Overview of Data from Indiana University and Open Society Foundation

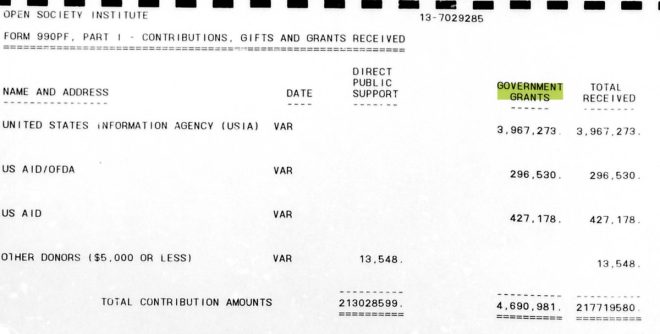

In a recent Twitter update, a user named DataRepublican shared significant findings regarding the Open Society Foundation (OSF) and its financial dealings, specifically through documents obtained from Indiana University. The update includes a notable 1995 Form 990-PF screenshot, which highlights the OSF’s receipt of government grants from the United States Information Agency (USIA) and other sources. This revelation has sparked interest in the intersection of philanthropy and governmental funding, raising questions about the implications for nonprofit organizations and their accountability.

Understanding Form 990-PF

Form 990-PF is a crucial tax document that private foundations in the United States must file annually. This form provides transparency regarding a foundation’s financial activities, including revenues, expenses, and grants awarded. It serves as a vital tool for researchers, policymakers, and the general public to assess how foundations operate, where they allocate funds, and their overall impact on society.

Key Details from the 1995 Form 990-PF

The specific Form 990-PF referenced by DataRepublican offers insights into the financial landscape of the Open Society Foundation in 1995. Notably, the foundation’s receipt of government grants indicates a relationship between philanthropic entities and federal agencies. This raises important questions about the motivations behind such funding and the potential influence of government on philanthropic initiatives.

The Role of the Open Society Foundation

Founded by billionaire investor George Soros, the Open Society Foundation aims to promote democracy, human rights, and social justice globally. With a mission centered around enhancing open societies, OSF has funded numerous initiatives across various sectors, including education, healthcare, and civil rights. However, the connection to government grants adds a layer of complexity to its operations, prompting discussions about the independence of philanthropic organizations.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Implications of Government Grants on Nonprofit Operations

The information shared by DataRepublican highlights a broader trend in the nonprofit sector: the reliance on government funding. While grants can supplement resources and expand the reach of organizations, they may also introduce potential challenges, such as:

- Influence on Mission and Priorities: Government funding can influence the strategic direction of nonprofit organizations. Foundations may feel pressured to align their initiatives with government objectives, potentially compromising their original mission.

- Accountability and Transparency: The flow of government funds necessitates a higher level of accountability. Nonprofits must demonstrate that they are using these resources effectively and in alignment with the stipulated goals of the funding agreements.

- Public Perception: The perception of a nonprofit can change based on its funding sources. Organizations that rely heavily on government grants may face skepticism regarding their independence and objectivity, particularly in politically charged environments.

The Importance of Document Transparency

The ongoing efforts to clean up and share documents from Indiana University signify a commitment to transparency in the nonprofit sector. Access to such documents allows for greater scrutiny of financial practices and helps ensure that philanthropic organizations are held accountable for their actions.

The Role of Social Media in Information Dissemination

Platforms like Twitter have emerged as powerful tools for sharing information quickly and broadly. DataRepublican’s tweet exemplifies how social media can facilitate the dissemination of crucial documents and findings, encouraging public discourse on important issues. This democratization of information empowers citizens to engage with and question the operations of influential organizations.

Future Research Directions

As DataRepublican prepares to release more documents from Indiana University, there will likely be increased interest in understanding the broader implications of these findings. Researchers, journalists, and activists may delve deeper into the relationship between government funding and philanthropic initiatives, examining case studies and potential correlations.

Conclusion

The update from DataRepublican regarding the Open Society Foundation’s financial dealings offers a glimpse into the complex interactions between philanthropy and government funding. The 1995 Form 990-PF serves as a critical document for understanding how foundations operate and the implications of receiving government grants. As the nonprofit sector continues to evolve, the importance of transparency and accountability remains paramount. The ongoing efforts to clean and share these documents underscore the need for informed public discourse about the role of philanthropic organizations in society.

In an age where information is more accessible than ever, the intersection of social media and document transparency presents an opportunity for increased scrutiny and engagement with the operations of influential foundations like the Open Society Foundation. As further documents are released, the conversation surrounding philanthropy, government funding, and nonprofit accountability is poised to grow, highlighting the importance of understanding these dynamics in shaping our society.

