Metaplanet: Japan’s Most Volatile Stock and its Connection to Bitcoin

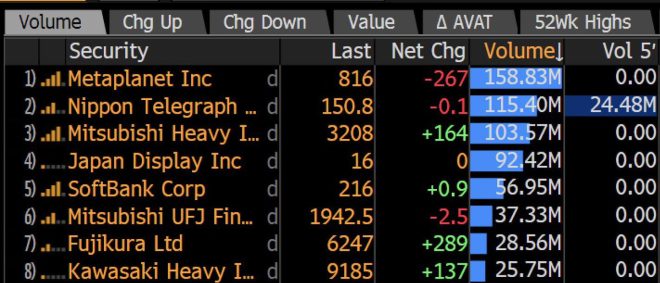

In a recent update that has caught the attention of investors and cryptocurrency enthusiasts alike, Metaplanet, a treasury company focused on Bitcoin, has been identified as Japan’s most volatile stock. This development highlights the significant impact that cryptocurrencies like Bitcoin are having on traditional financial markets, particularly in Japan, which has been at the forefront of cryptocurrency adoption.

The Rise of Metaplanet

Metaplanet is a company that has entered the market with a focus on managing and investing in Bitcoin. As cryptocurrencies continue to gain traction, companies like Metaplanet are beginning to play a pivotal role in bridging the gap between traditional finance and the digital asset world. The surge of interest in Bitcoin, fueled by its increasing acceptance among institutional investors and the general public, has positioned Metaplanet at a unique intersection of finance and technology.

Volatility: A Double-Edged Sword

Volatility is often viewed as a double-edged sword in the financial world. While it presents opportunities for high returns, it also comes with significant risks. The fact that Metaplanet has been labeled Japan’s most volatile stock indicates that it is experiencing sharp fluctuations in its stock price. For investors, this can mean the potential for substantial gains but also the risk of considerable losses.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

The Role of Bitcoin in Modern Finance

As Bitcoin continues to evolve as a digital asset, its influence on traditional financial markets cannot be ignored. With Metaplanet at the helm, investors are increasingly looking to Bitcoin as a hedge against inflation and a store of value. The company’s focus on Bitcoin allows it to attract a niche market of investors who are keen on integrating cryptocurrency into their portfolios.

Investor Sentiment and Market Trends

The announcement about Metaplanet’s volatility comes amid broader market trends that indicate a growing acceptance of Bitcoin among both retail and institutional investors. The interest in Bitcoin has been spurred by various factors, including its limited supply, growing institutional adoption, and increasing integration into everyday financial systems. As a result, stocks like Metaplanet that are closely tied to Bitcoin are likely to see increased activity and interest.

Regulatory Environment in Japan

Japan’s regulatory framework for cryptocurrencies has undergone significant changes in recent years. The country has established itself as a leader in the cryptocurrency space, with regulations that aim to protect investors while fostering innovation. Metaplanet’s role as a treasury company in this environment is crucial, as it must navigate these regulations while also capitalizing on the opportunities presented by the volatile nature of Bitcoin.

The Future of Metaplanet and Bitcoin

Looking ahead, the future of Metaplanet appears promising, given the continued interest in Bitcoin and cryptocurrencies. As more individuals and institutions recognize the potential of digital assets, companies like Metaplanet could see significant growth. However, investors must remain cautious and stay informed about market conditions and regulatory changes that could impact the volatility of stocks tied to cryptocurrencies.

Conclusion

In summary, Metaplanet’s emergence as Japan’s most volatile stock underscores the dynamic relationship between traditional finance and the evolving world of cryptocurrency. As Bitcoin continues to capture the imagination of investors, companies like Metaplanet are well-positioned to take advantage of this trend. However, the inherent volatility of both Bitcoin and related stocks means that investors should approach with caution, armed with knowledge and an understanding of the risks involved.

Key Takeaways

- Metaplanet is Japan’s most volatile stock, reflecting the intense fluctuations associated with Bitcoin.

- Volatility offers both opportunities and risks for investors in the stock market.

- Bitcoin’s role in modern finance is becoming increasingly significant, with companies like Metaplanet leading the charge.

- Investor sentiment is shifting, with growing interest in Bitcoin as a hedge against inflation.

- Japan’s regulatory environment plays a crucial role in shaping the future of cryptocurrencies and related companies like Metaplanet.

- The future looks promising for Metaplanet, but investors must remain vigilant in navigating the volatile market landscape.

As the landscape of digital assets continues to evolve, the relationship between companies like Metaplanet and Bitcoin will likely play a significant role in shaping the future of finance in Japan and beyond.

