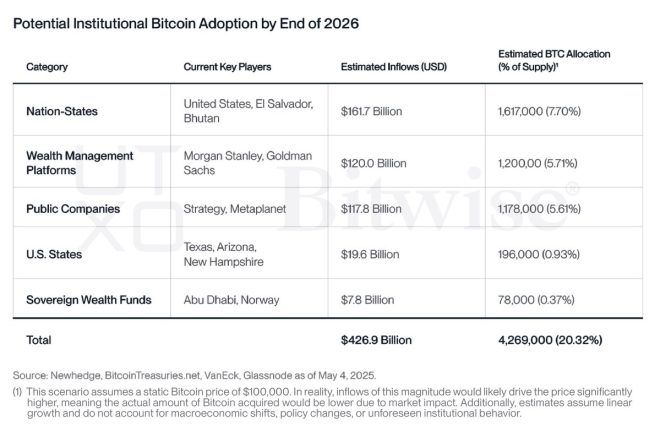

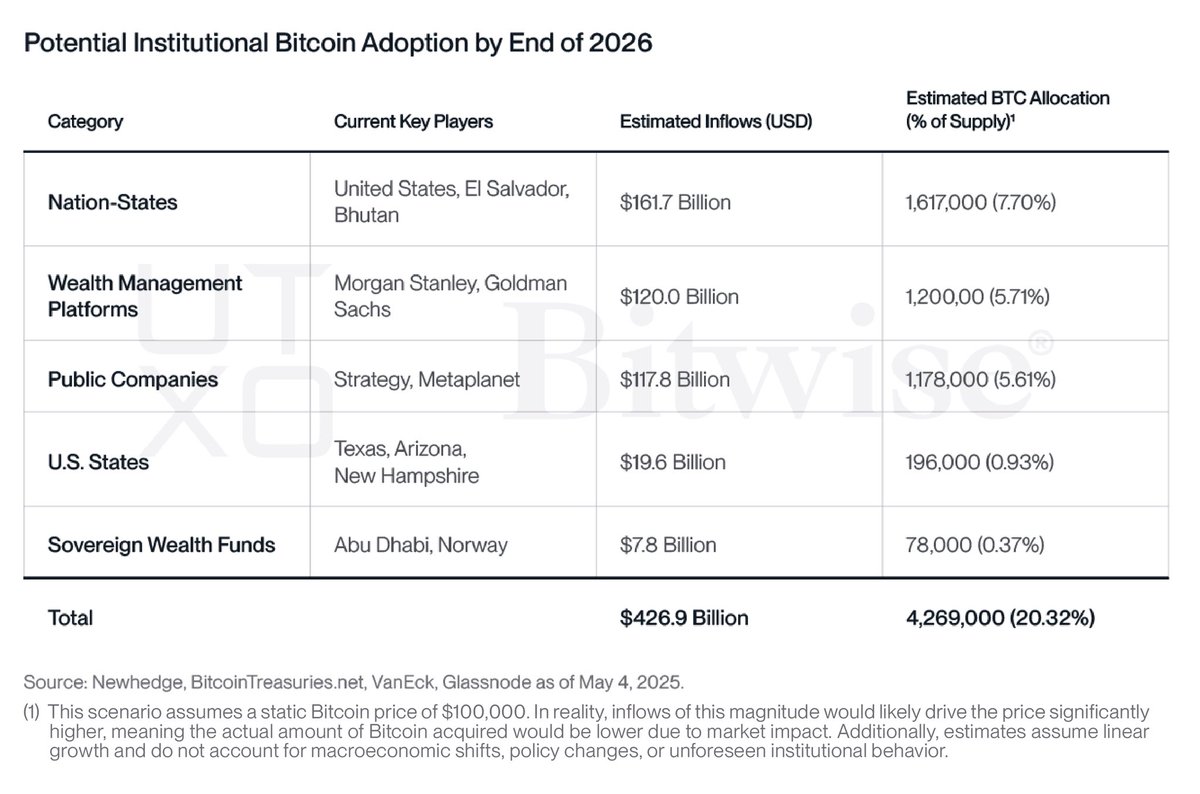

In a significant development in the world of cryptocurrency, Bitwise and UTXO have made a bold prediction regarding Bitcoin ownership by nation-states and institutions. According to their forecast, these entities are expected to hold a staggering 4,269,000 Bitcoins, valued at approximately $426.9 billion. This prediction emphasizes the growing interest and investment in Bitcoin by large entities, which could indicate a shift in the landscape of cryptocurrency ownership.

