Breaking news: Major Whale Activity in Ethereum Market

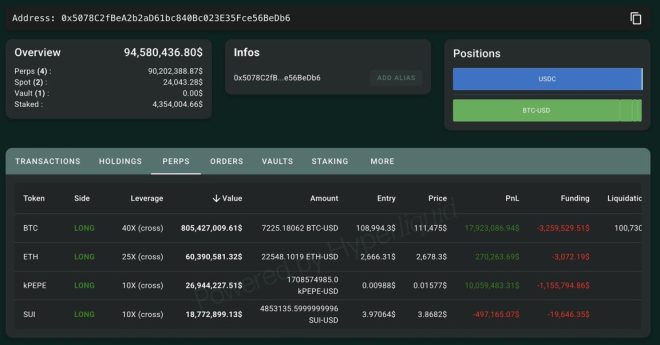

In a significant development within the cryptocurrency landscape, a notable whale has made headlines by opening a massive position in Ethereum (ETH). This whale, known for its strategic trading moves, has just initiated a $60.4 million position with a leverage of 25x at an entry price of $2666.31. This news has sent ripples through the crypto community, prompting discussions about the implications for market trends and potential price movements in the near future.

Understanding Whale Activity in Cryptocurrency

Whales are individuals or entities that hold substantial amounts of cryptocurrency. Their trading decisions can significantly impact market dynamics due to the sheer volume of assets they control. When a whale makes a large move, it often signals confidence in a particular asset, which can influence other traders’ behavior. The recent activity involving a 40X long position demonstrates a bullish sentiment towards Ethereum, indicating that the whale expects the price to rise.

The Impact of Leverage in Crypto Trading

Leverage trading allows investors to borrow funds to increase their position size, amplifying both potential gains and losses. In this case, the whale’s decision to use 25x leverage means that for every dollar invested, they are controlling $25 worth of Ethereum. While this strategy can lead to substantial profits if the market moves in the trader’s favor, it also carries significant risks. A small downturn in Ethereum’s price could lead to considerable losses, potentially triggering a liquidation of the position.

Ethereum’s Current Market Status

Ethereum has been experiencing a fluctuating market status, influenced by various factors, including regulatory developments, technological advancements, and overall market sentiment. As of the whale’s recent trade, Ethereum’s price was recorded at $2666.31. This level is critical, as it serves as both a support and resistance point in technical analyses. Traders and investors alike will be closely monitoring how Ethereum performs in the wake of this large position being opened.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Why This Whale Move Matters

The opening of such a significant position by a whale can be seen as a bullish signal for Ethereum. It suggests that this trader believes that the price of Ethereum will rise in the near future, which could attract more investors to the asset. Additionally, whale activity often leads to increased market volatility, which can present trading opportunities for both seasoned traders and newcomers.

Market Reactions and Speculations

In the wake of this announcement, social media platforms, particularly Twitter, have been abuzz with speculation and analysis. Traders are discussing potential price targets and the implications of this whale’s strategy. Some analysts believe that this move could lead to a rally in Ethereum’s price, while others caution that reliance on whale activity can be risky, as it may not always correlate with broader market trends.

The Role of Technical Analysis

For traders looking to capitalize on this news, technical analysis will play a crucial role. Key levels of support and resistance will be identified as traders seek to understand the potential price movements in Ethereum. The recent price point of $2666.31 will be scrutinized, as breaking through this level could lead to further gains, while a failure to maintain this price may prompt a reevaluation of positions.

Keeping an Eye on Market Sentiment

Market sentiment is a powerful driver of price movements in the cryptocurrency space. The influence of social media and news on trader psychology cannot be underestimated. As more traders become aware of this whale’s position, the sentiment around Ethereum may shift, potentially leading to increased buying activity. Conversely, if the market perceives this move as overly speculative or risky, it could lead to a bearish sentiment.

Conclusion: What Lies Ahead for Ethereum?

The recent whale activity highlights the dynamic nature of the cryptocurrency market and the influence that large players can exert on price movements. For Ethereum, this could be a pivotal moment, with the potential for significant price fluctuations in the near future. As traders and investors watch closely, understanding the implications of leverage, market sentiment, and technical analysis will be essential for navigating the evolving landscape of Ethereum and the broader cryptocurrency market.

By keeping abreast of such developments, traders can make informed decisions while recognizing the inherent risks and rewards associated with cryptocurrency trading. Whether this whale’s move will lead to a bullish trend or serve as a cautionary tale will unfold in the coming days, making it an exciting time for Ethereum enthusiasts and investors alike.

