Bitcoin Market Update: James Wynn’s $1 Billion Short Position Closed

In a dramatic turn of events within the cryptocurrency market, renowned trader James Wynn has reportedly closed his $1 billion short position on Bitcoin, marking a significant moment for investors and traders alike. This move comes amid indications that the bearish sentiment in the market is beginning to wane, leading many to speculate about a potential bullish reversal.

Understanding the Short Position

A short position is a trading strategy that involves selling assets not currently owned, with the intention of repurchasing them later at a lower price. Traders like Wynn engage in short selling to capitalize on market declines. However, closing a significant short position at a loss can signal a shift in market sentiment. In Wynn’s case, the closure of his short position indicates that he may be anticipating a bullish trend for Bitcoin.

The Current state of Bitcoin

As of late May 2025, Bitcoin has been experiencing considerable volatility. After hitting all-time highs in previous months, the cryptocurrency market has faced downward pressure, with many traders adopting bearish strategies. Wynn’s decision to close his short position suggests that he believes the bearish trend may be nearing its end, leading to increased optimism among other traders and investors.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions

The news of Wynn’s position closure has sent ripples through the cryptocurrency community, with many interpreting it as a sign of bullish sentiment returning to the market. Social media platforms like Twitter have been abuzz with discussions surrounding this development, with hashtags like "Bitcoin" trending as traders share their insights and predictions.

The Impact of Bearish Sentiment

Bearish sentiment has been prevalent in the cryptocurrency market, with many investors adopting a wait-and-see approach. The prolonged period of declining prices has led to capitulation among many traders, who may be unwilling to hold on to their positions in the face of continued losses. Wynn’s decision to close his short position could be seen as a pivotal moment, potentially encouraging other traders to reconsider their strategies.

Bullish Indicators

Several factors could contribute to a shift towards bullish sentiment in the Bitcoin market:

- Increased Institutional Investment: As more institutional investors enter the cryptocurrency space, the demand for Bitcoin may increase, driving prices higher.

- Technological Advancements: Innovations within the blockchain and cryptocurrency sectors can enhance Bitcoin’s value proposition, attracting more investors.

- Market Recovery Trends: Historical data shows that after prolonged bearish trends, markets often recover, presenting buying opportunities for savvy investors.

Future Outlook

While it’s impossible to predict market movements with certainty, Wynn’s closure of his short position may be an early indicator of a broader market shift. Traders and investors should remain vigilant, monitoring market trends and sentiment as they evolve.

Conclusion

James Wynn’s recent decision to close his $1 billion Bitcoin short position marks a notable moment in the cryptocurrency market, potentially signaling a shift from bearish to bullish sentiment. As the market reacts to this development, traders are encouraged to reassess their strategies and remain informed about the factors influencing Bitcoin’s price movements. With increasing institutional interest and potential technological advancements on the horizon, the future of Bitcoin could be poised for an upward trajectory.

For those looking to stay updated on Bitcoin and the cryptocurrency market, following market experts and staying engaged with the latest news is essential. The landscape of cryptocurrency is ever-changing, and understanding these shifts can help traders make informed decisions.

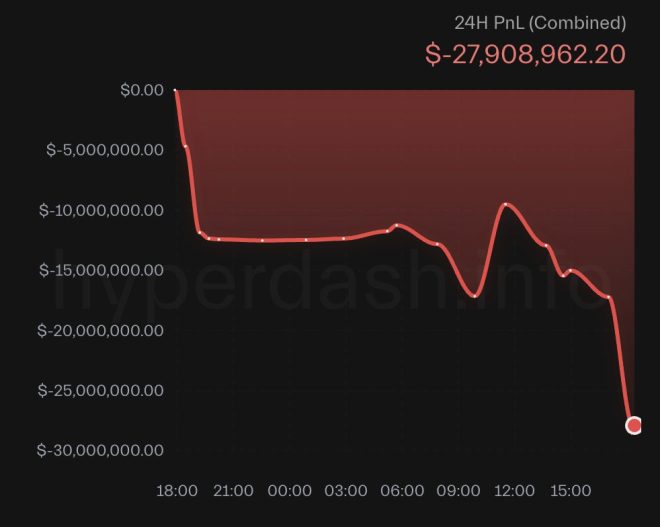

BREAKING: TRADER JAMES WYNN JUST CLOSED HIS $1 BILLION #BITCOIN SHORT AT A MASSIVE LOSS

THE BEARS ARE CAPITULATING. BULLISH pic.twitter.com/Z2OHsYzuBZ

— The Bitcoin Historian (@pete_rizzo_) May 25, 2025

BREAKING: TRADER JAMES WYNN JUST CLOSED HIS $1 BILLION #BITCOIN SHORT AT A MASSIVE LOSS

In the ever-fluctuating world of cryptocurrency, news travels fast, and yesterday was no different. Trader James Wynn made headlines when he decided to close a staggering $1 billion Bitcoin short position at what many are calling a massive loss. What does this mean for the crypto market? Is it a sign that the bears are capitulating, making way for a bullish trend? Let’s dive deep into this recent development and explore its implications for Bitcoin and the broader cryptocurrency landscape.