### The Rise of Institutional Investment in Bitcoin

The surge in institutional investments in Bitcoin is a notable trend that has been unfolding over the past few years. As cryptocurrencies gain mainstream acceptance, more and more institutional investors, including hedge funds, family offices, and even nation-states, are beginning to allocate a portion of their portfolios to digital assets. The prediction by Bitwise and UTXO suggests that this trend is not just a passing phase but is expected to continue growing, with institutions increasingly recognizing Bitcoin as a viable asset class.

### Implications for the Future of Bitcoin

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The ownership of such a significant amount of Bitcoin by institutions could have profound implications for the future of the cryptocurrency. Firstly, it could lead to increased market stability. With institutions holding large quantities of Bitcoin, the volatility that often characterizes the cryptocurrency market may be mitigated. Institutions typically have longer investment horizons and are less likely to panic-sell during market downturns, which could contribute to a more stable price trajectory for Bitcoin.

Secondly, institutional ownership could enhance Bitcoin’s legitimacy as a financial asset. As more reputable institutions enter the market, the perception of Bitcoin as a speculative investment may shift towards viewing it as a legitimate store of value. This paradigm shift could attract even more investors, further driving demand and potentially increasing the price of Bitcoin.

### The Role of Nation-States in Bitcoin Adoption

The involvement of nation-states in Bitcoin ownership is particularly noteworthy. If governments begin to hold significant amounts of Bitcoin, it could signal a broader acceptance of cryptocurrencies at the national level. This could lead to the development of regulatory frameworks that facilitate the use of Bitcoin and other cryptocurrencies, paving the way for more widespread adoption.

Moreover, nation-states owning Bitcoin could influence their monetary policy and economic strategies. For instance, countries that hold Bitcoin may use it as a hedge against inflation or as a tool for diversifying their foreign reserves. This development could lead to a reevaluation of how countries approach currency and asset management in the digital age.

### The Growing Demand for Bitcoin

The predicted ownership of 4,269,000 Bitcoins by institutions reflects the growing demand for this digital asset. Factors driving this demand include the increasing recognition of Bitcoin as a hedge against inflation, its potential for high returns, and the growing number of businesses accepting Bitcoin as a form of payment. Additionally, the rise of decentralized finance (DeFi) platforms has created new opportunities for investors to leverage their Bitcoin holdings.

As awareness of Bitcoin and its benefits continues to spread, it is likely that more individuals and institutions will seek to invest in this cryptocurrency. This growing demand may further contribute to the upward pressure on Bitcoin prices, creating a positive feedback loop that encourages more investment.

### Challenges and Considerations

While the prediction of institutional ownership of 4,269,000 Bitcoins is optimistic, it is important to acknowledge the challenges and considerations that could impact this trajectory. Regulatory scrutiny remains a significant concern for cryptocurrency investors. Governments around the world are grappling with how to regulate digital assets, and any unfavorable regulations could dampen institutional interest in Bitcoin.

Additionally, the environmental impact of Bitcoin mining has come under scrutiny. As concerns about climate change grow, institutions may reconsider their investments in Bitcoin if they face pressure to align their portfolios with sustainable practices. This could lead to a push for more sustainable mining practices or the development of greener alternatives to Bitcoin.

### Conclusion

The prediction by Bitwise and UTXO regarding the potential ownership of 4,269,000 Bitcoins by nation-states and institutions represents a pivotal moment in the evolution of cryptocurrency. As institutional interest in Bitcoin grows, it could lead to increased market stability, enhanced legitimacy, and broader acceptance of digital assets. However, it is essential to remain mindful of the challenges that lie ahead, including regulatory uncertainties and environmental concerns.

In summary, the future of Bitcoin looks promising as more institutions and nation-states enter the market. The predicted ownership of this significant amount of Bitcoin underscores the importance of this cryptocurrency in the broader financial landscape. As the world continues to adapt to the digital revolution, Bitcoin’s role as a store of value and investment asset may solidify, shaping the future of finance for years to come.

JUST IN: Bitwise and UTXO predicts nation-states and institutions to own 4,269,000 #Bitcoin worth $426.9 billion.

