Trump’s Tariff Threat and Its Economic Implications

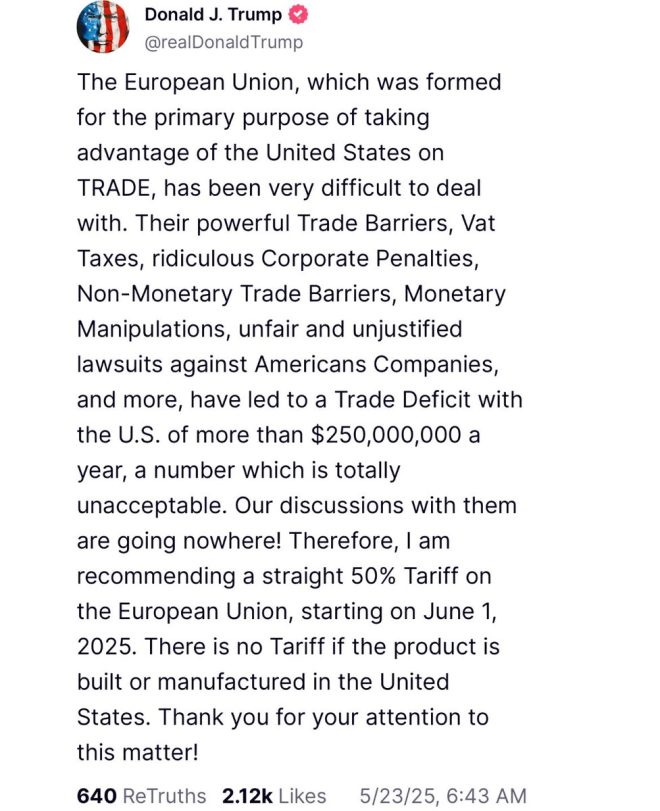

In recent news, former President Donald trump made headlines with his announcement of a potential 50% tariff on goods imported from the European Union (EU). This bold move is a direct reaction to the EU’s recent agreement to sign a minerals deal with Greenland, a territory that is rich in natural resources. The implications of such a tariff could be significant, not only for transatlantic trade relations but also for the broader global economy.

The Context of Trump’s Tariff Threat

The backdrop to Trump’s tariff threat involves a complex interplay of international trade dynamics. The EU’s deal with Greenland is seen as an attempt to bolster its raw materials supply chain in the face of increasing global competition. This agreement has reportedly angered Trump, who views it as a strategic threat to U.S. interests, especially in the context of the ongoing geopolitical tensions with China and other nations.

Trump’s administration has historically favored protectionist policies, arguing that they are necessary to protect American jobs and industries. However, the implementation of a 50% tariff could have adverse effects, including rising prices for consumers and potential retaliation from the EU, which may escalate into a trade war.

The Stock Market Reaction

As Trump’s tariff threat was announced, the stock market reacted negatively, leading to a significant downturn. Investors often perceive tariff threats as a sign of increasing uncertainty in the market, which can lead to volatility. This situation has raised questions about the effectiveness of Trump’s economic policies, especially among his critics who argue that his approach may be detrimental to economic stability.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Bill Madden, a prominent sports columnist and commentator, expressed his concerns on Twitter, suggesting that those who still believe that Trump is beneficial for the economy might be out of touch with economic realities. His comments highlight the growing divide in public opinion regarding Trump’s economic legacy and its implications for the future.

Economic Perspectives on Tariffs

Economists have long debated the effectiveness of tariffs as a tool for protecting domestic industries. While tariffs can provide temporary relief to certain sectors, they often lead to higher prices for consumers and strained relations with trade partners. The potential for a 50% tariff on EU goods raises questions about the long-term viability of such an approach, especially given the interconnectedness of the global economy.

The potential fallout from Trump’s tariff threat could extend beyond the immediate impact on the stock market. Supply chains that rely on imports from the EU may face disruptions, leading to production delays and increased costs for American companies. This could ultimately translate into higher prices for consumers, counteracting any short-term benefits that might arise from protecting specific industries.

The Role of Public Perception

Public perception plays a crucial role in shaping economic policy and its outcomes. As seen in Madden’s comments, there is a growing skepticism about Trump’s ability to manage economic challenges effectively. The narrative that Trump’s policies are beneficial for the economy is being increasingly questioned, particularly in light of recent market fluctuations and rising tensions with international partners.

For many, the idea that Trump’s administration could be "good for the economy" has become a polarizing topic. Supporters argue that tax cuts and deregulation have spurred growth, while detractors contend that these policies disproportionately benefit the wealthy and create instability in the long run. The current tariff threat adds another layer to this debate, as it could impact various sectors differently, further complicating the public’s understanding of what constitutes a healthy economy.

Conclusion: Navigating Economic Uncertainty

As the situation surrounding Trump’s tariff threat continues to evolve, it is essential for stakeholders, including businesses and consumers, to remain informed about the potential implications. The interconnected nature of the global economy means that decisions made in one part of the world can have far-reaching consequences.

The ongoing discourse about Trump’s economic policies underscores the complexity of navigating economic uncertainty in a rapidly changing global landscape. Policymakers must carefully weigh the potential benefits of protective measures against the risks of retaliation and market instability. Ultimately, the true impact of Trump’s tariff threat on the economy will depend on the responses from both the EU and the broader market, highlighting the importance of diplomacy and cooperation in international trade relations.

As the situation unfolds, it will be crucial for analysts and commentators to continue monitoring developments, providing insights that can help inform public opinion and guide future economic policy.

