Breaking news: James Wynn’s Massive Bitcoin Position

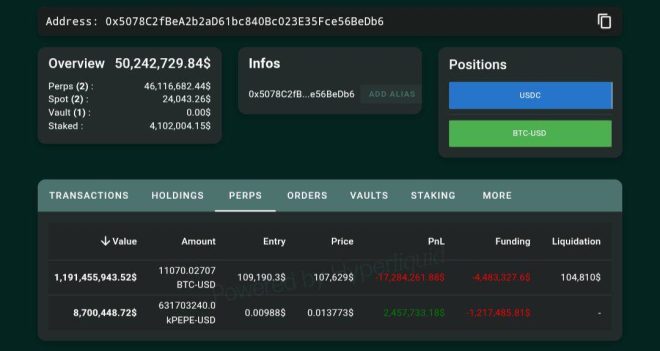

In a stunning development within the cryptocurrency market, James Wynn, known as the "Hyperliquid whale," has taken a monumental position in Bitcoin (BTC) that could shake the foundations of the market. Wynn has established a max long position amounting to an astonishing $1.19 billion. This significant investment has raised eyebrows across the crypto community, but it also comes with substantial risk. According to recent reports, Wynn’s position could face liquidation if Bitcoin’s price falls below $104,800.

Understanding the Implications of Wynn’s Position

Wynn’s massive investment indicates a strong bullish sentiment towards Bitcoin. A long position reflects an investor’s belief that the price of an asset will rise. In this case, Wynn is betting on Bitcoin’s continued growth, which has been characterized by volatility and rapid price changes. The $1.19 billion stake is not just a financial maneuver; it represents a vote of confidence in Bitcoin’s potential to reach new heights.

However, the warning regarding the liquidation threshold is crucial. If Bitcoin’s price drops below the critical level of $104,800, Wynn could face a forced liquidation of his position. This scenario could lead to significant market repercussions, especially given the size of his investment. A liquidation could trigger a cascading effect, causing panic selling among other investors and potentially driving Bitcoin’s price down further.

The Whale Phenomenon in Cryptocurrency Markets

Wynn’s position is a prime example of the whale phenomenon that exists in cryptocurrency markets. Whales are individuals or entities that hold large amounts of a particular cryptocurrency, and their trading actions can significantly impact market prices. The presence of whales like Wynn can lead to increased volatility, as their buying or selling decisions may sway market sentiment.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

In recent years, the influence of whales has become more pronounced as institutional investors have entered the cryptocurrency space. These large players often have the resources and market knowledge to make significant trades that can affect supply and demand dynamics. As a result, the actions of whales are closely monitored by other traders and analysts.

Bitcoin’s Price Trends and Future Projections

Bitcoin has experienced a rollercoaster of price movements over the years, characterized by sharp rises and significant corrections. As of now, Bitcoin’s price remains at a pivotal point. The cryptocurrency has been battling resistance levels while also facing downward pressure from macroeconomic factors and regulatory concerns.

The potential for Wynn’s liquidation could serve as a catalyst for a broader market reaction. If Bitcoin were to breach the $104,800 threshold, it could signal to other traders that the market sentiment is turning bearish. Conversely, if Bitcoin continues to rally and remains above this critical level, it may reinforce bullish sentiment and encourage further investments.

The Role of Market Sentiment in Cryptocurrency Trading

Market sentiment plays a crucial role in cryptocurrency trading. Traders often react to news and developments, such as Wynn’s massive long position, which can lead to shifts in buying and selling behavior. Positive news can attract new investors and drive prices higher, while negative news can instigate panic selling and create downward pressure.

In this context, Wynn’s position could serve as a double-edged sword. While it may inspire confidence among some investors, others may view it as a signal to be cautious. The fear of liquidation might deter potential buyers, fearing a price drop if Wynn’s position is forced to close.

Strategies for Investors in a Volatile Market

For retail investors, the news surrounding Wynn’s position serves as a reminder of the importance of risk management and strategic planning in a volatile market. Here are some strategies to consider:

1. Diversification

Investors should consider diversifying their portfolios to mitigate risks associated with a single asset. By spreading investments across various cryptocurrencies and other asset classes, investors can reduce the impact of adverse price movements in any one asset.

2. Set Stop-Loss Orders

Implementing stop-loss orders can help protect investments from significant losses. By setting a predetermined price at which to sell, investors can limit their exposure in case the market moves unfavorably.

3. Stay Informed

Keeping up with market news and developments is crucial for making informed investment decisions. Understanding the actions of major players like Wynn can provide insights into market trends and potential price movements.

4. Long-Term Perspective

While short-term trading can be tempting, adopting a long-term investment perspective can help investors ride out market volatility. Focusing on the fundamentals of Bitcoin and its potential for future adoption can guide investment decisions.

Conclusion

James Wynn’s substantial long position in Bitcoin underscores the complexities and risks of the cryptocurrency market. With a $1.19 billion bet on Bitcoin, the implications of his investment could reverberate throughout the ecosystem, especially if the price approaches the critical liquidation threshold of $104,800. As the market continues to evolve, both retail and institutional investors must remain vigilant, informed, and strategic in their trading approaches. The ever-present volatility in the cryptocurrency landscape necessitates a careful consideration of risk and reward, making it essential for investors to stay attuned to market dynamics and the actions of influential players like Wynn.

