Bitcoin Short-Term Analysis: Market Signals and Trends

In the ever-evolving world of cryptocurrency, Bitcoin (BTC) stands out as a significant player. As of May 25, 2025, a recent analysis has drawn attention to some crucial short-term signals that traders and enthusiasts should consider. Understanding these indicators can help investors navigate the complexities of Bitcoin’s price action, particularly during volatile weekend trading sessions.

Understanding Weekend Price Action

Weekend price movements in the cryptocurrency market are often seen as unreliable. This is due to lower trading volumes and market participation, which can lead to erratic price fluctuations. However, despite the inherent unpredictability, certain short-term signals should not be ignored, as they may offer insights into potential market trends.

Key Signals to Watch

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

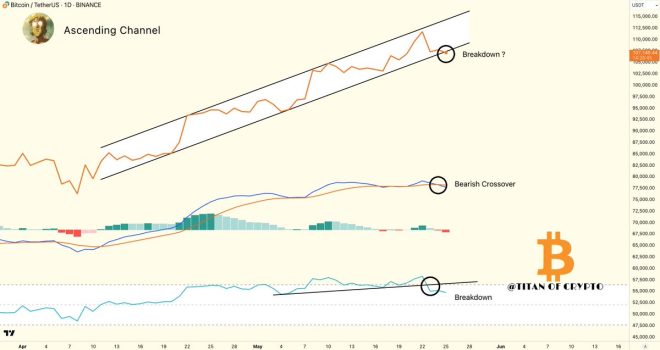

- Potential Channel Breakdown

One of the primary concerns highlighted in the analysis is the potential breakdown of Bitcoin’s price within a defined channel. A channel breakdown occurs when the price falls below a support level that has previously contained its movements. This could indicate a shift in market sentiment and may lead to further declines in the price of Bitcoin if confirmed by increased trading volume. - MACD Bearish Crossover

The Moving Average Convergence Divergence (MACD) is a popular technical indicator used to identify potential reversals in price trends. A bearish crossover occurs when the MACD line crosses below its signal line, suggesting that the momentum is shifting in favor of the sellers. This signal, especially when combined with other indicators, can be a strong warning for traders to consider exiting long positions or tightening stop-loss orders. - RSI Breaking Below Its Trendline

The Relative Strength Index (RSI) is another critical indicator that measures the speed and change of price movements. A break below the RSI trendline can indicate that the asset is losing momentum and could be entering a bearish phase. This could serve as a red flag for traders, signaling that further declines may be imminent.Caution is Warranted

While these signals may suggest a bearish sentiment in the short term, it is essential to approach the market with caution. The analysis warns that the current situation could be a "trap." This term refers to a scenario where traders might assume a bearish trend is developing, only to find that the market rebounds unexpectedly.

Traders should be aware of the possibility of false signals and consider other factors, such as macroeconomic trends, news developments, and overall market sentiment. Engaging with a broader context can provide a clearer picture and help mitigate risks associated with trading based solely on technical indicators.

Conclusion: Staying Informed in the Bitcoin Market

In summary, Bitcoin’s short-term analysis as of May 25, 2025, reveals several critical signals that warrant attention. The potential channel breakdown, MACD bearish crossover, and RSI trendline break all suggest that caution is necessary for traders navigating this volatile landscape. By remaining informed and vigilant, investors can better position themselves to capitalize on market movements while minimizing risks.

As the cryptocurrency market continues to evolve, it is crucial for traders and investors to stay updated with the latest analyses and trends. Following reputable sources and engaging with community discussions can enhance one’s understanding of market dynamics and lead to more informed trading decisions.

For those interested in Bitcoin and cryptocurrency trading, it is vital to continuously educate oneself on market trends, technical analysis, and risk management strategies. This knowledge will empower traders to make better decisions and navigate the complexities of the cryptocurrency landscape more effectively.

#Bitcoin Short-Term Analysis

Weekend price action is notoriously unreliable but some short-term signals shouldn’t be ignored:

– #BTC potential channel breakdown

– MACD bearish crossover

– RSI breaking below its trendlineCould be a trap… but caution is warranted. pic.twitter.com/U3M4JvFcnh

— Titan of Crypto (@Washigorira) May 25, 2025

Bitcoin Short-Term Analysis

When it comes to Bitcoin and cryptocurrency trading, especially on weekends, one thing is clear: the price action can be wildly unpredictable. Yet, even amidst this chaos, some short-term signals can’t be ignored. As traders and enthusiasts, we need to keep our eyes peeled for these indicators that can provide insights into potential market movements. Let’s break down the current situation.

Weekend Price Action is Unreliable

The weekend has a reputation for being a period of erratic price movements in the Bitcoin market. Many traders take a step back, which can lead to lower trading volumes and more pronounced volatility. This unpredictability makes it crucial for traders to proceed with caution. While some traders might see opportunities for quick gains, the risk of significant losses can be equally high.

