James Wynn Raises Short Position on Bitcoin: An Analysis

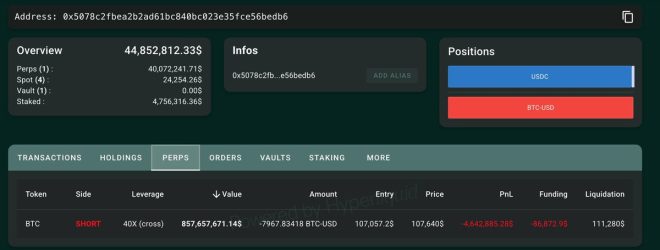

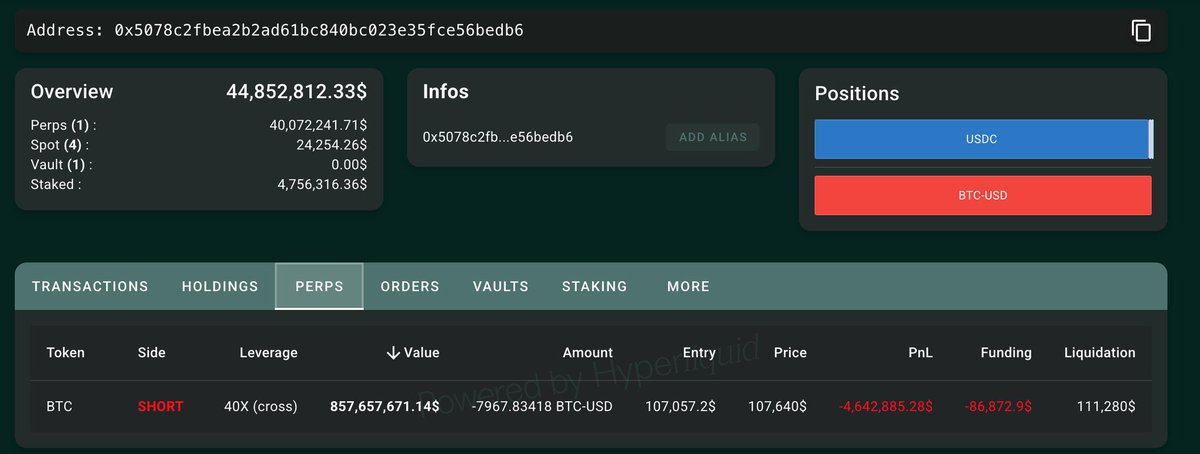

In a significant move in the cryptocurrency market, James Wynn has increased his short position on Bitcoin (BTC) to a staggering 7,967.83 BTC, which is valued at approximately $856 million at the time of this report. This development was shared by Whale Insider via Twitter on May 25, 2025, and has garnered considerable attention in the financial community. The liquidation price for this position has been set at $111,280, indicating a strategic approach to capitalizing on anticipated market movements.

Understanding Short Positions in Cryptocurrency

To comprehend the implications of Wynn’s actions, it is essential to understand what a short position entails. A short position is a trading strategy that speculates on the decline in the price of an asset. When an investor shorts Bitcoin, they are essentially betting that its price will drop below the level at which they sold it, allowing them to buy it back at a lower price for a profit.

In this case, by increasing his short position, Wynn is signaling his belief that Bitcoin’s price is likely to decline from its current level of around $107,057. The liquidation price of $111,280 is crucial for traders, as it represents the price point at which Wynn’s position would be automatically closed to prevent further losses.

The Market Context

As of May 2025, Bitcoin has experienced significant volatility, a hallmark of the cryptocurrency market. Traders and investors are continually assessing various factors, including regulatory changes, macroeconomic conditions, and technological advancements, that could influence Bitcoin’s price. Wynn’s decision to short Bitcoin could be influenced by a variety of these factors, including bearish market sentiment, potential regulatory scrutiny, or technical analysis predicting a downward trend.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Whale Activity and Market Sentiment

Wynn’s increased short position underscores the activities of "whales" in the cryptocurrency market. Whales are individuals or entities that hold large quantities of cryptocurrency and can significantly impact market prices through their trading decisions. The actions of whales often serve as indicators of market sentiment, with their movements closely monitored by traders and analysts.

