Death- Obituary news

Understanding the Impact of the republican Tax Scam Bill

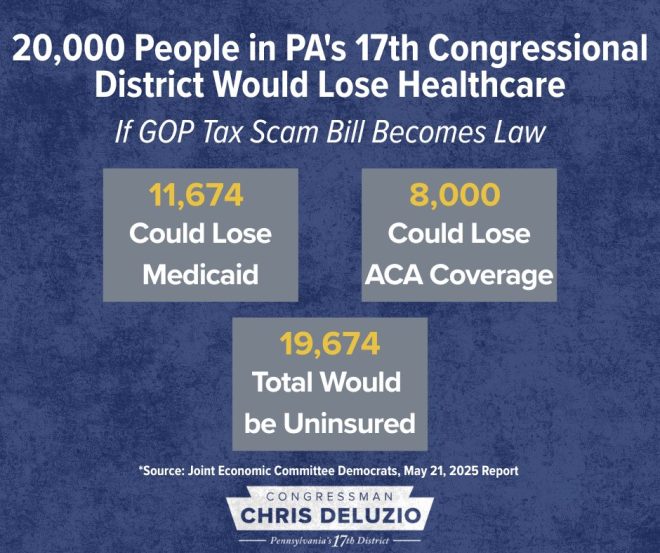

In a recent tweet, Congressman Chris Deluzio emphasized the potential negative consequences of the Republican Tax Scam Bill that narrowly passed with a single vote. He argued that this legislation could strip healthcare from thousands of Western Pennsylvanians while providing substantial tax breaks to the wealthiest individuals in the country. In this summary, we will delve into the key points raised by Deluzio, exploring the implications of the tax bill on healthcare, its fiscal impact, and the broader socio-economic context.

The Core Issues with the Tax Bill

The primary concern surrounding the Republican Tax Scam Bill is its potential to eliminate healthcare access for many individuals. As Deluzio pointed out, thousands of constituents could be adversely affected, leading to a public health crisis. The bill’s backing of tax cuts for the richest citizens raises questions about the prioritization of wealth over the well-being of the general population.

Healthcare Access and Affordability

Healthcare is a fundamental right, and access to it is crucial for maintaining public health. The tax bill, as proposed, threatens to undermine this right for countless Americans. With rising healthcare costs, many families in Western Pennsylvania and across the nation rely on government programs to afford necessary medical services. If these programs are cut or diminished due to the tax bill’s funding mechanisms, many individuals may find themselves without essential healthcare services.

- YOU MAY ALSO LIKE TO WATCH THIS TRENDING STORY ON YOUTUBE. Waverly Hills Hospital's Horror Story: The Most Haunted Room 502

Tax Cuts for the Wealthy

One of the most contentious aspects of the tax bill is its provision of significant tax cuts for the wealthiest individuals. Critics, including Congressman Deluzio, argue that this approach is fiscally irresponsible. By prioritizing tax breaks for the wealthiest, the bill shifts the financial burden onto the middle and lower classes, exacerbating income inequality. The vast majority of Americans may see little to no benefit from these tax cuts, while the richest individuals continue to accumulate wealth.

The Fiscal Recklessness of the Bill

Deluzio’s tweet highlights what he describes as the "fiscally reckless" nature of the Republican Tax Scam Bill. The bill is projected to add trillions of dollars to the national debt, raising concerns about the long-term financial stability of the country. Critics argue that this approach could lead to significant economic challenges in the future, including increased interest rates and reduced investments in critical public services.

Long-term Consequences on National Debt

The accumulation of national debt has far-reaching implications for the economy. Increased debt can lead to higher taxes in the future, as the government must find ways to address its financial obligations. This could result in cuts to essential services, including education and infrastructure, further impacting the quality of life for everyday Americans.

The Broader Socio-economic Context

The issues raised by Congressman Deluzio are part of a larger conversation about economic policy and social justice in the United States. The Republican Tax Scam Bill is not an isolated incident but rather a reflection of ongoing debates about wealth distribution, healthcare access, and the role of government in providing for its citizens.

Wealth Inequality in America

Wealth inequality has been a growing concern in the United States, with a significant gap between the richest and poorest citizens. The tax bill, according to critics, exacerbates this issue by favoring the wealthy at the expense of the middle and working classes. Addressing wealth inequality is essential for fostering a more equitable society and ensuring that all individuals have access to opportunities and essential services.

The Role of Government in Healthcare

The ongoing debate about healthcare in America often centers around the question of government involvement. Many advocates argue for a more significant government role in providing healthcare access, while others believe that the private sector should take the lead. The Republican Tax Scam Bill, in its current form, raises questions about the effectiveness of government programs and the implications of reducing support for healthcare.

Conclusion

In conclusion, Congressman Chris Deluzio’s critique of the Republican Tax Scam Bill sheds light on the potential negative consequences of this legislation. The bill threatens to strip healthcare from thousands of individuals in Western Pennsylvania, prioritizing tax cuts for the wealthiest citizens at the expense of the broader public good. Its projected impact on national debt and long-term fiscal stability raises additional concerns about the financial future of the country. As debates about wealth inequality and the role of government in healthcare continue, it is crucial for citizens to engage in these discussions and advocate for policies that prioritize the well-being of all Americans.

By understanding the far-reaching implications of such legislation, individuals can make informed decisions and participate actively in the democratic process, ensuring that their voices are heard in matters that directly affect their lives and communities.

