Potential Taxation of Harvard’s Endowment by the trump Administration

In a recent announcement, U.S. Treasury Secretary Scott Bessent revealed that the Trump Administration is considering the possibility of imposing taxes on the endowments of elite universities, specifically targeting Harvard University. This declaration has sparked significant conversations around the role of large university endowments in the current economic landscape and the implications of taxation on these substantial financial reserves.

Understanding University Endowments

University endowments consist of funds that institutions receive through donations, which are then invested to generate income. These endowments often amount to billions of dollars, providing universities with financial stability and the ability to fund scholarships, research, and campus improvements. Harvard University, being one of the wealthiest educational institutions, boasts an endowment exceeding $40 billion. This financial prowess raises critical questions about the responsibilities of such institutions, especially in terms of their tax obligations.

The Rationale Behind Taxing Endowments

The Trump Administration’s exploration into taxing university endowments stems from various factors:

- Equity in Taxation: Many argue that wealthy institutions should contribute to the tax system similarly to other sectors. The thought is that if private individuals and businesses are subject to taxes, so too should affluent universities that hold substantial financial resources.

- Access and Affordability: Critics of elite universities often point out that despite their vast resources, tuition rates remain high. Taxing endowments could potentially prompt universities to allocate more funds toward financial aid, thereby increasing accessibility for students from diverse economic backgrounds.

- Public Funding: Universities receive considerable public funding and benefits, including tax-exempt status. There is a growing sentiment that this status should come with obligations, such as contributing to the public good through taxes.

The Implications of Taxing Endowments

Imposing taxes on university endowments could have several ramifications:

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

- Funding for Programs and Initiatives: If universities are taxed, they may need to adjust their financial strategies. This could lead to reduced funding for various programs or increased tuition to offset the loss of revenue.

- Impact on Donors: A tax on endowments may deter potential donors who may feel their contributions are being taxed or diminished by such policies. The resulting decrease in donations could negatively impact university programs.

- Legal Challenges: Universities may challenge any new tax legislation, arguing that it violates their tax-exempt status. This could lead to protracted legal battles that distract from educational missions.

The Political Landscape

The announcement by Secretary Bessent aligns with broader republican sentiments regarding reducing the influence of elite institutions and promoting a more equitable tax system. This move may be seen as part of a larger strategy to appeal to middle-class families concerned about rising tuition costs and the perceived disconnect of elite universities from everyday economic realities.

The Response from Educational Institutions

In reaction to the announcement, Harvard University and other institutions may respond defensively. They are likely to argue that their endowment investments directly benefit society through research, scholarships, and community programs. They may also highlight the contributions they make to the economy, such as job creation and innovation.

Broader Economic Context

The consideration of taxing university endowments comes at a time of significant economic scrutiny in the U.S. The COVID-19 pandemic has exacerbated economic disparities, leading to renewed calls for accountability among the wealthiest sectors. By targeting university endowments, the Trump Administration may aim to address these disparities and foster a sense of fairness in taxation.

Public Opinion on University Endowments

Public sentiment regarding university endowments is mixed. Some advocate for the taxation of these funds, viewing it as a necessary step toward equity and accountability. Others defend the tax-exempt status of universities, arguing that these institutions contribute significantly to society and innovation, justifying their financial reserves. The discourse surrounding this topic is likely to evolve, especially as economic conditions change.

Conclusion

The Trump Administration’s consideration of taxing Harvard’s endowment reflects ongoing discussions about wealth distribution and the roles that elite institutions play in society. As this dialogue unfolds, stakeholders from various sectors, including policymakers, educators, students, and the public, will need to engage in thoughtful discussions about the implications of such taxation. The potential changes could significantly impact higher education funding, accessibility, and the responsibilities of affluent universities in the United States.

This announcement serves as a critical reminder of the complex relationship between education, taxation, and public accountability in a rapidly evolving economic landscape. The outcomes of these discussions may shape the future of not only Harvard but also other institutions with substantial endowments, influencing how they operate and serve their communities in the years to come.

In summary, the Trump Administration’s exploration into taxing university endowments, particularly Harvard’s, raises essential questions about financial equity and the role of elite educational institutions. As conversations progress, it will be important to consider the broader implications for education and society.

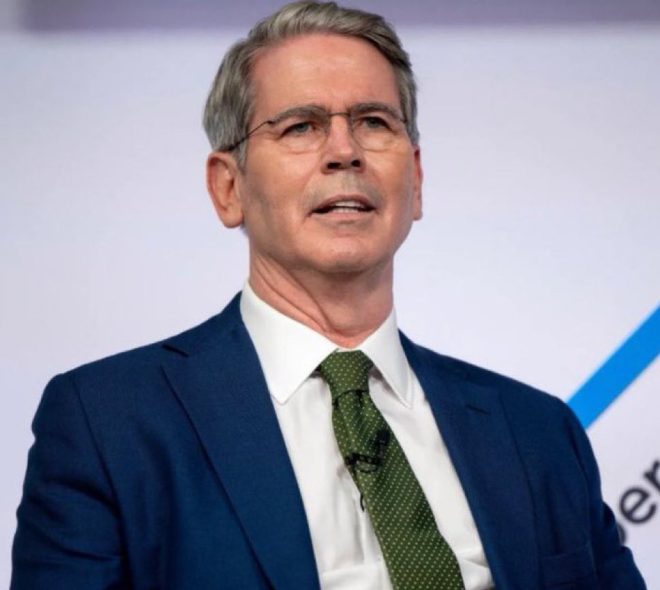

JUST IN: Treasury Secretary Scott Bessent announces that the Trump Administration is looking into taxing Harvard’s endowments. pic.twitter.com/87KnqVfKBk

— Ian Jaeger (@IanJaeger29) May 23, 2025

JUST IN: Treasury Secretary Scott Bessent Announces That the Trump Administration is Looking into Taxing Harvard’s Endowments

When you think of prestigious universities, Harvard often comes to mind. Not only is it renowned for its academic excellence, but it also boasts a jaw-dropping endowment that surpasses many countries’ GDPs. Recently, Treasury Secretary Scott Bessent made headlines by stating that the Trump Administration is considering taxing Harvard’s endowments. This announcement has stirred up quite a conversation, and it’s essential to unpack what this could mean for the university and similar institutions.

