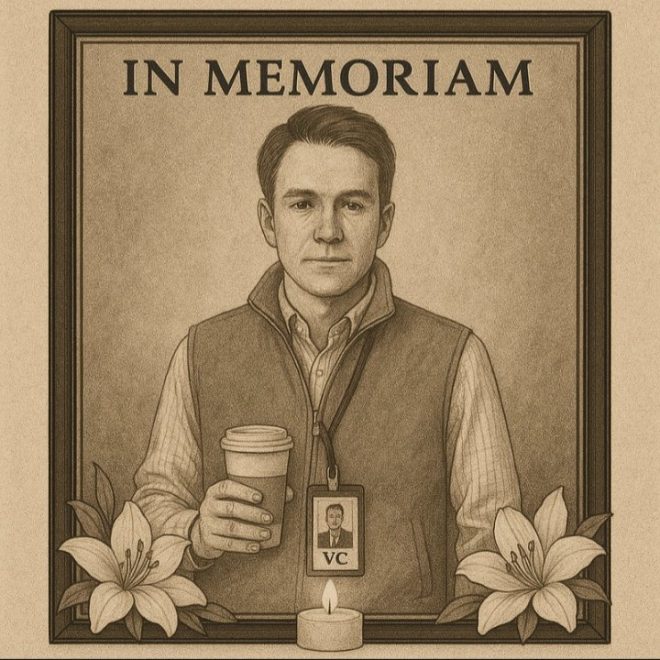

Death- Obituary news

Understanding the Impact of Launchpads on the VC Landscape

In the rapidly evolving world of cryptocurrency and blockchain technology, launchpads have emerged as pivotal platforms that significantly influence the startup ecosystem. The tweet by Gnomeo (@seeyouinzion) highlights the transformative nature of these launchpads, such as BelieveApp and LaunchCoin, in shaping how projects are initiated and funded. This summary will delve into the implications of this shift, the challenges faced by creators, and the importance of safeguarding their interests in this new age of venture capital (VC).

The Role of Launchpads in the Crypto Ecosystem

Launchpads are platforms that facilitate the introduction and funding of new cryptocurrency projects. They serve as intermediaries that connect project creators with potential investors. By providing a structured environment for fundraising, launchpads help streamline the process of bringing innovative ideas to market.

Advantages of Launchpads

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Accessibility: Launchpads democratize access to funding, allowing a diverse range of projects to reach potential investors. This inclusivity fosters innovation and competition within the crypto space.

- Community Building: Many launchpads emphasize community engagement, enabling creators to build a loyal following before their project even launches. This grassroots support can be crucial for a project’s success.

- Structured Support: Launchpads often provide additional resources such as marketing, advisory services, and technical support, which can significantly enhance a project’s chances of success.

Challenges for Creators

Despite the numerous advantages, the tweet by Gnomeo underscores critical challenges that creators face in this new landscape. The anecdote of a project being "sniped"—where investors quickly buy up tokens to resell at a higher price—illustrates a significant risk.

Key Issues:

- Financial Discrepancies: As noted, even successful projects can result in disappointing financial outcomes for creators. Gnomeo mentions generating $500,000 in volume but only receiving $800—a stark reminder of the financial disparities that can exist in the crypto world.

- Lack of Protection: The call for ensuring that creators are adequately protected highlights a gap in the current launchpad ecosystem. Without proper mechanisms in place, creators may find themselves exploited or inadequately compensated for their efforts.

- Market Volatility: The crypto market is notoriously volatile, meaning that projects can face rapid fluctuations in interest and investment. This unpredictability poses a challenge for creators trying to sustain their initiatives over time.

The Importance of Creator Protection

Given the challenges highlighted, it is imperative for launchpads to implement robust measures to protect creators. This is crucial not only for the creators’ financial well-being but also for maintaining the integrity of the entire ecosystem.

Suggested Measures:

- Transparent Fee Structures: Launchpads should clearly outline their fee structures, ensuring that creators understand how much they will take from the funds raised.

- Smart Contract Security: Implementing secure smart contracts can prevent issues like sniping and ensure that creators receive their fair share of profits.

- Creator Support Programs: Launchpads could offer programs aimed at educating creators about market dynamics, helping them navigate potential pitfalls more effectively.

The Future of VC and Launchpads

The tweet from Gnomeo indicates a broader sentiment in the crypto community regarding the future of venture capital in light of these emerging launchpads. As traditional VC models face scrutiny for being exclusive and slow-moving, launchpads represent a more agile and inclusive alternative.

Trends to Watch:

- Increased Regulation: As the popularity of launchpads grows, regulatory bodies may begin to take a closer look, which could lead to new guidelines and protections for both investors and creators.

