James Wynn’s Strategic Short Position on Bitcoin

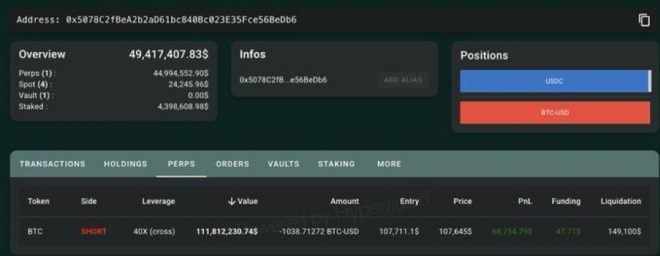

In a significant move within the cryptocurrency market, James Wynn has recently opened a short position valued at $111.8 million on 1,038.7 BTC, with an entry price of $107,711.10. This strategic decision has generated considerable attention among traders and investors, especially given the current volatility of Bitcoin and the broader digital assets landscape. The liquidation price for this short position has been set at $149,100, indicating Wynn’s risk management strategy in navigating the unpredictable market.

Understanding Short Positions in Cryptocurrency

A short position is a trading strategy that allows investors to profit from the decline in the price of an asset. Essentially, when an investor believes that the price of an asset, such as Bitcoin, will fall, they can borrow the asset and sell it at the current market price. If the price does indeed decrease, they can buy back the asset at the lower price, return it to the lender, and pocket the difference. This strategy can be particularly lucrative in the volatile world of cryptocurrencies, where price swings are frequent and often extreme.

Wynn’s $111.8 million short position indicates a strong belief that Bitcoin’s price will experience downward pressure in the near term. The liquidation price of $149,100 serves as a critical threshold; if Bitcoin’s price exceeds this level, Wynn’s position would be liquidated, resulting in a loss.

The Current state of Bitcoin

Bitcoin has been a focal point in discussions about digital currencies, fluctuating significantly over the years. As of late May 2025, Bitcoin’s price trends suggest an environment ripe for speculation. Factors influencing Bitcoin’s price include regulatory developments, market sentiment, macroeconomic conditions, and technological advancements within the blockchain space. Traders like Wynn closely monitor these factors to inform their investment strategies.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Market Reactions and Implications

The announcement of Wynn’s short position has sparked reactions across various trading platforms and social media channels. Traders often look to high-profile investors as indicators of market sentiment, and Wynn’s substantial bet against Bitcoin could signal broader bearish trends. This could lead to increased selling pressure from other investors and potentially accelerate a decline in Bitcoin’s price.

Moreover, Wynn’s action may encourage other traders to consider their positions. If they share his bearish outlook, they might also initiate short positions, further impacting the market dynamics. Conversely, if Bitcoin’s price stabilizes or begins to rise, Wynn could face significant financial repercussions due to the high stakes of his short position.

Risk Management in Cryptocurrency Trading

Wynn’s strategy highlights the importance of risk management in trading, particularly in the cryptocurrency market where volatility is a given. Setting a liquidation price is a common practice among traders to limit potential losses. By establishing a clear exit point, traders can protect their capital and make informed decisions based on market movements.

Investors should also be aware of the inherent risks associated with trading cryptocurrencies. Factors such as regulatory changes, technological vulnerabilities, and market manipulation can drastically affect prices. As such, traders need to stay updated with market trends and news to make informed decisions.

The Role of Social Media in Trading Decisions

The announcement of Wynn’s short position was made via Twitter, demonstrating the growing influence of social media in the trading community. Platforms like Twitter, Reddit, and specialized forums have become essential tools for traders to share insights, strategies, and market news. These platforms enable traders to react swiftly to market developments and adjust their positions accordingly.

Investors should exercise caution when interpreting information from social media, as not all insights are grounded in thorough analysis. However, high-profile trades like Wynn’s can influence market sentiment and lead to broader discussions regarding price expectations.

Future Outlook for Bitcoin

As Wynn’s short position unfolds, the future of Bitcoin remains uncertain. Market analysts will closely watch price movements to determine if Wynn’s prediction holds merit. If Bitcoin’s price continues to rise, it may challenge the validity of short positions and lead to significant losses for traders like Wynn.

On the other hand, if macroeconomic factors, regulatory pressures, or shifts in investor sentiment contribute to a decline in Bitcoin’s price, Wynn’s strategy may prove to be astute. The outcome of this high-stakes bet will undoubtedly be a point of discussion in the cryptocurrency community for months to come.

Conclusion

James Wynn’s decision to open a $111.8 million short position on Bitcoin underscores the dynamic and speculative nature of cryptocurrency trading. With a liquidation price set at $149,100, the implications of his trade will resonate throughout the market, influencing both trader behavior and market sentiment. As the cryptocurrency landscape continues to evolve, investors and traders alike must remain vigilant, informed, and prepared to adapt to the ever-changing conditions that define this digital frontier.

