Understanding the Impact of a 40x Bitcoin Whale Position on the Cryptocurrency Market

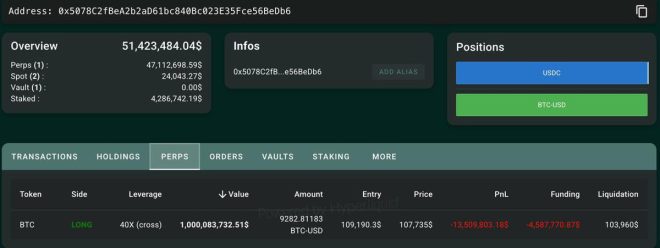

In the ever-evolving landscape of cryptocurrency, significant movements by large investors, often referred to as "whales," can have a profound impact on market dynamics. Recently, a tweet from crypto influencer Ash Crypto highlighted a notable situation involving a Bitcoin whale whose position has now exceeded $1 billion but is currently facing an unrealized loss of approximately $18 million. This situation raises crucial questions about the future direction of Bitcoin (BTC) and its potential price movements.

The Current Situation of the Bitcoin Whale

The term "whale" refers to individuals or entities that hold substantial amounts of cryptocurrency, often capable of influencing market prices with their trading activities. In this case, the whale’s position is reported to be 40 times leveraged, meaning they have borrowed significantly to increase their exposure to Bitcoin. While leveraging can amplify gains, it also heightens risks, particularly in a volatile market like cryptocurrency.

The whale’s current unrealized loss of $18 million indicates that, despite the position being valued at over $1 billion, the current market conditions have not favored their investment strategy. This situation presents an intriguing dilemma: will the whale liquidate their position to cut losses, or will they hold out for a potential new all-time high (ATH) for Bitcoin?

Liquidation Risk vs. New ATH

When discussing the potential outcomes for the whale’s position, two scenarios come to the forefront: liquidation and the possibility of Bitcoin reaching a new all-time high. Each scenario carries its implications for the broader market.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Risk of Liquidation

Liquidation occurs when an investor is forced to sell their position, typically due to not meeting margin requirements. In this case, if the price of Bitcoin continues to decline, the whale may face liquidation, which could trigger a wave of selling pressure in the market. This domino effect could lead to further declines in Bitcoin’s price, potentially affecting retail investors and smaller traders as well.

The fear of liquidation can create a self-fulfilling prophecy, where investors panic sell their holdings in anticipation of further declines. As a result, the presence of a heavily leveraged whale in the market adds a layer of volatility, making it crucial for traders to monitor the situation closely.

The Hope for a New ATH

On the flip side, the whale’s decision to hold onto their position could signal a belief in the long-term potential of Bitcoin. Many analysts and enthusiasts remain optimistic about Bitcoin’s future, citing factors such as increased institutional adoption, regulatory clarity, and the ongoing development of blockchain technology as reasons for a potential price surge.

If Bitcoin were to rally and reach a new all-time high, it could validate the whale’s strategy and lead to significant profits, not only for them but also for the broader market. A surge in price could trigger a renewed interest in cryptocurrency, attracting new investors and leading to increased trading volumes.

Analyzing Market Sentiment

The situation surrounding the Bitcoin whale’s position has ignited discussions within the cryptocurrency community. Social media platforms, forums, and crypto news outlets are buzzing with opinions and predictions about the potential outcomes. Traders and investors are closely monitoring price movements, looking for signs of strength or weakness in the market.

Market sentiment plays a crucial role in determining price direction. If a majority of investors believe that the whale’s liquidation is imminent, fear may drive selling pressure. Conversely, if optimism prevails, it could lead to increased buying activity, propelling Bitcoin’s price higher.

The Role of Technical Analysis

In addition to market sentiment, technical analysis can provide valuable insights into potential price movements. Traders often use chart patterns, support and resistance levels, and various indicators to make informed decisions. Understanding current trends and historical price movements can aid in predicting how the market may react to significant events, such as the potential liquidation of a major whale position.

Conclusion

The situation involving the 40x Bitcoin whale with a $1 billion position and an unrealized loss of $18 million serves as a stark reminder of the volatility and unpredictability of the cryptocurrency market. The looming question of whether this whale will liquidate their position or hold out for a new all-time high sets the stage for potential market movements that could affect countless investors.

As cryptocurrency enthusiasts and traders navigate this uncertain terrain, it is essential to stay informed, analyze market sentiment, and employ sound trading strategies based on technical analysis. Whether driven by fear of liquidation or hope for new highs, the actions of this whale will undoubtedly influence the market, making it a pivotal moment for Bitcoin and the broader cryptocurrency ecosystem.

In conclusion, understanding the implications of whale movements and institutional behavior is crucial for anyone involved in the cryptocurrency market. As this situation unfolds, it will serve as a case study for future trading strategies and market dynamics in the ever-changing world of cryptocurrencies.

BREAKING:

THE 40X BITCOIN WHALE POSITION IS

NOW OVER $1 BILLION. HE’S SITTING

ON $18M IN UNREALIZED LOSS.WHAT YOU THINK IS COMING NEXT ?

HIS LIQUIDATION OR BTC NEW ATH ? pic.twitter.com/nLEIqXOtgl

— Ash Crypto (@Ashcryptoreal) May 24, 2025

BREAKING: THE 40X BITCOIN WHALE POSITION IS NOW OVER $1 BILLION.