Why Tax Harvard’s Endowments?

The idea of taxing Harvard’s endowment raises several intriguing questions. Why would the government target such a wealthy institution? Well, endowments are essentially large sums of money that universities manage to fund scholarships, research, and various programs. Harvard’s endowment is currently one of the largest in the world, valued at over $40 billion. Critics argue that such immense wealth should be taxed to support public services or help alleviate student debt.

Some people feel that universities, especially those with substantial endowments like Harvard, should contribute more to society, particularly when many students struggle to afford tuition. This perspective aligns with a broader national discussion about wealth distribution and the responsibility of wealthy institutions.

The Implications of Taxing Endowments

If the Trump Administration decides to move forward with taxing Harvard’s endowments, it could set a precedent for other universities. Institutions across the U.S. would have to reevaluate their financial strategies and consider how to manage their endowments more efficiently. The potential tax could affect how universities allocate funds for scholarships, research initiatives, and campus improvements.

Moreover, it raises the question of fairness. Should universities be treated like any other business when it comes to taxes? Or do they serve a unique role in society that warrants special consideration? As these discussions unfold, university leaders will likely have to engage in dialogue with policymakers to advocate for their institutions and the students they serve.

Reactions from the Higher Education Community

The announcement from Secretary Bessent has elicited a flurry of reactions from the higher education community. Many university presidents and administrators are concerned about the potential impacts of such a tax. They argue that taxing endowments could inhibit their ability to provide financial aid and maintain academic programs, ultimately harming students.

On the flip side, some advocates argue that universities have a moral obligation to use their endowments more effectively to support students and communities. They believe that if a tax encourages universities to spend down their endowments more judiciously, it could benefit society in the long run.

The debate is complex, as it touches on financial responsibility, educational access, and societal expectations of wealthy institutions.

What This Means for Students

For students, the potential taxation of endowments could have mixed implications. On one hand, if universities are compelled to spend more of their endowments on scholarships or financial aid due to increased scrutiny, this could make higher education more accessible for many. On the other hand, if universities feel financially strained due to taxation, they may have to increase tuition or cut programs, which could negatively impact the student experience.

The uncertainty surrounding this issue might also create anxiety among current and prospective students. Many are already grappling with rising tuition costs and student debt, and any further complications could exacerbate these challenges.

Historical Context of University Endowments

Understanding the context of university endowments is crucial in this discussion. Endowments have become increasingly important for universities over the past few decades. They provide a source of financial stability and allow institutions to invest in long-term projects and initiatives. However, the significant growth of endowments has also led to scrutiny regarding their management and allocation.

Historically, universities have faced pressure to demonstrate their value to society. The rise of student activism and public discourse around higher education affordability has intensified calls for transparency in how endowments are used. Taxation could be seen as a tool for accountability, compelling universities to justify their financial decisions in light of their societal responsibilities.

Comparative Analysis: Other Institutions and Their Endowments

Harvard is not the only institution under the microscope when it comes to endowments. Other elite universities, such as Yale and Stanford, also manage vast endowments, and similar discussions could arise about their tax status. The potential for a broader tax on university endowments could galvanize a movement toward greater financial accountability across the education sector.

This situation highlights the disparity between wealth among universities. While some institutions amass billions in endowments, others struggle to secure basic funding. As the government considers taxing endowments, it may also need to look at how to support underfunded institutions to ensure a more equitable education landscape.

The Political Landscape Surrounding the Announcement

The political implications of taxing Harvard’s endowments are significant. The Trump Administration’s move could be seen as a populist gesture aimed at addressing concerns about wealth inequality. By targeting one of the wealthiest institutions, the government might be attempting to resonate with everyday Americans who feel the squeeze of economic disparity.

However, such a move could also face pushback from political opponents who argue that it could hinder educational advancement and innovation. The discussion surrounding this issue is likely to evolve as different political figures weigh in, and it could influence broader tax policy discussions in the future.

Future Considerations and the Role of Policy

As this conversation develops, policymakers will need to consider the long-term implications of taxing university endowments. It’s essential to strike a balance between holding institutions accountable and ensuring they can continue to serve their educational missions effectively.

While taxing Harvard’s endowments might seem straightforward, the reality is much more complex. The implications for students, faculty, and the broader society need careful consideration. Policymakers must also look at the potential ripple effects on the higher education landscape and the long-term sustainability of institutions.

In the coming months, as discussions heat up, it will be fascinating to see how universities respond and what changes, if any, come from this announcement. Will Harvard and similar institutions change their financial practices, or will they resist the pressure? The future of higher education funding may hinge on the outcomes of this ongoing dialogue.

Engaging with the Community

As this situation unfolds, it’s crucial for everyone—students, parents, educators, and policymakers—to engage in the conversation. Understanding the implications of taxing university endowments can lead to more informed discussions about higher education funding and access. It’s a topic that affects us all, and staying informed allows us to advocate for the future of education effectively.

If you want to stay updated on this issue, follow trusted news sources and engage with community discussions. The policies that emerge from this conversation will shape the educational landscape for years to come, and your voice matters in this important dialogue.