Bitcoin Whale Boosts Long Position to $1.25 Billion: A Game-Changer for Cryptocurrency

In a striking development within the cryptocurrency landscape, a Bitcoin whale has significantly increased its long position, now valued at $1.25 billion. This move comes as a pivotal moment for both the Bitcoin market and the broader cryptocurrency ecosystem. The news was shared by prominent crypto commentator DustyBC on Twitter, igniting discussions among traders and investors alike about the implications of such a massive investment in Bitcoin.

Understanding Bitcoin Whales

Bitcoin whales are individuals or entities that hold a substantial amount of Bitcoin, often influencing market trends and price fluctuations. These whales typically possess thousands of Bitcoins, positioning them as key players in the cryptocurrency market. Their trading decisions can lead to significant impacts on market sentiment, which is crucial for both short-term traders and long-term investors.

The Significance of a $1.25 Billion Investment

The recent decision by this Bitcoin whale to increase its long position to $1.25 billion is noteworthy for several reasons:

- Market Confidence: Such a substantial investment signals strong confidence in Bitcoin’s future performance. It indicates that the whale believes in the potential for price appreciation, which may inspire other investors to follow suit.

- Price Impact: When a whale enters or exits a position, it can lead to significant price movements. This increase in long positions could potentially drive up demand, resulting in a bullish trend for Bitcoin, as other traders may interpret this as a positive sign.

- Long-Term Outlook: The decision to bolster a long position suggests a long-term bullish outlook. This may reflect the whale’s belief in Bitcoin’s resilience and growth potential, especially amid a volatile market landscape.

Implications for Traders and Investors

For cryptocurrency traders and investors, this news serves as a critical indicator of market sentiment. Here are some implications to consider:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Increased Volatility

The Bitcoin market is known for its volatility, and the actions of whales can exacerbate this. Traders should brace for potential price swings as the market reacts to the whale’s long position. This could present both opportunities and risks for short-term traders looking to capitalize on price movements.

Shift in Market Sentiment

When wealthy investors take significant positions in Bitcoin, it can shift market sentiment. If more investors perceive the whale’s actions as a bullish signal, it may lead to increased buying pressure, further driving up prices. Traders should monitor social media channels and news outlets for updates on market sentiment to gauge the potential impact of this whale activity.

The Broader Context of Bitcoin’s Performance

Bitcoin has seen a turbulent journey since its inception over a decade ago. After reaching an all-time high in late 2021, the cryptocurrency experienced a significant decline in value throughout 2022 and early 2023. However, the recent actions of this Bitcoin whale may indicate a turning tide in the market.

Recovery and Resilience

As Bitcoin continues to demonstrate resilience, particularly in the face of regulatory challenges and market skepticism, strategic investments by whales may serve as a catalyst for recovery. The influx of capital from large investors can provide the necessary momentum for Bitcoin to regain its upward trajectory.

Institutional Interest

The growing interest from institutional investors has also played a role in Bitcoin’s recovery. Companies and investment firms are increasingly allocating resources to cryptocurrencies, further legitimizing Bitcoin as a viable asset class. This shift in perspective has contributed to a more stable market environment, making it an attractive option for both retail and institutional investors.

Conclusion: A New Chapter for Bitcoin?

The decision by a Bitcoin whale to boost its long position to $1.25 billion marks a significant moment in the cryptocurrency space. This bold move not only reflects confidence in Bitcoin’s future but also has the potential to influence market dynamics and trader behavior. As the cryptocurrency landscape continues to evolve, monitoring the actions of whales and understanding their impact on market sentiment will remain crucial for investors.

Key Takeaways

- Bitcoin Whale Activity: A substantial increase in a Bitcoin whale’s long position can signal market confidence and influence price trends.

- Volatility: Traders should prepare for potential volatility as the market reacts to whale movements.

- Long-Term Outlook: The whale’s decision may indicate a bullish long-term outlook for Bitcoin, suggesting resilience despite market fluctuations.

- Institutional Interest: The growing presence of institutional investors further legitimizes Bitcoin and contributes to its recovery potential.

- Market Sentiment: Monitoring social media and news channels will be essential for understanding the impact of whale activity on market sentiment.

In conclusion, the cryptocurrency market is witnessing dynamic shifts driven by the actions of significant players. The boost of a long position to $1.25 billion by a Bitcoin whale not only reflects confidence in Bitcoin but also sets the stage for potential market movements. As investors navigate this landscape, staying informed about these developments will be crucial for making informed trading decisions.

