Death- Obituary news

Trader James Wynn Closes $1 Billion Bitcoin Short: A Turning Point for Cryptocurrency Markets

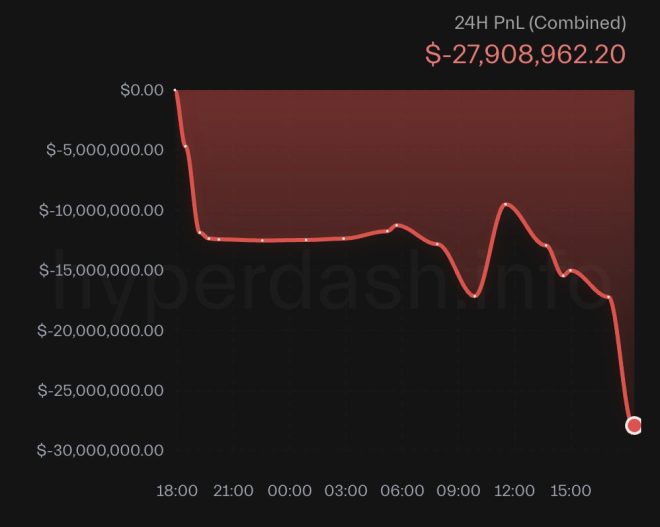

In an unprecedented move, renowned trader James Wynn has closed his massive $1 billion short position on Bitcoin, resulting in significant losses. This pivotal moment in the cryptocurrency market has sent ripples across the trading community, igniting bullish sentiments among investors. The news has sparked discussions about potential upcoming price surges, with many analysts speculating that the market is on the brink of achieving a new all-time high (ATH) within the week.

The Context of Wynn’s Position

Bitcoin, the leading cryptocurrency, has seen extreme volatility over the years. Traders like James Wynn have often positioned themselves on both sides of the market to leverage these fluctuations. A short position, in essence, bets against the asset, anticipating a decrease in its price. However, Wynn’s decision to close his short position at a substantial loss indicates a shift in market dynamics, particularly signaling a potential turnaround for Bitcoin.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Sentiment and Bearish Trends

For some time, the cryptocurrency market has experienced bearish trends, leading many traders to adopt cautious approaches. Wynn’s significant loss on his short position can be interpreted as a capitulation by the bears. The term "capitulation" refers to the moment when traders who are betting against an asset give up their positions, often leading to a price rebound. This sentiment is echoed in the tweet by Ripple Van Winkle, a prominent crypto researcher, who suggests that the bears are capitulating, which typically precedes bullish trends.

The Implications of Wynn’s Exit

Wynn’s exit from his short position may have broader implications for the cryptocurrency market. His decision could be a signal for other traders and investors to reconsider their positions. With the bearish sentiment potentially dissipating, many believe that a renewed interest in Bitcoin could drive prices upwards. The anticipation of a new ATH this week demonstrates the optimistic outlook shared by many in the crypto community.

The Role of Social Media in Cryptocurrency Trading

The announcement of Wynn’s decision was made via Twitter, highlighting the significant role that social media plays in today’s trading environment. Platforms like Twitter have become essential for real-time updates, market analysis, and sentiment tracking within the cryptocurrency community. Influential figures like Ripple Van Winkle can sway opinions and impact trading behaviors, making social media a powerful tool for both traders and investors.

Analyzing the Potential for an ATH

As the market reacts to the news of Wynn’s short closure, analysts are closely monitoring Bitcoin’s price movements. The prospects of reaching a new ATH depend on various factors, including market sentiment, trading volume, and broader economic conditions. If more traders follow Wynn’s lead and shift towards bullish strategies, Bitcoin could see a surge in demand, propelling its price higher.

Understanding the Current Market Landscape

The cryptocurrency market is known for its rapid changes and unpredictability. Factors such as regulatory developments, macroeconomic trends, and technological advancements can significantly influence price movements. Despite recent bearish trends, the closure of a substantial short position like Wynn’s can signal a shift in momentum, reminding traders of the cyclical nature of the market.

The Importance of Risk Management

Wynn’s situation serves as a reminder of the inherent risks involved in cryptocurrency trading. While the potential for substantial gains exists, the volatility of digital assets can lead to significant losses, as seen in Wynn’s case. Risk management strategies are crucial for traders to navigate the unpredictable landscape of cryptocurrencies effectively. Diversifying portfolios, setting stop-loss orders, and staying informed about market trends can help mitigate risks.

Looking Ahead: What This Means for Investors

Investors should remain vigilant and informed in light of the recent developments surrounding Bitcoin. While Wynn’s exit from his short position may indicate a shift towards bullish sentiment, the market remains unpredictable. Understanding market trends, conducting thorough research, and maintaining a disciplined approach to trading are essential for success in the cryptocurrency space.

Conclusion

The closure of James Wynn’s $1 billion Bitcoin short position marks a significant moment in the cryptocurrency market, potentially indicating a turning point in sentiment. As traders and investors react to this news, the possibility of reaching a new ATH looms large. The dynamics of the market are ever-changing, and the influence of social media on trading behaviors cannot be underestimated. For those involved in cryptocurrency trading, staying informed and adopting sound risk management strategies will be key to navigating this exciting yet volatile landscape.

In summary, with the bears possibly capitulating and bullish trends emerging, the next few days could prove crucial for Bitcoin’s price trajectory. Investors are encouraged to watch the market closely and consider the implications of Wynn’s actions as they strategize their next moves in the ever-evolving world of cryptocurrency.