JUST IN: #Bitcoin treasury company Metaplanet is now Japan’s most volatile stock. pic.twitter.com/lCfpnEumGE

— Bitcoin Magazine (@BitcoinMagazine) May 23, 2025

JUST IN: #Bitcoin treasury company Metaplanet is now Japan’s most volatile stock.

In the ever-evolving world of cryptocurrency and finance, news travels fast, and it’s often packed with excitement. Recently, we learned that Metaplanet, a treasury company focused on Bitcoin, has become the most volatile stock in Japan. This development is significant not just for investors but also for anyone interested in the intersection of traditional finance and digital currencies. Let’s dive into what this means and why it matters.

What is Metaplanet?

Metaplanet is a company that has been gaining traction in the cryptocurrency space, particularly in Japan. Its focus on Bitcoin treasury management sets it apart from other companies in the market. Essentially, Metaplanet aims to manage Bitcoin assets for various clients, ranging from individuals to organizations looking to diversify their investment portfolios. By leveraging the volatility of Bitcoin, the company can create opportunities for high returns, albeit with substantial risks.

The Volatility Phenomenon

Volatility is a term that gets thrown around a lot in financial discussions, but what does it really mean? In simple terms, volatility refers to the degree of variation in trading prices over time. A stock or asset that is considered volatile experiences rapid price changes, which can be both positive and negative. In the case of Metaplanet, its stock has shown wild swings, making it the talk of the town among traders and analysts alike.

Why Is Metaplanet So Volatile?

Several factors contribute to the volatility of Metaplanet’s stock. Firstly, Bitcoin itself is known for its price fluctuations. Events such as regulatory news, market trends, and technological advancements can cause Bitcoin’s price to soar or plummet, directly impacting companies like Metaplanet that are heavily invested in it. Additionally, the Japanese market is increasingly becoming more receptive to cryptocurrency, leading to fluctuations as investors react to news and trends.

Impact on Investors

For investors, the volatility of Metaplanet presents both challenges and opportunities. On one hand, potential for high returns is alluring, especially for those willing to take risks. On the other hand, the unpredictability means that investors must also be prepared for significant losses. It’s essential for anyone considering investing in Metaplanet to conduct thorough research and understand their risk tolerance, as the stock’s performance can shift dramatically in a short period.

Japan’s Growing Interest in Cryptocurrency

Japan has been at the forefront of adopting cryptocurrency as a legitimate form of finance. With regulatory frameworks in place and increasing public interest, the country has become a hotspot for crypto investments. The rise of Metaplanet as a leading stock reflects this growing enthusiasm. As more investors look to Bitcoin as an asset class, companies like Metaplanet are positioned to benefit immensely.

The Future of Metaplanet

Looking ahead, the future of Metaplanet could be bright, provided it navigates the volatile landscape effectively. As the world becomes more digitized and cryptocurrencies gain mainstream acceptance, companies in this space may find new opportunities for growth. However, staying adaptable and responsive to market changes will be crucial for Metaplanet to maintain its position as Japan’s most volatile stock.

What Investors Should Keep in Mind

For anyone thinking about investing in Metaplanet or similar companies, a few key points are worth considering. First, always stay informed about market trends and how they might affect Bitcoin prices. Pay attention to regulatory news, as changes in laws can have immediate impacts on cryptocurrency values. Finally, consider diversifying your investment portfolio. Relying solely on highly volatile stocks can be risky, so balancing your investments with more stable options can help mitigate potential losses.

Community Reaction

The news of Metaplanet’s volatility has sparked conversations across social media platforms and investment forums. Many enthusiasts are excited about the potential for high returns, while cautious investors are reminding others of the risks involved. Discussions around the balance between risk and reward in the crypto market are more relevant than ever, and it’s essential for everyone to weigh their options carefully.

Conclusion

The financial world is always buzzing with news, and Metaplanet’s rise as Japan’s most volatile stock adds another layer of excitement to the Bitcoin narrative. As more individuals and institutions explore cryptocurrency investments, keeping an eye on companies like Metaplanet could prove beneficial. Whether you’re a seasoned investor or a newcomer to the crypto scene, understanding the dynamics of volatility and market trends will play a significant role in your investment journey.

For more updates and insights on Bitcoin and the evolving financial landscape, make sure to follow reliable sources like Bitcoin Magazine.

“`

This article is structured with relevant headings and engages readers by presenting the information in a conversational tone. It also incorporates SEO optimization through the use of keywords and links to credible sources.