Bitcoin Whales: A Deep Dive into Recent Market Movements

In the world of cryptocurrency, the actions of large holders, commonly referred to as "whales," can significantly impact market trends and investor sentiment. One such recent event has drawn the attention of the crypto community: a whale who had taken a massive long position on Bitcoin has closed this position, incurring a staggering loss of $13.4 million. This article aims to explore the implications of this action, how it fits into broader market trends, and what it means for both investors and the future of Bitcoin.

The Whale’s Position and Market Impact

The term "whale" typically refers to individuals or entities that hold a significant amount of cryptocurrency, affording them the ability to influence market prices through their trading decisions. In this case, the whale had taken a 40x long position on Bitcoin, indicating a highly leveraged bet that the price of Bitcoin would rise. Such a position magnifies both potential profits and losses, making it a high-risk strategy.

According to a tweet from Crypto Beast, the whale’s decision to close the position resulted in a significant financial loss, amounting to $13.4 million. This news has sparked a flurry of discussions within the cryptocurrency community, as traders and investors analyze the implications of such a move. The closing of such a large position can lead to increased volatility in the market, as it may signal a loss of confidence in Bitcoin’s short-term price movements.

Understanding Leverage in Cryptocurrency Trading

Leverage is a trading strategy that allows investors to control a larger position than their actual capital would permit. In the context of cryptocurrency, a 40x leverage means that for every $1 of the trader’s capital, they can control $40 worth of Bitcoin. While this can lead to substantial profits in a bullish market, it also exposes traders to heightened risk, as losses can accumulate rapidly.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In this instance, the whale’s decision to exit the market at a loss raises questions about the overall sentiment surrounding Bitcoin. Investors often closely monitor whale activity, as it can serve as a bellwether for market trends. A substantial loss like this may indicate that even large investors are facing challenges and uncertainties in the current market climate.

Current Market Trends and Sentiment

Bitcoin’s price is notoriously volatile, influenced by a myriad of factors ranging from regulatory news to macroeconomic trends. The recent whale’s loss comes at a time when Bitcoin has experienced fluctuations in value, leading to mixed sentiments among traders. While some investors remain bullish, believing in Bitcoin’s long-term potential, others are more cautious, particularly in the face of regulatory pressures and market corrections.

As of May 2025, Bitcoin has been navigating through a complex landscape. The increasing interest from institutional investors has created optimism; however, market corrections and profit-taking have caused many to reevaluate their positions. The decision by a whale to cut losses and exit a long position could be interpreted as a sign that even seasoned investors are wary of the current state of the market.

The Psychological Aspect of Loss in Trading

The psychological impact of trading losses cannot be underestimated. For many investors, especially those with significant capital at stake, the fear of loss can lead to a range of emotional responses. The whale’s $13.4 million loss may serve as a cautionary tale for both novice and experienced traders alike, emphasizing the importance of risk management and the need to remain grounded in one’s trading strategy.

In trading, the ability to cut losses and move on is a crucial skill. Many traders struggle with this, often holding onto losing positions in the hope that the market will turn in their favor. The decision made by the whale to close their position demonstrates a level of discipline that can be beneficial for all investors to observe.

Implications for Retail Investors

The actions of whales can serve as valuable lessons for retail investors. While it may be tempting to mimic high-stakes strategies, the risks associated with leveraged trading should not be overlooked. Retail investors should consider their risk tolerance, investment goals, and market conditions before making similar moves.

Moreover, the visibility of such massive losses can lead to increased caution among smaller investors who may fear following in the footsteps of those who have recently incurred significant losses. It reinforces the idea that the cryptocurrency market, while offering the potential for high returns, comes with substantial risk that requires careful consideration and strategic planning.

Conclusion

The recent closure of a 40x long position by a Bitcoin whale, resulting in a $13.4 million loss, serves as a compelling focal point for discussions surrounding market sentiment, trading psychology, and the broader implications for investors. As the cryptocurrency market continues to evolve, the actions of whales will remain a crucial aspect for traders to monitor, providing insights into market trends and potential future movements.

While the volatility of Bitcoin can present opportunities, it is essential for all investors to approach trading with caution and a well-defined strategy. The lessons learned from this incident can guide both seasoned traders and newcomers in navigating the unpredictable landscape of cryptocurrency investments. As Bitcoin continues to capture the imagination of investors worldwide, understanding the dynamics of whale activity and market sentiment will be vital in making informed trading decisions.

