Breaking news: Major Bitcoin Whale Enters $376 Million Short Position

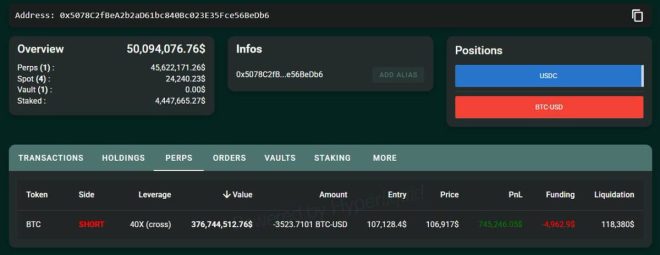

In a significant development in the cryptocurrency market, a notable Bitcoin whale has opened a massive short position valued at $376 million. This move has sparked considerable interest and speculation within the crypto community, especially given the whale’s position size and the implications for Bitcoin’s price trajectory. According to the tweet from Max (@MaxCryptoxx) on May 25, 2025, if Bitcoin (BTC) reaches a critical price point of $118.5K, this whale will face liquidation.

Understanding Bitcoin Whales

Bitcoin whales are individuals or entities that hold large amounts of Bitcoin, often significantly influencing market trends and price movements. Their trading activities can lead to heightened volatility, making them key players in the cryptocurrency space. In this case, the whale’s decision to short Bitcoin indicates a bearish outlook, suggesting that they anticipate a decline in Bitcoin’s price.

The Implications of a $376 Million Short Position

Opening a short position typically means that the trader is betting against the asset, expecting its price to fall. With a position as large as $376 million, the whale’s actions could have substantial implications for Bitcoin’s market dynamics. If the price of BTC approaches the liquidation point of $118.5K, it could trigger a wave of sell-offs, potentially accelerating the decline and causing panic among other investors.

Market Reactions and Speculations

The announcement of such a significant short position has led to varied reactions in the cryptocurrency market. Traders and analysts are closely monitoring Bitcoin’s price movements, speculating on whether the whale’s position will influence broader market sentiment. If more traders perceive this as a signal to sell, it could lead to a downward spiral in Bitcoin’s price, prompting additional sell-offs and increasing market volatility.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Key Levels to Watch

As Bitcoin’s price fluctuates, several key levels will be crucial for traders and investors to watch. The liquidation point of $118.5K is a significant threshold; if Bitcoin approaches this level, it could trigger liquidations not only for this whale but potentially for other traders with leveraged positions. Conversely, any signs of support around current price levels could indicate that the market is resisting the bearish sentiment.

The Broader Context of Bitcoin’s Price Movement

Bitcoin has experienced substantial price movements over the past few months, with various factors influencing its trajectory, including macroeconomic trends, regulatory developments, and market sentiment. The announcement of this whale’s short position adds another layer of complexity to the ongoing narrative surrounding Bitcoin.

Conclusion

The entry of a Bitcoin whale into a $376 million short position marks a pivotal moment in the cryptocurrency landscape. As traders and investors assess the potential implications of this move, the focus will remain on Bitcoin’s price action, particularly as it approaches the critical liquidation point of $118.5K. The next few days and weeks will be instrumental in determining whether this whale’s gamble pays off or if Bitcoin’s resilience prevails amid growing bearish sentiment.

In summary, the cryptocurrency market is on high alert as the actions of this Bitcoin whale could signal a shift in market dynamics. Whether you are a seasoned trader or a newcomer to the crypto space, understanding the implications of such high-stakes trading activity is vital for navigating the ever-evolving landscape of Bitcoin and the broader cryptocurrency ecosystem.

BREAKING:

40X BITCOIN WHALE HAS NOW OPENED $376 MILLION SHORT POSITION. IF BTC HITS $118.5K HE WILL GET LIQUIDATED. pic.twitter.com/4egqxTisT5

— Max (@MaxCryptoxx) May 25, 2025

BREAKING:

In the ever-evolving world of cryptocurrency, big moves by significant players can send shockwaves throughout the market. Recently, an intriguing situation unfolded as a major player in the Bitcoin space, often referred to as a “whale,” made headlines with a stunning financial maneuver. This whale has opened a staggering $376 million short position at a leverage of 40X. If Bitcoin (BTC) were to reach $118.5K, this position could lead to liquidation. This development is not just another statistic; it’s a clear indicator of market sentiment and future trends.

