Bitcoin User Growth: A 1999 Internet Comparison

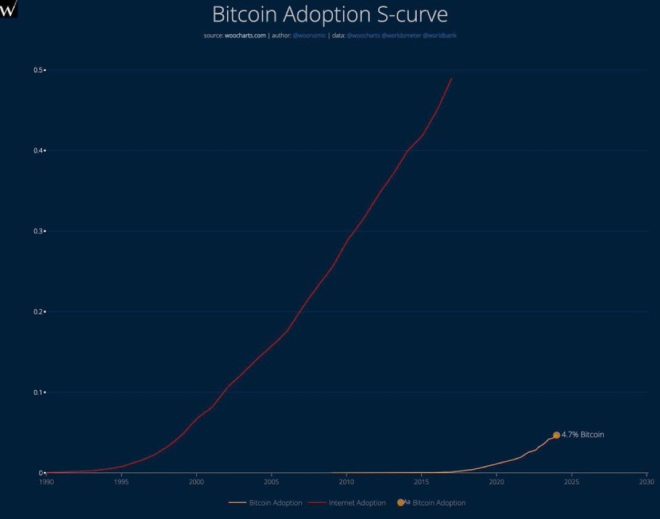

In a groundbreaking announcement made on May 25, 2025, Crypto Beast, a prominent figure in the cryptocurrency space, highlighted a striking comparison between Bitcoin and the early days of the Internet. According to the tweet, Bitcoin has reached a user base comparable to that of the Internet in 1999, a period that marked a pivotal moment in the digital revolution. This comparison raises important questions about the future of Bitcoin and its potential to become a mainstream financial instrument.

Understanding the Significance of User Growth

The claim that Bitcoin has the same number of users as the Internet did in 1999 underscores the rapid adoption of this cryptocurrency. In 1999, the Internet was still in its infancy, with approximately 248 million users worldwide. This was just before the dot-com boom, which saw an explosion in Internet usage and the birth of many now-famous online platforms. The fact that Bitcoin has achieved similar user numbers indicates a significant milestone in its journey toward becoming a widely accepted form of currency.

The Journey of Bitcoin

Bitcoin was introduced in 2009 by an anonymous individual or group known as Satoshi Nakamoto. Initially met with skepticism and limited use, Bitcoin has evolved into a major player in the financial landscape. The cryptocurrency’s decentralized nature, security features, and potential for financial inclusion have contributed to its growing popularity. As more individuals and institutions recognize the value of Bitcoin, its user base has surged, paralleling the Internet’s trajectory in the late ’90s.

Factors Driving Bitcoin Adoption

Several key factors contribute to the rising adoption of Bitcoin and its comparison to the Internet’s early user growth:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Increased Awareness: As media coverage of Bitcoin and cryptocurrencies has increased, more people are becoming aware of their potential. Educational resources, social media, and community engagement have played significant roles in demystifying Bitcoin.

- Institutional Interest: Major financial institutions have begun to invest in Bitcoin, further legitimizing it as a credible asset class. Companies like Tesla and MicroStrategy have made significant investments in Bitcoin, influencing others to follow suit.

- Technological Advancements: The development of user-friendly wallets and exchanges has made it easier for individuals to buy, sell, and store Bitcoin. Innovations such as the Lightning Network have improved transaction speed and reduced costs, enhancing the overall user experience.

- Global Economic Factors: Economic instability, inflation, and the desire for alternative investment options have driven many to explore cryptocurrencies. Bitcoin is often viewed as a hedge against inflation, attracting users seeking financial security.

A Look Back at 1999: The Internet Boom

In 1999, the Internet was characterized by the emergence of various online services, including e-commerce, social networking, and search engines. Companies like Amazon and eBay were just beginning to make their mark, setting the stage for the digital economy. During this time, the Internet’s user base grew rapidly, driven by increasing accessibility and the proliferation of personal computers.

As Bitcoin mirrors this growth trajectory, it is crucial to consider the implications for its future. The Internet transformed industries, created new business models, and revolutionized communication. Similarly, Bitcoin has the potential to disrupt traditional finance, banking, and even the way we conduct transactions.

Future Implications for Bitcoin

The comparison of Bitcoin’s user base to that of the Internet in 1999 raises important questions about what lies ahead for this cryptocurrency:

- Mainstream Adoption: If Bitcoin continues to grow at its current pace, we may soon see it integrated into everyday transactions, similar to how credit cards and digital payment systems have become ubiquitous.

- Regulatory Landscape: As the user base expands, governments and regulatory bodies will likely take a closer look at Bitcoin. This could lead to clearer regulations that may enhance user confidence and adoption.

- Technological Innovations: Just as the Internet evolved with new technologies, Bitcoin and the broader cryptocurrency ecosystem are likely to see continued innovation. Solutions that enhance scalability, privacy, and interoperability may drive further adoption.

- Investment Opportunities: As more users join the Bitcoin network, the potential for investment opportunities will increase. This could attract both retail and institutional investors seeking to capitalize on Bitcoin’s growth.

Conclusion

The comparison of Bitcoin’s user base to that of the Internet in 1999 serves as a powerful reminder of the cryptocurrency’s rapid growth and potential impact on the financial landscape. With increasing awareness, institutional interest, and technological advancements, Bitcoin is well-positioned for continued adoption. As we reflect on the lessons learned from the early days of the Internet, it is clear that Bitcoin may very well be on the cusp of a transformative journey that could redefine how we view money and finance in the years to come.