BREAKING

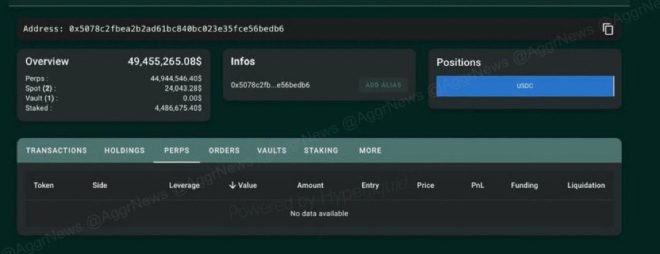

The billion dollar #bitcoin 40x long whale closes his position for a $13.4M loss pic.twitter.com/WfaxHKG0dL

— Crypto Beast (@cryptobeastreal) May 25, 2025

BREAKING

In the ever-volatile world of cryptocurrency, major movements can happen in the blink of an eye. Recently, the crypto community was rocked by news that a billion-dollar Bitcoin whale, known for their enormous trading positions, closed a staggering 40x long position for a jaw-dropping $13.4 million loss. This event not only highlights the risks involved in cryptocurrency trading but also sheds light on the unpredictable nature of the Bitcoin market.

The Billion Dollar Bitcoin Whale

When we talk about a “whale” in the crypto space, we’re referring to individuals or entities that hold large amounts of cryptocurrency. These players can significantly influence market prices with their trading activities. The whale in question had taken a massive long position on Bitcoin, betting that the price would rise. However, this strategy can backfire spectacularly, as we’ve just witnessed. Such high leverage, like the 40x in this case, amplifies both potential gains and losses, making it a double-edged sword.

The Impact of Closing a Position

Closing a position, especially one as large as this, can cause ripples throughout the market. When a whale exits a position, it can lead to increased volatility as other traders react to the news. In this case, the closure of the 40x long position not only signifies a personal loss for the trader but could also trigger a wave of selling from others who may fear a further drop in Bitcoin’s price. The situation underscores the importance of risk management in trading.

Understanding Leverage in Cryptocurrency Trading

Leverage allows traders to amplify their exposure to an asset without having to commit the full amount of capital upfront. While it can lead to significant profits, it also poses a high risk, especially in a market as unpredictable as cryptocurrency. In this instance, the decision to go 40x long on Bitcoin was a bold move, reflecting confidence in the market. However, when the market turned against this whale, the consequences were severe. Losing $13.4 million is no small feat, and it serves as a cautionary tale for other investors considering high-leverage trading.

The Bitcoin Market: A Rollercoaster Ride

The Bitcoin market is notorious for its volatility. Prices can soar or plummet within hours, influenced by a myriad of factors including market sentiment, regulatory news, and broader economic conditions. This unpredictability makes it both a thrilling and treacherous landscape for traders. The whale’s recent loss is a stark reminder that even the most seasoned players are not immune to the whims of the market.

What Does This Mean for Retail Traders?

For everyday investors, this news might send shivers down your spine. If a whale can take such a hit, what does that mean for smaller traders? It’s essential to approach the market with caution and develop a robust trading strategy. Diversifying your portfolio, setting stop-loss orders, and only risking what you can afford to lose are crucial steps in navigating the crypto waters. Remember, the thrill of trading should never outweigh the importance of protecting your capital.

Market Reactions and Sentiment

After the news broke, market reactions were swift. Many traders took to social media platforms to discuss the implications of such a significant loss. Sentiment shifted rapidly as fear and uncertainty crept in. Traders often look to these big players for cues on market direction, and a major loss like this can lead to a bearish outlook. This is why keeping an eye on whale activity is crucial for retail traders; it can provide insights into potential market movements.

Learning from the Loss

So, what can we learn from this situation? First and foremost, it highlights the importance of risk management in trading. No matter how confident you are in a trade, leveraging too much can lead to catastrophic results. Additionally, it emphasizes the need for ongoing education in the crypto space. Understanding market dynamics, leverage, and the psychology of trading can help mitigate losses and enhance your trading strategy.

The Future of Bitcoin and Cryptocurrency Trading

Despite this significant loss, the future of Bitcoin and the broader cryptocurrency market remains bright. Many analysts and enthusiasts believe in the long-term potential of Bitcoin as a store of value and a hedge against inflation. The key for traders is to navigate this landscape with a clear strategy and a cautious approach. Keeping updated on market trends and news, like this recent closure of a long position, can help traders make informed decisions.

Final Thoughts on the Whale’s Loss

In the world of cryptocurrency, where fortunes can be made and lost in an instant, the story of the billion-dollar Bitcoin whale serves as a powerful reminder. It emphasizes the need for caution, the importance of understanding leverage, and the unpredictable nature of the market. For anyone involved in trading, whether you’re a seasoned pro or a newcomer, it’s crucial to keep learning and adapting your strategies. Keep your eyes peeled, stay informed, and remember that in this game, it’s not just about riding the highs but also managing the lows effectively.

Stay Updated with Cryptocurrency News

To stay on top of the latest developments in the cryptocurrency market, be sure to follow reliable sources and news outlets. Engaging with the community on platforms like Twitter can also provide valuable insights. As we navigate this thrilling and often tumultuous landscape, staying informed is your best strategy for success.

“`

This HTML article captures the key elements of the breaking news while maintaining an engaging and informative tone. Each section is designed to provide insights into the implications of the whale’s significant loss, making it relevant and valuable to readers interested in cryptocurrency trading.

The billion dollar #bitcoin 40x long whale closes his position for a $13.4M loss