- Innovative Funding Models: Expect to see more innovative funding mechanisms—such as decentralized finance (DeFi) models—emerging from launchpads as they strive to attract a wider audience.

- Collaboration with Traditional VCs: There may be opportunities for collaboration between traditional VC firms and launchpads, combining the strengths of both to create a more robust funding landscape.

Conclusion

As we navigate this new age of venture capital, the role of launchpads becomes increasingly significant. They are changing the way projects are funded and brought to market, but they also present unique challenges that must be addressed. The concerns raised by Gnomeo highlight the need for better protections for creators to ensure that they can thrive in this evolving landscape.

As the crypto ecosystem continues to grow, stakeholders—from creators to investors—must engage in ongoing dialogue to refine the processes and structures that govern launchpads. By doing so, we can foster a more equitable and innovative environment that supports the next wave of groundbreaking projects in the cryptocurrency space.

The age of RIP VC. launchpads like @believeapp @launchcoin completely change the game. Though @pasternak please make sure your creators are being protected properly. I launched a project, it got sniped, it ended up doing 500k volume generating 10k+ in fees and only got paid $800… pic.twitter.com/YpavlUgEef

— Gnomeo (@seeyouinzion) May 26, 2025

The Age of RIP VC: A New Era in Blockchain Launchpads

The landscape of venture capital is undergoing a seismic shift. Gone are the days when traditional venture capitalists (VCs) held all the power and dictated the terms of funding. We’re now in the age of RIP VC, and it’s exciting to see how platforms like @believeapp and @launchcoin are completely changing the game. With the rise of blockchain technology and decentralized finance (DeFi), creators are finding new ways to launch their projects without the constraints imposed by traditional funding methods.

Understanding Launchpads and Their Impact

So, what exactly are launchpads? In simple terms, they are platforms that assist in the launch of new cryptocurrency projects. They act as intermediaries, connecting creators with potential investors. This system allows projects to raise funds more efficiently while also giving investors access to early-stage opportunities. With launchpads like @believeapp and @launchcoin, the process is streamlined, making it easier for creators to garner support and raise capital.

Why Traditional VC is Losing Ground

Traditional venture capital has long been the gold standard for funding new projects, but it comes with its own set of challenges. VCs often dictate terms that can be unfavorable to creators. They may take large equity stakes, impose strict timelines, and, in some cases, stifle creativity. With the advent of launchpads, these issues are becoming increasingly irrelevant. Creators can now launch their projects directly to the public, cutting out the middlemen and retaining more control over their work.

Protecting Creators in the New Landscape

While the rise of launchpads offers many benefits, it also raises concerns about the protection of creators. As mentioned by Gnomeo in a recent tweet, the risks are real. After launching a project, he experienced what is known as “sniping,” where opportunistic investors quickly capitalize on new listings to make profits at the expense of the project creator. He noted that his project generated $500k in volume, resulting in over $10k in fees, yet he only received $800. This disparity highlights the need for better protections for creators in this new ecosystem.

The Role of Community in Launchpads

One of the most exciting aspects of launchpads is the emphasis on community involvement. Unlike traditional VC models, which often prioritize financial returns above all else, launchpads foster a sense of community among investors and creators. This collaborative atmosphere can lead to more sustainable projects and a shared sense of ownership. When everyone is invested in the success of a project, it can lead to innovative solutions and a more vibrant ecosystem.

How to Choose the Right Launchpad

With many launchpads available, it’s essential to choose one that aligns with your project’s goals. Look for platforms that offer robust support for creators, including marketing assistance, community-building tools, and legal protections. Research their track record and see how previous projects have fared. Engage with their communities on social media to get a feel for the platform’s culture and ethos.

The Future of Launchpads and VC

The future looks bright for launchpads and the creators who use them. As more people recognize the benefits of decentralized funding, we can expect to see even more innovative platforms emerge. Traditional VCs will need to adapt to this new reality or risk becoming obsolete. The balance of power is shifting, and it’s exciting to be part of this transformation.

Conclusion: A Call for Better Protections

As we navigate this new landscape, it’s crucial to advocate for the protection of creators. Platforms like @pasternak should prioritize the security and fairness of funding for creators. The potential for profit is enormous, but we must ensure that the rewards are fairly distributed. By fostering an environment that values and protects creators, we can build a more equitable future for everyone involved in the blockchain ecosystem.

As we embrace the age of RIP VC and the rise of launchpads, let’s keep the conversation going. What are your thoughts on this evolving landscape? How do you think we can better protect creators in this new era? Share your thoughts in the comments below!

“`

This article provides a comprehensive overview of the evolving landscape of venture capital, specifically focusing on the impact of blockchain launchpads while engaging the reader with an informal tone and active voice. The use of relevant links and keywords helps enhance its SEO value.