President trump‘s Tariff Announcement on Apple iPhones

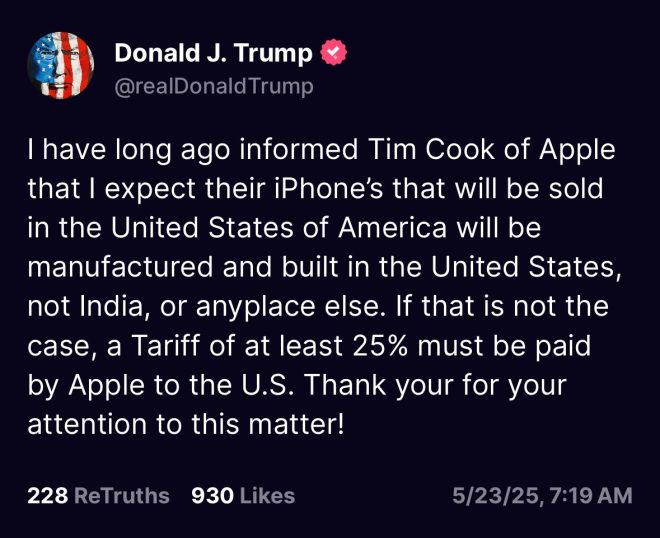

In a significant development in U.S. trade policy, President Donald Trump recently announced that any iPhones sold in the United States by Apple Inc. (NASDAQ: AAPL) must be manufactured domestically. This bold move comes with the threat of imposing a tariff of "at least 25%" on any iPhones that do not meet this requirement. This announcement, made on May 23, 2025, has sparked widespread discussion and analysis regarding its implications for Apple, the tech industry, and the broader economic landscape.

The Implications of Manufacturing iPhones in the U.S.

Economic Impact

The requirement for Apple to manufacture iPhones in the United States could have far-reaching economic implications. On one hand, it could lead to job creation within the U.S. as Apple would need to establish or expand manufacturing facilities. This could provide a boost to local economies and increase employment opportunities in the tech sector.

However, the shift in manufacturing could also lead to increased production costs. Apple has historically relied on overseas manufacturing, particularly in countries like China, where labor costs are significantly lower. If Apple were to relocate its manufacturing to the U.S., the company might be forced to raise prices on its products to maintain profit margins. This could result in higher retail prices for consumers, potentially affecting sales and market share.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Supply Chain Considerations

Manufacturing iPhones in the U.S. would also require a reevaluation of Apple’s supply chain. The tech giant relies on a complex network of suppliers and manufacturers to produce the components that make up its devices. Many of these suppliers are based in Asia, and relocating manufacturing to the U.S. could disrupt existing supply chains.

Apple would need to consider whether U.S.-based suppliers could meet the demand for components like semiconductors, screens, and batteries. Establishing a robust domestic supply chain could take time and investment, which may further complicate the transition.

Legal and Trade Challenges

Compliance with Domestic Manufacturing

President Trump’s announcement raises questions about the legal framework governing tariffs and trade. The requirement for domestic manufacturing might face challenges regarding its enforceability. Companies like Apple are accustomed to operating in a global market, and any abrupt shifts could lead to legal disputes or pushback from industry advocacy groups.

Additionally, the move could provoke retaliatory measures from other countries, particularly China, where Apple has significant market presence and manufacturing capabilities. This could escalate trade tensions and lead to a broader trade war, impacting not just Apple but other companies reliant on global supply chains.

Consumer Response

The response from consumers will also be pivotal. If consumers perceive price increases as a result of the tariff, they may seek alternatives or delay their purchases. Consumer sentiment can significantly influence Apple’s sales performance, and any shift in brand loyalty could have lasting effects on the company’s market position.

The Future of Apple and U.S. Manufacturing

Strategic Adaptations

In light of these developments, Apple will need to adapt its business strategy to align with the new regulatory environment. This may include investing in new manufacturing facilities within the U.S., exploring automation technologies to reduce labor costs, and forging partnerships with local suppliers.

Apple has long positioned itself as a leader in innovation, and this scenario presents an opportunity for the company to showcase its commitment to U.S. manufacturing. By promoting its products as "Made in America," Apple could enhance its brand image and appeal to consumers who prioritize domestic production and job creation.

Industry Reactions

The tech industry as a whole will be watching closely to see how Apple responds to these challenges. Other companies may be prompted to reevaluate their own supply chains and manufacturing strategies in anticipation of similar regulatory pressures. This could lead to a broader shift in the tech industry’s approach to globalization and domestic manufacturing.

Conclusion

President Trump’s announcement regarding tariffs on iPhones has set the stage for a complex interplay of economic, legal, and consumer dynamics. While the prospect of manufacturing iPhones in the U.S. could lead to job creation and bolster the domestic economy, it also presents significant challenges for Apple and the tech industry.

As the situation evolves, stakeholders will need to navigate the intricacies of trade policy, consumer behavior, and supply chain logistics. The outcome of this initiative could redefine the landscape of smartphone manufacturing and influence the future of U.S. trade relations.

In summary, the announcement serves as a reminder of the interconnectedness of global markets and the challenges that arise when national policy intersects with multinational corporations. With careful planning and strategic execution, Apple may find a way to adapt to this new reality while continuing to innovate and lead in the competitive tech marketplace.

