its commitment to cryptocurrency.

- This investment reflects the growing institutional interest in Bitcoin and digital assets.

- As more companies adopt cryptocurrency, the market is likely to see increased legitimacy and integration of digital currencies into mainstream finance.

By monitoring developments like Remixpoint’s investment, investors and businesses alike can better understand the evolving landscape of cryptocurrencies and their potential impact on the future of finance.

JUST IN: JAPANESE PUBLIC COMPANY REMIXPOINT TO BUY 200 MORE #BITCOIN FOR ¥1 BILLION

THEY ARE RACING TO 1,000 BTC. INSANITY pic.twitter.com/wbeXSrMQRM

— The Bitcoin Historian (@pete_rizzo_) May 26, 2025

JUST IN: JAPANESE PUBLIC COMPANY REMIXPOINT TO BUY 200 MORE #BITCOIN FOR ¥1 BILLION

In an electrifying move, the Japanese public company Remixpoint has announced its plans to purchase an additional 200 Bitcoin for a whopping ¥1 billion. This is not just a casual investment; this is a serious commitment in the world of cryptocurrency. With this latest acquisition, Remixpoint is racing towards the impressive milestone of 1,000 BTC. The excitement surrounding this news is palpable, and rightly so—this decision could signal a shift in how corporations view Bitcoin and its potential as a mainstream asset.

THEY ARE RACING TO 1,000 BTC. INSANITY

As the crypto market continues to evolve, companies like Remixpoint are making bold moves that are hard to ignore. The company’s decision to ramp up its Bitcoin holdings reflects a growing trend among businesses to hold cryptocurrencies as part of their asset portfolios. This isn’t merely about speculation; it’s about positioning themselves in a future where digital currencies could play a fundamental role in the economy.

The phrase “racing to 1,000 BTC” isn’t just hyperbole; it highlights the urgency and determination behind Remixpoint’s strategy. With many companies still hesitating to dive into the world of cryptocurrency, Remixpoint is taking the leap, potentially setting a precedent for others to follow. This kind of bold investment could be seen as a signal that Bitcoin is becoming a more acceptable and robust part of financial strategies.

WHAT DOES THIS MEAN FOR BITCOIN?

So, what does Remixpoint’s acquisition mean for Bitcoin as a whole? First off, it demonstrates a growing institutional interest in the cryptocurrency market. When public companies begin to invest heavily in digital assets, it sends a message to the market that Bitcoin is not just a fad but a viable investment option. This could encourage other companies to follow suit, which could further drive up demand and, consequently, the price of Bitcoin.

Moreover, as more established companies invest in Bitcoin, it could help to stabilize the market. Unlike retail investors who may be more susceptible to panic selling, institutional investors tend to have a longer-term view. Their presence can provide a cushion during volatile market fluctuations, making Bitcoin a more attractive option for cautious investors.

THE ROLE OF REMIXPOINT IN THE CRYPTO SPACE

Remixpoint is not a newcomer to the crypto scene. The company has been actively involved in the cryptocurrency sector, particularly through its services related to Bitcoin trading and exchange. Their decision to acquire more Bitcoin is a strategic move that aligns with their ongoing commitment to the blockchain and cryptocurrency market. By increasing their holdings, they are not only enhancing their balance sheet but also reinforcing their position in a rapidly changing financial landscape.

Having a solid grasp of the market dynamics, Remixpoint is likely betting on the long-term appreciation of Bitcoin. Their actions could inspire confidence in other investors, potentially leading to a ripple effect across the industry. This could be the start of a wave where crypto investments become the norm rather than the exception.

HOW DOES THIS AFFECT INVESTORS?

For individual investors, the news of Remixpoint’s acquisition may serve as a wake-up call. If a public company is willing to invest such a significant amount in Bitcoin, it could be time for retail investors to reassess their portfolios. The concept of investing in Bitcoin may no longer be seen as a high-risk gamble but rather a strategic move in line with modern financial practices.

Investors should keep an eye on how Remixpoint’s decision impacts Bitcoin’s price and market sentiment. If more companies follow in their footsteps, we could see increased interest in Bitcoin, leading to a potential bull market. This is an opportunity for investors to educate themselves about the cryptocurrency market and consider how they might want to participate.

THE FUTURE OF BITCOIN INVESTMENTS

The announcement by Remixpoint is a significant marker for the future of Bitcoin investments. As digital currencies gain traction in mainstream financial circles, we can expect to see more companies integrating Bitcoin into their business models. This could pave the way for new innovations in how Bitcoin is used, from payment systems to investment vehicles.

As companies like Remixpoint invest heavily in Bitcoin, they are not just betting on the currency itself but on the underlying technology—blockchain. The more companies invest in Bitcoin, the more they contribute to the development of blockchain technologies, which could revolutionize various industries beyond finance.

CHALLENGES AHEAD

Despite the enthusiasm surrounding Remixpoint’s investment, it’s essential to recognize the challenges that lie ahead. The cryptocurrency market is notoriously volatile, and while institutional investment can bring stability, it also comes with risks. Regulatory frameworks are still evolving, and any significant changes in laws or regulations could impact Bitcoin’s price dramatically.

Moreover, as more companies invest in Bitcoin, we may see increased scrutiny from regulators. It’s crucial for investors to stay informed about the legal landscape surrounding cryptocurrency to navigate these challenges effectively.

IN CONCLUSION

Remixpoint’s recent announcement to buy 200 more Bitcoin for ¥1 billion is a game changer in the cryptocurrency space. Their aggressive strategy to reach 1,000 BTC showcases a commitment to Bitcoin that could inspire other companies to follow suit. As we watch this story unfold, it’s clear that Bitcoin is no longer just a speculative asset but a legitimate investment option that could shape the future of finance.

Whether you’re a seasoned investor or just starting, keeping an eye on developments like this is crucial. Remixpoint’s move could be the beginning of a broader acceptance of Bitcoin in the corporate world, marking a significant shift in how we view and utilize cryptocurrency. Stay tuned to see how this unfolds!

“`