When a whale like Wynn increases a short position, it can create a ripple effect throughout the market. Other traders may interpret this as a bearish signal, leading to increased selling pressure. Conversely, if the market moves contrary to expectations and Bitcoin’s price rises significantly above the liquidation price, it could lead to a short squeeze, where short sellers are forced to buy back their positions at a loss, potentially driving the price even higher.

Implications for Retail Investors

For retail investors, Wynn’s action can serve as both a warning and an opportunity. Those who are not familiar with short selling might view it as a risky strategy, especially in a market known for its unpredictability. However, understanding the motivations behind such large trades can provide valuable insights into market trends.

Investors should exercise caution and conduct thorough research before making trading decisions, especially in response to high-profile trades like Wynn’s. It is essential to use appropriate risk management techniques and not to follow trends blindly based on whale activity.

The Broader Impact on the Cryptocurrency Ecosystem

Wynn’s increased short position also highlights the ongoing evolution of the cryptocurrency ecosystem. As institutional investors become more active in the market, their strategies and trading patterns can lead to increased market sophistication. This may result in more robust trading tools and platforms that allow both institutional and retail investors to navigate the complexities of cryptocurrency trading.

Moreover, a growing acceptance of short selling in the cryptocurrency space can lead to more balanced market dynamics. By enabling investors to profit from both rising and falling markets, short selling contributes to price discovery and market efficiency.

Conclusion: What Lies Ahead for Bitcoin?

As Bitcoin continues to fluctuate in price, traders and investors will undoubtedly keep a close eye on developments related to James Wynn’s short position and other similar trades within the market. The potential implications for both Bitcoin and the broader cryptocurrency ecosystem are significant.

Wynn’s actions reflect a strategic approach to navigating the complexities of cryptocurrency trading and could serve as a bellwether for future market movements. Investors should remain vigilant, utilizing informed strategies and comprehensive analysis to navigate the ever-changing landscape of cryptocurrency.

In summary, James Wynn’s decision to increase his short position on Bitcoin to 7,967.83 BTC highlights the strategic maneuvers of major players in the cryptocurrency market. This move, coupled with the established liquidation price, serves as a critical point of reference for traders and investors alike. As the market evolves, the insights gleaned from such high-profile trading strategies will be invaluable for understanding the future trajectory of Bitcoin and the broader cryptocurrency market.

JUST IN: James Wynn increases short position on BTC to 7,967.83 BTC ($856 million) at $107,057; liquidation price set at $111,280. pic.twitter.com/ljX0yeGHHv

— Whale Insider (@WhaleInsider) May 25, 2025

JUST IN: James Wynn increases short position on BTC to 7,967.83 BTC ($856 million) at $107,057; liquidation price set at $111,280.

In the ever-fluctuating world of cryptocurrency, news travels fast, and when big players make significant moves, it sends ripples throughout the market. Recently, James Wynn made headlines by increasing his short position on Bitcoin (BTC) to a staggering 7,967.83 BTC, valued at approximately $856 million, with an entry price of $107,057 and a liquidation price set at $111,280. This bold move is not just another trading strategy; it speaks volumes about market sentiment and the potential volatility of Bitcoin. So, what does this mean for investors and traders alike? Let’s dive into this fascinating development.

Understanding Short Positions in Cryptocurrency

To grasp the implications of Wynn’s actions, we first need to understand what a short position is. In simple terms, a short position is a trading strategy where an investor borrows an asset—in this case, Bitcoin—and sells it at the current market price, hoping to buy it back later at a lower price. If successful, the trader profits from the difference. However, if the price rises instead, the losses can be significant. This strategy is often employed when a trader believes that the price of an asset will decline in the near future.

Wynn’s decision to increase his short position indicates that he anticipates a downturn in Bitcoin’s price. With such a sizable bet against BTC, it’s crucial to analyze the market factors influencing his decision and what this could mean for other traders.

The Current Bitcoin Landscape

Bitcoin has had its fair share of ups and downs. Recently, the cryptocurrency market has been marked by increased volatility, influenced by various factors, including regulatory changes, macroeconomic conditions, and market sentiment. As of now, Bitcoin is hovering around the $107,000 mark, a point that has seen both bullish and bearish sentiments from investors.