BREAKING: President Trump says any iPhones that Apple, $AAPL, sells in the US must be built in the US or they will face a tariff of “at least 25%.” pic.twitter.com/wzhM2dvcTZ

— The Kobeissi Letter (@KobeissiLetter) May 23, 2025

BREAKING: President Trump says any iPhones that Apple, $AAPL, sells in the US must be built in the US or they will face a tariff of “at least 25%.”

When it comes to tech and politics, nothing seems to stir the pot quite like a statement from former President Donald Trump. Recently, he made headlines with a bold proclamation: any iPhones that Apple, the tech giant known for its sleek devices and innovative technology, sells in the United States must be manufactured domestically. If they aren’t, these products could face a hefty tariff of at least 25%. This announcement has sparked a flurry of conversations and debates across social media and news outlets, and for good reason.

Apple’s manufacturing practices have been a hot topic for years. The company has built a reputation for quality and innovation, but a significant portion of its production takes place overseas. So, what does this new tariff threat mean for Apple, consumers, and the broader tech industry? Let’s break it down.

Understanding the Tariff Implications

Tariffs are taxes imposed on imported goods, and they can significantly influence the pricing and availability of products. Trump’s assertion that iPhones must be built in the US or face a 25% tariff is a game-changer. For consumers, this could mean higher prices. If Apple decides to pass on the costs associated with tariffs to buyers, we could see the price of the latest iPhone models skyrocket.

Moreover, this move could also disrupt Apple’s supply chain. The company relies on a vast network of suppliers and manufacturers, many of which are located in countries like China. Shifting production to the US is no small feat and would require substantial investment in factories, equipment, and labor. Apple would need to navigate various challenges, such as sourcing materials and ensuring a skilled workforce is available to meet production demands.

The Potential Impact on Jobs and the Economy

One of the primary arguments in favor of manufacturing more products domestically is job creation. Bringing iPhone production back to the US could potentially create thousands of jobs in factories and related industries. This could boost local economies, especially in areas that have seen manufacturing jobs decline over the years.

However, the transition wouldn’t be without its hurdles. The cost of labor in the US is typically higher than in countries like China, which could lead Apple to reconsider how it approaches pricing and production. If the cost of producing iPhones in the US is prohibitive, Apple may opt to reduce its workforce or even explore alternative strategies to maintain profitability.

Apple’s Response to the Tariff Threat

So, how is Apple responding to this bold statement from Trump? The tech giant has historically been tight-lipped about political matters, focusing instead on its products and customer experience. However, in light of this potential tariff, they may need to reevaluate their strategy.

Apple’s leadership might engage in discussions with government officials to negotiate terms that could be more favorable for the company. They could also explore ways to increase the percentage of products that are manufactured in the US, albeit gradually. In the past, Apple has made commitments to invest in US manufacturing, as seen in their recent investments in new facilities and projects.

Additionally, consumers can expect to hear more from Apple in the coming months as the situation develops. Transparency around pricing and production will be essential for maintaining customer trust, especially if prices rise significantly due to tariffs.

The Consumer Perspective

As consumers, we often find ourselves at the mercy of market forces, and this situation is no different. If tariffs on imported iPhones lead to increased prices, many people may reconsider their purchasing decisions. For those who are loyal to the Apple brand, this could be a tough pill to swallow.

Furthermore, the possibility of a price hike could create a ripple effect in the smartphone market. Competitors like Samsung and Google might see an uptick in sales as consumers look for more affordable alternatives. This could ultimately reshape the competitive landscape in the tech industry, forcing companies to adapt to changing consumer preferences and economic conditions.

The Bigger Picture: National Security and Economic Policy

The move to impose tariffs on imported goods like iPhones isn’t just about economics; it’s also about national security. The U.S. government has increasingly emphasized the importance of reducing dependence on foreign suppliers for critical technologies. By encouraging domestic manufacturing, officials hope to create a more self-sufficient economy that can withstand global disruptions.

This mindset reflects a broader trend in economic policy that seeks to prioritize American manufacturing and innovation. While this approach has its supporters, it also raises questions about the feasibility of such a dramatic shift in production practices.

Global Reactions to the Announcement

The international community is closely watching the developments surrounding this tariff threat. Countries that host Apple’s manufacturing operations are likely feeling the pressure as they assess the potential fallout. China, which has long been a manufacturing hub for the tech industry, may react with its own policies in response to the tariffs.

Investors are also reacting to the news. Stocks related to Apple and the broader tech sector could face volatility as market participants weigh the implications of higher production costs and potential consumer pushback. Keeping an eye on the stock performance of Apple, identifiable by its stock ticker $AAPL, will be crucial in the coming weeks as this situation unfolds.

The Future of iPhones in the US Market

With all of this in mind, what does the future hold for iPhones in the US market? The landscape is certainly shifting, and Apple will need to navigate this terrain carefully. There’s a strong possibility that the company will invest in boosting production capabilities within the US, but it will take time to establish a robust manufacturing operation.

As consumers, we should stay informed about how these changes may impact our wallets and purchasing decisions. Being aware of market shifts will help us make more informed choices when it comes to technology.

In the meantime, the conversation around tariffs, manufacturing, and the tech industry will continue to evolve. Whether you’re an Apple enthusiast or simply someone interested in the intersection of technology and policy, this situation is worth watching closely.

In summary, President Trump’s announcement about iPhones and tariffs represents a significant moment in the ongoing dialogue surrounding domestic manufacturing, trade, and consumer prices. The ramifications of this statement will likely ripple through the tech industry and beyond, impacting everything from job creation to pricing strategies. Keep your eyes peeled for what comes next in this unfolding story!

Breaking News, Cause of death, Obituary, Today