The Republican Tax Scam Bill that was just rammed through and passed by a single vote would rip away healthcare from thousands of Western Pennsylvanians to fund tax giveaways to the richest people who have ever lived. This fiscally reckless bill would saddle us with trillions in… pic.twitter.com/cjQk6Co0tw

— Congressman Chris Deluzio (@RepDeluzio) May 23, 2025

The Republican Tax Scam Bill: A Closer Look

Recently, a significant piece of legislation known as The Republican Tax Scam Bill made headlines across the nation, especially in Western Pennsylvania. This bill, which was pushed through Congress with a narrow margin of just one vote, has sparked intense debate and concern among citizens and lawmakers alike. Congressman Chris Deluzio articulated the fears surrounding this bill succinctly, stating that it would “rip away healthcare from thousands of Western Pennsylvanians to fund tax giveaways to the richest people who have ever lived.”

The Impact on Healthcare for Western Pennsylvanians

One of the most alarming aspects of the Republican Tax Scam Bill is its potential to dismantle essential healthcare services for many individuals in Western Pennsylvania. The bill could jeopardize coverage for thousands of families who depend on government programs for their healthcare needs. Politico reports that many families fear losing access to vital medical services, which could lead to devastating health outcomes.

Imagine waking up one day to find that your healthcare coverage has been stripped away, leaving you vulnerable and anxious about how to afford necessary treatments. This is not just a hypothetical scenario; it’s a reality for many if this bill goes into full effect. The concern is not just about immediate healthcare needs but the long-term implications for public health in the region.

Tax Giveaways for the Wealthy

At the heart of the controversy surrounding the Republican Tax Scam Bill is the issue of tax breaks for the wealthy. Critics argue that the bill is designed primarily to benefit the richest Americans, rather than the average citizen. According to Forbes, the legislation provides significant tax cuts that disproportionately favor millionaires and billionaires, all while placing the financial burden on the middle and lower classes.

This raises an important question: should our tax system prioritize the needs of the wealthiest individuals at the expense of the health and well-being of average families? Many believe the answer is a resounding no. The focus should be on creating a fair tax system that provides necessary support for all citizens, especially in areas like healthcare.

Fiscal Responsibility and Long-Term Consequences

Another critical issue at stake is the long-term fiscal responsibility of the government. The Republican Tax Scam Bill is projected to add trillions to the national debt, which could have dire consequences for future generations. A Washington Post analysis highlights how this increased debt could lead to higher taxes and cuts in essential services down the line.

When lawmakers prioritize short-term tax cuts over long-term fiscal health, the result is often a cycle of financial instability that can harm the very people they claim to represent. For many Western Pennsylvanians, this bill represents a gamble that could pay off for the wealthy while placing their financial futures in jeopardy.

The Voices of Concerned Citizens

In the wake of the bill’s passage, many citizens have voiced their concerns. Town hall meetings and community forums have become a platform for residents to express their fears regarding healthcare and financial security. These gatherings provide a space for open dialogue about how the Republican Tax Scam Bill could impact their lives.

During one such meeting, a local mother shared how losing her healthcare coverage would affect her family: “Without my coverage, I don’t know how I would afford my son’s medication. This bill feels like a direct attack on our family.” Her story is just one of many that illustrate the real-life implications of this legislation.

The Role of Elected officials

The role of elected officials is crucial in times like these. Members of Congress, such as Congressman Chris Deluzio, are taking a stand against the bill, advocating for the needs of their constituents. Deluzio emphasized the need to prioritize healthcare and the well-being of families over tax cuts for the wealthy. His commitment to fighting for the people of Western Pennsylvania is a crucial aspect of the ongoing debate.

It’s essential for citizens to engage with their representatives, voicing their concerns and urging them to consider the impacts of such legislation. Elected officials should be held accountable for the decisions they make, especially when those decisions affect the health and financial stability of their constituents.

What’s Next for the Republican Tax Scam Bill?

As discussions continue surrounding the Republican Tax Scam Bill, many are left wondering what the future holds. Will there be amendments made to address the concerns raised by citizens and healthcare advocates? Or will the bill remain as is, potentially causing harm to thousands of families?

One thing is clear: the fight is not over. Advocacy groups and concerned citizens are rallying together to push for changes and protect healthcare access. The voices of the people are powerful, and together they can influence the direction of this legislation.

Engaging in the Legislative Process

For those looking to make a difference, engaging in the legislative process is key. Writing to your representatives, participating in local rallies, and staying informed about ongoing developments are all effective ways to make your voice heard. The more citizens are involved, the more likely they are to influence change.

Additionally, sharing stories and experiences on social media platforms can amplify the message. Engaging with others who share similar concerns can help build a sense of community and solidarity. Remember, you are not alone in this fight, and collective action can lead to meaningful change.

Final Thoughts on Healthcare and Taxation

The Republican Tax Scam Bill has sparked a nationwide conversation about the intersection of healthcare and taxation. As the debate continues, it’s vital to keep the focus on the people who will be impacted the most. Healthcare is a fundamental right, and it should not be compromised for the sake of tax cuts.

As we move forward, let’s ensure that our elected officials are held accountable for their actions. The health and well-being of families in Western Pennsylvania and beyond depend on our collective efforts to advocate for a fair and just system. Together, we can work towards a future where healthcare is prioritized, and the needs of all citizens are met.