I’ve obtained the first two documents from Indiana University. I’ll clean them up and add them to the document dump shortly. In the meantime, here’s a screenshot of the 1995 Form 990-PF. As you can see, the Open Society Foundation received government grants from both USIA and… pic.twitter.com/MSWjXygyJV

— DataRepublican (small r) (@DataRepublican) May 23, 2025

I’ve obtained the first two documents from Indiana University

Exciting news is hitting the internet waves, and it’s all about some intriguing documents that have surfaced from the archives of Indiana University. As a researcher or just an avid news follower, you might be curious about what these documents entail. The recent tweet from DataRepublican highlights that they have gotten their hands on the first two documents and are currently in the process of cleaning them up for a bigger document dump. This kind of information can be a treasure trove for anyone interested in the intersections of finance, government, and non-profit organizations.

I’ll clean them up and add them to the document dump shortly

Document dumps can be incredibly enlightening, especially when they relate to influential organizations like the Open Society Foundation. The anticipation builds as the documents are set to be cleaned up and made accessible for public viewing. If you’re someone who loves digging into paperwork that reveals financial dealings and grant distributions, you’re in for a treat. It’s always fascinating to see how organizations operate behind the scenes, and these documents promise to shed some light on that.

In the meantime, here’s a screenshot of the 1995 Form 990-PF

Now, let’s talk about the juicy part—the screenshot of the 1995 Form 990-PF. This form is particularly significant as it provides a glimpse into the financial status of non-profits and grants received during that year. The Open Society Foundation, known for its extensive work in promoting democracy and human rights globally, is a focal point in this document. Seeing the specifics of their funding can give you insight into how they’ve managed their projects and initiatives over the years.

As you can see, the Open Society Foundation received government grants from both USIA

Diving deeper into the Form 990-PF, the revelation that the Open Society Foundation received government grants from the United States Information Agency (USIA) is worth noting. This connection sheds light on the relationship between governmental entities and non-profit organizations, which often collaborate for shared goals. It’s essential to understand how these grants are allocated and the impact they have on the foundation’s mission. The intertwining of government and non-profit funding can lead to significant outcomes in policy and community outreach.

Understanding Form 990-PF and Its Importance

For those who may not be familiar, Form 990-PF is a tax form used by private foundations to report their financial activities. This form is crucial because it provides transparency about a foundation’s income, expenditures, and the grants it provides. By examining these forms, researchers, journalists, and the public can hold organizations accountable and ensure that they are operating in line with their stated missions. When documents like these become available, they open doors to discussions about funding practices and their implications on societal issues.

The Role of the Open Society Foundation

The Open Society Foundation has been a pivotal player in global philanthropy since its inception. Founded by George Soros, the foundation aims to foster open societies and promote democracy, human rights, and justice worldwide. Understanding how they are funded, especially through government grants, raises questions about the influence of such funding on their operations and policies. Are they beholden to the interests of their funders, or do they maintain independence? These are critical questions that arise when analyzing financial documents like the Form 990-PF.

What Does This Mean for Future Research?

The release of documents like the 1995 Form 990-PF is a goldmine for researchers and analysts alike. It allows for a deeper understanding of the funding dynamics between government agencies and non-profits. It also encourages discussions about transparency and accountability in the non-profit sector. As more documents are uncovered, the narrative around funding practices and their implications will continue to evolve. Researchers can build upon this foundation of knowledge, leading to more comprehensive studies on the impacts of such funding on public policy and social change.

The Importance of Transparency in Non-Profits

Transparency in non-profit organizations is crucial for maintaining public trust. When foundations disclose their funding sources, it helps demystify their operations and ensures that they are held accountable for their actions. The recent revelation about the Open Society Foundation receiving government grants is a reminder of the importance of scrutinizing the financial dealings of non-profits. It’s vital for stakeholders, including donors, beneficiaries, and the general public, to have access to this information to make informed decisions about their support.

Engaging with the Data

As more documents are released, it is essential for the community to engage with this data meaningfully. Public discussions, academic research, and even social media conversations can help dissect the information and its implications. If you’re interested in participating in these discussions, consider following researchers, journalists, and organizations that focus on non-profit transparency. Engaging with these communities can provide you with insights and help you stay updated on the latest findings and discussions.

Conclusion: Anticipating More Insights

The excitement surrounding the documents from Indiana University is just the beginning. As we await the full document dump, the conversations sparked by the initial findings will likely continue to unfold. The implications of these documents will reach far beyond the Open Society Foundation, influencing discussions about funding practices, accountability, and the role of non-profits in society.

If you want to stay informed about further developments and insights, make sure to follow sources like DataRepublican for updates. The world of non-profit funding is complex, but with transparency and community engagement, we can better understand and navigate these waters. Keep your eyes peeled for more information, and get ready to dive into the data!

“`