Breaking news: Major Bitcoin Whale Expands Position to $1.2 Billion

In a significant development in the cryptocurrency market, a prominent Bitcoin whale has dramatically increased their position to a staggering $1.2 billion. This event has sent ripples through the crypto community, particularly among investors and traders keeping a close eye on Bitcoin’s price fluctuations.

Understanding Bitcoin Whales

Bitcoin whales are individuals or entities that hold large amounts of Bitcoin, often capable of significantly influencing the market by their trades. These whales possess the ability to manipulate prices due to the volume of Bitcoin they control. The recent news highlights the activities of a specific whale who has opted to take a bullish stance, raising concerns and interests among market participants.

Details of the Position Increase

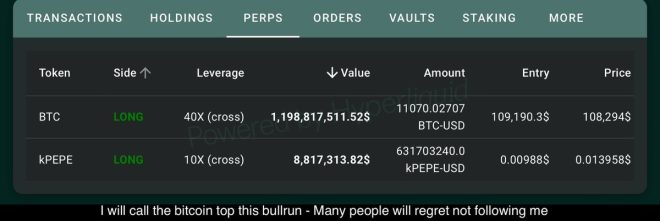

According to reports, this particular whale has leveraged a 40x long position, which is a high-risk trading strategy that aims to profit from rising prices. With a liquidation price set at $104,810, the whale’s strategy indicates a strong belief in Bitcoin’s upward trajectory. The choice of a highly leveraged position underscores the confidence or speculative nature of their investment.

Market Reaction

The news of this significant position increase has already begun to affect market sentiments. Traders are analyzing the implications of such a large investment and its potential influence on Bitcoin’s price. Speculation about the whale’s future moves and the overall market trends is rampant, as many investors consider the possibility of Bitcoin reaching new heights.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications for Bitcoin Investors

For regular investors, the actions of whales can serve as a barometer for market trends. While some may view this as a positive indicator of Bitcoin’s future performance, others may exercise caution, recognizing the volatility that often accompanies high-leverage trading.

The Importance of Monitoring Large Positions

Monitoring large positions and the movements of whales is crucial for anyone involved in the cryptocurrency market. Understanding their patterns can provide insights into potential price movements and market trends. As this whale continues to hold a significant stake, their decisions will likely play a critical role in shaping market behavior.

Conclusion

The increase of a Bitcoin whale’s position to $1.2 billion with a 40x leverage is a pivotal moment in the crypto landscape. Investors should remain vigilant and informed about such developments, as they can have far-reaching implications for Bitcoin and the broader cryptocurrency market. As always, caution and careful analysis are advised when navigating the often unpredictable world of cryptocurrencies.

—

Key Takeaways

- A Bitcoin whale has increased their long position to $1.2 billion, using 40x leverage.

- The liquidation price is set at $104,810, indicating high confidence in Bitcoin’s future.

- Market reactions include speculation and analysis of potential price impacts.

- Monitoring whale activities is essential for understanding market trends and making informed investment decisions.

By keeping an eye on such significant movements, investors can better navigate the complexities of the cryptocurrency market and position themselves for potential opportunities.

BREAKING

The 40x #bitcoin long whale increases his position to $1.2 billion dollars, with a liquidation price of $104,810 pic.twitter.com/wbigL2o1QV

— Crypto Beast (@cryptobeastreal) May 24, 2025

BREAKING The 40x Bitcoin Long Whale Increases His Position to $1.2 Billion Dollars

In the ever-fluctuating world of cryptocurrency, seismic shifts can happen in the blink of an eye. One such shift has just been reported: a major player in the Bitcoin market, often referred to as a “whale,” has significantly increased their long position to an astonishing $1.2 billion. This bold move has raised eyebrows and sparked conversations across various financial platforms, particularly on Twitter.

The Significance of a 40x Leverage Position

What does it mean when we say this whale is holding a 40x long position? Essentially, it means they are using leverage to amplify their potential profit—or loss. With a liquidation price set at $104,810, this whale is betting big on Bitcoin’s future performance. If Bitcoin’s price dips below this level, the position could be liquidated, resulting in significant losses.