In the fast-paced world of cryptocurrency, the term “whale” refers to individuals or entities that hold large amounts of a cryptocurrency. Recently, a prominent figure in the crypto community made headlines as it was reported that a particular 40X Bitcoin whale position has surged past the staggering mark of $1 billion. While this kind of news typically excites investors and enthusiasts, it also raises eyebrows considering that this whale is currently sitting on an unrealized loss of $18 million. Now, the burning question on everyone’s mind is: what’s next? Will we see a liquidation, or could Bitcoin reach a new all-time high (ATH)?

HE’S SITTING ON $18M IN UNREALIZED LOSS.

Let’s break down what it means to be “sitting on unrealized loss.” In simple terms, an unrealized loss occurs when an asset has decreased in value, but the owner has not yet sold it. For this whale, that means while the value of his Bitcoin holdings has plummeted, he hasn’t converted those assets into cash just yet. This situation can be a double-edged sword. On one hand, holding onto the Bitcoin could mean that if the market turns around, he might recover those losses and even profit. On the other hand, there’s a real risk that the value could drop even further, leading to potential liquidation.

For context, liquidation occurs when a trader’s account falls below a required amount of margin, prompting the broker to sell off assets to cover the losses. This whale’s position is significant, and if the market doesn’t favor him soon, a forced liquidation could happen, leading to a cascade effect that might impact Bitcoin’s price overall. It’s crucial to monitor the situation closely, as it could set off a chain reaction in the crypto markets.

WHAT YOU THINK IS COMING NEXT?

The big question is what comes next for this Bitcoin whale and the broader market. If you’re involved in crypto, you know that predicting market movements is like trying to forecast the weather; it’s notoriously unpredictable. However, analyzing past trends and current market sentiment can give us some insight.

Some experts believe that the current market dynamics could lead to a new ATH for Bitcoin, especially if the overall economic climate shifts favorably. Factors such as institutional adoption, regulatory clarity, and technological advancements within the Bitcoin network could spur a bullish market. For instance, when institutions like Tesla and MicroStrategy began investing in Bitcoin, it significantly influenced market confidence.

On the flip side, if the whale decides to liquidate his position to mitigate losses, it could create panic among smaller investors. This could drive Bitcoin’s price down further, especially if other whales follow suit. The psychological aspect of trading cannot be underestimated; fear and greed tend to drive market behavior more than fundamental analysis at times.

HIS LIQUIDATION OR BTC NEW ATH?

There are two primary scenarios to consider: the whale’s potential liquidation or Bitcoin reaching a new ATH. Each outcome comes with its own set of implications. If the whale liquidates, it could push Bitcoin’s price down as a large amount of selling pressure floods the market. This scenario could lead to a bearish trend, potentially causing a domino effect where other investors panic-sell.

Conversely, if Bitcoin can rally past resistance levels and reach a new ATH, it could restore confidence in the market. Historical data shows that Bitcoin often experiences significant volatility before reaching new highs. If this whale can hold onto his position long enough for the market to recover, he could not only recover his losses but also capitalize on the next upward trend.

Investors, especially those who follow the whale phenomenon closely, should keep an eye on market indicators. Tools like the Fear and Greed Index can provide insight into market sentiment. When fear is high, it may be an opportune time to buy, while extreme greed often precedes corrections.

THE ROLE OF WHALES IN THE CRYPTO MARKET

Whales play a significant role in the cryptocurrency market. Their trading decisions can affect prices significantly, given the sheer volume they control. They often have the power to sway market sentiment, either positively or negatively. Understanding whale behavior can provide insights for smaller traders.

For example, when a whale accumulates Bitcoin, it typically signals confidence in the asset. Conversely, large sell-offs can trigger fear and drive prices down. The actions of this $1 billion whale are being closely monitored not just for their immediate impact, but for what they indicate about the broader market dynamics.

Investors should also consider that whales often operate on different timelines compared to retail investors. While many small traders might react impulsively to market movements, whales often have a long-term strategy that may not align with immediate price fluctuations. This difference in approach can sometimes lead to misinterpretations of market signals.

WHAT CAN TRADERS DO IN THIS SITUATION?

For individual traders watching this situation unfold, it’s essential to remain calm and strategic. Here are some tips to navigate the current landscape:

1. **Stay Informed**: Keep an eye on market news, especially about this whale’s position. Understanding the broader implications can help you make informed decisions.

2. **Diversify Your Portfolio**: Don’t put all your eggs in one basket. By diversifying, you can mitigate risk and protect against market volatility.

3. **Set Clear Goals**: Define your investment goals and stick to them. Whether you’re in for the long haul or looking to capitalize on short-term fluctuations, having a clear strategy can guide your decisions.

4. **Use Stop-Loss Orders**: If you’re concerned about potential losses, consider setting stop-loss orders to limit your exposure in the event of a downturn.

5. **Engage with the Community**: The crypto community is vibrant and full of insights. Engaging with others can provide new perspectives and information that could be beneficial.

CONCLUSION

As the crypto world watches this $1 billion whale and the potential for liquidation or a new ATH, the tension is palpable. The decisions made by this individual could have ripple effects across the market, influencing the sentiment of both retail and institutional investors. In a landscape as volatile as cryptocurrency, staying informed and prepared is key. Whether this whale’s journey ends in recovery or liquidation, one thing is clear: the world of Bitcoin never fails to keep us on our toes.

To keep updated on the latest developments, make sure to follow trusted sources and engage with communities that share insights on cryptocurrency trends and movements.

THE 40X BITCOIN WHALE POSITION IS

NOW OVER $1 BILLION. HE'S SITTING

ON $18M IN UNREALIZED LOSS.

WHAT YOU THINK IS COMING NEXT ?

HIS LIQUIDATION OR BTC NEW ATH ?