Innovative Real Estate Financing Strategy: A Summary

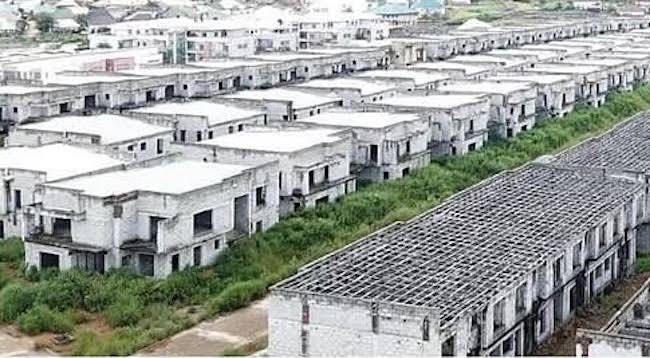

In the ever-evolving landscape of real estate investment and financing, an intriguing proposal recently surfaced from financial expert Kalu Aja. This strategy centers around a closed-end mortgage-backed security (MBS) designed to optimize the management and profitability of a collection of 753 homes. Below, we outline this innovative approach and its potential implications for the real estate market.

Understanding Closed-End Mortgage-Backed Securities (MBS)

Closed-end mortgage-backed securities are investment vehicles that pool together mortgage loans, allowing investors to buy shares in a portfolio that generates income through the repayment of those loans. By creating an MBS for the 753 homes, Aja proposes an efficient way to manage these properties while attracting capital from investors.

Step 1: Creation of a Closed-End MBS

The first step in Aja’s strategy is the establishment of a closed-end MBS that will encompass the 753 homes. This involves bundling the mortgages of these properties into a single financial product. By doing so, the risks associated with individual properties are diversified, making the investment more appealing to potential buyers.

Step 2: Appointing a Global Property Manager

To ensure effective management of the properties within the MBS, a professional global property management firm would be appointed. This entity would be responsible for the day-to-day operations, maintenance, and tenant relations of the homes. A skilled property manager can enhance property values, ensure high occupancy rates, and improve overall returns for investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Step 3: Listing the MBS on the Stock Exchange via IPO

Once the MBS is established and a property manager is in place, the next step is to list the security on the stock exchange through an Initial Public Offering (IPO). This move not only raises capital but also provides liquidity to investors, allowing them to buy and sell shares in the MBS much like traditional stocks. The IPO proceeds can then be utilized for further investments, property improvements, or paying down existing debts.

Step 4: Utilizing IPO Proceeds

The funds generated from the IPO would play a crucial role in the overall success of the strategy. These proceeds could be reinvested into the properties to enhance their value, such as through renovations or upgrades. Additionally, the capital could be used to cover operational costs, ensuring that the properties are well-maintained and financially viable.

Benefits of the Proposed Strategy

Aja’s approach offers numerous benefits, both for investors and the broader real estate market. Here are some key advantages:

Enhanced Liquidity

By listing the MBS on the stock exchange, investors gain the ability to enter and exit their investments more easily than traditional real estate investments would allow. This liquidity can attract a broader range of investors, including those who may have been hesitant to invest in real estate due to its illiquid nature.

Diversification of Risk

Pooling the mortgages of 753 homes into a single MBS allows for diversification of risk. Investors are less exposed to the fluctuations of individual property values, as the performance of the MBS is tied to the collective performance of all properties within the pool.

Professional Management

The appointment of a global property manager ensures that the homes are managed by experienced professionals. This can lead to improved tenant satisfaction, lower vacancy rates, and ultimately higher returns for investors.

Increased Access to Capital

The IPO process allows for the infusion of capital that can be used to improve the properties and expand the portfolio. This increased access to funds can accelerate growth and enhance overall profitability.

Challenges and Considerations

While Aja’s strategy presents exciting possibilities, it is not without its challenges. Regulatory considerations surrounding the creation and management of an MBS can be complex and require careful navigation. Additionally, the success of the plan hinges on the ability to attract investors during the IPO process, which may be influenced by market conditions at the time.

Conclusion

Kalu Aja’s innovative proposal to create a closed-end mortgage-backed security for a collection of 753 homes presents a unique opportunity for both real estate investors and property managers. By leveraging the benefits of an MBS, this strategy could redefine how residential properties are financed and managed, ultimately leading to enhanced profitability and investor satisfaction. As the real estate market continues to evolve, adopting such innovative financial strategies may prove essential for maximizing returns and ensuring long-term success.