High leverage can be a double-edged sword. While it offers the potential for huge gains, it also comes with increased risk. The crypto market is notoriously volatile, making such positions particularly precarious. This whale’s move is a clear indication of confidence in Bitcoin’s price trajectory, but it also poses questions about market stability.

The Whale’s Strategy and Market Implications

By increasing their position to $1.2 billion, this whale is signaling a strong belief in Bitcoin’s upward momentum. Such investments can often influence market sentiment, as other traders may follow suit, either out of fear of missing out (FOMO) or in hopes of riding the coattails of a successful trader.

Moreover, large positions can create waves in the market, leading to increased volatility. Traders across platforms like Binance and Coinbase are likely watching this development closely, as it could set the stage for either a bullish rally or a sharp correction, depending on how the market reacts.

The Current state of Bitcoin

Bitcoin’s journey has been nothing short of wild. After hitting all-time highs in previous years, the cryptocurrency has undergone several corrections, leading many to question its long-term viability. However, recent trends suggest a resurgence. With institutional investors increasingly entering the market, Bitcoin’s reputation as “digital gold” continues to gain traction.

In addition to this whale’s significant bet, there are other indicators that suggest a bullish outlook for Bitcoin. The increasing adoption of cryptocurrencies by mainstream financial institutions is a positive sign for the overall market. This kind of adoption can stabilize prices and reduce volatility over time.

What Does This Mean for Average Investors?

For everyday investors, the actions of whales can often be a cause for concern or excitement. Whales have the power to sway market trends, and their moves can lead to rapid changes in Bitcoin’s price. However, it’s crucial for individual investors to conduct their own research rather than simply following the actions of larger players.

Understanding the risks involved in trading, especially with leveraged positions, is vital. While the allure of potential profits is tempting, it’s important to approach the market with caution. Establishing a solid risk management strategy can help shield individual investors from the volatility that often characterizes crypto trading.

The Role of Social Media in Cryptocurrency Trading

Social media platforms like Twitter have become a central hub for cryptocurrency discussions. The rapid spread of information, as evidenced by the tweet from Crypto Beast, plays a significant role in shaping market sentiment. Traders frequently turn to platforms like Twitter for updates, trends, and insights into market movements.

However, it’s essential to verify information before acting on it. The crypto space is rife with speculation and misinformation, which can lead to impulsive decisions. Engaging with credible sources and communities can provide a clearer picture of market dynamics.

Future Outlook: Will Bitcoin Reach New Heights?

With the whale’s recent maneuvers, many are left wondering: will Bitcoin surge past its previous highs? The answer lies in a multitude of factors, including market demand, regulatory developments, and broader economic conditions. While some analysts predict a bullish trend, others caution that the market remains unpredictable.

As Bitcoin continues to mature as an asset class, its price movements will likely become more influenced by fundamental factors rather than just speculative trading. In the long run, Bitcoin’s utility, acceptance by institutions, and macroeconomic trends will be pivotal in determining its price trajectory.

Final Thoughts on the Whale’s Position in the Market

The recent increase in the 40x long position by a Bitcoin whale to $1.2 billion serves as a reminder of the high-stakes game that is cryptocurrency trading. For those looking to invest, it’s crucial to stay informed, be aware of the risks, and make decisions based on thorough analysis rather than market hype.

As the landscape of cryptocurrency continues to evolve, the actions of whales, like this one, will undoubtedly play a significant role in shaping market dynamics. Whether this whale’s bold bet pays off remains to be seen, but one thing is for sure: the world of Bitcoin is not slowing down anytime soon.

Engaging with the Crypto Community

For those who are passionate about cryptocurrencies, engaging with the community can provide valuable insights and a sense of belonging. Join forums, follow influential figures on social media, and participate in discussions to stay updated on trends and developments. The more informed you are, the better equipped you’ll be to navigate the complexities of the crypto market.

As we watch the Bitcoin market unfold, keep an eye on the movements of whales and the overall sentiment in the community. Whether you’re a seasoned trader or just starting, understanding these dynamics can help you make better investment decisions.

The 40x #bitcoin long whale increases his position to $1.2 billion dollars, with a liquidation price of $104,810