BREAKING

40X LONG WHALE JUST OPENED A $60.4M ETH POSITION WITH 25X LEVERAGE AT AN ENTRY OF $2666.31. pic.twitter.com/epNi3dZzTs

— DustyBC Crypto (@TheDustyBC) May 23, 2025

BREAKING

Crypto markets are always buzzing with activity, and sometimes, big moves grab our attention like nothing else. Recently, a whale trader made waves by opening a massive position in Ethereum (ETH). This move involved a whopping $60.4 million investment, leveraging it 25 times at an entry price of $2666.31. The implications of such a significant bet are worth delving into, especially for those of us watching the cryptocurrency landscape closely.

40X LONG WHALE JUST OPENED A $60.4M ETH POSITION WITH 25X LEVERAGE AT AN ENTRY OF $2666.31.

Whales, or large investors in the crypto space, hold the power to influence market trends significantly. When a whale opens a position like this, it often leads to a ripple effect across the market. The fact that this particular whale opted for a 40X long position indicates a strong belief in the upward momentum of Ethereum’s price. But what does this mean for everyday traders and investors?

The Mechanics of Leverage Trading

To understand the impact of such a position, we first need to grasp what leverage trading is. Leverage allows traders to control a larger position than their initial investment would typically allow. In this case, a 25X leverage means that for every dollar the trader puts in, they can control $25 worth of ETH. This can amplify gains but also comes with increased risk. If the market moves against the position, losses can pile up quickly.

So why would a trader like this whale choose to leverage their position so heavily? It often boils down to a calculated risk. With Ethereum’s historical price movements and upcoming developments within the network, traders see opportunities that they believe can lead to substantial profits.

Market Sentiment and Its Influence

When a whale makes such a significant investment, it can shift market sentiment. Many smaller traders might interpret this move as a signal that ETH is poised for a price surge. This can lead to increased buying pressure, driving the price higher and potentially creating a self-fulfilling prophecy. However, it’s essential to keep in mind that following the whales blindly can be risky. Market dynamics are complex, and what works for a whale may not work for individual traders.

Why Ethereum?

Ethereum has been a favorite among investors, and for good reason. Its smart contract capabilities have opened up numerous possibilities, from decentralized finance (DeFi) to non-fungible tokens (NFTs). As developments continue, including the transition to Ethereum 2.0, which aims to improve scalability and reduce energy consumption, many believe that ETH’s value will only increase over time. This belief is likely part of what motivated the whale to take such a bold position.

What Can We Learn from This Move?

For those of us who are not whales but still want to navigate the crypto waters, this situation offers valuable lessons. First, it highlights the importance of understanding market signals. Monitoring large trades can provide insights into potential price movements. However, it’s crucial to conduct your own research and not rely solely on the actions of larger players.

Secondly, it emphasizes the risks associated with leverage trading. While the potential for high returns is tempting, the risk of significant losses is equally present. Always consider your risk tolerance and financial situation before diving into leveraged positions.

Future Implications of the Whale’s Move

This whale’s $60.4 million ETH position could set the tone for future market movements. Should Ethereum’s price rise as the whale anticipates, it could encourage more buying from retail investors, further pushing the price up. Conversely, if the market takes a downturn, it could create panic selling, leading to a sharp drop in prices. This volatility is typical in the crypto space, making it crucial for investors to stay informed and ready to act.

Keeping an Eye on the Market

In the world of cryptocurrencies, staying updated is vital. Following reputable sources on social media platforms like Twitter can provide real-time insights into market movements. The original announcement of this whale trade came from [DustyBC Crypto](https://twitter.com/TheDustyBC/status/1925806818816582104), showcasing how social media plays a crucial role in disseminating information quickly. Engaging with the community and participating in discussions can also offer different perspectives on market trends.

The Role of Technology and Tools

For those looking to capitalize on market movements, utilizing trading platforms that provide advanced tools and analytics is essential. Many platforms offer features like real-time price tracking, market analysis, and even alerts for significant trades. Taking advantage of these tools can enhance your trading strategy and help you make informed decisions.

Conclusion: A Time for Caution and Opportunity

While the whale’s massive $60.4 million ETH position reflects confidence in Ethereum’s potential, it’s crucial for individual traders to approach the market with a mix of caution and optimism. The crypto landscape can change rapidly, and what seems like a guaranteed opportunity can turn sour in an instant. Do your research, stay informed, and never invest more than you can afford to lose. As we watch how this whale’s move unfolds, let’s remember that in the world of crypto, knowledge and strategy are your best allies.

40X LONG WHALE JUST OPENED A $60.4M ETH POSITION WITH 25X LEVERAGE AT AN ENTRY OF $2666.31.