BREAKING

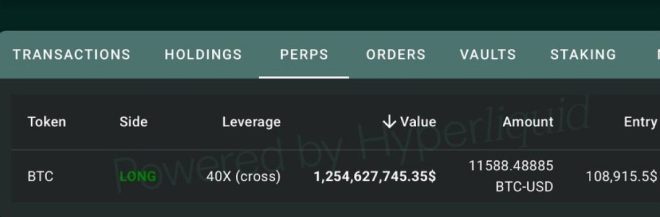

40X BITCOIN WHALE JUST BOOSTED HIS LONG POSITION TO $1.25 BILLION pic.twitter.com/5MkY41DZEg

— DustyBC Crypto (@TheDustyBC) May 24, 2025

BREAKING

In the ever-evolving world of cryptocurrency, few events capture the attention of traders and investors quite like the actions of a Bitcoin whale. Recently, one such whale made headlines by boosting their long position to an astonishing $1.25 billion, leveraging a staggering 40X. This move has sent ripples through the crypto community, prompting discussions about market trends, future price movements, and the implications for everyday investors.

Understanding Bitcoin Whales

First, let’s take a moment to understand what a Bitcoin whale is. Essentially, a Bitcoin whale is any individual or entity that holds a significant amount of Bitcoin. These whales can have a major impact on market dynamics, given that their trading activities can influence Bitcoin’s price considerably. The term ‘whale’ is often used to describe those who hold large quantities of Bitcoin, typically in the thousands or millions of dollars, which gives them the power to sway market sentiment.

The Significance of a 40X Leverage

When we talk about a 40X leverage, it means that the trader is borrowing funds to trade with a position size that is 40 times larger than the capital they have. While leveraging can amplify profits, it also significantly increases risk. For instance, a small price movement in the opposite direction can lead to substantial losses. This is why leveraging is often recommended only for seasoned traders who can stomach the volatility of the cryptocurrency market.

The Current Landscape of Bitcoin

The Bitcoin market has been incredibly volatile, with fluctuations that can make or break traders in a matter of hours. As of now, Bitcoin has shown resilience, bouncing back from previous dips and creating opportunities for both new and experienced investors. The news of a whale increasing their position could indicate confidence in Bitcoin’s future price appreciation, potentially attracting more investors to the market.

Market Reactions to Whale Activity

Whenever a whale makes a significant move, it tends to lead to a variety of reactions within the market. Some traders may view this as a bullish signal, interpreting it as a sign that the whale expects the price to rise. Others might take a more cautious approach, worried that such a high-leverage position could lead to a liquidation, especially if Bitcoin’s price goes on a downward trend. It’s a classic case of differing perspectives in trading psychology.

Impacts on Retail Investors

For retail investors, this news serves as both a cautionary tale and a potential opportunity. On one hand, the risk associated with such high leverage is a reminder of the volatility inherent in cryptocurrency trading. On the other hand, following the actions of whales can sometimes provide valuable insights into market trends. Many traders use whale tracking tools to monitor large transactions, hoping to capitalize on the movements of these big players.

What Does This Mean for the Future of Bitcoin?

The boost to a $1.25 billion long position could suggest that the whale is betting on a bullish future for Bitcoin. Historically, large investments often precede significant price movements. However, the cryptocurrency market is notoriously unpredictable, and past performance is not always indicative of future results. Market analysts will be closely watching to see how this whale’s position affects Bitcoin’s price trajectory in the coming weeks.

Strategies for Retail Traders

So, what should retail traders consider doing in light of this development? Here are a few strategies:

- Stay Informed: Keeping an eye on whale movements can provide insights into market sentiment.

- Risk Management: Use stop-loss orders to protect your investments, especially in a volatile market.

- Diversify: Don’t put all your eggs in one basket. Consider diversifying your investments across different cryptocurrencies.

- Educate Yourself: Understanding how leverage works and the risks involved is crucial for anyone looking to trade in high-stakes environments.

Community Perspectives

The crypto community is buzzing with opinions following the whale’s move. Some see it as a signal to buy, while others warn of the potential pitfalls of following such large players blindly. The truth is, while whales have deep pockets, their strategies may not always align with those of smaller traders. Engaging in community discussions can provide valuable perspectives and help shape your trading strategies.

Final Thoughts on Whale Movements

At the end of the day, the actions of whales like the one who just boosted their position to $1.25 billion are fascinating and instructive. They remind us of the complex interplay between different market participants and the importance of being informed. Whether you choose to follow in their footsteps or tread carefully is entirely up to you.

Bitcoin remains a dynamic and exciting asset, and while the actions of whales can influence the market, the final outcome depends on a myriad of factors, including broader economic indicators, regulatory news, and technological advancements within the crypto space.

Further Reading

If you’re interested in diving deeper into the world of cryptocurrency trading, consider checking out resources like CoinDesk for news updates and analysis, or Binance Academy for educational content on trading strategies and market dynamics.

40X BITCOIN WHALE JUST BOOSTED HIS LONG POSITION TO $1.25 BILLION