BREAKING: TRADER JAMES WYNN JUST CLOSED HIS $1 BILLION #BITCOIN SHORT AT A MASSIVE LOSS

THE BEARS ARE CAPITULATING. BULLISH

We are going to make a new ATH this week

Watch pic.twitter.com/uv7IU6uo2H

— Ripple Van Winkle | Crypto Researcher (@RipBullWinkle) May 25, 2025

BREAKING: TRADER JAMES WYNN JUST CLOSED HIS $1 BILLION #BITCOIN SHORT AT A MASSIVE LOSS

When news hits the crypto world, it often shakes the very foundations of the market, and the recent announcement about Trader James Wynn is no exception. Just recently, Wynn closed his staggering $1 billion Bitcoin short position, experiencing a massive loss in the process. This move has sent ripples through the crypto community, leading many to speculate about what it means for Bitcoin’s future. So, let’s dive into the details and explore the implications of this dramatic turn of events.

THE BEARS ARE CAPITULATING. BULLISH

What does it mean when “the bears are capitulating”? In the world of trading, a “bear” is someone who believes that prices will fall. When they capitulate, it means they’re throwing in the towel, admitting defeat, and often buying back into the market. Wynn’s closure of his short position suggests that he, like many others, is starting to feel the bullish wave that Bitcoin has been riding.

Investors who were pessimistic about Bitcoin are beginning to change their minds. This shift in sentiment can lead to a more significant rally in prices, as traders start to buy in anticipation of future gains. The bullish outlook is evident, especially with Wynn’s costly retreat from a bearish position. Analysts are now buzzing about the potential for Bitcoin to reach new all-time highs (ATH), with many believing that this week could be pivotal.

We are going to make a new ATH this week

The excitement around Bitcoin reaching a new all-time high is palpable. If you’ve been following the crypto markets, you know that Bitcoin has experienced its fair share of ups and downs. However, every time it seems to gain momentum, the question arises: could this be the moment when it breaks through to new heights? With Wynn’s capitulation and a wave of bullish sentiment, many investors are feeling optimistic.

The growing acceptance of Bitcoin as a legitimate asset class and the increasing interest from institutional investors contribute to this bullish sentiment. Bitcoin has been gaining traction as a hedge against inflation and a store of value, drawing in both retail and institutional investors. If you’re curious about how institutional investment is shaping the crypto landscape, you might want to check out insights from [CoinDesk](https://www.coindesk.com).

Investors are keenly watching market trends, and social media is buzzing with speculation about what’s next. As we navigate through volatile market conditions, keeping an eye on influential traders like James Wynn can provide insights into the overall market sentiment.

Watch

With so much happening in the Bitcoin space, it’s essential to stay informed and watch the market closely. The cryptocurrency landscape is ever-changing, and being proactive can lead to significant opportunities. Whether you’re a seasoned trader or just starting, understanding the implications of Wynn’s move can help you make better decisions.

Social media platforms, especially Twitter, have become essential for real-time updates on market movements. Following key influencers and analysts can provide valuable insights that traditional news outlets might miss. For instance, the tweet by Ripple Van Winkle has already sparked discussions among traders, and following such accounts can keep you in the loop about potential market shifts.

If you’re planning to dive deeper into Bitcoin trading or investment, consider joining communities on platforms like Reddit or Discord. Engaging with fellow traders can help you stay ahead of the curve and understand market sentiment better.

Understanding Bitcoin’s Volatility

Bitcoin’s volatility is both its curse and its blessing. While it can lead to significant losses—like the one James Wynn just experienced—it can also create opportunities for substantial gains. New traders often find themselves overwhelmed by the price swings, but understanding the factors that contribute to this volatility can help you navigate the market more effectively.

Several factors contribute to Bitcoin’s price fluctuations, including market sentiment, regulatory news, technological advancements, and macroeconomic trends. For example, news regarding government regulations can send shockwaves through the market, affecting prices dramatically. Staying informed about these developments is crucial for making informed trading decisions.

Additionally, understanding technical analysis can give traders an edge. By analyzing price charts and market trends, you can identify patterns that may predict future price movements. If you’re new to technical analysis, many online resources can help you get started, from YouTube tutorials to comprehensive guides on trading websites.

What’s Next for Bitcoin? Predictions and Speculations

As we look ahead, many traders are asking: what’s next for Bitcoin? With the recent shift in sentiment and the potential for new all-time highs, predictions are flying left and right. Some analysts are bullish, suggesting that Bitcoin could soar past its previous highs, while others remain cautious, advising traders to tread carefully given the cryptocurrency’s unpredictable nature.

The upcoming week could prove to be pivotal. If Bitcoin manages to break through resistance levels, it might attract even more investors. However, it’s essential to keep in mind that market conditions can change rapidly, and what seems like a sure thing today could turn on a dime tomorrow.

For those looking to invest, consider developing a strategy that includes both entry and exit points. Setting stop-loss orders can also help mitigate potential losses if the market turns against you.

Final Thoughts

James Wynn’s decision to close his $1 billion Bitcoin short position is a significant event that signals a shift in market sentiment. As the bears capitulate and bullish sentiment grows, the potential for Bitcoin to reach new heights becomes increasingly plausible.

If you’re involved in the crypto space, stay vigilant, keep learning, and don’t be afraid to adapt your strategies as the market evolves. Whether you’re a long-term investor or a short-term trader, understanding the dynamics at play can help you navigate the thrilling—and often unpredictable—world of Bitcoin trading.

In the end, the cryptocurrency market is full of surprises, and being informed is your best weapon in this exciting journey. So, keep an eye on those trends, stay engaged with the community, and who knows? You might just ride the next wave to success.