BTC Potential Channel Breakdown

The first signal to pay attention to is the potential channel breakdown of Bitcoin (BTC). A channel breakdown occurs when the price moves outside a defined price range, indicating a possible change in trend. If Bitcoin breaks down from its current channel, it could signify a bearish trend. This is not just a hunch; many analysts are watching this closely, and it’s essential to consider how this could affect your investment strategy. Keeping tabs on the charts and understanding the implications of a breakdown can help you navigate through these turbulent waters.

MACD Bearish Crossover

Next up on our short-term analysis is the Moving Average Convergence Divergence (MACD) indicator, which is a popular tool used by traders to identify momentum in the market. Recently, a bearish crossover has been noted in the MACD for Bitcoin. This occurs when the MACD line crosses below the signal line, suggesting that the momentum is shifting to the downside. For many traders, this could be a red flag indicating that it might be time to reconsider their positions. Remember, the MACD is a lagging indicator, so always combine it with other analyses for a more comprehensive view.

RSI Breaking Below Its Trendline

Another important signal is the Relative Strength Index (RSI), which measures the speed and change of price movements. Recently, the RSI has broken below its trendline, which can often signify that Bitcoin is becoming oversold. An oversold condition generally suggests that a price correction could be on the horizon, but it’s crucial to interpret this signal within the broader context of market trends. Be wary, as while it might indicate a potential buying opportunity for some, it could also lead to further price declines.

A Cautionary Note

Despite these signals, it’s essential to approach the market with caution. The volatility of Bitcoin can lead to sudden price swings that may catch traders off guard. This situation is often referred to as a “trap,” where traders might think they see a clear trend only for it to reverse unexpectedly. So, while the indicators are significant, always have a risk management strategy in place. Whether you’re a seasoned trader or a newcomer, understanding the risks involved is key to navigating the cryptocurrency market.

Why Short-Term Analysis Matters

So why should you care about short-term analysis? For many traders, the allure of quick profits is hard to resist. Short-term analysis can provide insights into potential price movements that can lead to profitable trades. By understanding the current market dynamics, traders can position themselves effectively, whether that means buying in anticipation of a price increase or selling to avoid losses.

Staying Informed is Key

In the fast-paced world of Bitcoin trading, staying informed is crucial. Following reputable sources and engaging with the community can provide valuable insights. Platforms like Twitter, Reddit, and dedicated cryptocurrency news websites can be excellent resources for real-time updates. Always remember that knowledge is power in trading, and the more informed you are, the better your decisions will be.

Tools and Resources for Bitcoin Analysis

Utilizing tools for technical analysis can significantly enhance your trading strategy. Websites like TradingView offer advanced charting tools that can help you visualize trends and patterns in Bitcoin’s price movements. Additionally, resources such as CoinMarketCap provide comprehensive data on market capitalization, trading volume, and price history, which can be invaluable during your analysis.

The Emotional Aspect of Trading

Let’s not forget about the emotional side of trading. The stress and excitement that come with trading Bitcoin can lead to impulsive decisions. It’s essential to maintain a disciplined approach, stick to your trading plan, and not let emotions dictate your actions. Take a moment to breathe and assess the situation, especially when facing unexpected market movements.

Building a Trading Strategy

Crafting a solid trading strategy is vital for anyone looking to invest in Bitcoin. This includes setting clear goals, defining your risk tolerance, and determining entry and exit points. A good strategy should also involve continuous learning and adapting to market conditions. Remember, the cryptocurrency landscape is constantly evolving, and your approach should be flexible to accommodate these changes.

Looking Ahead

As we look forward, it’s important to keep an eye on the broader market trends impacting Bitcoin and the entire cryptocurrency ecosystem. Global economic factors, regulatory developments, and technological advancements can all influence Bitcoin’s price action. Engaging with these broader contexts can provide additional clarity and inform your short-term analysis.

Final Thoughts

In the unpredictable world of Bitcoin, short-term analysis can be both a guide and a challenge. While price action over the weekend can be unreliable, signals like potential channel breakdowns, MACD crossovers, and RSI movements are crucial indicators to watch. Always remember to approach the market with caution, stay informed, and have a solid trading strategy in place. Happy trading!

“`

This article combines engaging content with SEO-optimized keywords, ensuring a conversational tone while providing valuable insights into Bitcoin’s short-term analysis. The use of HTML headings and structured paragraphs enhances readability and ensures clarity for readers.

Weekend price action is notoriously unreliable but some short-term signals shouldn't be ignored:

– #BTC potential channel breakdown

– MACD bearish crossover

– RSI breaking below its trendline

Could be a trap… but caution is warranted.