In summary, Wynn’s short position serves as a reminder of the complexities involved in cryptocurrency trading and the critical importance of risk management. As Bitcoin navigates its path forward, the interplay between bullish and bearish sentiments will shape the discussions and strategies of traders worldwide. Whether Wynn’s bet pays off or not, it highlights the ongoing volatility and excitement that characterizes the world of digital currencies.

The cryptocurrency market is a continuously evolving environment, making timely information, prudent risk management, and informed trading decisions essential for success. As more investors enter this space, understanding the implications of high-stakes trades like Wynn’s will be crucial in navigating the tumultuous waters of cryptocurrency investing.

JUST IN: James Wynn opens $111.8 million short position on 1,038.7 BTC at $107,711.10; liquidation price set at $149,100. pic.twitter.com/MFJraXJTLS

— Whale Insider (@WhaleInsider) May 25, 2025

JUST IN: James Wynn Opens $111.8 Million Short Position on 1,038.7 BTC at $107,711.10; Liquidation Price Set at $149,100

When it comes to the world of cryptocurrency trading, news travels fast, and the latest buzz revolves around a significant move by James Wynn, a prominent trader in the crypto space. Recently, Wynn opened a short position valued at a staggering $111.8 million, encompassing 1,038.7 BTC (Bitcoin) at a price of $107,711.10 per Bitcoin. The liquidation price for this position is set at $149,100. This bold maneuver has raised eyebrows and sparked discussions among traders and investors alike.

But what exactly does this mean, and why should you care? Let’s dive into the details of this monumental trade and explore its implications for the market.

Understanding Short Positions in Cryptocurrency

At its core, a short position is a strategy used by traders to profit from the decline in the price of an asset. In simple terms, when you short Bitcoin, you’re betting that its price will go down. If Wynn’s prediction holds true, he stands to make a considerable profit. The idea behind shorting is that you borrow the asset (in this case, Bitcoin), sell it at the current market price, and then aim to buy it back at a lower price, pocketing the difference.

The crypto market is notoriously volatile, and traders like James Wynn often take calculated risks. However, shorting can be a double-edged sword; if the price rises instead of falling, the losses can be significant, especially with such a high stake involved.

The Significance of the $111.8 Million Position

Wynn’s decision to open a $111.8 million short position is not something you see every day. This level of investment signifies a strong belief in market trends. Given that 1,038.7 BTC is a substantial amount, the implications of this move could be far-reaching. It reflects not only Wynn’s confidence but also serves as a bellwether for other traders.

When big players like Wynn take such positions, it can influence market sentiment. Other traders might follow suit or adjust their strategies based on his actions. This creates a ripple effect in the market, leading to increased volatility, which traders often thrive on.

What the Liquidation Price Means

Wynn’s liquidation price is set at $149,100, which is critical in understanding the risk involved in his trade. The liquidation price is the point at which the broker will close his position to prevent further losses. If Bitcoin’s price rises to this level, Wynn’s position would be liquidated, meaning he would incur significant losses.

This liquidation price highlights the inherent risks associated with trading cryptocurrencies. Traders need to carefully consider their entry and exit points, especially in a market that can swing wildly in a matter of hours.

Market Reactions and Predictions

As news of Wynn’s short position spreads, market reactions are bound to follow. Traders and analysts will be keenly watching Bitcoin’s price movements, especially as it approaches the liquidation threshold. If Bitcoin’s price starts to trend downward, Wynn could see significant gains, while a rise toward the liquidation price could trigger panic among other traders.

Market predictions are tricky, especially in the crypto realm. Some experts believe that this move could indicate an impending dip in Bitcoin’s price, while others argue that it could lead to a temporary surge as traders react to Wynn’s bold strategy.

Why Traders Should Pay Attention

For anyone involved in cryptocurrency trading, keeping an eye on significant players like James Wynn is crucial. Following their moves can provide valuable insights into market trends and potential shifts. It’s essential to analyze the reasons behind such trades and consider how they align with broader market trends.

Moreover, understanding the mechanics of short positions can enhance your trading strategy. Whether you’re a seasoned trader or new to the game, grasping the nuances of shorting can help you make more informed decisions.

Conclusion: The Ongoing Dance of Crypto Trading

In the fast-paced world of cryptocurrency, moves like those made by James Wynn can set the stage for dramatic market shifts. His $111.8 million short position on 1,038.7 BTC at $107,711.10, with a liquidation price of $149,100, highlights both the potential for profit and the risks involved in trading.

As the crypto landscape continues to evolve, staying informed and adaptable will be key for traders looking to navigate these turbulent waters. Keep an eye on Bitcoin’s price movements and consider how Wynn’s position might influence your own trading strategies.

In the end, the world of cryptocurrency trading is an exhilarating mix of risk and reward, and every new development adds another layer to this complex and fascinating market.