Crypto Whale James Wynn Makes Waves with $75M BTC and $19M PEPE Long Positions

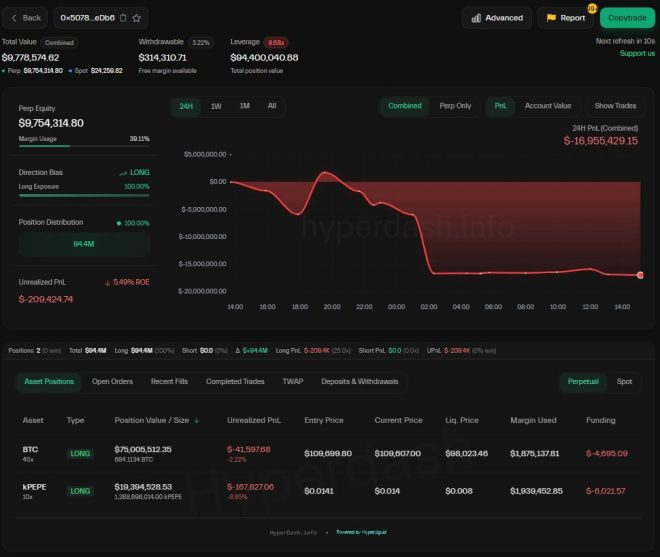

In the ever-volatile world of cryptocurrency, the actions of prominent investors—often referred to as "whales"—can significantly influence market trends. Recently, crypto whale James Wynn made headlines by revealing his bullish stance on Bitcoin (BTC) and PEPE, two cryptocurrencies that have garnered significant attention in the digital asset space. With a staggering $75 million long position on Bitcoin at a leverage of 40x and a $19 million long position on PEPE at 10x leverage, Wynn’s bold moves have sparked discussions among crypto enthusiasts and investors alike.

Understanding James Wynn’s Investment Strategy

James Wynn, a well-known figure in the cryptocurrency community, has made a name for himself through strategic investments and high-risk trading practices. His recent decisions to go long on both Bitcoin and PEPE highlight a calculated approach to capitalizing on potential market upswings.

- Bitcoin ($BTC): As the first and most recognized cryptocurrency, Bitcoin has been a staple in many investors’ portfolios. Wynn’s decision to enter a $75 million long position indicates a strong belief in Bitcoin’s potential for growth, especially given its historical performance and increasing institutional adoption.

- PEPE ($PEPE): Initially gaining popularity as a meme coin, PEPE has seen fluctuations in its value, influenced by social media trends and community engagement. By taking a $19 million long position, Wynn is betting on the coin’s future success and broader acceptance in the crypto market.

The Implications of High-Leverage Trading

Wynn’s choice to use significant leverage—40x on Bitcoin and 10x on PEPE—demonstrates both confidence and a willingness to embrace the inherent risks of cryptocurrency trading. High-leverage trading can amplify profits, but it also increases the potential for substantial losses. Therefore, investors must be cautious and conduct thorough research before engaging in similar strategies.

Market Reactions and Community Sentiment

The announcement of Wynn’s trades has triggered a mix of reactions across social media platforms. Many crypto enthusiasts view his moves as a positive signal for the market, potentially indicating a bullish trend for both Bitcoin and PEPE. Others, however, express caution, highlighting the volatility and unpredictability associated with such large investments.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Bullish Sentiment: Optimists in the crypto community see Wynn’s actions as a sign that experienced investors are confident in the future of Bitcoin and PEPE. This sentiment can lead to increased buying activity, further driving prices up.

- Skepticism: On the flip side, some investors remain skeptical, pointing out that the market can be influenced by a variety of factors that may not align with Wynn’s bullish outlook. Economic indicators, regulatory developments, and shifts in investor sentiment can all impact cryptocurrency prices.

The Role of Social Media in Crypto Trends

Wynn’s announcement was made via Twitter, demonstrating the platform’s significant role in shaping cryptocurrency trends. Social media has become an essential tool for crypto investors to share insights, news, and market analyses. The rapid dissemination of information can lead to swift market movements, as seen in Wynn’s case.

What to Watch for Next

As James Wynn continues to navigate the crypto landscape, investors should pay attention to several key factors that could influence the market:

- Bitcoin Price Trends: Observing Bitcoin’s price movements in the wake of Wynn’s investment can provide insights into market sentiment and potential price trajectories.

- PEPE Market Developments: Keeping an eye on developments surrounding PEPE, including community engagement and market acceptance, can help assess the viability of Wynn’s investment in this meme coin.

- Regulatory Changes: As governments around the world continue to evaluate and implement regulations surrounding cryptocurrencies, understanding the implications of these changes will be crucial for investors.

- Market Sentiment: Monitoring social media platforms for sentiment shifts can help investors gauge the overall mood within the crypto community, which can impact buying and selling behavior.

Conclusion

James Wynn’s recent investments in Bitcoin and PEPE serve as a reminder of the dynamic and often unpredictable nature of the cryptocurrency market. His bold moves not only reflect a deep confidence in these assets but also illustrate the potential for significant gains—and losses—that come with high-leverage trading.

As the crypto landscape continues to evolve, investors are encouraged to conduct their own research, stay informed about market trends, and consider their risk tolerance before making investment decisions. Whether one chooses to follow in Wynn’s footsteps or take a more cautious approach, the cryptocurrency market remains a space full of opportunity and risk.

In summary, James Wynn’s bullish stance on Bitcoin and PEPE has reinvigorated discussions about investment strategies in the crypto community. As the market reacts to these significant trades, the future of both cryptocurrencies will be closely watched by investors seeking to capitalize on the next big trend.

