Summary of Donald trump‘s Threat to Apple Over Tariffs

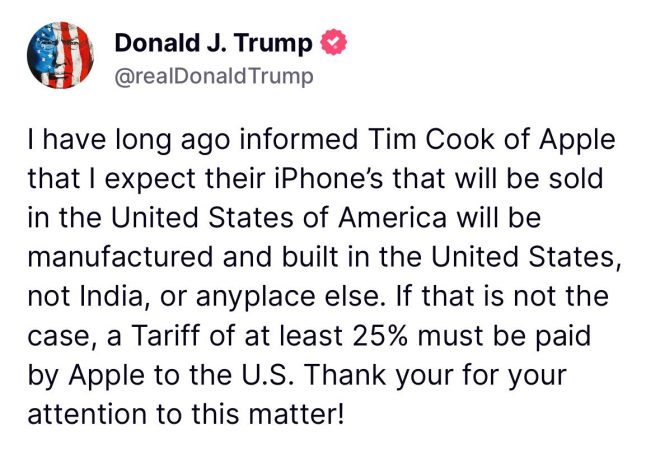

On May 23, 2025, former US President Donald Trump issued a stern warning directed at Apple, the tech giant known for its innovative products, including the iPhone. In a tweet, Trump threatened to impose an additional 25% tariff on Apple if the company did not cease its manufacturing operations in India and other countries. This statement highlights the ongoing tensions between the United States and multinational corporations regarding manufacturing practices and the impact on the American economy.

The Context of Trump’s Threat

Trump’s remarks come amid a broader dialogue about the importance of domestic manufacturing and the need for American companies to prioritize production within the United States. His administration had previously introduced tariffs on various imports as a strategy to protect American jobs and industries. By threatening Apple, Trump is tapping into a larger narrative about manufacturing jobs being outsourced overseas, which has been a significant concern for many Americans.

The Implications for Apple

Apple, known for its global supply chain, has increasingly shifted some of its manufacturing to countries like India as part of its strategy to diversify its production capabilities. This move is partly in response to the tariffs imposed during Trump’s presidency, which made manufacturing in China more costly. However, Trump’s renewed threat poses a dilemma for Apple, which has to balance between optimizing costs and maintaining a favorable relationship with the US government.

If Trump follows through on his threat, a 25% tariff could significantly increase the cost of iPhones and other Apple products sold in the United States, potentially leading to higher prices for consumers. This situation could also prompt Apple to reconsider its manufacturing strategies and possibly bring some production back to the US, which could create jobs but also increase operational costs.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Economic Impact and Consumer Response

The potential tariff increase could have far-reaching implications not only for Apple but also for the wider tech industry and American consumers. Higher prices on iPhones could lead to decreased sales, impacting Apple’s revenue and ultimately affecting its stock prices. Consumers may respond by seeking alternative products, which could provide opportunities for competitors in the smartphone market.

Moreover, the threat of tariffs could lead to a ripple effect across various sectors that rely on Apple’s technology and innovations. Suppliers and other businesses that partner with Apple may also face challenges if the company decides to adjust its manufacturing strategies in response to the tariffs.

The Broader Trade Landscape

Trump’s comments come at a time when the global trade landscape is increasingly complex. The US has been engaged in trade negotiations with multiple countries, and tariffs have become a common tool used by governments to exert economic pressure. The relationship between the US and China, in particular, remains tense, and any actions taken against Apple could be seen as part of a broader strategy to assert American interests in global trade.

As manufacturers like Apple navigate these turbulent waters, they must consider not only the financial implications of tariffs but also the potential impact on their brand image and reputation. Consumers are becoming more conscious of where products are made and the ethical implications of outsourcing manufacturing.

Conclusion

Donald Trump’s recent threat to impose a 25% tariff on Apple if the company continues its manufacturing operations outside the United States underscores the ongoing debate about domestic manufacturing and trade policies. As Apple weighs its options, the potential economic consequences could reverberate throughout the tech industry and impact consumers directly. This situation highlights the importance of understanding the intricate relationship between government policy, corporate strategy, and consumer behavior in today’s global economy.

The looming question remains: How will Apple respond to this ultimatum, and what will be the long-term effects on the company and the broader economic landscape? As these developments unfold, stakeholders across the board will need to closely monitor the situation, as it may set important precedents for future trade relations and manufacturing practices in the tech industry.

#BREAKING: US President Donald Trump threatens fresh 25% tariffs on @Apple if they do not stop manufacturing IPhones “in India or anyplace else”. pic.twitter.com/qLkc8YWJCd

— Aditya Raj Kaul (@AdityaRajKaul) May 23, 2025

BREAKING: US President Donald Trump threatens fresh 25% tariffs on @Apple if they do not stop manufacturing IPhones “in India or anyplace else”

In the world of tech and politics, few things can stir up a storm like the potential for new tariffs. Recently, US President Donald Trump has thrown down the gauntlet, threatening Apple with a hefty 25% tariff if they continue manufacturing iPhones outside the United States, particularly in India. This bold move has sent shockwaves through the technology sector and has raised questions about the future of manufacturing, trade relationships, and the impact on consumers.