Understanding the Bitcoin Market Dynamics

Before we jump into the ramifications of Wynn’s high-stakes move, it’s crucial to understand the dynamics of the Bitcoin market. Bitcoin, the original cryptocurrency, has been known for its volatility. Traders often engage in short selling, betting that the price will decrease. However, as history has shown, predicting Bitcoin’s price movements can be as tricky as navigating a maze blindfolded.

In Wynn’s case, closing a billion-dollar short position suggests a significant shift in his market outlook. If you’re not familiar with short selling, it involves borrowing an asset and selling it with the intention of buying it back at a lower price. If the price goes up instead of down, the trader faces losses. Wynn’s decision to close his position hints that he might expect Bitcoin’s price to climb.

What Does This Mean for Bitcoin Investors?

The closing of a major short position by a trader like Wynn can be interpreted in several ways. First, it signals a potential shift in market sentiment. When a significant player like Wynn capitulates, it often reflects broader trends among traders. Many may start to question their bearish positions, which could lead to a short squeeze, driving prices even higher.

For investors, this might be viewed as an opportunity. If the bears are indeed capitulating, it could indicate that a bullish trend is on the horizon. Historically, when traders exit their short positions en masse, it often contributes to upward momentum in Bitcoin’s price.

Analyzing the Current Market Sentiment

The cryptocurrency market is heavily influenced by sentiment, driven by news, social media, and macroeconomic factors. Wynn’s decision has sparked discussions across platforms, with many traders and analysts weighing in on the implications. The phrase “THE BEARS ARE CAPITULATING” has become a rallying cry for those optimistic about Bitcoin’s future.

Moreover, social media platforms like Twitter have become hotspots for real-time discussions about market trends. For instance, the announcement by the Bitcoin Historian on Twitter has attracted significant attention. The crypto community is buzzing with speculation about what this means for Bitcoin’s trajectory.

Impacts on Bitcoin Price Trends

So, how exactly could Wynn’s move affect Bitcoin’s price? If more traders begin to close their short positions, we could see a rapid increase in demand for Bitcoin, leading to price surges. The psychology of trading plays a crucial role here; as prices start to climb, more traders may jump on the bandwagon, further propelling Bitcoin’s price upward.

Additionally, it’s essential to consider external factors that could influence Bitcoin’s price. Regulatory news, technological advancements, and macroeconomic trends can all have significant effects on the market. If Bitcoin continues to gain traction as a hedge against inflation and economic uncertainty, it could bolster the bullish sentiment even further.

Long-Term Prospects for Bitcoin

While the current news is exciting, it’s also important to take a step back and look at the long-term prospects for Bitcoin. The cryptocurrency market is still relatively young and evolving. Price fluctuations are a part of the game, and while short-term trends can be enticing, long-term investors should focus on fundamental analysis.

Bitcoin has garnered a reputation as “digital gold,” attracting institutional investors and mainstream adoption. As more companies and individuals recognize its value, the demand for Bitcoin could continue to rise, creating a robust foundation for future growth.

What Should Traders Consider Moving Forward?

For traders, this news serves as a reminder of the importance of staying informed and adaptable. The cryptocurrency market is notoriously unpredictable, and being able to pivot based on new information is crucial. Here are a few considerations for traders:

1. **Stay Updated**: Follow reliable sources and market analysts to keep abreast of developments.

2. **Manage Risk**: Ensure you have a solid risk management strategy in place. This will help you navigate the volatility of crypto trading.

3. **Diversify**: While Bitcoin is a leading cryptocurrency, consider diversifying your portfolio to mitigate risks associated with individual asset movements.

Community Reactions and Market Predictions

As news of Wynn’s $1 billion Bitcoin short position closure spreads, community reactions have been mixed yet predominantly optimistic. Many traders are discussing potential price targets, with some predicting a significant rally if the momentum continues.

Market analysts are also weighing in, suggesting that the technical indicators may be trending bullish. If Bitcoin breaks through key resistance levels, we could see a surge in buying activity, further validating the bullish sentiment sparked by Wynn’s decision.

Conclusion: The Shift Towards Bullish Sentiment

Wynn’s recent move to close his Bitcoin short position at a massive loss has undoubtedly shifted the narrative within the cryptocurrency community. As the bears seem to be capitulating, many are feeling bullish about Bitcoin’s future. The combination of market sentiment, potential upward price movements, and long-term adoption trends will play significant roles in shaping the next phase of Bitcoin’s journey.

Whether you’re a seasoned trader or a newcomer to the crypto space, keeping a close eye on these developments can help you navigate the challenges and opportunities in this ever-evolving landscape. With the right strategies and an informed approach, you can position yourself to take advantage of the bullish trends that may lie ahead.

As Bitcoin continues to capture the attention of investors worldwide, the excitement and speculation surrounding its potential are only expected to grow. So, buckle up; it’s going to be an exhilarating ride!

BREAKING: TRADER JAMES WYNN JUST CLOSED HIS $1 BILLION #BITCOIN SHORT AT A MASSIVE LOSS

THE BEARS ARE CAPITULATING. BULLISH