What Does It Mean to Be a Bitcoin Whale?

Before diving deeper into this whale’s actions, let’s clarify what it means to be a Bitcoin whale. In the crypto world, a whale is an individual or entity that holds a significant amount of Bitcoin. These players wield considerable influence over market dynamics due to the sheer volume of assets they control. A whale’s buy or sell decisions can dramatically impact Bitcoin’s price, creating ripples across exchanges and influencing retail investors.

The Mechanics of Short Selling

Now, let’s break down what it means to open a short position in cryptocurrency. Short selling is a strategy used when traders believe that the price of an asset will decrease. By borrowing Bitcoin and selling it at the current market price, they aim to buy it back later at a lower price, returning the borrowed amount and pocketing the difference. In this case, this whale is betting against Bitcoin, anticipating a downward price movement. If the price rises instead, the whale risks being liquidated, which is a forced closure of their position to prevent further losses.

The Implications of a $376 Million Short Position

This particular whale’s $376 million short position is a significant move, indicative of strong bearish sentiment. The fact that they are using 40X leverage means that they are amplifying their risk. If Bitcoin’s price hits $118.5K, the whale will be liquidated, meaning they could lose a substantial portion of their investment. This high level of leverage is often reserved for traders who are either extremely confident in their predictions or willing to take on substantial risk.

Market Reactions and Sentiment

Market reactions to such significant trades can vary. Some traders might see this as a bearish signal, prompting them to sell their holdings and avoid potential losses. Others may interpret this as a buying opportunity if they believe that the whale is mistaken in their prediction. The cryptocurrency market is volatile, and traders often react impulsively to news about large trades.

Can Bitcoin Reach $118.5K?

The question on everyone’s mind now is whether Bitcoin can hit that $118.5K mark. The cryptocurrency market is notorious for its price swings. Just when you think you have it figured out, a new development flips the narrative. Several factors can influence Bitcoin’s price, from macroeconomic trends to regulatory news, and even social media buzz. For instance, increased institutional adoption can lead to higher demand, while negative news can drive prices down.

The Role of Whales in Market Manipulation

Whales have often been accused of manipulating the market due to their significant holdings. When a whale decides to short Bitcoin heavily, it can create panic among retail investors, leading to a sell-off. Conversely, if a whale suddenly buys a large amount of Bitcoin, it can send the price soaring. Understanding the behavior of these whales is crucial for retail investors trying to navigate the turbulent waters of cryptocurrency trading.

Historical Perspectives on Bitcoin Price Movements

Looking back at Bitcoin’s price history, we’ve seen some dramatic shifts. For instance, the infamous bull run of 2017 saw Bitcoin reach nearly $20K before crashing down to below $4K in 2018. More recently, Bitcoin reached an all-time high of around $64K in April 2021 before experiencing another significant correction. Such patterns can help inform traders about potential future movements, but they are by no means guaranteed.

Strategies for Retail Investors

As a retail investor, it’s essential to keep your emotions in check and base your decisions on research rather than fear or hype. Here are some strategies to consider:

- Research: Always stay informed about market trends, news, and analysis. Websites like CoinDesk and CoinTelegraph provide up-to-date information on market movements.

- Diversify: Don’t put all your eggs in one basket. Consider diversifying your portfolio across different cryptocurrencies and investment types.

- Set Stop-Loss Orders: Protect your investments by using stop-loss orders to limit potential losses during market downturns.

- Stay Calm: The crypto market is volatile. It’s crucial to remain calm and avoid making impulsive decisions based on sudden price movements.

Conclusion: What Lies Ahead?

The cryptocurrency market is ever-changing, and the recent actions of this Bitcoin whale are a testament to that. Whether Bitcoin will hit the $118.5K mark remains to be seen, but one thing is for sure: the actions of whales can significantly influence market sentiment. As a retail investor, understanding these dynamics can help you navigate the complexities of the crypto landscape.

In summary, the move by this Bitcoin whale to open a $376 million short position at 40X leverage certainly raises eyebrows and could have far-reaching implications for the market. Whether it leads to liquidation or a significant price drop in Bitcoin is still uncertain, but it certainly adds to the excitement of trading in the cryptocurrency space.

40X BITCOIN WHALE HAS NOW OPENED $376 MILLION SHORT POSITION. IF BTC HITS $118.5K HE WILL GET LIQUIDATED.