Institutions are coming pic.twitter.com/te50cIK8bT

— Bitcoin Magazine (@BitcoinMagazine) May 23, 2025

JUST IN: Bitwise and UTXO Predicts Nation-States and Institutions to Own 4,269,000 Bitcoin Worth $426.9 Billion

There’s a buzz in the cryptocurrency community, and it’s all about the latest prediction from Bitcoin Magazine. According to insights from Bitwise and UTXO, we’re looking at a future where nation-states and institutions end up holding an astonishing 4,269,000 Bitcoin, which is a mind-blowing $426.9 billion! This is a significant indicator of how the landscape of Bitcoin ownership is evolving, and it has everyone talking.

Institutions Are Coming

The phrase “institutions are coming” isn’t just a catchy tagline; it represents a seismic shift in the way Bitcoin is perceived and utilized. Gone are the days when Bitcoin was viewed solely as a speculative asset. Now, major financial players are beginning to see it as a legitimate store of value, comparable to gold. This shift opens the door for more widespread adoption and could significantly impact the overall cryptocurrency market.

The Impact of Institutional Investment

When institutions dive into Bitcoin, it’s not just about buying and holding; it’s about creating a framework that legitimizes cryptocurrency in the eyes of the public and regulators. Major players entering the market could lead to increased liquidity, more robust infrastructure, and ultimately, a more stable price for Bitcoin. Imagine a world where Bitcoin is not only a tool for individual investors but also a staple in institutional portfolios.

Understanding the Numbers: 4,269,000 Bitcoin

So, what does the figure 4,269,000 Bitcoin really mean? Let’s break it down. The total supply of Bitcoin is capped at 21 million, meaning that this prediction indicates a significant concentration of ownership among a relatively small number of entities. If this comes to fruition, it could raise questions about market control and the influence these institutions will have over Bitcoin’s future. Are we ready for a future where a few institutions wield so much power over a decentralized currency?

Why Institutions Are Turning to Bitcoin

There are a few compelling reasons why institutions are increasingly investing in Bitcoin. First, it acts as a hedge against inflation. With central banks printing money at unprecedented rates, many financial institutions are looking for ways to protect their assets, and Bitcoin offers a way to do that. Moreover, companies like MicroStrategy and Tesla have already made headlines for their significant Bitcoin purchases, setting a trend that many others are likely to follow.

The Role of Regulatory Clarity

Another factor driving institutional interest is the increasing regulatory clarity surrounding cryptocurrencies. Governments around the world are slowly but surely laying down the law on how crypto should be treated. This clarity helps institutions feel more secure in their investments. As the regulatory landscape evolves, we can expect more institutions to step into the crypto space, further driving up the demand for Bitcoin.

Challenges Ahead

Despite the optimistic outlook, there are also challenges that could impact institutional investment in Bitcoin. Regulatory hurdles remain a concern, as do issues surrounding security, volatility, and market manipulation. Institutions will need to navigate these challenges carefully to mitigate risks while maximizing their potential gains. The crypto market is still relatively young and unregulated compared to traditional markets, which adds an element of unpredictability.

The Future of Bitcoin Ownership

As we look to the future, the possibility of institutions holding vast amounts of Bitcoin raises important questions. Will Bitcoin remain decentralized, or will it become more centralized as large institutions accumulate more of it? How will this affect the ethos of Bitcoin as a digital currency that empowers individuals? These are questions that experts and enthusiasts alike are pondering as we watch this space evolve.

Bitcoin’s Growing Legitimacy

The predicted ownership of 4,269,000 Bitcoin by institutions is not just a number; it signals a broader acceptance of cryptocurrency as a legitimate asset class. As more institutions start adding Bitcoin to their balance sheets, it will bolster Bitcoin’s legitimacy and potentially lead to even greater adoption among retail investors. It’s a cycle that can snowball quickly, and we’re already witnessing the early signs of this phenomenon.

Conclusion: What This Means for Investors

For everyday investors, the implications are significant. As institutions begin to dominate Bitcoin ownership, retail investors may find it more challenging to acquire Bitcoin at favorable prices. However, this also means that the overall market could become more stable, with less extreme price fluctuations. Understanding these dynamics will be crucial for anyone looking to invest in Bitcoin in the coming years.

Stay Informed

As we continue to monitor this rapidly changing landscape, staying informed will be your best tool. Following reputable sources like Bitcoin Magazine will keep you updated on the latest trends and insights in the world of cryptocurrency and institutional investment. The future of Bitcoin is exciting, and it’s only just beginning!