Wynn’s short position increase comes at a time when many analysts are debating the sustainability of the current Bitcoin price. Some believe that Bitcoin could reach new highs, while others fear a potential correction. This conflicting sentiment creates an intriguing backdrop for Wynn’s significant short position.

What Does the $856 Million Bet Mean for Traders?

For many traders, Wynn’s hefty short position serves as a warning. A liquidation price set at $111,280 indicates that if Bitcoin’s price climbs above this threshold, Wynn could face substantial losses. This high-stakes gamble places pressure not only on Wynn but also on the broader market. If Bitcoin approaches or surpasses this liquidation price, it could trigger a wave of selling as other traders react to the shift in sentiment.

Moreover, Wynn’s actions might inspire other traders to consider their positions carefully. If they see a prominent figure like Wynn betting against Bitcoin, it could instill doubt and lead to a shift in trading strategies across the board.

The Role of Market Sentiment

Market sentiment plays a vital role in the cryptocurrency space. Traders are often influenced by the actions of whales—large investors like James Wynn, whose movements can sway the market. When a well-known investor increases a short position significantly, it can lead to fear among other investors, prompting them to reassess their own strategies.

For instance, if many traders start selling their Bitcoin holdings out of fear of a price drop, it could lead to a self-fulfilling prophecy, causing the price to dip further. This is why it’s essential for traders to keep an eye on the moves made by influential figures in the industry.

Potential Outcomes of Wynn’s Position

So, what are the possible outcomes of Wynn’s short position? If Bitcoin’s price does decline, Wynn stands to gain significantly from his $856 million bet. This outcome could bolster confidence among other short sellers, potentially leading to a wave of similar positions as traders rush to capitalize on the downward trend.

On the flip side, if Bitcoin rises above the liquidation price, Wynn could face a substantial loss. This scenario could trigger a cascade of liquidation events, where other traders who have shorted Bitcoin might also be forced to close their positions, further driving up the price. This phenomenon is known as a short squeeze and can lead to rapid price increases as traders rush to buy back their positions.

What Should Investors Do?

For investors and traders watching this situation unfold, it’s essential to approach the market with caution. While Wynn’s actions provide insight into one trader’s perspective, they should not dictate your investment strategy. Here are a few tips to consider:

1. **Conduct Your Research**: Always do your due diligence before making any trading decisions. Analyze market trends, news, and the overall sentiment surrounding Bitcoin.

2. **Diversify Your Portfolio**: Don’t put all your eggs in one basket. Consider diversifying your investments across different cryptocurrencies or asset classes to mitigate risks.

3. **Stay Updated**: The cryptocurrency market is incredibly dynamic. Keep an eye on news and developments that could impact Bitcoin’s price.

4. **Have an Exit Strategy**: Whether you’re going long or short, always have a clear exit strategy in place. This will help you minimize potential losses and maximize gains.

The Future of Bitcoin and Short Selling

As the cryptocurrency market continues to evolve, the practice of short selling will likely remain a contentious topic. With significant figures like James Wynn making bold moves, it raises questions about market manipulation and the ethical implications of such strategies.

However, short selling also reflects the market’s inherent nature—its volatility and unpredictability. For many traders, it’s a necessary tool that can help balance their portfolios and protect against declines in asset prices.

In the end, whether you’re a seasoned trader or a newcomer to the crypto space, staying informed and adaptable is crucial. The cryptocurrency market can change on a dime, and understanding the motivations behind significant trades, like Wynn’s increased short position, is key to navigating this exciting yet volatile landscape.

Final Thoughts

James Wynn’s recent increase in his short position on Bitcoin is a noteworthy event in the cryptocurrency world. With a position worth $856 million and a liquidation price set at $111,280, it’s clear that Wynn is betting on a price decline. This move not only highlights the ongoing volatility in the Bitcoin market but also serves as a reminder of the importance of being vigilant and well-informed as a trader.

As the market continues to fluctuate, keeping an eye on influential traders and understanding their strategies can provide valuable insights into potential market movements. Remember, in the fast-paced world of cryptocurrency, knowledge is power. Stay informed, stay strategic, and most importantly, enjoy the ride!