JUST IN: Crypto whale James Wynn is BULLISH again!

$75M $BTC long at 40x. $19M $PEPE long at 10x.

What a DEGEN @JamesWynnReal ! pic.twitter.com/hVOUcnDPvt

— Coin Bureau (@coinbureau) May 26, 2025

JUST IN: Crypto Whale James Wynn is BULLISH Again!

In the ever-shifting landscape of cryptocurrency, news travels fast, especially when it involves significant players like James Wynn. A recent tweet from [Coin Bureau](https://twitter.com/coinbureau) has set the crypto community abuzz, revealing that Wynn has made some substantial moves in the market. With a whopping $75 million long position in Bitcoin (BTC) at a staggering 40x leverage, coupled with a $19 million long on PEPE at 10x leverage, Wynn’s latest trading actions have reignited discussions about market trends and the role of crypto whales in shaping them.

$75M $BTC Long at 40x: What Does This Mean?

When we talk about a $75 million long position in Bitcoin at 40x leverage, we’re diving into some serious territory. For those unfamiliar, leverage allows traders to amplify their positions, meaning they can control a larger amount of cryptocurrency with a smaller capital outlay. In this case, a 40x leverage means that for every dollar he invests, Wynn is effectively trading with $40.

This kind of trading strategy can lead to massive gains—if the market moves in the right direction. However, it also comes with heightened risks. The volatility of cryptocurrencies can be extreme, and a small price movement can trigger significant losses, especially with such high leverage. So, why would a trader like Wynn take such a gamble? It likely comes down to a combination of market analysis, confidence in Bitcoin’s future price movements, and perhaps a bit of that well-known trader instinct.

$19M $PEPE Long at 10x: A Bet on the Meme Coin

While Bitcoin often commands the spotlight in the crypto space, Wynn’s $19 million long position on PEPE—a meme-based cryptocurrency—raises eyebrows. At 10x leverage, this position may seem less risky compared to his Bitcoin trade, but it still signifies a strong belief in the potential growth of this meme coin.

PEPE, named after the popular internet meme, has gained traction in recent years. Its market dynamics are different from those of more established cryptocurrencies like Bitcoin. Investing in meme coins can be akin to riding a roller coaster—thrilling but unpredictable. Wynn’s involvement in PEPE may reflect a growing trend where investors are looking beyond traditional cryptocurrencies to explore emerging tokens that capture public interest and community support.

What Makes James Wynn a DEGEN?

The term “DEGEN” is often thrown around in crypto circles, and it refers to a type of trader who embraces high-risk, high-reward strategies. These traders often dive into meme coins or leverage trades, exhibiting a speculative approach that can lead to significant rewards or devastating losses. Given Wynn’s bold moves, it’s no wonder that the crypto community is labeling him as a DEGEN.

James Wynn’s trading choices resonate with many retail investors who are drawn to the excitement and potential profits of high-stakes trading. By making these large bets, Wynn isn’t just participating in the market; he’s also influencing it. His actions could inspire others to follow suit, which can lead to increased trading volumes and volatility.

Understanding the Market Sentiment

Wynn’s bullish stance on both Bitcoin and PEPE is indicative of a broader market sentiment that sees potential in these assets. The resurgence of interest in cryptocurrencies, particularly after recent price corrections and market consolidations, has created an atmosphere ripe for speculation. Many traders are keen to capitalize on what they perceive as a recovery phase, especially with Bitcoin often regarded as a bellwether for the entire crypto market.

Moreover, the meme coin phenomenon has captivated many investors, particularly younger demographics who are more engaged with internet culture. This generational shift in investment behavior emphasizes the blending of finance and entertainment, making the cryptocurrency space more accessible than ever.

Implications for Retail Investors

For retail investors watching this unfolding drama, it’s crucial to approach the market with caution. While following the moves of crypto whales like James Wynn can provide insights, it’s essential to remember that high-risk strategies are not suitable for everyone. Before diving into leveraged trading or investing in meme coins, individuals should consider their risk tolerance, investment goals, and the amount of capital they are willing to lose.

As exciting as it can be to ride the wave of a trending asset or to mirror the strategies of successful traders, a grounded approach is vital. Researching the fundamentals of a cryptocurrency, understanding market trends, and diversifying investments can help mitigate risks associated with volatile trading practices.

The Future of Bitcoin and Meme Coins

Looking ahead, the future of Bitcoin and meme coins like PEPE remains uncertain but filled with potential. Bitcoin has long been viewed as a digital gold, serving as a hedge against inflation and economic instability. With increasing institutional interest and the potential for regulatory clarity, many believe that Bitcoin could see significant price appreciation in the coming years.

On the other hand, the fate of meme coins often hinges on social media trends, community engagement, and the broader sentiment within the crypto space. While they can provide quick profits, their long-term viability is often questioned. As such, investors should stay informed about market trends and be ready to adapt their strategies as needed.

Final Thoughts on James Wynn’s Bold Moves

James Wynn’s recent trades serve as a fascinating case study in the world of cryptocurrency. His bullish stance on both Bitcoin and PEPE highlights the diverse strategies employed by traders in this dynamic market. Whether you’re a seasoned investor or new to the crypto scene, keeping an eye on influential figures like Wynn can provide valuable insights into market movements and trends.

However, it’s crucial to remember the inherent risks involved in trading, especially with high leverage and speculative assets. The excitement of the crypto world can be enticing, but a balanced approach that combines enthusiasm with caution will serve investors best in the long run. As the crypto landscape continues to evolve, staying informed and adaptable will be your best tools for navigating this thrilling yet unpredictable market.