BREAKING

The Famous Hyperliquid whale, James Wynn, is max long on $BTC with a $1.19 billion position that could potentially get liquidated if the price drops below $104,800. pic.twitter.com/g2rcoyaLug

— Crypto Aman (@cryptoamanclub) May 24, 2025

BREAKING

In the world of cryptocurrency, few events can generate as much buzz as a major player making a significant move. Recently, the infamous Hyperliquid whale, James Wynn, has put the spotlight back on Bitcoin ($BTC) with a staggering $1.19 billion position. This news has left traders and crypto enthusiasts buzzing with speculation and excitement. What does it mean for the market, and what should investors be on the lookout for? Let’s dive into this thrilling development.

The Implications of a $1.19 Billion Position

When someone like James Wynn goes “max long” on Bitcoin, it raises eyebrows. A max long position means that he is betting heavily on Bitcoin’s price to rise. But this isn’t just any ordinary gamble; it’s a multi-billion dollar stake that could potentially shake up the market. The critical aspect here is the liquidation price: if Bitcoin’s price dips below $104,800, Wynn could face liquidation of his investment. This creates a fascinating scenario where market movements could be heavily influenced by Wynn’s investment decisions.

Who is James Wynn? The Hyperliquid Whale

James Wynn isn’t just another name in the crypto space; he’s known as a “whale” for a reason. In financial terms, a whale is an individual or entity that holds a large amount of cryptocurrency, enough to influence market trends and prices. Wynn has made a name for himself through strategic investments and bold moves, and this latest long position on Bitcoin is no exception. But beyond the numbers, Wynn’s confidence in Bitcoin reflects a larger trend in crypto investment, where many believe that Bitcoin is poised for another significant rally.

Why Bitcoin? The Current Market Sentiment

Bitcoin often serves as the bellwether for the entire cryptocurrency market. When Bitcoin performs well, it typically drags other altcoins along for the ride. So, why is Wynn so bullish on Bitcoin right now? The market sentiment appears to be shifting towards optimism, with institutional investors showing renewed interest. Factors such as increased adoption, advancements in blockchain technology, and the potential of Bitcoin as a hedge against inflation are contributing to this bullish sentiment. The fear of missing out (FOMO) is real, and it’s driving many investors to jump on the Bitcoin bandwagon.

Risk Factors: What Happens if Bitcoin Drops?

While the excitement is palpable, it’s essential to consider the risks associated with Wynn’s position. If Bitcoin does drop below that crucial liquidation price of $104,800, it could trigger a wave of selling pressure. Liquidation of such a massive position could lead to a cascading effect, where other traders panic and sell off their holdings, further driving the price down. This scenario could create a volatile environment, and traders need to be prepared for sudden fluctuations.

The Importance of Market Analysis

For those looking to navigate this thrilling yet risky landscape, understanding market analysis is crucial. Keeping an eye on technical indicators, market news, and sentiment can help traders make informed decisions. With the looming possibility of a price drop, tools like stop-loss orders and diversification strategies become essential in protecting investments. Always remember that the cryptocurrency market is highly speculative, and caution is key.

Community Reactions: What Are Traders Saying?

The news of James Wynn’s massive position has sparked lively discussions across social media platforms and forums. Many traders are expressing excitement and optimism, while others are more cautious, wondering if this is a sign of a potential correction. The crypto community is known for its passionate opinions, and this situation is no different. Some see Wynn’s confidence as a green light to invest, while others are waiting to see how the market reacts in the coming days.

Understanding Liquidation: A Closer Look

Liquidation can sound intimidating, especially for those who are new to trading. In simple terms, liquidation occurs when a trader’s position is forcibly closed by the exchange due to insufficient margin to maintain the trade. In Wynn’s case, if Bitcoin’s price falls below $104,800, his position could be liquidated, resulting in a significant loss. For everyday traders, understanding how liquidation works can help in managing risk and crafting effective trading strategies.

Future Price Predictions for Bitcoin

With Wynn’s massive investment and the potential for volatility, many are curious about future price predictions for Bitcoin. Analysts are divided, with some forecasting a bullish trend that could see Bitcoin surpassing its previous all-time highs, while others warn of possible corrections. It’s vital to stay updated with reliable sources and expert analyses to navigate these predictions effectively. Websites like CoinDesk and CoinTelegraph offer insightful market analyses that can be beneficial for traders.

How to Stay Ahead in the Crypto Game

For those looking to thrive in the cryptocurrency landscape, staying informed is crucial. Follow reputable news sources, engage in community discussions, and continuously educate yourself about market trends. Tools like technical analysis and market sentiment indicators can be valuable assets. Additionally, consider diversifying your portfolio to mitigate risks associated with large positions like that of James Wynn.

The Takeaway: What This Means for You

The news surrounding James Wynn’s $1.19 billion long position on Bitcoin is significant not only for him but for the entire crypto community. It showcases the potential for massive gains but also highlights the risks involved. As a trader or investor, understanding the implications of such moves can help you navigate the market effectively. Whether you choose to follow Wynn’s lead or play it safe, staying informed and cautious is essential in this ever-evolving landscape.

In the end, the cryptocurrency world is as exhilarating as it is unpredictable. As Bitcoin continues to capture the attention of whales and retail investors alike, the coming days will be crucial in determining its direction. So, keep your eyes peeled, stay informed, and remember that in the crypto game, knowledge is power!

The Famous Hyperliquid whale, James Wynn, is max long on $BTC with a $1.19 billion position that could potentially get liquidated if the price drops below $104,800.