As we move forward, it will be fascinating to see how this proposal develops and whether it can be successfully implemented in the competitive real estate landscape. Investors, property managers, and financial institutions alike should keep a close eye on this emerging trend, as it may shape the future of real estate investment and management.

Don’t sell the homes, immediately

1. Create a closed-end mortgage-backed security MBS that will hold all 753 homes, appoint a global property manager

2. List the MBS on the stock exchange via IPO

3. Property manager to manage the estate

4. Use IPO proceeds to complete… pic.twitter.com/IaYuHmzfIM

— Kalu Aja (@FinPlanKaluAja1) May 24, 2025

Don’t Sell the Homes, Immediately

Have you ever found yourself in a situation where selling might not be the best option? When it comes to real estate, sometimes the smartest moves don’t involve putting a “For Sale” sign in the yard. Instead of selling the homes, why not think outside the box and explore innovative financial strategies? This article will delve into a unique approach that could potentially unlock significant value from a portfolio of properties.

Create a Closed-End Mortgage-Backed Security (MBS)

First things first, let’s talk about creating a closed-end mortgage-backed security (MBS). This financial instrument allows investors to pool together mortgages and convert them into tradable securities. Imagine having all 753 homes under one umbrella! By creating an MBS that holds these properties, you’re not just holding real estate; you’re crafting a powerful investment vehicle.

Why is this beneficial? Well, an MBS can attract a wide range of investors looking for diverse opportunities in the housing market without the headaches of property management. This approach can also provide liquidity, which is crucial in today’s fast-paced financial environment. Plus, appointing a global property manager ensures that someone with expertise is taking care of the properties, maximizing their value.

For a deeper dive into mortgage-backed securities and their benefits, check out this detailed guide on [Investopedia](https://www.investopedia.com/terms/m/mortgagebackedsecurity.asp).

List the MBS on the Stock Exchange via IPO

Next up, let’s talk about taking this MBS public. Listing the MBS on the stock exchange via an Initial Public Offering (IPO) is an exciting step. An IPO can be a game changer for your investment strategy. It opens up access to capital, allowing you to raise funds without incurring debt.

When you go public, investors can buy shares of the MBS, giving them exposure to the real estate market without having to directly own properties. This can lead to a more stable source of income as the MBS generates returns based on the mortgage payments from the homes within the portfolio.

Additionally, an IPO can attract institutional investors who are always on the lookout for solid assets. This can significantly boost the visibility and credibility of your investment vehicle. If you want more insights into how IPOs work, you might find this article from [Forbes](https://www.forbes.com/advisor/investing/what-is-an-ipo/) helpful.

Property Manager to Manage the Estate

Now that you have your MBS set up and listed, it’s time to focus on the operational aspect—property management. Appointing a global property manager is crucial. This person or team will take the reins, ensuring that the properties are well-maintained and that tenants are satisfied.

A good property manager can significantly increase the value of the assets. They handle everything from tenant relations to maintenance issues, allowing you to focus on strategic decisions. They also have the expertise to optimize rental income and manage expenses, making sure the properties are profitable.

Furthermore, a global property manager can leverage technology for efficient management, ensuring that the properties are always in top shape and that the investment continues to yield returns. If you’re interested in learning more about effective property management, check out [Zillow’s property management tips](https://www.zillow.com/rental-manager/resources/property-management-tips/).

Use IPO Proceeds to Complete Development and Enhance Value

Finally, let’s talk about what to do with the proceeds from the IPO. This is where the magic happens. The funds raised from going public can be used to complete development projects, upgrade existing properties, or even acquire additional assets.

Imagine transforming those 753 homes into even more desirable living spaces. You could invest in renovations, energy-efficient upgrades, or enhanced amenities—whatever it takes to boost the value of your properties. This not only increases the rental income but also enhances the overall marketability of the MBS.

Moreover, reinvesting in the properties can create a positive feedback loop: improved homes lead to higher occupancy rates, which in turn generates more revenue for the MBS. It’s a win-win situation for both the investors and the property manager. For insights on how to wisely reinvest your capital, take a look at [Harvard Business Review’s article on reinvestment strategies](https://hbr.org/2017/07/3-questions-to-ask-before-you-reinvest).

Conclusion

The world of real estate investment is constantly evolving, and with the right strategies, you can make decisions that maximize your returns without rushing to sell your properties. By creating a closed-end mortgage-backed security, going public through an IPO, engaging a skilled property manager, and wisely using the proceeds, you can create a robust investment ecosystem that benefits all parties involved.

So, before you throw in the towel and sell those homes, consider these innovative strategies. You might just find that holding onto them can lead to greater financial success in the long run.