Trump’s 50% tariff threat on the EU is a direct response to the EU signing a minerals deal with Greenland. Meanwhile, the stock market is once agan tanking. If you are one of the idiots who is still of the opinion that Trump is good for the economy, then you might be in a cult. pic.twitter.com/7e0BexZolo

— Bill Madden (@maddenifico) May 23, 2025

Trump’s 50% Tariff Threat on the EU: A Complex Economic Response

When we think about tariffs, especially ones as steep as Trump’s 50% threat on the EU, it’s essential to understand the bigger picture. This specific tariff threat is not just a standalone event but a complex reaction to the EU signing a minerals deal with Greenland. If you’re scratching your head and wondering how these pieces fit together, you’re not alone. The global economy can sometimes feel like a tangled web, and understanding the motivations behind tariff policies can help clarify why markets react the way they do.

In this scenario, Trump’s proposed tariffs are seen by many as a tactical maneuver aimed at asserting economic dominance in response to international agreements. The backdrop of this situation is the ongoing tension surrounding trade relationships and resource allocation. With the EU establishing a minerals deal with Greenland, it raises questions about resource control and economic competition, prompting a strong response from the U.S. administration.

Understanding the EU’s Deal with Greenland

The minerals deal between the EU and Greenland is significant for multiple reasons. First, Greenland is rich in natural resources, including rare earth minerals essential for various technologies, from smartphones to electric vehicles. The EU’s decision to engage in this deal might be viewed as a strategic move to secure its supply chains and reduce dependency on other sources, particularly China, which currently dominates the market for these vital resources.

By securing a partnership with Greenland, the EU could potentially strengthen its economic position and technology sector. This is where Trump’s tariff threat comes into play. The U.S. government, particularly under Trump’s administration, has often adopted a protectionist stance, believing that such measures can safeguard American jobs and industries. The idea is that by imposing hefty tariffs, it would discourage European companies from engaging with Greenland, thereby protecting U.S. interests.

The Stock Market’s Reaction: A Telling Indicator

As the news of Trump’s tariff threat spread, the stock market began to react negatively. This isn’t surprising. Tariffs can create uncertainty in the market, leading to volatility as investors scramble to reassess their positions in light of new economic realities. When you throw a 50% tariff into the mix, it raises alarm bells about potential trade wars, increased costs for consumers, and a slowdown in economic growth.

If you’re one of those who believes Trump is good for the economy, it might be time to reassess that viewpoint. The stock market’s decline in response to these tariff threats illustrates a growing concern among investors. It’s a classic case of how policy decisions can ripple through the economy, affecting not just trade but also market confidence.

The Economic Cult: A Controversial Perspective

In the midst of this economic turmoil, Bill Madden’s tweet suggests that those who still believe in the positive economic impact of Trump’s policies may be part of a “cult.” While this might sound extreme, it underscores a critical divide in public opinion. On one side, you have staunch supporters of Trump’s economic agenda who argue that his policies lead to job growth and economic resurgence. On the other, critics point to instances like this tariff threat and the market’s reaction as evidence of mismanagement and harmful tactics.

This debate isn’t just political; it’s deeply economic. Supporters often focus on tax cuts and deregulation as markers of economic success, while opponents highlight tariffs and trade wars as detrimental to long-term stability. It’s important to engage with these perspectives critically and understand that economic policy often doesn’t have a one-size-fits-all solution.

Global Trade Dynamics and the U.S. Economy

The implications of Trump’s tariff threat extend beyond just the U.S. and the EU. Global trade dynamics are influenced heavily by such actions, with countries reassessing their strategies in light of protectionist policies. Trade relationships are often delicate, relying on mutual agreements that facilitate the exchange of goods and services. When one nation threatens tariffs, it can lead to retaliatory measures, further complicating international relations.

The U.S. economy, heavily intertwined with global markets, feels the effects of these tensions. American manufacturers who rely on imported goods may face higher costs, which could be passed on to consumers. This situation raises a crucial question: are tariffs really the answer to protecting American interests, or do they create more problems than they solve?

Consumer Impact: The Hidden Costs of Tariffs

Let’s not forget about the average consumer. While tariffs are often positioned as a way to protect American jobs, they can lead to increased prices for everyday goods. A 50% tariff means that companies importing goods from the EU will likely raise prices to maintain their profit margins. This could affect anything from electronics to clothing, hitting consumers right in the pocketbook.

Moreover, the stock market’s downturn can also impact consumers indirectly. When the market is shaky, it can affect retirement accounts, investment portfolios, and overall consumer confidence. People tend to spend less when they feel uncertain about their financial future, which can further slow down economic growth. So while the focus may be on high-level political maneuvers, the real impact often trickles down to everyday Americans.

The Path Forward: What Can Be Done?

Navigating economic policy in today’s global landscape requires a nuanced approach. The key lies in balancing protectionist measures with the need for international cooperation. While it’s essential to protect American interests, it’s equally important to foster relationships that promote trade and mutual growth.

Finding common ground with allies like the EU, rather than escalating tensions through tariffs, may lead to more sustainable economic outcomes. Encouraging dialogue and open communication can pave the way for agreements that benefit all parties involved. After all, in an interconnected world, collaboration often yields better results than confrontation.

Final Thoughts

Trump’s 50% tariff threat on the EU serves as a stark reminder of the complexities involved in global trade and economic policy. It highlights the delicate balance between protecting national interests and fostering international cooperation. As the stock market reacts to these developments, it’s crucial for consumers and policymakers alike to stay informed and engaged in the ongoing conversation about the future of trade.

Whether you’re a staunch supporter of Trump’s policies or a vocal critic, understanding the implications of tariffs and international agreements is essential. The conversation surrounding trade and economics isn’t just for policymakers; it affects us all. As we move forward, let’s prioritize informed discussions that consider the long-term impacts on our economy and society.

Breaking News, Cause of death, Obituary, Today