The Context Behind the Tariff Threat

Understanding the backdrop to this tariff threat requires a look at America’s growing concerns about outsourcing. Over the years, many tech giants, including Apple, have shifted a significant portion of their production overseas. India, with its burgeoning manufacturing capabilities and cost-effective labor, has become a hotspot for companies looking to cut costs. However, this has also led to the loss of jobs in the US, prompting a backlash from politicians and the public alike.

Trump’s administration has been vocal about prioritizing American jobs and manufacturing. His threat to impose a 25% tariff on Apple is not just about the iPhones themselves; it’s a broader message about American manufacturing and the need to keep jobs at home. With the recent trend of companies relocating their production lines to countries like India, this tariff could be a way to push back against that trend.

What Does This Mean for Apple?

For Apple, this situation is far from trivial. The company has spent years building its supply chain and manufacturing operations abroad, particularly in Asia. If Trump’s tariffs are implemented, the financial implications for Apple could be substantial. A 25% tariff would significantly increase the cost of iPhones imported back to the US, potentially leading to higher prices for consumers.

Additionally, Apple’s reputation as a premium brand could be put at risk if prices rise too sharply, prompting customers to consider alternatives. The company has always prided itself on providing high-quality products, but if those products become too expensive, loyal customers might look elsewhere.

The Consumer Impact

When it comes to tariffs, the ultimate burden often falls on consumers. If Apple is forced to raise prices to accommodate the additional 25% tariff, the average consumer could end up paying significantly more for their beloved iPhones. This could lead to a ripple effect across the tech industry, as competitors may also raise prices in response.

Moreover, the timing couldn’t be worse for consumers. As the economy continues to navigate the aftermath of the pandemic, many people are already feeling the pinch. An increase in iPhone prices could discourage consumers from upgrading their devices, impacting Apple’s sales and overall market performance.

Global Supply Chains at Risk

This tariff threat also brings to light the fragility of global supply chains. Companies like Apple rely on a vast network of suppliers and manufacturers across the globe. If these tariffs are enforced, it could force Apple and others to rethink their supply chain strategies entirely.

Some analysts suggest that Apple might be pushed to bring some manufacturing back to the US, which could be a long and costly process. Not only would this require significant investment in infrastructure, but it would also necessitate a skilled workforce that is currently not available in the numbers needed.

Furthermore, the potential for retaliatory tariffs from other countries could escalate the situation into a full-blown trade war. If countries like India were to respond with their own tariffs on American goods, it could further complicate the landscape for global trade and manufacturing.

The Broader Economic Implications

This isn’t just about Apple. The implications of Trump’s threat reach far beyond just one company. Tariffs can significantly impact the broader economic landscape, influencing everything from inflation rates to employment levels. If consumers are forced to pay more for technology, it could lead to decreased spending in other areas, ultimately slowing down economic recovery.

Moreover, this situation highlights the ongoing debate about trade policies and their effectiveness. Critics of tariffs argue that they often lead to negative outcomes, such as increased prices for consumers and strained international relationships.

On the flip side, proponents believe that tariffs can protect domestic industries and jobs. The challenge lies in finding a balance that protects American interests without creating undue hardship for consumers or damaging relationships with trading partners.

How Will Apple Respond?

As we await Apple’s response to this tariff threat, many are left wondering how the tech giant will navigate these turbulent waters. Historically, Apple has been adept at managing its supply chain and adapting to changes in trade policies.

It’s likely that the company will explore multiple avenues to mitigate the impact of these tariffs. This could include negotiating with the US government for exemptions or working to shift more production back to the United States. Apple may also look to innovative solutions, such as investing in automation and advanced manufacturing technologies to reduce costs.

The Future of Manufacturing in the US

One of the significant takeaways from this situation is the ongoing discussion about the future of manufacturing in the United States. With increasing pressures to bring jobs back home, companies will need to consider how they can adapt their strategies to align with domestic priorities.

Investing in American manufacturing could not only create jobs but also strengthen the economy. However, it poses challenges, including higher labor costs and the need for skilled workers.

The question remains: will companies like Apple rise to the occasion and invest in American manufacturing, or will the lure of lower costs overseas continue to dominate their decision-making?

Final Thoughts

The threat of a 25% tariff on Apple for manufacturing iPhones outside the US is a significant moment in the ongoing dialogue about trade, manufacturing, and consumer impact. As we watch how this situation unfolds, it’s essential to consider the broader implications for the economy, consumers, and international relationships.

In a rapidly changing global landscape, companies must be agile and responsive to new challenges. Whether this leads to a shift in manufacturing back to the US remains to be seen, but one thing is clear: the conversation about tariffs and trade is far from over. The outcome will shape not only the future of Apple but potentially the broader tech industry and the American economy as a whole.