In summary, as Bitcoin approaches the same user milestones as the Internet did in 1999, its trajectory will be closely watched by investors, analysts, and enthusiasts alike. The future holds exciting possibilities for Bitcoin, and its evolution may parallel that of the Internet in ways we are just beginning to understand.

BREAKING

Bitcoin has the same number of users the Internet had in 1999. pic.twitter.com/QTY82oAsDn

— Crypto Beast (@cryptobeastreal) May 25, 2025

BREAKING

Bitcoin has taken the world by storm, and a recent tweet from Crypto Beast highlights a striking fact: Bitcoin has the same number of users the Internet had in 1999. This comparison sheds light on the rapid growth and adoption of cryptocurrency in our modern digital landscape. But what does this mean for the future of Bitcoin and other cryptocurrencies? Let’s dive into it!

Bitcoin: A Brief Overview

To understand the significance of Bitcoin’s user base, we first need to grasp what Bitcoin actually is. Launched in 2009 by an anonymous entity known as Satoshi Nakamoto, Bitcoin is a decentralized digital currency that operates without a central authority or bank. Transactions are verified by network nodes through cryptography and recorded on a public ledger called the blockchain. This innovative approach has revolutionized how we think about money and transactions, allowing for peer-to-peer transfers that bypass traditional financial institutions.

The Comparison to Internet Users in 1999

Now, why is the comparison to the Internet in 1999 so compelling? Back in 1999, the Internet was just beginning to gain traction. Major players like Google and eBay were emerging, and millions of users were starting to explore the possibilities of online communication and commerce. Fast forward to today, and we see a similar trend with Bitcoin. According to estimates, Bitcoin has reached a user base of around 200 million, mirroring the Internet’s growth trajectory. This parallel raises questions about the potential future of Bitcoin and how it might evolve.

The Growth of Bitcoin Users

So, what does this rapid growth indicate? Bitcoin’s rising user base suggests that more people are becoming aware of and interested in cryptocurrencies. As traditional financial systems face challenges, individuals are looking for alternatives, and Bitcoin is often the first option they explore. The ease of access, combined with the allure of decentralization and potential for high returns, draws users in.

Why Are People Choosing Bitcoin?

There are several reasons why people are flocking to Bitcoin:

- Decentralization: Bitcoin operates on a decentralized network, meaning no single entity controls it. This appeals to those who value independence from government and bank control.

- Potential for High Returns: Early adopters of Bitcoin have seen substantial returns on their investments, enticing new users to join the space.

- Global Accessibility: Unlike traditional banking systems, Bitcoin can be accessed from anywhere in the world with an internet connection, making it a viable option for those without access to traditional banking.

- Inflation Hedge: In times of economic uncertainty, many view Bitcoin as a hedge against inflation, similar to gold.

The Challenges Ahead for Bitcoin

Despite its impressive growth, Bitcoin faces several challenges. Regulatory scrutiny is increasing worldwide as governments seek to establish frameworks for cryptocurrencies. Additionally, the environmental impact of Bitcoin mining has come under fire, with critics pointing to the carbon footprint associated with the process.

Moreover, the volatility of Bitcoin’s price can deter some potential users. While the potential for high returns is enticing, the risk of losing money can be a significant barrier for newcomers. It’s essential for anyone considering an investment in Bitcoin to conduct thorough research and understand the risks involved.

The Future of Bitcoin Adoption

The fact that Bitcoin has matched the Internet’s user base in 1999 is an exciting milestone, but it also begs the question: what’s next? As technology continues to evolve, we may see further integration of Bitcoin into everyday transactions. Major companies are beginning to accept Bitcoin as a form of payment, and financial institutions are starting to offer cryptocurrency services.

Additionally, as more people become educated about blockchain technology and its applications, we could see an increase in Bitcoin’s legitimacy and acceptance. Educational initiatives and user-friendly platforms will play a crucial role in driving adoption.

Bitcoin vs. Other Cryptocurrencies

While Bitcoin is the leading cryptocurrency, it’s essential to recognize the growing presence of other digital currencies, often referred to as altcoins. Ethereum, for example, has gained significant traction due to its smart contract functionality, which allows developers to create decentralized applications (dApps) on its platform.

As the cryptocurrency market matures, users may diversify their portfolios by exploring altcoins, leading to a more competitive landscape. However, Bitcoin remains the flagship cryptocurrency and often sets the tone for the market as a whole.

The Importance of Community and Education

As we look to the future, fostering a strong community and providing education about Bitcoin and cryptocurrencies will be vital. Initiatives that promote understanding can dismantle misconceptions and encourage more users to join the movement. Online forums, educational platforms, and social media groups can facilitate discussions and share valuable insights.

Moreover, as Bitcoin continues to gain traction, it’s essential for the community to advocate for responsible usage and ethical practices. Promoting transparency and accountability will help build trust among users and attract newcomers.

Conclusion: The Road Ahead for Bitcoin

Bitcoin’s user base mirroring that of the Internet in 1999 is a significant indicator of its growth potential and the increasing interest in cryptocurrencies. As we navigate this digital landscape, it’s crucial to stay informed and engaged. Whether you’re a seasoned investor or just starting, understanding the implications of Bitcoin’s rise will empower you to make informed decisions in this evolving market.

So, as we watch Bitcoin continue its journey, let’s embrace the opportunities and challenges it presents. Who knows what the future holds for this revolutionary digital currency?

“`

Bitcoin has the same number of users the Internet had in 1999.